Retail banking main processes; Payment, Deposit, and Loan process are rapidly moving from branchesto the Internet. This retail banking transformation - from branches to online banking – is an Universal phenomenon. Annually, the shift from paper-based payments to electronic payments formed in Europe on the average 5% from the total volume of cashless payment transfers in 1997 – 2001. Only 30% of cashless bill payments were conducted at the branches in EU15 countries in 2001. Is the similar development expected to happen also with Deposit and Loan processes?

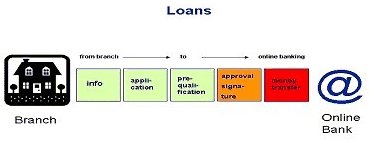

To more accurately understand retail banking transformation, retail banking main processes; payment, deposit and loan processes are divided each of them, to five basic stages giving more exact picture and model of the online development with the mentioned main processes. Below is presented Loan Process Model, most of the leading online banking service providers in Europe, like Nordea, OP Bank Group, La Caixa, Rabobank and Egg offer Online application choice for example with mortgage loans.

Loan Process Model

A truly paperless, five-stage Internet-based mortgage financing process is still yet not feasible in mass use. According to a Mortgage Bankers Association of America, some 20% of mortgage loan applications were made online in 2003 in the U.S.A. Online Payment process and Online Deposit process are already offered fully online with major banks in Europe.

The laws of the New Economy; Moore's, Coase's and Metcalfe's law, Arthur's law of Increasing returns, Law of Disruption and Law of Diminishing firms by Downes & Mui affect retail banking transformation and mentioned laws explain, why banking services are headed from branches to the online environment.

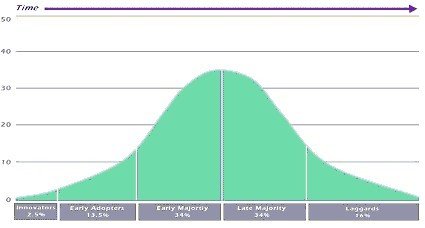

The transformation of retail banking main processes follows normal diffusion curve (S-shape adoption curve) and progress almost similarly in developed industrial countries. The adoption of online banking services follows normal distribution model, because of the large target group, in developed economies, 60-85% of the population has a bank account. (Global Insight, 2003)

Banking Transformation Model (BTM) is developed based on the Rogers model of Diffusion of Innovations. BTM describes and predicts the expected development of retail banking main processes. The significant finding of this model states that standard deviation describes the timelines T1, T2 and T3 to be equal long time periods, thus the standard deviation is measurement of diffusion time.

Universal Banking Transformation Model

(Modified from Rogers 1983 and Market Forecasting 1995)

|

I |

T1 |

I |

T2 |

I |

T3 |

I |

Timelines (T): T1,T2,T3=equal |

|

2.5% |

|

16% |

|

50% |

|

|

84% Adoption rate in Time |

|

I |

|

I |

|

I |

|

|

% Payments online |

|

I |

|

I |

|

I |

|

|

% Deposits online |

|

|

|

|

|

|

|

|

% Loans online |

|

A year |

T |

|

T |

C year |

|

|

C=2xT (50% adoption rate |

An example: If adoption of a service takes 2 years to proceed from adoption rate of 2.5% to 16% of population, then 50% penetration shall be reached after 4 yrs counted from A year. Universal Banking Transformation Model requires target group for adoption large enough to guarantee normal distribution to happen with Bell-shaped model, as presented above.

The writer, Ph.D. Vesa V. Viitaniemi is the Managing Director of South-West Finland's Co-Operative Bank