- within Intellectual Property topic(s)

- with Finance and Tax Executives and Inhouse Counsel

- with readers working within the Advertising & Public Relations, Pharmaceuticals & BioTech and Law Firm industries

Background

In recent years, the investment from Chinese companies in Europe has increased substantially 1. The fact that there is a growing investment by Chinese companies in European jurisdictions may result in a greater concern by these investors to protect their intellectual assets in Europe. In this sense, this article will seek to identify the profile of patent applications having origin in China and filed in European countries, in order to identify the main jurisdictions targeted by Chinese applicants and which are the technological fields of the respective patent applications.

We have gathered information referred to patent applications from public patent databases, namely the databases Espacenet and EP Bulletin Search, both provided by the European Patent Office (EPO), the statistics database made available by the World Intellectual Property Organization (WIPO), and the database OECD.Stat provided by the Organization for Economic co-operation and Development.

Investment from China in Europe

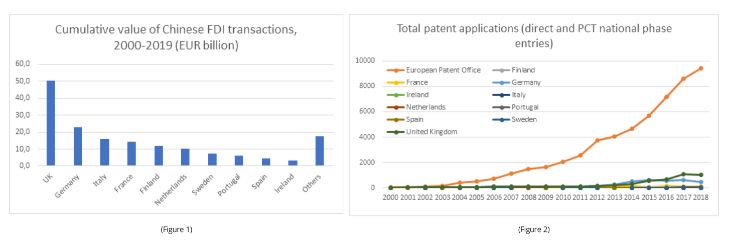

The figure 1 shows the cumulative value of Chinese foreign direct investment (FDI) in the European Union (EU) by country from 2000 to 2019 1. The top 10 countries recited in figure 1 have received in said period almost 90% of the overall Chinese FDI.

According to data from the MERICS 1, the sectoral mix of Chinese investment in Europe was quite concentrated in 2019, far more so than in the previous year. The sectors Automotive, Consumer Products and Services, Financial and Business Services, Health and Biotechnology and ICT received more than 80 percent of total Chinese investment within the EU.

Total number of patent application having origin in China

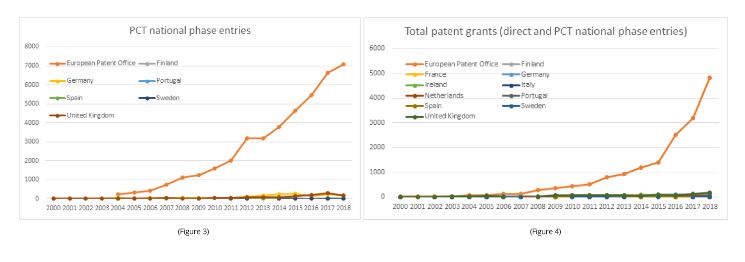

The trend of filing of patent applications having origin in China Mainland before European countries and before the regional European Patent Office (EPO) is shown in Figure 2. To identify these results, we have used the WIPO statistics database. The results of Figure 2 were obtained through the indicator Total Patent Applications (direct and PCT national phase entries), in which the country of origin is China Mainland, and the filing Patent Offices correspond to the National Patent Offices of each one of the countries expressly cited in figure 1 and EPO from 2000 to 2018. The figure 3 reveals that the Chinese Applicants usually employ the Treaty of Cooperation in Patents (PCT) in order to file the patent applications before the European jurisdictions, wherein the results of figure 3 were obtained by a similar indicator to that one employed for figure 2. The results show a massive predominance of patent applications in EPO, corresponding to Euro-PCT applications, followed by minor filing applications before the National Patent Office from UK and before the National Patent Office from Germany.

We shall mention that selecting the EPO as the filing Office is advantageous when the Applicant seeks protections for his invention before many countries from Europe, because after having a patent granted, it is possible to easily validate it in several countries, filing requests of validation of the European patent to each one of the countries of interest. In addition, the processing of a European patent enjoys a centralized and rigorous examination process that is accepted by the member state institutes. Annuities, while the European patent application is being analyzed, are due to the European Institute itself. Figure 3 shows a growth in European patent applications from PCT applications. This growth has been steady over the past few years.

Figure 4 shows the total patent grants (direct and PCT national phase entries), as a result of mapping the indicator Total Patent grants (direct and PCT national phase entries), comprised in the WIPO statistics database, in which the country of origin is China Mainland, and the filing Patent Offices correspond to the National Patent Offices of each one of the countries expressly cited in figure 1 and EPO from 2000 to 2018. It is observed a positive correlation between the patent applications before EPO and their grants, which highlights the quality of inventions having origin in China.

Preferred technological fields

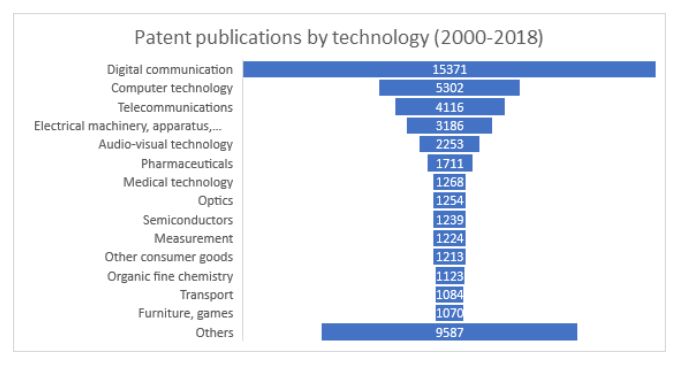

Regarding the main technological fields of applications filed by Chinese applicants in Europe, emphasis on patent applications related to the areas of digital communications, computer technology, telecommunications and heavy machinery and energy is observed in the set of results. Figure above presents the results related to the indicator Patent publications by technology, from 2000 to 2018, obtained from the WIPO statistics database.

Main Applicants

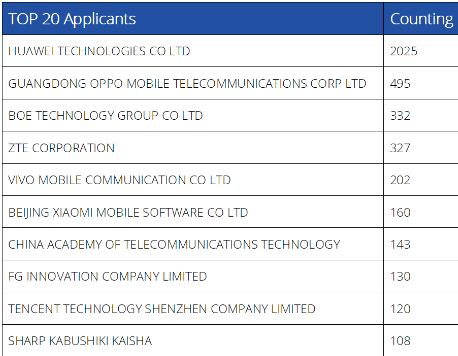

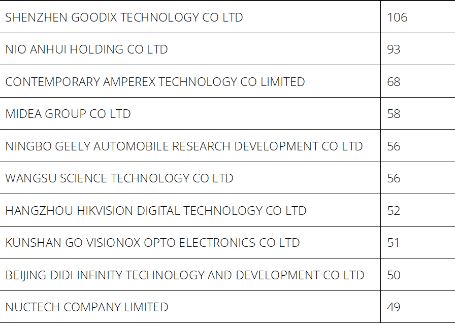

We have used the database EPO Bulletin Search for identifying the main Chinese Applicants that file European patent applications. According to this database, in 2018 were filed 8991 European patent applications wherein the proprietor/applicant is from China. The top 20 applicants retrieved from these results are recited in Table 1. Indeed, the main applicants are related to digital communication, computer technology and telecommunications sectors.

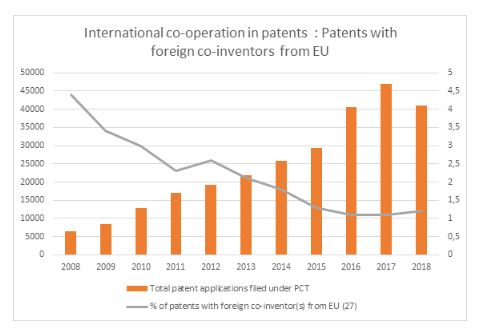

International co-operation in patents

The number of patent application having Chinese organizations as applicants has been increasing in a massive way, as it is illustrated in the figure above, by the number of patent applications filed under the PCT. On the other hand, the share of international patent applications wherein there are co-inventors from China and from some country belonging to the EU has been diminishing significantly over the same period.

Conclusions

From this study, it is possible to remark some useful conclusions that indicate the current scenario of the protection of intellectual assets of Chinese organizations in European jurisdictions.

Our small study concludes that there is an increase in the number of European applications from China. This growth has been overwhelming and coincides with the entry of Chinese companies in the global market for technological products. The technological development that China has had in the last decade has triggered several inventions, and this is latent when we analyze the types of inventions present in figure 5. The inventions related to computers and communications are highlighted in the first places. When considering the companies requesting the majority of patent applications, they are well known companies, in the sector of telecommunications and computer devices.

Finally, we would like to express that this growth trend is not expected to slow down in the coming years. Chinese companies have been given greater prominence in technological development worldwide, and the number of patent applications is certain to continue to rise.

Footnote

1 Agatha Kratz, Mikko Huotari, Thilo Hanemann, Rebecca Arcesati; CHINESE FDI IN EUROPE: 2019 UPDATE; A report by Rhodium Group (RHG) and the Mercator Institute for China Studies (MERICS), April 2020.

This article was originally published in China IP Magazine.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]