Introduction

Anti-Money Laundering legislation requires each EU Member State to establish a Central Register of Beneficial Ownership of Trusts (CRBOT).

The CRBOT will contain details of relevant trusts and their beneficial owners. Trustees must submit these details to the Irish Revenue, who will manage the CRBOT.

For trusts that were established on or before 23 April 2021, the registration deadline is 23 October 2021. Trusts created after 23 April 2021 must be filed within 6 months of their creation.

The following shall have the right to inspect the Trust Register: -

- An Garda Síochána

- Financial Intelligence Unit (FIU) Ireland

- Revenue Commissioners

- Criminal Assets Bureau

- Competent authorities engaged in the prevention, detection or investigation of possible money laundering or terrorist financing.

- A designated person assigned to it by Section 25 Criminal Justice (Money Laundering and Terrorist Financing) Act 2010.

Trusts Required to Register and Certain Exemptions

Relevant trusts must submit information to the Central Register of Beneficial Ownership of Trusts (CRBOT) when:

- the trustees are resident in the state

or

- the trust is administered in the state

A relevant trust is an express trust established by deed or other declaration in writing.

Multiple Member States

The trustee must acquire a certificate (must be made available for insepection) from the Registrar in another Member State (MS) where a relevant trust:

- is administered in more than one MS; or

- two or more of the trustees reside in different MS; and

- the trustee has filed on the Central Register in another MS; and

- the information is the same as what is required to be filed on the CRBOT.

Non-Residents

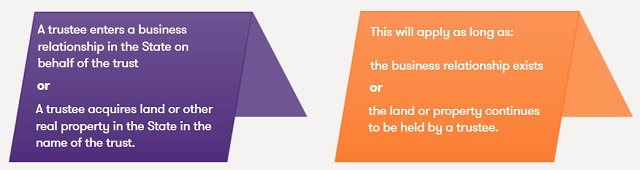

Trusts where none of the trustees are resident in the EU and the trust is not administered in the EU must register with the CRBOT if:

What if the trustees are not resident in the EU but have business relationships or property in more than one MS?

What if the trustees are not resident in the EU but have business relationships or property in more than one MS?

The trustee must acquire a certificate from the Registrar in another Member State (MS) where:

- a trustee enters a business relationship in Ireland on behalf of the trust; or

- a trustee acquires land or other real property in Ireland in the name of the trust; and

- the trustee has filed the information on the Central Register in another MS; and

- the information is the same as what is required to be filed on the CRBOT.

What information must be submitted on the CRBOT?

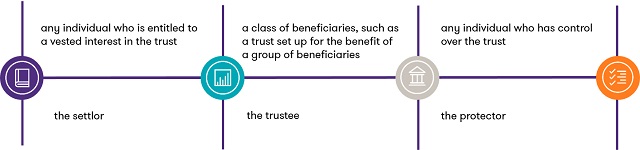

Trustees must submit information in relation to each beneficial owner of the trust.

A beneficial owner is any one of the following:

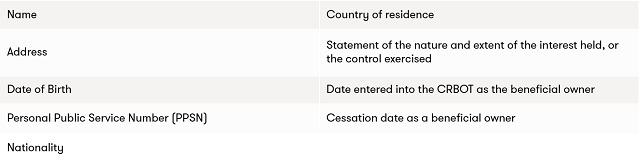

Information to be filed when the beneficial owner is an individual:

If the individual does not have a PPSN they must provide and upload proof of one of the following:

- foreign tax registration number

- passport number; or

- national identity number.

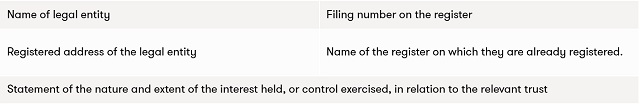

Information to be filed when the beneficial owner is a legal entity

How to Register for the CRBOT

Trustees (or their agents, advisors, or employees) can register through the 'Trust Register' portal on Revenue Online Service (ROS).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.