- within Corporate/Commercial Law topic(s)

- in Canada

- within Corporate/Commercial Law topic(s)

- within Law Practice Management, Criminal Law, Litigation and Mediation & Arbitration topic(s)

This paper addresses four key segments1 : sporting equipment, athletic footwear, activewear, and outdoor. While companies in the outdoor segment could broadly be subsumed under the other three, the outdoor market exhibits distinct drivers and growth patterns (see "Value Indications" chapter) and is therefore treated separately

Across Europe's sporting-goods landscape, momentum is anchored by house-of-brands consolidation, omnichannel and direct-to-consumer (D2C) reach, disciplined value-proposition clarity, and ESG-driven trust, together steering the sector's next wave of growth. Al is also reshaping the industry i.a. by enhancing product design, optimising supply-chain efficiencies, and enabling greater personalisation.

M&A momentum has rebounded sharply, with H1 2025 volumes

matching the post-Covid surge - signalling renewed buyer confidence

despite headwinds in adjacent consumer segments over the last 18-24

months. Strategics pursuing cross-border expansion, channel

balancing and digital infrastructure, while privately-owned

sporting-goods platforms with powerful brands and loyal communities

remain priority targets. Normalised valuation multiples are

unlocking founder sell-side appetite and should sustain robust deal

flow into H2 2025 and beyond.

Normalised valuation multiples are unlocking founder sell-side

appetite.

MARKET OVERVIEW

A DYNAMIC LANDSCAPE OF PERFORMANCE, LIFESTYLE, AND INNOVATION

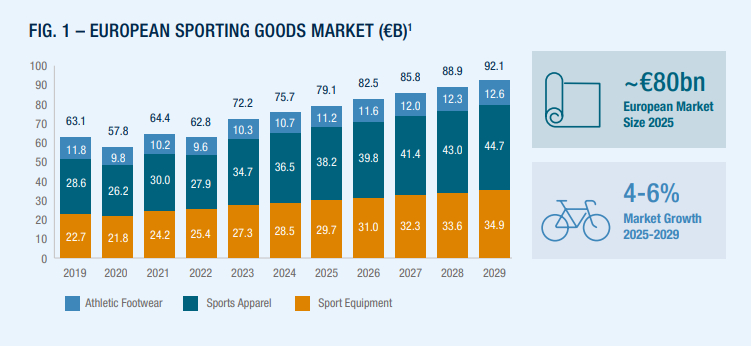

The European sporting-goods industry posts ~€80 billion in annual turnover and employs more than 700,000 people. This figure reflects revenue earned by the 1,800 manufacturers and brand owners headquartered in Europe, rather than retail mark-ups, offering a clear view of the sector's economic weight.

Momentum remains solid. Analysts expect the global category to grow between 4% and 6% per year through 2029, with Western Europe sustaining mid-single-digit growth despite economical headwinds. Rising health consciousness, hybrid work arrangements, and the blending of performance, leisure, and everyday wear keep broadening the market's reach.

The product mix is shifting from pure performance gear to holistic lifestyle solutions. Consumers now expect brands to support well-being through prevention—running, cycling, outdoor pursuits or gym use—rather than just supplying kit for organised sport.

This pivot extends category reach and aligns with public-health goals by encouraging activity and easing healthcare burdens.

Digital acceleration reinforces the shift. Smart wearable adoption in Europe is climbing at a double-digit rate, and more than threequarters of EU internet users shop online, pushing omnichannel and direct-to-consumer models deeper into the value chain. Connected hardware and data-rich training apps are raising expectations for seamless service and responsible production.

Complexity is rising as well. Half of industry executives (still) rank sustainability among their top priorities, making ESG readiness, circular design and resilient supply chains essential for future growth. Firms that translate data-driven insight into agile product innovation will be best positioned to capture Europe's next sportinggoods expansion.

Source: 1 Statista Insights (includes Sport & Swimwear; Gym, Training & Running Footwear; Sport Equipment – for clarification: comprising outdoor within the specific segments), A&M research

MARKET TRENDS

BRIDGING CHANNELS: UNLOCKING GROWTH WITH A MULTI-CHANNEL AND D2C STRATEGY

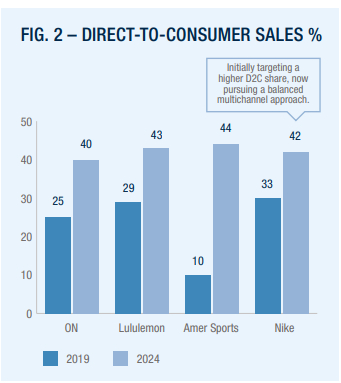

The sporting goods sector is witnessing a recalibration of go-tomarket strategies as brands adjust to a post-peak D2C environment. Direct-to-consumer channels remain strategically relevant, offering gross margin benefits, data access, and brand control. However, rising digital acquisition costs, inventory pressures, and the resurgence of in-store traffic have prompted leading brands to reengage with wholesale, shifting the focus toward scalable, hybrid models that optimise reach, efficiency, and brand equity

Nike, once the front-runner of a full D2C pivot, has reversed course. FY-24 commentary highlights renewed emphasis on retail partnerships, with the company actively repairing ties to stabilise sell-through. The rapid revival of its Foot Locker deal exemplifies this shift—balancing wholesale reach with D2C margin control. Similarly, adidas, under CEO Bjørn Gulden, has reaffirmed the importance of wholesale, spotlighting retail partners to re-anchor distribution after the Yeezy fallout. With DTC stabilised at ~40% of revenues, adidas is leveraging wholesale to rebuild regional depth and storytelling

Retailers like REI and JD Sports remain important for product validation, customer acquisition, and market reach.

Meanwhile, both online and offline are evolving rapidly, investing in store experience, digital integration, and personalization. This shift has reshaped brand-retailer relationships into more collaborative partnerships, with growing expectations around agility, data sharing, and marketing support.

Investments are increasingly flowing into hybrid experiences – digitally enabled stores, AR fitting tools, and integrated inventory systems – blurring the lines between digital and physical. These capitalintensive initiatives signal a longer-term commitment to omnichannel convergence, with brands and retailers alike positioning themselves for consumer journeys that cross formats and platforms.

The emerging consensus is clear: neither pure D2C nor wholesale dominance offers a complete solution. Winning strategies hinge on channel diversification, operational agility, and the ability to collaborate across ecosystems – balancing margin with scale, control with flexibility, and digital prowess with in-store credibility

Source: Sporting Goods 2025, Annual reports, Statista, A&M research

CURATING IDENTITY: SCALING GROWTH THROUGH THE HOUSE OF BRANDS MODEL

The House-of-Brands model has become a core growth playbook for sporting-goods companies, enabling scalable expansion while preserving distinct brand identities. Under one corporate umbrella, each label serves a specific consumer tribe, while shared backend platforms – procurement, logistics, digital commerce, and innovation – can add two to three EBIT margin points, according to recent industry benchmarking.

The model is inherently M&A-friendly: portfolio owners can diversify quickly and break into complementary and adjacent categories. Recent proof points range from Rossignol's string of niche ski acquisitions to Oberalp's six-brand alpine portfolio. At the larger end of the spectrum, Amer Sports has scaled Arc'teryx, Salomon, and Wilson into a US$5-billion platform, and VF Corp centralises services across The North Face, Vans, and Timberland, targeting hundreds of millions in annual cost savings. Such breadth boosts bargaining power with retailers and unlocks cross-brand innovation, enhancing profitability.

Consumer dynamics reinforce the thesis. Active lifestyles now shape personal identity, and more than half of European consumers say they mix specialist labels to express different facets of their lives. By curating distinct yet complementary brands, portfolio owners capture this mosaic of demand, deepening loyalty and winning share from single-brand rivals.

Success, however, hinges on disciplined governance: centralised operations must coexist with brand-autonomous design and storytelling to prevent cannibalisation or dilution. When executed well, the House-of-Brands approach equips sporting-goods firms to outpace rivals, adapt swiftly to shifting tastes, and sustain profitable growth in an increasingly competitive market.

Source: Company websites, public filings, A&M Research

MARKET TRENDS

BUILDING WITH PURPOSE: DRIVING BRAND EQUITY THROUGH ESG AND SUSTAINABILITY

The sporting-goods industry – historically material-intensive – is undergoing a structural shift toward circular models, including recycled content, low-impact materials, and formalised repair and reuse programmes.

Brands like Patagonia, Vaude, and a growing field of outdoorfocused players are placing sustainability at the core of their proposition, using it as both a differentiator and a platform for innovation.

Second-hand and refurbished product services are becoming a key pillar in these efforts. Programmes such as Decathlon's "Second Life," Arc'teryx's "ReBIRD," and Patagonia's "Worn Wear" are gaining traction with value-conscious and sustainability-driven consumers, offering lower emissions, longer product lifespans, and deeper customer loyalty. At the same time, these initiatives introduce operational and organisational complexity – requiring robust reverse logistics, rigorous quality control, and careful stewardship of brand perception to ensure consistency and consumer trust.

From an M&A perspective, ESG maturity has become a genuine value lever. More than 70% of European dealmakers say they have paused or abandoned targets over ESG red flags, and over half indicate they would pay a premium for businesses with auditable sustainability credentials—particularly those that can demonstrate progress on circularity at scale. ESG strength signals resilience, brand quality, and strategic fit in a market where regulation, consumer scrutiny, and capital flows increasingly reward purposeled operators. Despite current political headwinds ESG is here to stay

To view the full article clickhere

Originally published 17 July 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.