- within Corporate/Commercial Law topic(s)

- in United Kingdom

- with readers working within the Banking & Credit industries

- within Corporate/Commercial Law topic(s)

- in United Kingdom

- within Corporate/Commercial Law, Technology and Insurance topic(s)

- with readers working within the Healthcare industries

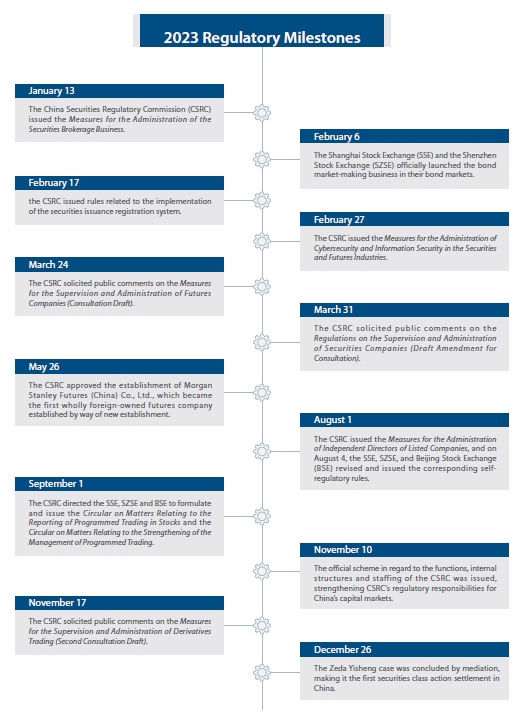

2023 Regulatory Mainline Review

01 Reform of the financial regulatory system, with a clear signal to focus on the development of capital markets

In March 2023, the Plan for the Reform of Party and State Institutions was issued, proposing the establishment of the National Financial Regulatory Administration (NFRA) based on the former China Banking and Insurance Regulatory Commission (CBIRC), which was responsible for the supervision of the financial services sector, with the exception of the securities sector. The former CBIRC was no longer retained, and the People's Bank of China's daily regulatory responsibilities for financial holding companies and other financial groups, financial consumer protection responsibilities, and the investor protection responsibilities of the CSRC were transferred to the NFRA. In addition, the CSRC was restructured from being a public institution directly affiliated with the State Council to becoming a government agency directly under the State Council. Moreover, the responsibility for approval of corporate bond issuance originally undertaken by the National Development and Reform Commission (NDRC) was transferred to the CSRC. Despite the replacement of the former CBIRC, the CSRC retained its position and gained an upgraded status, reflecting the importance attached to the regulation of securities and development of the capital markets through top-level regulation.

02 Full implementation of the securities issuance registration system, with corresponding improvements in the supporting regulations

Following the success of the pilot system of registration in the Sci-Tech Innovation Board, Growth Enterprise Market, and Beijing Stock Exchange, on February 17, 2023, the CSRC issued rules for the "comprehensive" implementation of the registration system. Simultaneously, various securities exchanges, including the National Equities Exchange and Quotations Co., Ltd., China Securities Depository and Clearing Corporation Limited, China Securities Industry Association, and other institutions, released supporting implementation rules. This marks the expansion of the system of registration to the entire market and all types of public securities offerings (including stocks, convertible corporate bonds and depositary receipts), representing a milestone in the development of China's capital markets.

Under the registration system, the issuance conditions under the previous system (which was based on approvals) will be transformed into disclosure requirements, as much as possible. Additionally, the regulator and exchanges will monitor the quality of information disclosure and enforce the chief responsibility of issuers for information disclosure and the gatekeeper responsibility of intermediary institutions through on-site supervision and inspections. The division of responsibilities and operations for exchanges review and CSRC registration have been unified and better coordinated. The exchanges will conduct comprehensive reviews of whether or not corporates meet the required issuance conditions, listing conditions, and disclosure requirements, while the CSRC will be tasked with ensuring compliance with national industrial policies and sector positioning simultaneously and will carry out registration procedures based on exchanges review opinions. The full implementation of the new registration system will enable corporates with development potential and excellent fundamentals to be able to list more effectively and efficiently.

Following the implementation of the registration system, the CSRC also improved the relevant rules. For example, on November 10, the CSRC solicited public comments on the revision of the Provisions on On-Site Inspection of Issuers for Initial Public Offering and the Regulations on Supervision and Guidance of Initial Public Offering and Listing of Stocks, aiming to establish on-site inspection and listing guidance supervision mechanism suitable for the registration system. Additionally, on December 22, the CSRC revised and issued two financial information disclosure rules to enhance the effectiveness of financial information disclosure rules in the capital market. The Optimization of relevant supporting regulations will further ensure the smooth progress of registration system reform.

On April 10, 2023, the first batch of 10 companies was listed on the Shanghai and Shenzhen Stock Exchanges' main boards under the new registration system, marking the comprehensive implementation of stock issuance registration system. Around 290 companies were listed under the registration system in 2023, accounting for over 90% of the total number of IPOs for the year.

03 Revision and promulgation of multiple rules to implement the Futures and Derivatives Law, and the futures sector continues to open up

In 2022, the promulgation of the Futures and Derivatives Law laid the overall regulatory framework for the futures and derivatives markets. To implement this foundational law, in 2023, multiple futures and derivatives related rules were introduced or revised.

In March, the CSRC solicited public comments on the Supervision and Administration of Derivative Trading and the Supervision and Administration of Futures Companies. Additionally, the revised Measures for the Administration of Futures Exchanges were formally promulgated to reflect and elaborate on the contents of the Futures and Derivatives Law. It is worth mentioning that the Measures for the Supervision and Management of Futures Companies (Consultation Draft) underwent significant revisions, particularly expanding the scope of futures companies' business. Subject to certain qualification requirements, futures companies are allowed to engage in futures market making and derivatives trading, which were originally within the business scope of risk management subsidiary of the futures company. This should bring new opportunities for leading futures companies to further expand and strengthen their businesses.

In November, the CSRC solicited public comments on the revision of the Measures for the Supervision and Management of Derivative Trading (Second Consultation Draft). Compared to the first draft published in March 2023, this second Consultation draft adjusted the scope of derivatives trading institutions, reports on derivatives contract development, and supervision of overseas/cross-border derivatives transactions. However, for certain issues that sparked market discussion, such as the consolidation of positions of exchanges and OTC market and prohibited trading activities, the CSRC maintained a strict attitude consistent with the first draft, reflecting its cautious approach to strengthening regulation in the derivatives market, addressing regulatory gaps, and its determination to combat illegal activities and prevent risks in the derivatives field.

In addition, the CSRC and the China Futures Association (CFA) have also established and improved applicable rules regarding the management of futures practitioners, the opening of accounts for futures companies, and the management of futures market positions. For example, the Interim Provisions on Futures Market Position Management issued on July 31, 2023 stipulate regulations on position limits and exemptions, hedging, reporting of large positions, and position aggregation, filling the gap in position management requirements at the departmental regulation level.

Further to rule revisions and updates, in 2023, various securities and futures exchanges also introduced many new futures and options products. For instance, in June, two exchange-listed options contracts based on the Sci-Tech 50 Index – Huaxia Sci-Tech 50 ETF Options and E Fund Sci-Tech 50 ETF Options – were listed on the Shanghai Stock Exchange, with the combined scale of the two ETF products exceeding RMB 87 billion. In July, lithium carbonate futures and options were listed on the Guangzhou Futures Exchange, becoming the second largest listed product after industrial silicon futures and options.

Meanwhile, the opening-up of the futures sector continued. In January and August 2023, a total of nine futures and options contracts from the Zhengzhou Commodity Exchange and the Shanghai International Energy Exchange were designated as specific domestic products, allowing the participation of overseas traders in trading. Additionally, on November 24, 2023, the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Stock Exchange (HKEx) simultaneously announced plans to launch treasury futures contracts in Hong Kong, offering additional risk management tools for overseas investors and generally enhancing the ecosystem of offshore renminbi products.

04 Improvement of securities firms-related regulatory rules, involving multiple business and internal control compliance aspects

In 2023, the CSRC and the Securities Association of China (SAC) issued and revised multiple regulatory rules related to securities firms, covering supervision and administration of securities firms, business rules, internal control compliance, and other aspects.

Specifically, on March 31, the CSRC solicited public comments on the Regulations on the Supervision and Management of Securities Firms (Revised Draft for Consultation) to further implement the requirements of the new Securities Law enacted in 2019. Adjustments or supplements were made in the corporate governance, compliance risk control, and business rules of securities firms.

At the level of business rules, the CSRC issued the Measures for the Administration of Securities Brokerage Business in January 2023, which clarified the scope of brokerage business, optimized business processes, and strengthened client behavior management and rights protection. The SAC subsequently released related detailed business rules. In February, the CSRC put into place corrective measures for illegal cross-border business by domestic securities firms' overseas subsidiaries, prohibiting overseas institutions without domestic licenses from opening accounts for new domestic investors and requiring them to resolve existing domestic clients in an orderly manner. Regarding the bond business, in July and October 2023, the SAC issued several rules, involving underwriting, entrusted management, handling of bond default risks, and quality evaluation of bond businesses. In October 2023, the CSRC made adjustments to margin trading and the Shanghai Stock Exchange and Shenzhen Stock Exchange issued notices regarding margin trading and securities lending trading arrangements. Securities firms were required to establish sound mechanisms for margin trading securities sourcing, penetration verification, and access control, and strengthen management of margin trading transactions. Most securities firms had implemented these requirements by the end of 2023.

In terms of internal control and compliance rules, the SAC issued multiple related rules in 2023, such as the Guidelines for Internal Auditing of Securities Firms, Guidelines for Stress Testing of Securities Firms, Guidelines for Operational Risk Management of Securities Firms, and norms related to employees' integrity and professional conduct. On November 3, 2023, the CSRC solicited public opinions on the Regulations on Calculation Standards for Risk Control Indicators of Securities Firms, whose aim was to improve the risk control indicator calculation standards adopted by securities firms for market making, asset management, participation in public real estate investment trusts (REITs), while strengthening classified supervision, supporting compliant and stable high-quality securities firms to improve capital utilization and providing more leverage space for leading securities firms.

05 Improvement of information technology-related rules in the securities and futures sector, and introduction of regulatory measures for algorithmic trading

In recent years, securities and futures companies have resorted to using an increasing number of technological tools and. That has led to a number of regulations and rules being introduced to cover how these tools are used in securities and futures businesses in 2023.

In March 2023, the CSRC issued the Measures for the Administration of Cybersecurity and Information Security in the Securities and Futures Industries, which covers various entities such as infrastructure operators, operating institutions, and information technology system service providers in the securities and futures field, proposing more comprehensive regulatory requirements for cybersecurity, personal information protection, and other issues. In June, applicable industry associations issued a three-year improvement plan for the cyber and information security of securities firms, futures companies, and fund management companies, further refining the work objectives and requirements of relevant institutions. Meanwhile, in April, the CSRC solicited public comments on the Administrative Provisions on Trading Server Colocation for the Securities and Futures Markets (Consultation Draft), aiming to regulate the provision of trading server colocation services by securities and futures exchanges and the leasing of related colocation services by securities and futures operating institutions. Furthermore, the CSRC released a series of financial industry standards related to information technology in the securities and futures industry in 2023, continuously improving the informatization construction of the securities and futures field.

Another major regulatory measure that attracted market attention in 2023 was the introduction of rules related to algorithmic trading by the Shanghai, Shenzhen, and Beijing stock exchanges. On September 1, 2023, the three exchanges simultaneously issued notices regarding matters related to the reporting of algorithmic trading in stocks and strengthened management of algorithmic trading. Building upon the existing system for reporting algorithmic trading in convertible bonds, the exchanges officially established a reporting system for algorithmic trading in the stock market and stipulated that the requirements for algorithmic trading would also apply to funds and depositary receipt trading conducted on the exchanges. In addition to specifying reporting requirements for investors, the notices also emphasized strengthening monitoring of abnormal and high-frequency trading and required securities firms to fulfill their responsibilities in managing algorithmic trading. The introduction of these exchange-related rules is conducive to guiding the standardized development of algorithmic trading, assisting regulatory authorities in clarifying the situations of quantitative trading in the domestic market and lay the groundwork for subsequent regulation or reform.

06 Rules for overseas listing of domestic enterprises fall into place, unified implementation of filing requirements

On February 17, 2023, the CSRC issued rules covering the management of overseas listings, including the Trial Measures for Administration of the Issuance and Overseas Listing of Securities by Domestic Enterprises, and five supporting guidelines. The rules and regulations refine the "negative list" - situations where overseas issuance and listing are not allowed according to the principle of "minimum and necessary", do not set additional thresholds and conditions for overseas listings, as well as specifying the requirements of the overseas listing filing process. Such measures bring together in one place the filing management process for both direct and indirect overseas listings by enterprises and also require overseas securities firms acting as sponsors or lead underwriters for domestic enterprises' overseas issuance and listing businesses to fulfill filing obligations to the CSRC. These changes to the overseas listing regulatory system emphasize the combination of delegation and regulation and are intended to make it more efficient for domestic enterprises to secure overseas financing.

On the same day, the CSRC signed a memorandum of regulatory cooperation with the SFC on matters related to overseas listings, clarifying the regulatory cooperation arrangements and procedures in areas such as issuance and listing, cross-border law enforcement cooperation, intermediary supervision, and information exchange. This was intended to strengthen regulatory cooperation on matters related to mainland Chinese enterprises listing in Hong Kong.

In addition, to provide clearer guidance for the confidentiality and archive management of enterprise overseas listing activities and improve related cross-border regulatory cooperation arrangements, the CSRC, together with applicable departments, revised and issued the Provisions on Strengthening the Confidentiality and Archive Management of Domestic Enterprises' Overseas Issuance of Securities and Listing on February 24.

As of December 31, 2023, 81 companies received notice that they needed to file for overseas listing filings (including filings for overseas issuance and listing and filings for "full circulation" of unlisted shares domestically), while 87 enterprises were in the process of filing. Additionally, as of December 31, 2023, 185 overseas securities firms engaged in domestic enterprises' overseas issuance and listing businesses had completed their filings with the CSRC.

07 Major changes in regulations of bonds and multiple institutional reforms including bond registration

In 2023, significant changes were made to China's bond regulatory system, and the regulators introduced many policies to promote the development, unification and standardization of the bond market. Based on the reform of the financial regulatory system by the State Council, bond market regulation tended to be unified. In addition to the supervision of the interbank bond market retained by the People's Bank of China, corporate bonds fell under the supervision of the CSRC. The transition period for corporate bonds was completed on October 20, 2023. On the same day, the CSRC clarified the arrangements for accepting and reviewing corporate bond registration, custody, risk prevention and control, and issued revised rules related to the issuance and trading of corporate bonds, incorporating corporate bonds into the regulatory scope, and establishing a unified regulatory system for corporate bond regulation rules.

Another significant change in the bond market in 2023 was the refinement of the system of bond registration. On June 21, the CSRC issued the Guiding Opinions on Deepening the Reform of the Bond Registration System and the Guiding Opinions on Improving the Practice Quality of Bond Business of Intermediary Institutions under the Registration System. These were intended to optimize the bond review and registration process, strengthen the management of bonds during the issuance period, make clear the responsibilities of issuers and intermediary institutions, and improve the quality of intermediary institutions. At the same time, efforts were made to increase the crackdown on serious violators of laws and regulations in the bond market.

Furthermore, to promote the high-quality development of the bond market and enhance market vitality, the Shanghai Stock Exchange and Shenzhen Stock Exchange officially launched bond market-making services on February 3, 2023. By the end of 2023, a total of 15 institutions had become market makers on the Shanghai Stock Exchange's bond market, with 14 of them also providing market-making services for the Shenzhen Stock Exchange's bond market.

In addition to these changes, many new regulations targeting specific enterprises or specific areas of bonds were introduced in 2023. In April, the CSRC issued the Action Plan for Promoting the High-Quality Development of Bonds for Technology Innovation Companies, making it easier for high-tech companies to access the bond market; in December, the CSRC and the State-owned Assets Supervision and Administration Commission (SASAC) jointly issued the Notice on Supporting Central Enterprises to Issue Green Bonds, with the aim of facilitating finance support for the issuance of green bonds and to encourage central enterprises to invest in green projects.

08 Strict crackdown on illegal activities in the securities field and maintaining a high-pressure enforcement posture

In 2023, the crackdown on illegal activities in the securities field continued to maintain a high-pressure posture, and significant progress was made in several cases of false statements, fraudulent issuance, and related investor lawsuits and claims.

In 2023, the CSRC remained focused on the compliance of securities firms' investment banking business. On September 6, the CSRC issued 13 fines in one go, taking regulatory steps against 6 securities firms and 13 executives for violations of laws and regulations related to investment banking. On December 8, 2023, the Ministry of Public Security, in conjunction with the CSRC, cracked down on multiple major cases of insider trading and market manipulation, arresting more than 50 people in cases involving more than RMB9 billion.

Regarding major cases of false statements and fraudulent issuance related to securities, on July 28, after the Zeda Yisheng Securities false statement liability dispute officially became the second special representative litigation case in China after the Kangmei Pharmaceutical case, the case was settled through mediation on December 26, with the China Securities Investor Service Center representing 7,195 eligible investors receiving full compensation of over 280 million yuan, making it the first case of collective securities litigation and settlement in China, with demonstration significance. On December 29, based on the administrative law enforcement commitment system stipulated in the Securities Law, the CSRC signed commitment recognition agreements with intermediary institutions involved in illegal and irregular activities under the Zijin Storage case, with four intermediary institutions fulfilling commitments such as paying commitment fees and self-inspection and rectification. Under such a system, if the parties involved make corresponding commitments during the investigation, the CSRC can suspend the investigation, and if the parties fulfill their commitments, the CSRC can terminate the investigation. This system ensured efficient and maximum protection of investor interests in the Zijin Storage case, while ensuring that the parties involved were duly punished, which is of great significance for quickly restoring market order.

So far as cross-border law enforcement is concerned, the CSRC held two law enforcement cooperation work meetings with the SFC in 2023, exchanging work priorities and progress in major case handling, which helps further improve the cross-border law enforcement cooperation mechanism between the two places.

2024 Regulatory Outlook

01 Continuing to expand the opening up of the securities and futures market to international participants

China made some progress in opening up the securities and futures markets in 2023. We expect that in 2024 China will continue to open up its securities and futures markets.

In 2023, the CSRC approved the establishment of some foreign-funded securities companies and foreign-funded futures companies such as Standard Chartered Securities (China) Co., Ltd. and Morgan Stanley Futures (China) Co., Ltd. There are a number of foreign-funded securities or futures institutions in the process of applying to set up in China, and it is expected that more foreign-funded securities or futures institutions will get approval to carry out business in China in 2024. In addition, China is also continuing to put in place supporting measures to facilitate foreign institutions to expand their business in China. Among these measures are recognition of overseas financial professional qualifications in the securities, futures and funds sectors, and facilitating the employment of qualified professionals from abroad in China.

So far as cross-border trading is concerned, it is expected that the interconnection mechanism between Mainland and Hong Kong Stock Markets (the "Interconnection Mechanism") will expand in 2024. In August 2023, the CSRC and the SFC reached a consensus to accelerate the inclusion of block trading (non-automated counter trading) in the Interconnection Mechanism, and the supporting rules are expected to formally come into effect in 2024. The intention is that the inclusion of block trades in the Interconnection Mechanism will make for greater trading convenience and help to promote the capital markets in both markets. As at the end of 2023, China's futures market had 24 specific products open to foreign traders for trading, and 46 commodities, stock index futures and options products were open to QFIIs and RQFIIs for trading, of which the proportion of primary products had reached 96% and 70& respectively. It is expected that in 2024, the varieties of futures open to foreign traders as well as the varieties of futures and options products open to QFIIs and RQFIIs, will continue to expand, thus attracting more foreign institutions to participate in the pricing of China's primary product futures, enhancing the representativeness and influence of China's futures prices, and providing more accurate price signals for industrial enterprises.

Meanwhile, the Provisions on the Administration of Domestic Securities and Futures Investment Funds of Foreign Institutional Investors (Consultation Draft) issued in November 2023 abolished the administrative approval requirements for QFII and RQFII to register their funds with the State Administration of Foreign Exchange (SAFE), and further simplified the exchange administration requirements. The formal implementation of this regulation should encourage foreign institutional investors to carry out securities and futures investments in China.

So far as cross-border listing is concerned, in June 2023 one official of the SFC delivered a keynote speech entitled Reconnecting with the Mainland Market, in which, apart from mentioning the aforementioned deepening of the Interconnection Mechanism, the official mentioned that SFC would establish flexible regulatory approaches to accommodate more mainland companies listing in Hong Kong and thereby assist China's economic restructuring. At the same time one CSRC official also mentioned in a media interview in the middle of 2023 that further practical measures would be adopted to support the development of the Hong Kong market and to co-ordinate the enhancement of the activity of A-shares and Hong Kong stocks. He also called for the support of dual listing of US-listed shares in Hong Kong. In recent years, through new initiatives such as the different voting rights structure, the return of US-listed Chinese companies, and the listing measures for biotechnology companies, the Hong Kong securities market has absorbed many mainland enterprises to list in Hong Kong. It is expected that by 2024, the Mainland and Hong Kong securities markets will have further close ties in cross-border listing.

In addition, in order to attract more foreign investment as well as international cooperation, we will need to look out for regulatory adjustment allowing for integrated group operation and cross-border data transfer while the risk is controllable, which has given rise to concern among international investors.

02 Improving bond market rules and promoting the functioning of the exchange bond market

The bond market has introduced a number of new rules and deepened the reform regarding the bond registration system in 2023. It is expected that the CSRC will introduce more measures to stabilize expectations and confidence and stimulate bond market activities in 2024, including strengthening the investment side regulations of the bond market, giving permission to banking institutions to participate fully in the trading of the exchange bond market, further advancing the reform of the inquiry and quotation system, and granting more access to international participants of China's bond market.

In addition, we expect that in 2024, the authorities will further promote the exchange bond market to reduce the cost of financing, smooth financing channels, optimize the financing structure and other functions, and raise the standards of the bond market to serve the real economy, so as to better serve the overall situation of the smooth operation of the economy through the bond market. In terms of specific bond categories, in regard of REITs, it is expected to have new categories of REITs including consumer infrastructure, to promote REITs market for high-quality expansion, and to press ahead the supply of high-quality REITs projects. The CSRC also revealed that it is studying the launch of REITs-related index and ETF products, as well as promoting the interconnection of the REITs market with the Hong Kong market. We await announcements on this score in the coming year. The main focus of real estate, urban investment related bond is expected to remain on risk resolution, prevention and control, supporting the reasonable financing needs of normally operating real estate enterprises while focusing on the steady resolution of the risk of bond defaults by large real estate enterprises and strengthening the monitoring and early warning of urban investment bond risks. Finally, we should expect emerging bond products including science and technology innovation bonds and green bonds that will further develop and have a positive effect on China's economy.

03 Possible further changes in the securities sector and the Matthew effect further intensified

On October 31, the Central Financial Work Conference called for the creation of first-class investment banks and investment institutions. The CSRC followed this up by calling for the top securities firms in China to enhance themselves through business innovation, group operation, mergers and acquisitions, etc., so as to build first-class investment banks, to help support the real economy and to act as the ballast for maintaining the financial stability.

According to the SAC, there are currently 146 securities companies in China. There is a lot of competition between brokerages. The Matthew effect is also more pronounced. If the top securities firms focus on business innovation, group operation and mergers and acquisitions, they can better fulfill resource allocation and further enhance the influence of China's local securities firms on the world stage. With the encouragement of policies, it cannot be ruled out that China's securities sector will be changed in 2024.

04 Stabilizing market confidence and enhancing investment attractiveness of listed companies

According to statistics, a total of 313 new companies were listed on the A-share IPO market in 2023, down by more than a quarter (26%) on 2022. More enterprises than 2022 withdrew their application to list. It can be seen that the pace of IPOs in the A-Share market is gradually slowing down, which could possibly be related to the CSRC's emphasis since the end of August 2023 on strengthening counter-cyclical regulation, phased tightening of IPO to ensure a good quality of company listing.

"Enhancing the investment attractiveness of listed companies and promoting the stable development of the capital market" is a constant theme that has been emphasized by the regulators. In September 2023, the CSRC convened three symposiums to analyze the situation of the capital markets, exchanging views on how best to invigorate China's capital markets and to boost investor confidence, as well as on the hotspot issues that are of concern to the market. According to an article in China Securities Journal, the CSRC has been in the early stage of brainstorming a number of initiatives around the invigoration of the capital market, the next step will be continuing to study and validate the policy initiatives have not yet been launched and to sweeten market expectations. Combined with the recent speech of the relevant official of the CSRC, it is expected that specific initiatives to be issued may include the establishment and improvement of the listing and financing of science and technology-based enterprises, more bond issuances, green channel for M&A and reorganization, the introduction of the capital market reform action plan of the investment side to increase the introduction of medium- and long-term funds, improving the listed companies dividends binding mechanism, amending the rules of the system of share repurchase to relax the relevant conditions for the repurchase, the introduction of rules on the restructuring of the directional convertible bond, improving the review mechanism for the micro restructuring of listed companies, enriching the payment and financing tools for restructuring, pushing forward the construction of a valuation system with Chinese characteristics, and reasonably grasping the pace of IPOs and refinancing.

We expect overall the CSRC and the stock exchanges to adopt a prudent attitude towards new IPO projects to address the imbalance between the supply and demand of the capital in the secondary market, and, on this basis, accelerate the implementation of relevant policy initiatives in order to boost investor confidence and invigorate the capital markets.

05 Ongoing regulatory transformation, with focus on regulatory responsibility and accountability

After the reform of the issuance registration system, it will continue to be a strong focus on the transformation of all-round supervision by the CSRC, including corporate supervision, institutional supervision, inspection and punishment, and scientific and technological supervision. Among them, in recent years, particular emphasis has been placed on cracking down on illegal activities in securities and futures market, strengthening the implementation of regulatory responsibility and accountability, and improving the regulatory system and mechanism for inspections and penalties. It is expected that these issues will continue to be an important topic in the regulatory transformation of the CSRC in 2024.

The relevant official of the CSRC said in a recent speech that the CSRC will strengthen its collaboration with the public security and judicial organs, continue to improve the capital market system and mechanism to prevent and combat fraud, promote the administrative, civil and criminal three-dimensional accountability system, increase the financial counterfeiting, fraudulent issuance, market manipulation and other violations, and penalize the intermediary institutions who fail to perform their duties. It is expected that in 2024, the CSRC will still adhere to the regulatory idea of "treating the root of the problem with seriousness" and crack down on violations in the securities and futures market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.