- within Intellectual Property topic(s)

- within Technology topic(s)

The largest increase in the number of patent applications in the last 20 years has been observed for inventions related to electric propulsion, which now outnumber applications related to chemical propulsion, with most of such electric propulsion-based solutions coming from China. This is one of the most surprising conclusions of the report entitled "Propulsion systems for space," issued in May this year by the European Patent Office.

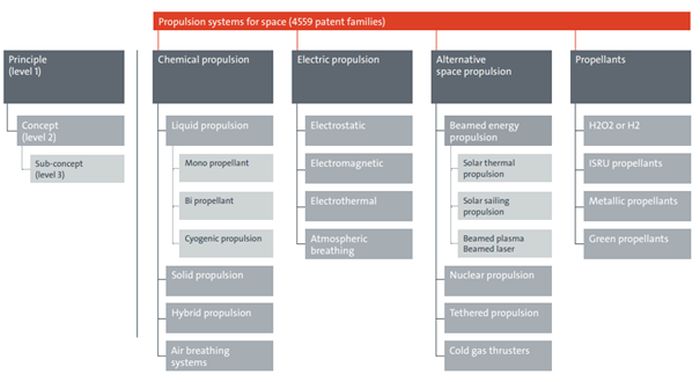

For the purposes of the report, 4559 families of patents related to propulsion systems for space and filed with 52 patent offices were identified. A patent family is a collection of patent documents covering the same invention, filed by the applicant in various countries (in this case, the applicants were registered in 43 countries and the inventors resided in 53 countries). The inventions have been categorized into four distinct technological areas, such as chemical propulsion, electric propulsion, alternative space propulsion, and propellants.

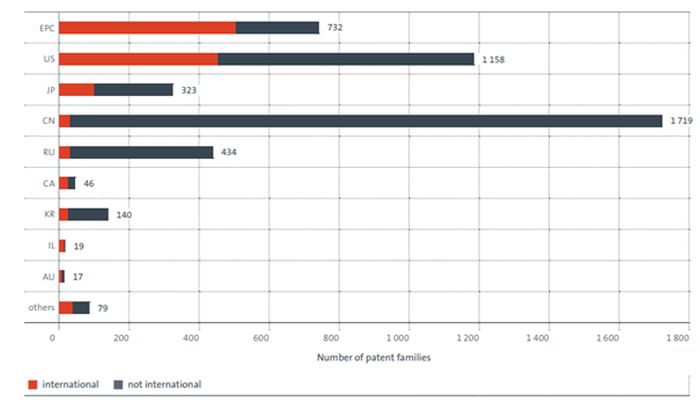

The report indicates that the main players in the space sector remain the same and include China, the United States, Europe (mainly France and Germany), Japan and Russia. As in other technological fields, also in the space sector China's strong position is evident in relation to virtually every type of propulsion systems. While still being niche, nuclear propulsion appears in an increasing number of patent applications, with the United States and China being the most prominent in this area, which is naturally associated with the dominance of these countries in space exploration.

The report relies on carefully selected patent applications and patents that have been "fished out" from more than 150 million documents found in databases. Appropriate selection of keywords and patent classification allows to examine a specific area of technology to illustrate trends and new directions of development. The data thus prepared provide information that may be helpful in taking business decisions regarding the development of a specific technology or even stopping or modifying an R&D project when similar solutions have been found to exist.

The analysis of the data collected in the report indicates China's leading position. Approximately 38% of all identified inventions submitted between 2003-2022 come from this country. In 2022 alone, China's share rose to as much as 65%, which may mean that space propulsion systems are of strategic importance to Chinese decision-makers. The Chinese and Indian aerospace industries have shown significant progress, and these countries appear to be significant players in the international market. The United States, Germany, Japan and France come next in terms of the number of patent applications filed. On the other hand, the most frequently cited patent applications originate from the United States, due to the high innovativeness of patented solutions. The analysis of the data also indicates that in most countries patent applications are filed mainly by privately held companies, and only in China the portfolios of patent applications come from research institutions and universities. Europe is represented by companies from France and Germany, such as Airbus, Safran, Arian and Thales.

In 2022, more than 1,000 companies operating in the space sector were active, which is twice as much as in 2012. The number of launched satellites has also increased significantly, from about 300 per year in 2010‒2019 to over 2800 in 2023. There is also a considerable increase in the number of private entities participating in the race to conquer space. However, they still represent a small portion of what is financed from the public budget earmarked for space research. Institutional spending in 2022 reached almost EUR 100 billion, with private capital amounting to around EUR 8.8 billion. The main growth factors in the space sector are the fight against climate change, security, meteorology and connectivity. One of the most important breakthroughs in this sector has been SpaceX's Falcon 9 vertical takeoff, vertical landing rocket. Although Falcon 9 is currently the only launch vehicle with working reusable launch technology, multiple rocket takeoffs accounted for as much as 41% of all takeoffs in 2023.

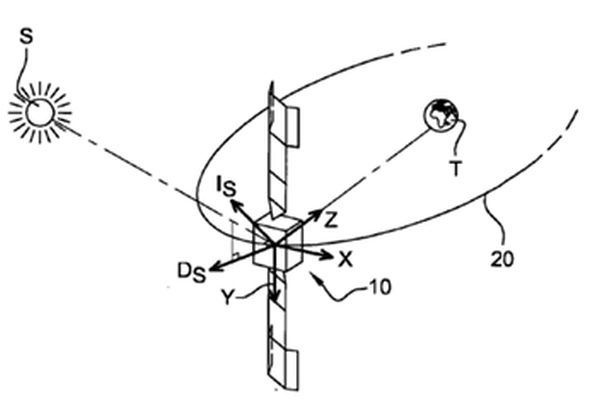

Among the propulsion systems described in the report, the water-based ones are interesting. They include, among others, Water-Resistojet (WR), a type of electrothermal propulsion system using water as a fuel. Water electrolysis propulsion (WEP), on the other hand, uses an electrolyser to generate oxygen and hydrogen from stored water. These two gases are then utilized to operate conventional chemical propulsion systems or Hall-effect thrusters (HET). Another interesting concept is a beam-powered propulsion system operating like a sail, where propulsion is provided by solar or laser radiation pressure. The solution is presented in the drawing from the patent description.

An examination of the state of the art (i.e., all solutions from around the world known to exist up to a given date) along with an analysis of the results obtained can show the trends in the development of a specific field of technology. An analysis of selected patent documents has revealed that China has the highest number of patent applications in which electric propulsion-based inventions predominate. In addition, this analysis has helped to identify the main players in the form of specific countries, as well as companies and research institutions. This type of search indicates which areas of technology are developing more intensively and which companies and institutions are most active in them. Before starting a new R&D project, it is worth conducting such an examination to get to know the domestic, European or international market, thus minimizing the risk of a duplicated invention, and to identify your competitors, which will result in better informed business and technological decisions regarding the next years of your company's development.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.