- within Corporate/Commercial Law topic(s)

- within Real Estate and Construction topic(s)

In recent years, China's private equity investment fund industry has developed steadily, playing an active role in increasing the proportion of direct financing and promoting economic development. As China's antitrust enforcement has gradually intensified, private equity funds, whose businessmainly involves investment transactions, shouldtakeantitrust compliance seriously during its fundraising, investment, management, and exit phases. This includes incorporating merger control filing obligations into the compliance process to avoid more stringent penalties for failure to file under the Anti-Monopoly Law. In practice, we have also observed that private equity funds are increasingly paying attention to merger control filing compliance. Among the notification cases published on the official website of antitrust enforcement agencies ("SAMR"), there are numerous cases where private equity funds have filed notification because the transactionshave triggered the merger control filing thresholds, and all such filings have been cleared.

Although the basic rules for determining whether a transaction involving private equity fundstriggers merger control filing obligations are not significantly different from those in other industries, there are indeed some unique rules and practices. Based on pastexperience, the author provides a practical analysis of the situations in which private equity funds may need to file for merger control during the fundraising, investment, management, and exit phases.

1. Thresholds for Triggering Merger Control Filing Obligations

According to Article 26 of the Anti-Monopoly Law, operators must file with the State Council's antitrust enforcement agency if a merger meets the filing thresholds prescribed by the State Council. Transactions that have not been filed cannot be implemented. When determining whether a transaction requires a merger control filing, one must first assess whether the transaction constitutes a concentration of undertakings, and then determine whether the concentration meets the filing thresholds.

1) Determination of "Concentration of Undertakings"

The term "concentration of undertakings," according to Article 25 of the Anti-Monopoly Law, includes three scenarios: the merger of undertakings, the acquisition of control over other undertakings through equity or asset purchases, and the acquisition of control or the ability to exert decisive influence over other undertakings through contracts or other means. Therefore, whether an undertaking acquires control over other undertakings or can exert decisive influence (hereinafter collectively referred to as "control") is the standard for determining whether a transaction constitutes a concentration of undertakings.

Themeaningof "control" under the Anti-Monopoly Law differs from the understanding of control under Company Law, Securities Law, and other legal frameworks. China's Anti-Monopoly Law does not explicitly define "control," and it is generally analyzebased on factors such as equity structure, voting rights structure, management structure, and decision-making mechanisms for major business and management matters of the enterprise. Article 5 of the Provisions on the Review of Concentration of Undertakings (hereinafter referred to asem>the Review Provisions) and Article 11 of the Anti - monpoly Compliance Guidelines for Concentration of Undertakings (hereinafter referred to as the Compliance Guidelines) list the factors that need to be considered, such as the voting matters and voting mechanisms of the shareholders' meeting or other decision-making bodies, their historical attendance rates and voting results, the composition of the board of directors or other decision-making or management bodies, their voting mechanisms, historical attendance rates and voting results, and even the right to veto major business management matters such as annual business plans, financial budgets, and the appointment or dismissal of senior management personnel.

Based on the merger control filing and review practice, antitrust enforcement agencies interpret "control" to have meaning of both "active control" and "passive control." Active control refers to the ability of the relevant undertakings to actively make decisions on the company's daily operations and business strategies. In practice, rights that involve major business management matters of the company and are thus recognized as acquiring "control" include: holding a majority of equity, voting rights, or similar interests; the right to nominate or remove senior management personnel; the right to determine business plans and investment plans; and the right to decide or veto financial budgets. Generally, if an undertaking acquires more than 50% of the equity or obtains more than half of the seats on the board of directors, it is usually considered to have "active control." Passive control, also referred to as "joint control," mainly manifests in situations where the relevant undertakings, although unable to participate in active decision-making regarding the company's daily operations, can exercise veto power over certain daily business or commercial decisions, such as annual business plans, financial budgets, major investments, and the appointment or removal of senior management personnel. However, if the investor only obtains rights aiming to protect the interests of minority shareholders underthe Company Law, such as the right to veto amendments to the company's articles of association, changes to registered capital, mergers, splits, dissolutions, affiliated-party transactions, or changes to the company's legal structure, it is generally not considered to have acquired "control" over the target company.

2) Calculation of Turnover

Article 3 of the Regulations of the State Council on the Thresholds for Merger Control Filings, released in January 2024, raises the thresholds for the total global turnover of all undertakingsto the concentration in the previous fiscal year from 10 billion RMB to 12 billion RMB, and the total turnover within China from 2 billion RMB to 4 billion RMB. Additionally, it raises the threshold for undertakings having a turnover within China exceeding 400 million RMB in the previous fiscal year to 800 million RMB.

Turnover includes the revenue obtained by the relevant undertakings from the sale of products and the provision of services in the previous fiscal year, minus relevant taxes and surcharges. When calculating turnover, it is important to note that:

- The turnover of the undertakings to the concentration includes the total turnover of the undertaking itself and all undertakings that have a direct or indirect control relationship with it, excluding the turnover between the aforementioned undertakings. Specifically, when calculating the turnover of an individual undertaking to the concentration, the turnover of the affiliated parties within its "group" that it has control over or under its control should also be included.

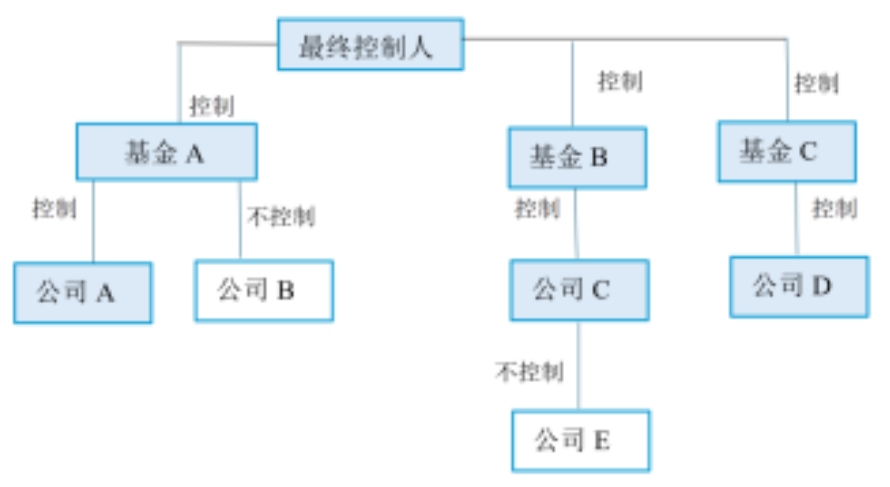

- According to the above rules, the calculation of the turnover of a private equity fund should be traced back to its ultimate controller and include the turnover of all undertakings under its control (i.e., the "group" turnover). Specifically, this includes:

i)The turnover of the fund itself, which usually includes management fees and investment income, etc.;

ii)The turnover of other funds or invested enterprises controlled by the fund;

iii)The turnover of the fund's actual controller (usually the fund's GP or the entity that has control over the fund according to the fund's governance documents);

iv)The turnover of other funds and invested enterprises controlled by the fund's actual controller.

Please referto the diagram below, where the turnover of all companies filled in blue should be included in the turnover of the ultimate controller.

- According to the relevant provisions of the Measures for the Calculation of Turnover for Merger Control Filings in the Financial Sector (hereinafter referred to as the Calculation Measures), the method for calculating the turnover of financial undertakings is: Turnover = (Sum of turnover elements - Business taxes and surcharges) × 10%. This regulation applies to enterprises with "financial institution" qualifications, including bank or financial institutions, securities companies, futures companies, fund management companies, and insurance companies. As for whether the turnover of private equity funds can be regarded as the "fund management companies" stipulated in the Calculation Measures when calculating its turnover, we understand that the "fund management companies" mentioned in the Calculation Measures only refer to licensed public fund management companies that have obtained a public fund license. Although private equity funds are registered with the Asset Management Association of China (AMAC), they have not obtained the relevant licenses, so this special calculation method is not applicable to private equity fund.

- Regarding the definition of the "previous fiscal year": The previous fiscal year refers to the fiscal year prior to the execution date ofthe concentration agreement.

- Regarding the definition of "within China": According to Article 5 of the Guiding Opinions on Merger Control Filings, "within China" meaning that the location of the purchasers is within China. This includes exports from countries or regions outside China to China, but does not include exports of products or services from China to countries or regions outside China. For private equity funds, domestic turnover includes the turnover generated by both domestic and foreign entities from providing services to customers located within China.

Additionally, it should be noted that according to the newly added Article 26, Paragraphs 2 and 3 of the Anti-Monopoly Law, even if a concentration of undertakings does not meet the filing thresholds, if there is evidence that the concentration has or may have the effect of eliminating or restricting competition, the enforcement agency may require the undertakings to file notification; if the undertakings fail to file as required, the enforcement agency shall initiate an investigation. This new article will further expand the scope of the merger control filing obligations. China's antitrust enforcement agencies are highly focused on concentrations involving start-ups or concentrations in the platform economy where the undertakings involved have turnover below the filing threshold due to free or low-price business models. Therefore, if a private equity fund plans to engage in transactions that may significantly impact market competition such as killer acquisitions, it should plan ahead for merger control filing requirements.

- Procedural Issues in Merger Control Filing

1)Parties Responsible for Filing

According to Article 13 of the Review Provisions, in the case of a concentration of undertakings implemented through a merger, all parties to the merger are responsible for filing. In other scenarios, the undertaking that acquires control or can exert decisive influence is responsible for filing, while the other undertakings should cooperate. If there are multipleparties responsible forfiling in the same concentration, one of them can be entrusted to file on behalf of the others. If the entrustedpartyfails to file, the othersare not exempted from their filing obligations. If theparty responsible for filingfails to file, other undertakings in the concentration may submit the filing.

For fund formation,theGP and LP that acquire control over the newly established fund areresponsible forfiling, but in cases where there are multiple controllers, one party can be entrusted to handle the filing, and LPs should cooperate by providing relevant information and documents. For acquisitionsby funds, only the fund that acquires control over the target company isresponsible forfiling. Additionally,ifundertakings directly involved in the transactionisspecial purposevehicle,it is not appropriate for the SPVbe the filing party.

2)Timingfor Filing

The filing party must submit the notification after the agreement is executed and before the concentration is implemented; otherwise, it would constitute" gun-jumping." Factors to decide whether the concentration has been implemented include, but are not limited to, whether the entity registration or rights transfer registration has been completed, whether senior management have been appointed, actual participation in business decision-making and management, exchange of sensitive information with other undertakings, and substantive business integration.

3)Time Required for Filing

Based on ourpastexperience, where there are no competition concerns and no third-party objections, a filing under the simplified procedure generally takes about 1 to 2 months, while a filing under the normal procedure takes approximately 4 to 5 months. Additionally, the current Anti-Monopoly Lawadoptsa "stop-the-clock" mechanism, which may extend the review time under certain circumstances.

Based on the reviewpractices, in the context of fund establishment, the relevant market is typically defined based on the fund's business. According to published cases, we havenoticedthat in most fundformationcases, the relevant market is defined as the private equity investment fund market within China. Due to the presence of numerous competitors in this market in China and relatively sufficient competition, the market share of private equity funds in the "Chinese private equity investment fund market" generally does not exceed 15%, and the simplified procedure can be appliedin most cases.

In the context of fund investment and mergers, private equity funds typically seek investment opportunities across various sectors and subfields. Therefore, there is usually no horizontal overlap or vertical relationship between the private equity fund (and its affiliates) and the target company. In such cases, if themarket share of thetarget company in the relevant market is below 25%, normallythe simplified procedure can be applied. Moreover, some private equity funds may focus on investing in a specific industry or concentrate on a particular track. In such add-on acquisition scenarios, there may be horizontal overlap between the invested companies controlled by the private equity fund and the target company. If the combined market share is below 15%, the simplified procedure can still be applied. However, if the combined market share exceeds 15%, the normal procedure filing is required.

- Merger Control Filing Involving Fund Establishment

1) GP Establishes and Controls the Fund Independently

A transaction where a single investor establishes and controls a fund typically does not constitute a concentration and therefore does not require a merger control filing. In practice, a fund is generally managed by a General Partner (GP) and its affiliated fund management company, with the fund being solely controlled by the GP. The establishment of a fund, which is solely set up and controlled by a single company, does not constitute a "concentration" and therefore does not trigger the merger control filing obligation.

2) Co-GP Jointly Establishes and Controls the Fund

In practice, many private equity funds adopt a Co-GP modelforestablishment. Under this model, the private equity fund has multiple GPs who collaborate and share responsibilities. The Co-GP model mainly includes the following scenarios: (1) GP1 serves as the fund manager, and GP2 serves as the executive partner; (2) GP1 serves as both the fund manager and executive partner, while GP2 serves as the executive partner; (3) GP1 serves as the executive partner, and GP2's affiliate serves as the fund manager. Although there is somework allocationwithin the GPs, two or more GPs generally have decision-making power overimportantmatters related to the fund's operations, management, and investment activities, it is typically assumed that these two or more GPs jointly control the newly established fund. The establishment of a private equity fund under the "Co-GP" model is a common scenario that triggers a merger control filing.

3) GP and LP Jointly Establish and Control the Fund

In China, the organizational forms of private equity funds can be corporate, partnership, and contractual structures. Although the names and forms vary, there is no essential difference in the roles and rights of investors in the partnership structure and corporate structures. For example, in a partnership fund, the fund is jointly established by the GP and LP through a limited partnership agreement, and in the form of a limited partnership entity. The Limited Partner (LP) is the primary capital contributor to the fund but does not directly participate in the daily operations and management of the fund. Their limited protective rights include the right to profit distribution, the right to information, or an observer seat on the investment decision committee. As long as the LP does not have veto power over the target company's operations or major strategic matters, these protective rights generally do not constitute "control." The LP's liability for the fund's debts is limited to the amount of their committed capital contribution. The GP, despite contributing only a small percentage to the fund, usually only 1% or 2% of the fund's scale, is responsible for the fund's operations as the executive partner, including the fund's initiation, determining fundraising scale and investment fields, setting investment strategies, selecting specific investment projects, and bearing unlimited liability for the fund's debts. Although only holding a small share of the fund, the GPs are generally considered to have control over the fund due to their decision-making authority over its operations, management, and investment activities. The LP, although holding a larger share of the fund, typically acts as a passive investor and does not participate in specific operational management or investment decisions. In such cases, it is generally assumed that the fund is solely controlled by the GP, which does not constitute a concentration and thus does not trigger a merger control filing.

However, some LPs may request additional rights beyond the usual protective rights, gaining control or the ability to exert decisive influence over the fund. These rights could lead to the LP obtaining joint control. For example, if an LP demandsdecision-makingrightsor veto power over major matters such as the fund's investment projects, business plans, executive appointments, financial budgets, or participationin investment and operational decisions through attending partner meetings or appointing members to the fund's investment decision committee or advisory committee, this could be seen as obtaining joint control. Furthermore, if an LP holds a large share of the fund or if a government-guided fund acts as an LP, they might require voting rightsin the investment decision committee or impose restrictive requirements on the fund's investment fields, geographic areas, exit strategies, or hold veto rights over specific investment projects or executive appointments. In such cases, the LP may be considered tohavejoint controloverthe fund along with the GP. For example, in the case of the joint venture between Porsche AG and CICC Private Equity Fund Management Co., Ltd. clearedon December 14, 2023, CICC Private Equity, as the General Partner, held approximately 1.9% of the shares, while Porsche, as the Limited Partner, held 30.5% of the shares, with both jointly controlling the joint venture. This shows that LPs may also obtain control through their influence over the fund's investment management decisions.

4) Newly Established Joint Venture Serving as GP

In some cases, two or more entities establish a jointly controlled joint venture, which then serves as the GP for a newly established fund. If two or more entities jointly exercise the powers of the GP through the joint venture, making decisions on significant operational matters of the fund, thistype of transactionmay also constitute a concentration. A typical case is the joint venture between Ningxia Jiaze New Energy Co., Ltd. and Unity CMC Holdings Limited,clearedin January 2022. In this case, Jiaze New Energy and CMC planned to establish a joint venture with respective shareholdings of 51% and 49%. Jiaze New Energy and CMC's GLP China Holdings Limited jointly initiated the establishment of a new energy investment fund to acquire wind and photovoltaic power generation projects developed by Jiaze New Energy or third parties.The joint venture will serve as the General Partner of the fundAfteritsestablishment.

- Merger Control Filing in the Fund Investment Process

1) Minority Equity Acquisition

When a fund only acquires a minority share in the target company, meaning the equity proportion does not reach absolute or relative control, this does not automatically exempt thefundfrom thefiling obligation. If the fund has the right to appoint more than half of the board members of the target company, orhasveto power over key matters such as the company's annual budget, business plan, or the appointment and removal of senior management, or if they can exert decisive influence over the target company's daily operations or major business decisions, they will be deemed to have acquired control under the Anti-Monopoly Law.

Based on publicly available information, in 2023, a total of 75 cases involved private equity funds investment, of which 69 cases disclosed the equity proportion obtained by the fund. Among these, there were 12 cases where the funds acquired 0%-20% minority equity stakes, and 41 cases where the funds acquired less than 50% equity. For example, in the case of one Shen Zhen logistics company's acquisition of shares in one Jiangsu logistics company cleared in the first half of 2023, the acquisition of 12% share by the Shen Zhen logistics company is deemed as gaining control. Another example is the case cleared in August 2023, where one Suzhou venture capital partnership and one Shanghai investment company acquired shares in one logistics technology company, the former two entities obtained joint control over the target company by acquiring 1.4778% and 0.9853% of the shares of the target, respectively.

2) Package Transactions

A "package transaction," also known as a "step by step transaction, "meaning the control of the target company is not acquired in the first step but gradually in subsequent steps. When a private equity fund makes multiple rounds of investments in the same target, the parties usually sign an overarching agreement or framework document before the first step of transaction begins, outlining the overall arrangement of the transaction. As for the timing of the notification, Article 12 of the Compliance Guidelines clearly states that if a step-by-step acquisition transaction is determined by the parties to occur for the same economic purpose, and if the steps are interrelated and conditional on each other, they may constituteone concentration of undertakings, and the notification must be made before the first step is implemented.

3)Shifting Alliances

A "shifting alliance" is a concept under EU law, often translated as an "unstable shareholder alliance." It refers to a situation where there is no stable majorityin the decision-making procedureandthe majority can on each occasion be any of the various combinations possible among the minority shareholders, with no single shareholder holding veto power. Under EU law, this situation is generally not consideredas havingsole or joint control. However, Chinese antitrust law does not provide specific regulations on the concept of "shifting alliance," and whether a shifting alliance constitutes "control" is subject to case-by-case determination by antitrust enforcement agencies. Therefore,wecannot entirely rule out the risk of triggering a merger control filing obligationfor the transaction, and a comprehensive assessment based on the specific circumstances of each case should be conducted. Itisalso advisable to seek advice from antitrust enforcement agenciesby way ofconsultationbefore formal notification.

- Antitrust Risks That May Arise in Post-Investment Management of Funds

Some private equity funds choose to invest in multiple companies within the same industry, which may result in overlap or crossover between board members or post-investment management teams appointed by the fund in different portfolio companies within the same industry or sector. "Interlocking Directorate" is a concept under U.S. antitrust law, regulated by Section 8 of the Clayton Act, and refers to the situation where the board members of two competing companies serve on each other's boards or management teams. In such circumstances, there may be risks of exchanging sensitive information or even collusion between competing portfolio companies, potentially leading to the risk of monopoly agreements or concerted practices as stipulated by the Anti-Monopoly Law and the Provisions on the Prohibition of Monopolistic Agreements. Therefore, the author suggests that private equity funds with similar situation as mentioned above shall consider setting up appropriate "firewalls" within their internal compliance management systems to avoid possible antitrust risks.

- Merger Control Filing Involved in Fund Exits Phases

There are several ways for private equity fundtoexit,includingpublic listings, mergers and acquisitions (M&A), buybacks, and liquidation. For M&A and buyback, the exit may lead to changes in the control of the portfolio company (such as introducing new controlling parties or reducing the number of controlling parties), thereby triggering merger control filing obligations. In such cases, the exiting fund, as the seller, is no longer the filing party but should cooperate with the filing party inthefilingprocess, even thoughitdoes not face the risk of fines for illegal implementation of the concentration.

For public listing exits, the antitrust compliance of the portfolio company may affect its listing process.As fordomestic listings, companies planning to go public are typically required to have no major legal violations within the past three years. If the company has been subject to administrative penalties for antitrust violations, it may be required to obtain a written opinion from the penalty authority stating whether the penalty constitutes a major legal violation. Additionally, Article 26 of the Guidance on Application of Regulatory Rules — Legal Category No. 2: Practicing Rules for Legal Services Provided by Law Firms in Initial Public Offering and Listing issued by the China Securities Regulatory Commission (CSRC) on January 28, 2022, also mentions antitrust compliance: Lawyers should verify whether the issuer's completed or planned acquisitions, sales of assets, asset swaps, or asset divestitures comply with legal regulations, including whether these actions have undergone the internal decision-making procedures as required by laws and regulations and the company's articles of association, and whether approvals or filings with relevant authorities, such as state-owned asset management departments, foreign investment departments, and antitrust enforcement agencies, are required.

- Legal Consequences of Failure to File

In practice, antitrust enforcement agencies may discover cases of failure to file through public reports, third-party complaints, or by reviewing the filing documents of other transactions involving the same company, and may initiate investigations and impose penalties accordingly.

According to Article 58 of the Anti-Monopoly Law, the maximum fine for transactions that should have been filed but do not have a negative effect on competition has been lifted to 5 million RMB. For transactions that do or may have effect of eliminating or restricting competition, the maximum fine has been increased to 10% of the previous year's turnover. Moreover, antitrust enforcement agencies may order the cessation of the concentration, require the disposal of shares or assets within a specified period, or take other measures to restore the transaction to its pre-concentration state. To date, there has been only one casewhere such "restoration" measures have been applied toan implementedtransaction.

In addition to the direct legal consequences mentioned above, there are other potential risks that should not be overlooked. First, the administrative penalty decision for illegal implementation will be publicly disclosed on the website of the Anti-Monopoly Bureau of SAMR, and the non-compliance record will remain publicly available, potentially harming the reputation of the fund. Second, if during the review process, a private equity fund is found to have failed to file in previous transactions, the antitrust enforcement agency may initiate an investigation. This could affect the review timeline of the ongoing transaction and increase the risk of penalties for other historical transactions of the fund that should have been notified but were not.

- Conclusion

In recent years, China's antitrust enforcement has made significant progress, and the merger control review mechanism has become increasingly comprehensive. Private equity funds should actively comply with relevant antitrust laws and regulations to prevent antitrust risks and operate in accordance with the law.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]