- within Employment and HR topic(s)

As global economies struggle to stabilize post-COVID, organizations need to recalibrate their compensation and salary budget planning strategies.

As we transition into 2025, organizations around the world are recalibrating their compensation strategies in response to a shifting economic landscape. The December 2024 edition of WTW's Salary Budget Planning Report provides crucial insights into these adjustments, reflecting a period of stabilization in key markets after years of aggressive salary growth. The report also offers three pivotal trends that compensation and HR professionals should consider in their strategic planning.

01

Stabilization of aggressive salary budget

growth

The era of rapid salary budget escalations reached its zenith in 2023, with 2024 projections for 2025 indicating a move toward stabilization. This reveals a significant shift in how companies are approaching salary planning.

From a global perspective, salary increments surged after the Great Resignation due to competitive pressures in the job market. However, the latest report suggests that this trajectory is leveling out. This overall trend shows a dialing back from aggressive increases, with a noticeable move toward more sustainable — albeit still elevated — salary growth rates.

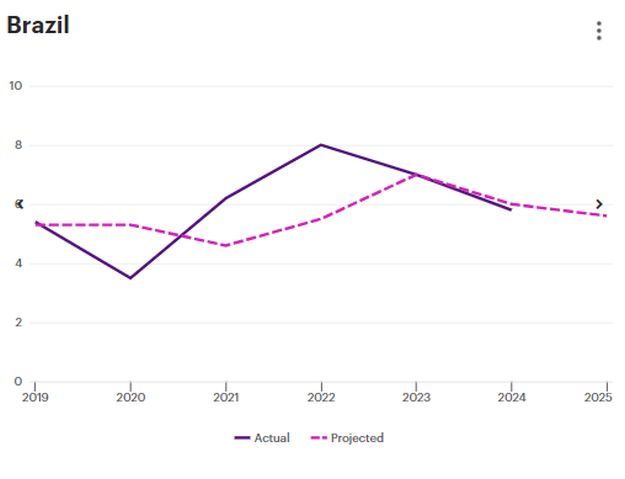

However, while there is a general trend toward stabilization, the dynamics vary by region (Figure 1):

- Slowing: In countries like France and Canada, the deceleration in salary budget growth observed in mid-2024 continues, though at a less dramatic pace. These locations are projecting salary increases around 3.5% in 2025, reflecting a cautious optimism.

- Stabilizing: The United States, United Kingdom, and Germany appear to have found a new equilibrium for increases: 4%. This might represent what could be termed a "new normal," balancing between inflation, cost management, and competitive compensation needs.

- Emerging markets: Conversely, nations like Brazil and China are adjusting their projections upward by small margins (0.1% and 0.4%, respectively, since July), although they remain below earlier expectations for 2024. This adjustment suggests a nuanced approach to salary budgeting that takes into account local economic conditions and inflation rates.

Figure 1. Actual and projected salary increases, at median (2019-2025)

Click the arrow on the right side of the graphic to see different locations

Source: WTW Salary Budget Planning Reports, 2019-2024

02

Focus on headcount stability

The report also underscores a shift in organizational focus from aggressive hiring to stabilizing current workforce levels, reflecting a strategic pivot toward optimizing existing talent rather than expanding teams:

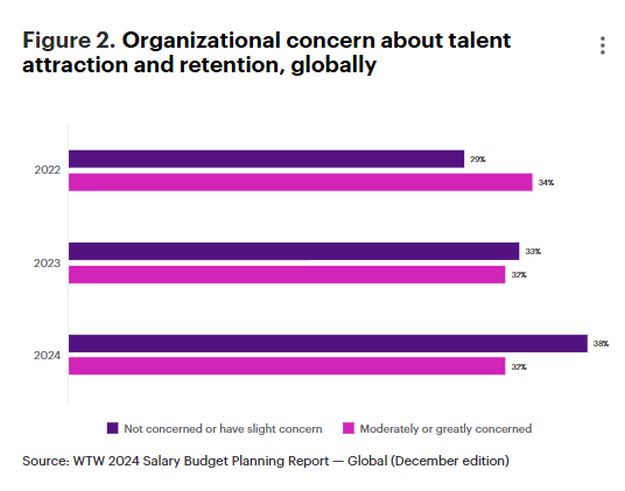

There also is a notable decline in concern regarding talent attraction and retention (Figure 2). Nearly 40% of respondents expressed minimal concern in these areas, with only 32% feeling moderately or greatly worried. This shift indicates that many organizations believe they have reached a saturation point in their talent pools or, perhaps, the market dynamics have slightly shifted the power balance back toward employers.

- 76% of organizations plan to hold steady on their current headcount

- 14% of organizations anticipate headcount growth

- 10% of organizations foresee reductions in headcount

03

Evolving hiring strategies amid persistent economic

concerns

Despite the stabilization in salary growth, economic concerns continue to shape organizational strategies, leading to varied responses across regions. For example, inflation, cost management and the looming threat of recession are cited as top priorities around the world. And these concerns drive a careful approach to compensation planning.

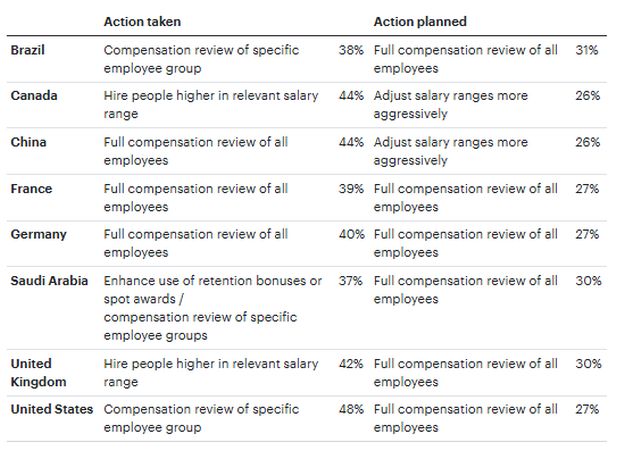

In response, organizations remain focused on thorough compensation reviews to ensure internal equity and external competitiveness while making the best use of budgeted salary increases. In addition, a significant portion of organizations in Canada (44%) and the United Kingdom (42%) are not just reviewing compensation, they also are focused on hiring at higher points within ranges. This strategy might be aimed at attracting top talent or compensating for higher living costs or market rate adjustments in these regions (Figure 3).

Figure 3. Evolving hiring strategies amid persistent economic concerns

Source: WTW 2024 Salary Budget Survey — Global (December edition)

Implications for your HR strategy

Insights from the December 2024 Salary Budget Planning Report offer several strategic implications:

- Budgeting for stability. HR leaders should prepare for a future in which salary budgets do not grow at the rates seen in recent years. This calls for more strategic allocation of salary increments, focusing on key roles or high performers.

- Enhancing the employee value proposition. With less focus on salary as the primary tool for attraction and retention, organizations need to enrich their employee value proposition through other means, including career development, employee benefits, diversity, equity and inclusion initiatives, and other employee engagement efforts.

- Geographic customization. Companies with a global footprint must tailor their compensation strategies to address regional economic conditions, recognizing the divergence in salary growth trends.

- Proactive talent management. Even as concerns about talent acquisition diminish, proactive talent management remains crucial. This goes beyond hiring strategies to include retention through career development opportunities and employee engagement.

- Economic resilience planning. Organizations must remain vigilant about economic indicators that could affect their compensation strategies such as inflation and potential recessions. It is critical for organizations to adapt quickly with flexible compensation models that can scale with economic shifts.

In short, the stabilization of salary budgets after an aggressive growth phase offers both a challenge and an opportunity. The challenge lies in managing expectations around salary growth while ensuring market competitiveness.

The opportunity, however, is in crafting more holistic, strategic approaches to talent management that extend beyond salary alone. Engaging employees through meaningful work, career progression and a supportive work culture could become the new battleground for talent in this stabilized economic phase.

The insights from WTW's Salary Budget Planning Report serve as a compass for navigating these waters, ensuring that organizations not only adapt to current trends, but also position themselves advantageously for future shifts in the global employment landscape.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.