- within Consumer Protection topic(s)

- within Privacy, Government, Public Sector and Immigration topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Banking & Credit industries

In 2025, ASIC will continue to focus on targeting misconduct against financially vulnerable consumers and protecting consumers from financial harm.

The hardship provision under the National Consumer Credit Protection Act 2009 (Cth) ("NCCP Act") and the National Credit Code is an important mechanism to protect customers who may be vulnerable in times of financial hardship. This provision requires credit licensees, such as lenders and debt managers (together "Licensees"), to ensure that they are properly engaging with their customers, including providing a prompt response to customers' hardship notices within the time required by law.

What Are Your Statutory Obligations as a Credit Licensee?

Section 72(1) of the National Credit Code provides that when a debtor finds that they are or will be unable to meet their obligations under a credit contract, they may notify the credit provider or debt manager of their hardship. This notification, known as a hardship notice, imposes specific legal obligations on Licensees, including the requirement to provide a timely and reasonable response.

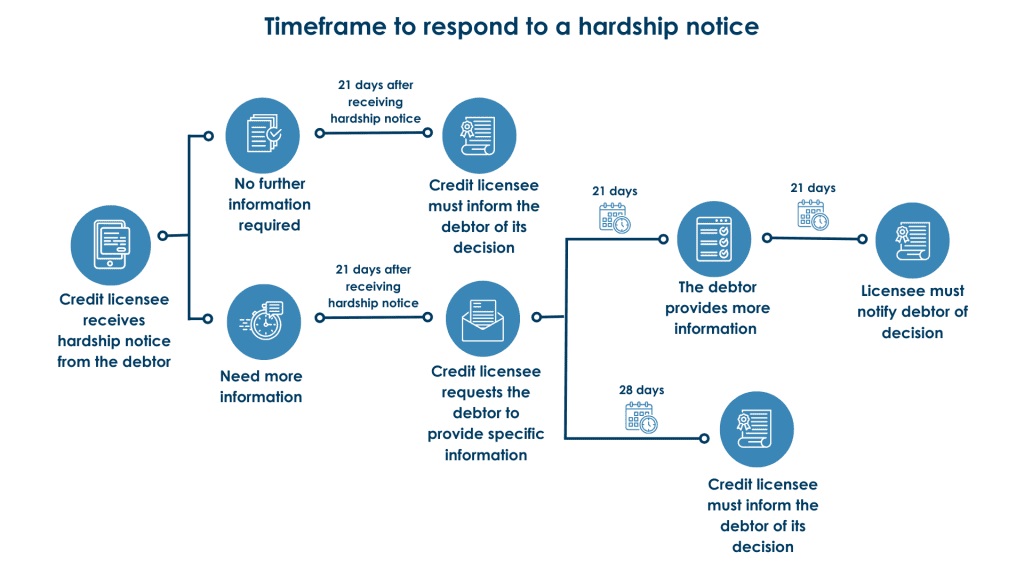

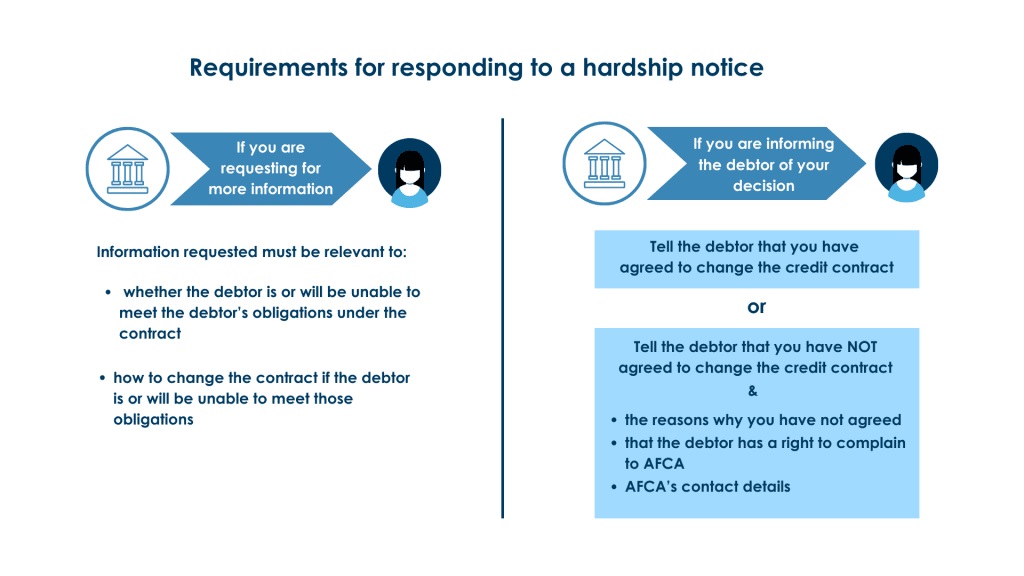

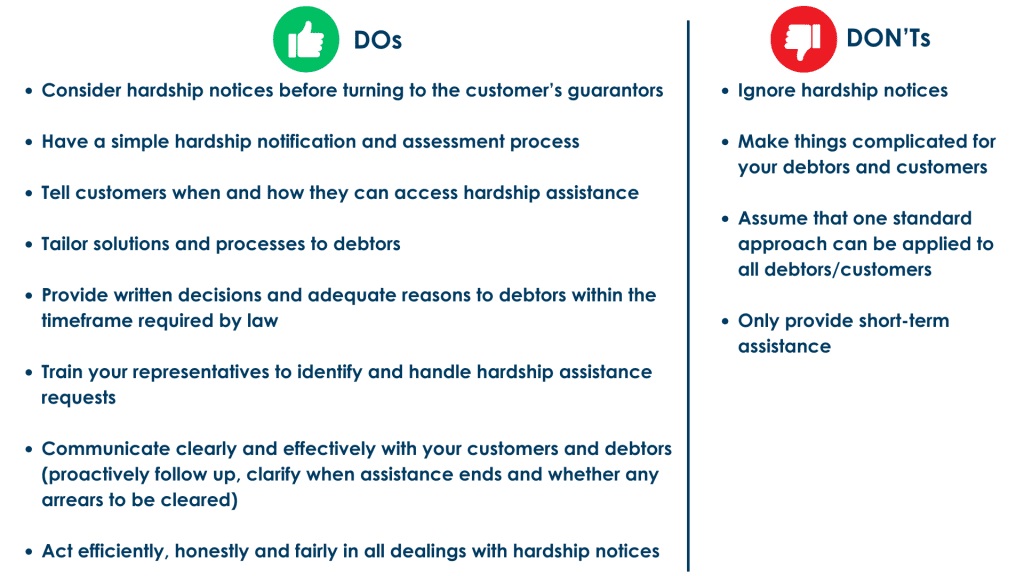

Upon receiving a hardship notice, Licensees must consider whether they can vary the customer's credit contract (for example, agreeing to alternative payment arrangements) and inform the customer of their decision within 21 days of receiving the notice. Licensees may also request the customer to provide further information to enable them to make the decision. If the customer does not provide the information requested within 28 days of the date of the request, the Licensee must inform the customer of the decision.

If a Licensee decides not to vary the credit contract, they must inform the customer:

- that they have not agreed to change the credit contract;

- the reasons why they have not agreed to change the credit contract;

- of the customer's right to lodge a complaint with the Australian Financial Complaints Authority ("AFCA"); and

- AFCA's contact details.

Failure to meet these obligations can result in severe consequences, including the suspension or cancellation of the credit licence, along with potential fines or imprisonment for the Licensee and its representatives.

Lessons learnt from ASIC's legal action

To date, ASIC has commenced legal proceedings against three credit licensees for failing to promptly respond to customers' hardship notices. One case has concluded with the licensee (Membo Finance Pty Ltd) incurring a substantial penalty of $6 million, while two cases are ongoing (Westpac and NAB).

If your business requires assistance in meeting its obligations to promptly address vulnerability and financial hardship notices from customers, please contact us. You may also like to implement a Hardship Policy and/or Vulnerability and Financial Hardship Policy for your business.

Further Reading

- ASIC announces new enforcement priorities with a focus on cost of living pressures

- ASIC releases report on hardship for credit providers

- Q&As for lenders – dealing with financial assistance requests

- ASIC Strengthens Oversight of Credit and Debt Management

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.