- within Consumer Protection topic(s)

- in United States

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Securities & Investment and Law Firm industries

There have been an increasing number of Australian Financial Services Licences ("AFSL") and Australian Credit Licences ("credit licences") cancelled in recent months, one of the latest cancellations follows a payment of compensation by the Compensation Scheme of Last Resort ("CSLR").

What is the CSLR?

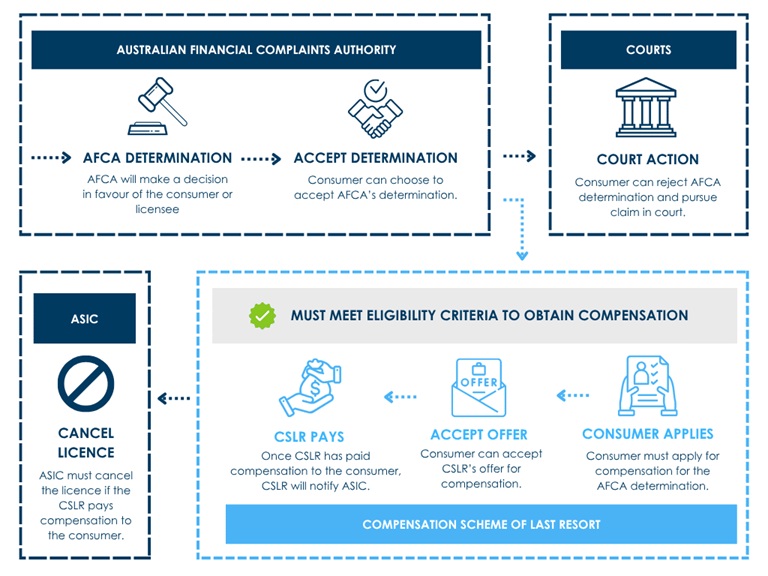

The CSLR is an independent not-for-profit company authorised to provide compensation of up to $150,000 to a consumer for an unpaid AFCA determination. There are certain criteria that consumers must satisfy before the CSLR can provide compensation, including:

- the AFCA determination required the licensee to pay an amount to the consumer;

- the amount specified in the determination is not fully paid to the consumer; and

- the consumer notified AFCA within 12 months (or a longer period that AFCA has agreed to) after the determination was made, that the licensee has not paid;

- the consumer is not eligible to receive compensation under another statutory compensation scheme for matters covered in the determination and for an amount equal or greater than the amount that the licensee was required to pay under the determination; and

- the consumer applies for compensation for the determination to the CSLR.

What is an AFCA Determination?

An AFCA determination is AFCA's written decision resolving a complaint between a licensee and a consumer. It is the final stage of AFCA's complaint resolution process. The determination outlines:

- reasons for the decision;

- relevant factual information available at the time of AFCA's determination;

- relevant issues relating to the complaint and AFCA's analysis of those issues;

- AFCA's decision on how the complaint should be resolved and why; and

- any remedies awarded such as monetary or non-monetary compensation, and when they need to be paid.

It is important to remember:

- AFCA determinations not relating to superannuation or a regulated superannuation fund require the consumer to accept the determination before the licensee is required to comply with it and the remedy;

- consumers who choose not to accept AFCA's determination have the right to pursue their claim against the licensee through the courts; and

- licensees do not have the option to reject AFCA determinations made against them or in their favour once it becomes binding or is accepted by the consumer.

Key takeaways:

Further documentation request

- If the CSLR offers compensation and the consumer accepts the offer of compensation payments, the CSLR may exercise powers to obtain further documents from the licensee about the consumer's application to the CSLR.

- It's important that licensees comply with any request from the CSLR for further documentation, as failure to do so will result in the CSLR notifying AFCA and ASIC of the licensee's failure to comply with the request for further information.

- Licensees should ensure communications from the CSLR are dealt with promptly and the appropriate people within their organisation have the resources and access to documentation in order to respond to the request.

- Licensees should also ensure all complaint data, including correspondence between the licensee, the consumer and AFCA and data in relation to the services originally provided to the consumer is kept on file and easily accessible upon request.

CSLR compensation payment

- Where an AFCA determination requires the licensee to make a remediation or compensation payment to a consumer, the licensee should ensure the payment is made upon becoming aware that the consumer had accepted the AFCA determination. This will usually require senior managers or directors to be informed of the outcome of the AFCA complaint procedure and approve the payment. In the event the licensee does not pay, the CSLR can make a payment to the consumer.

- Once the CSLR has paid compensation to the consumer, the CSLR will notify ASIC of the licensee's details and the failure to pay the amount in the AFCA determination.

- Following the notification from the CSLR, ASIC must cancel the licensee's AFSL or credit licence by giving notice to the licensee.

Further Reading

- ASIC cancels licence of Viridian Equity Group Pty Ltd

- ASIC cancels licence of Brite Advisors Pty Ltd

- What is CSLR?

- FAQs about the Compensation Scheme of Last Resort

- AFCA's Complaint Resolution Process

- How does AFCA calculate loss? What financial advisers need to know

- Treasury Laws Amendment (Financial Services Compensation Scheme of Last Resort) Act 2023 (Cth)

- Section 915B of the Corporations Act 2001 (Cth)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.