- with readers working within the Pharmaceuticals & BioTech industries

Month-Special

The Swiss minimum wage – the biggest hurdle of a secondment?

1. Essence

In principle, all foreign employees need a work permit in Switzerland in order to be allowed to legally work here. With regard to whether a work permit is required, it must be clarified whether the employee's activity in Switzerland is defined as gainful employment within the meaning of the Federal Act on Foreign Nationals and the Integration Act.

If the activity is not defined as gainful employment requiring a permit, the employer does not have to apply for a work permit and the employee requiring a visa only has to apply for a type C Schengen visa in order to enter Switzerland.

It is justifiable to believe that the compensation would have to correspond to the equivalent Swiss minimum wage, despite employment not requiring work authorization. Not every company implements this principle in this "gray" area. Based on the statistical results that almost 50% of the companies in Switzerland are controlled by the employment office or by the various joint institutions, it is recommended to deal with the calculation of the Swiss minimum wage or the local and customary wage as this term is known from the specialist literature.

2. Regulations

The Federal Act on Accompanying Measures for Posted Workers and on the Control of Minimum Wages Provided for in Standard Employment Contracts regulates, among other things, the conditions for the remuneration of posted workers and dependent service providers within the framework of the implementation of the accompanying measures as a product of the EU Directives on Posted Workers.

This law is also the basis for the employment offices to control employers in respect to compliance with the mandatory regulations on pay, working and rest periods, minimum duration of holidays, protection for pregnant women and those who have recently given birth, protection of young people, non-discrimination, occupational health and safety as well as night and Sunday work. Violations of the Posted Workers Act are subject to government sanctions, such as:

- Administrative fines up to CHF 5'000

- Temporary service bans of 1 to 5 years

- Imposition of control costs on failing employers

Criminal sanctions are also mentioned as follows:

- Criminal fines of up to CHF 1,000,000 for systematic violations with the intent of profit

- Confiscation of assets, e.g. unlawfully obtained profits

3. Compliance with Swiss wage thresholds

The local employment of EU/EFTA nationals does not need to be checked by the labor market authorities. This means that compliance with local and customary wages is not conditional. In the case of the posting of EU/EFTA nationals and the employment of third-country nationals (both for posting and for local employment), compliance with Swiss wage regulations is the main requirement for the issuance of a work permit by the cantonal migration authorities.

4. Implementation / effective payout

IThe remuneration under the Posting of Workers Act presupposes compliance with the minimum requirements for the payment of the equivalent Swiss minimum wage and the coverage of posting allowances (cover of travel, board, and lodging expenses by the employer abroad).

The payment of posting allowances is an indispensable prerequisite for the granting of a work permit for posted workers (and locally employed third-country nationals) as well as a reason for sanctioning the foreign employer during a labor market inspection if this has not taken place or cannot be proven.

How can the Swiss minimum wage be calculated?

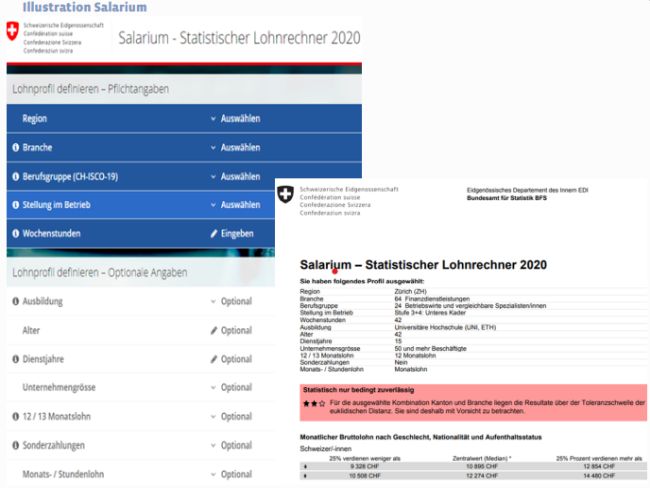

- In Switzerland, there are no minimum wages per se, but only collected data from statistics with Swiss employers, which then serve as the basis for calculating the Swiss minimum wage in the work permit procedure. This data is periodically uploaded to the electronic platform «Salarium – Statistical Wage Calculator 2020», last updated on February 23, 2023. The current version of the Salarium is based on wage data from 2020.

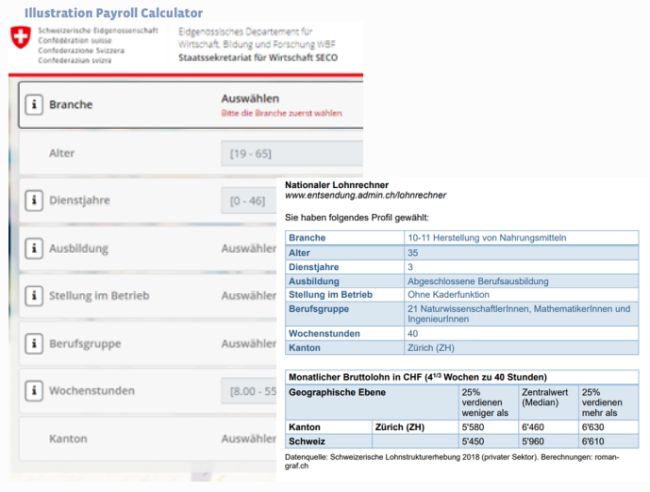

Another option is also offered by the national wage calculator, which, like the Salarium, provides statistical data from the respective canton of work/assignment. An example of the calculation platforms can be found in the following illustrations:

For the online notification procedure, the lower value (lower quartile) should be sufficient. For the granting of a work permit, the median value valid for the respective canton must be used as the lowest limit of remuneration.

In 2022, the Office for Economy and Labour of the Canton of Zurich developed and published the new "Swiss Payroll Book 2022". This reference work contains in detail all minimum wages as well as the local and industry-standard/customary wages in Switzerland. Real wages in the various cantons as well as the training and professional experience of employees in the respective sectors were taken into account.

Currently, many offices and stakeholders in the private sector use the "Salarium – Statistical Wage Calculator 2020" or the national wage calculator to calculate the Swiss minimum wage, which is the basic requirement for issuing a work permit to foreign workers.

The results of both platforms are obtained by entering precise information regarding region, age, occupation, education, function, professional experience, and working hours for each individual case. The calculations are based on wage statistics from the year 2020. The 2022 paybook, on the other hand, determines the Swiss minimum wage based on education and professional experience in the respective regions.

While the online platforms divide the result of the wage calculation into three categories (lower quartile - 25% earn less, median value and upper quartile - 25% earn more), in the Zurich wage book you will only find the distinction between the median and average value.

In the work permit procedure, it is essential that the applicant has calculated or verified the Swiss minimum wage, whether via online platforms or based on the wage book. Often the salary is higher than the usual remuneration in practice by means of online calculation. Therefore, it is recommended to consult all resources in this context before contracting a salary.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.