The Need for Account Remediation

Due to a reliance on legacy systems, outdated programming code and manual processes, normal course of business processing of investment accounts can result in errors to transactions and account balances. Often, these errors require a quantification of impact to each account. Companies need to remediate errors accurately and quickly for reputational and regulatory purposes.

Errors can surface from several sources including customer complaints or questions, internal quality control reviews, external audits, regulator reviews and whistleblowers. Unresolved issues can lead to violations of ERISA or other financial regulations and attract scrutiny and potential investigations from the DOJ, SEC and FINRA.

The Situation: Errors happen during normal business operations

- Legacy systems contain program code that has not been maintained or is leveraged for reasons outside its original use case. Even minor "bugs" in the program code can have a substantial impact on accounts that leverage it for daily updates.

- Manual processes increase the chance of mistakes during account maintenance processes. Without proper controls, mistakes can go unnoticed for a long period of time. These factors increase both the affected time and the number of accounts that require a correction.

The Problem: Providers are unable to timely correct accounts at scale

- Existing systems and processing protocols are manual and cannot perform calculations at the scale required for correcting errors that impact many accounts.

- Strong desire from within and outside the organization to correct accounts quickly and accurately to avoid further exposure to error. Independent calculations can meet regulatory and audit requirements.

Our Approach to Remediation

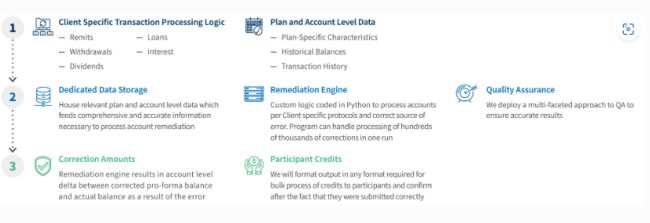

Our Data & Analytics practice deploys teams to build custom engines that can replay historical events specific to your investment product. These engines are capable of correcting errors at scale, returning results for thousands of accounts in minutes. The result is an accurate pro-forma account balance. We bridge the gaps across Legal, Compliance, IT and Operations to resolve the needs of all stakeholders.

Prior to a remediation engine build-out, we can deploy software engineers to identify the cause of the error and confirm the subsequent correction to the computer code was applied correctly. We help ensure clients have resolved the known error and advise on governance and control updates to prevent future occurrences of similar issues.

Our approach to remediation provides benefits to all parties interested in an accurate and timely resolution. Most importantly, this approach ensures account owners are accurately corrected. The approach benefits different functions within the organization including Legal, Compliance, IT and Operations.

Our priority is production of accurate results that ensure account owners are made whole. Accuracy is achieved through rigorous Quality Assurance programs that leverage dual coding approaches, selection of statistically valid samples for manual review, outlier testing and partnership with our Clients on their preferred approach to QA.

We understand the need for timely resolution and its deployment of technology allows organizations to correct accounts at scale. The sooner account owners are made whole, the sooner an organization can put the issue and the reputational risk that comes with it behind them.

The account remediation team provides documentation, account level proofs and access to source code to ensure our results are auditable.

Through its vast experience in financial services matters involving regulatory inquires, compliance questions and account remediation efforts, our team is well positioned to work with both internal and external counsel to ensure the correction process satisfies all legal requirements.

Our Approach to Software Code and Business Process Root Cause Analysis

Our approach to root cause identification relies on a diverse set of inputs, deploys numerous approaches to testing and results in identification of issues and errors along with recommendations for addressing current gaps and process improvements moving forward.

| INPUTS | ANALYSIS | OUTCOME |

|---|---|---|

| Internal Documentation Internal policies and procedures Functional and technical specifications QA testing and results |

Unit Testing Define expected outcomes and run samples to confirm expected behavior |

Assessment of an application's ability to achieve stated purpose |

| Source Code | Source Code Review Identify critical portions of code and review for confirmation of stated functionality |

Detailed examples of issues and errors discovered |

| Application Database and Data Dictionaries | Analysis of Systems Assessment of viability given expected use case and processing load |

Policy, procedure and process recommendations |

| Hardware and System Specifications | Data Analysis Test for data integrity, applicability of data model and identification of gaps in required information |

Data security, audit history and governance

recommendations |

Case Study

Retirement Services Provider: Program Correction and Account Remediation

Situation

FTI Consulting was engaged by an insurance company that identified an error in their system code which was causing accounts to receive incorrect investment allocations. The error required a two-phase correction. First, the company needed to correct the error in the system code and verify, moving forward, accounts were being processed correctly. Second, the company needed to calculate any unexpected changes to accounts as a result of the error. The client discovered that their Java program was not passing the correct data to the investment allocation engine. This programming error potentially led to inaccurate allocation elections for ~15K participants. The error also led to delays in rebalancing participants on their normal cycle.

Our Role

- After the company fixed the system code, we performed an extensive code review of the company's program to confirm it was properly feeding the investment allocation engine

- We performed targeted reviews on a statistically valid sample of accounts to further verify the program was working as expected on a go-forward basis

- We performed an extensive code review of the company's correction program to confirm it was accurately calculating the pro-forma monetary position for each participant had the error not occurred

- In addition to the code review, we created our own remediation engine and compared results to the Company's program on a statistically valid sample to confirm both programs arrived at the same outcome

Our Impact

- We independently verified the client's Java program was properly feeding the investment allocation engine for all necessary participant parameters

- We built our own remediation engine to verify the company's calculations of participants' monetary losses and gains and then reconciled any discrepancies

Case Study

Global Insurance Company: Retirement Services Program Remediation Calculation

Situation

FTI Consulting was engaged by a retirement services provider to review and remediate ~50K retirement accounts with outdated investment allocations. The accounts of interest had missed several investment allocation updates and rebalances over a three-year period. The client sought guidance from counsel on how to best calculate the impact on each account by incorporating the fund allocation updates historically. FTI Consulting was engaged to ensure correct implementation of the first allocation updates for each plan and to remediate each account harmed as a result of the error.

Our Role

- We analyzed participant account allocations for 10 different investment plans and confirmed all participant accounts had moved to the correct investment allocations on a go-forward basis

- We built a remediation engine to calculate the pro forma account balance based on the client's custom system logic which accounted for dozens of different transactions. We determined the remediation amount to be credited to each account

- We created a program to correctly apply account credits to remediated accounts and confirmed the Client executed it correctly

- We transitioned the remediation engine to the client

Our Impact

- We led both the proactive correction process and the calculation of remediation amounts over the historical period impacted by the error

- We designed and developed an independent calculation engine to determine remediation amounts for accounts with reallocations

- We confirmed the client corrected the model allocation issue by placing participants in their current models

Case Study

Fintech Company: Distributed E-Delivery Platform Code Analysis and Data Reconciliation

Situation

FTI Consulting was engaged by a fintech company through outside counsel to identify the root cause, scope and fix for a computer coding error that resulted in failure to deliver critical information to customers. The missed communications had potentially large reputational and regulatory consequences. Over a period of multiple years, client systems had a configuration issue that resulted in certain types of communication responsibilities not being fulfilled per contractual requirements with their customers. IT installed a short-term technical patch to resolve the known error on all future communications and then implemented a long-term technical patch.

FTI Consulting was engaged to review the notification system, including the underlying code and related data and reports, to confirm the source of the error, understand the scope of the issue, and ensure that the system was working appropriately on a go-forward basis.

Our Role

- We performed a targeted documentation and code review and held discussions with key employees to confirm the processes within the review scope, understand the root cause of the error and comprehend the strategy behind the fix

- To confirm the client's quantification of the error, we performed analyses on database extracts from production systems on the magnitude of billions of records. We analyzed relevant time periods and key configurations that caused the error to accurately measure the impact

- We recreated and tested key components of the client's code-fix to confirm the effectiveness of the long-term patch

- We performed data-driven reconciliations on production jobs covering the time periods before and after the long-term fix was implemented to verify that the error was resolved

- We assisted on client communications to explain the error, scope and timeline of the software fix

Our Impact

- We leveraged documentation, code review and a data-driven sampling analysis to confirm the effectiveness of the short-term and long-term fixes

- We recommended policy, procedure and process improvements that will help prevent the recurrence of an issue similar to the subject error

- We identified and reported unrelated issues in several systems that caused errors in the communication of business-critical information to customers for the client to address

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.