- within Energy and Natural Resources topic(s)

- in United States

- within Criminal Law, Law Practice Management, Litigation and Mediation & Arbitration topic(s)

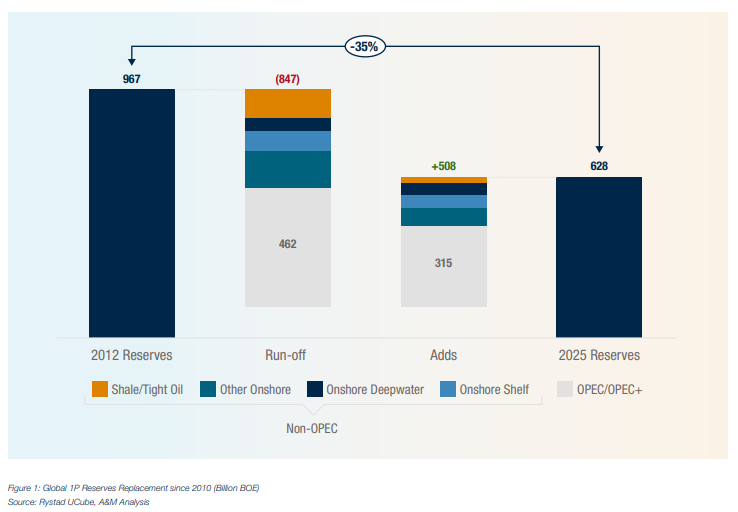

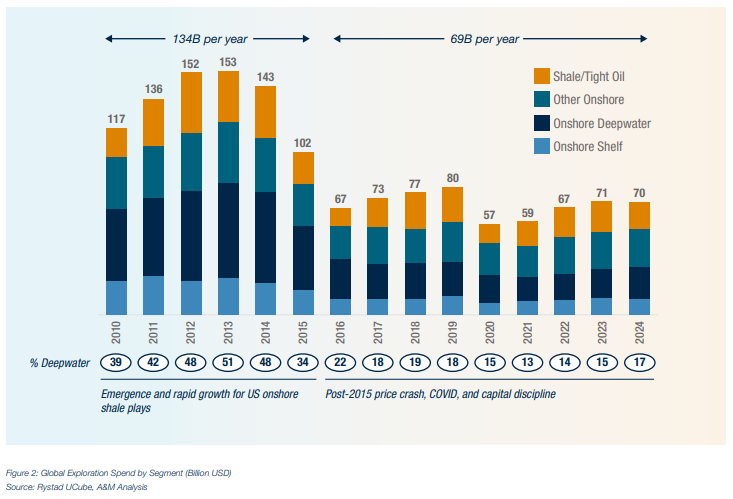

The exploration sector within oil and gas is at an inflection point. While global demand for hydrocarbons remains resilient—even under aggressive climate change scenario—supply is falling behind. Proven reserves (1P) have declined by 35% over the past 15 years, and exploration capital remains stuck at ~50% of pre-2015 levels.1 Alarmingly, commercial success rates are deteriorating while discovery cost increases continue to outpace inflation, eroding returns and confidence in upstream reinvestment.

To reverse these trends, the industry must take bold, structural steps to reframe how exploration is conceived, structured, and executed. A new playbook must:

- Reevaluate strategy

Update "where to play" and "how to win" choices, grounded in realistic capital allocation and strategic positioning. - Redesign the exploration stage-gate

Adopt lessons learned from other industries (e.g., Pharma's R&D model) to streamline decisions, incorporate AI, and minimize waste. - Leverage AI to widen the opportunity

funnel

Aggregate and structure vast datasets to enable high-throughput screening and smarter prioritization. - Accelerate decisions and improve agility

Shift to sprint-based screening and play evaluation processes to drive faster, betterinformed choices. - Be decisive earlier

Enforce clear gate criteria and delegate authority to empowered teams to drive sharp, early decisions with minimal drag.

Exploration rooted simply in geologic evaluation is no longer sufficient. Effective strategies are underpinned by decision science, digital enablement, and organizational alignment. Leaders who embrace this transformation will outperform; those who cling to legacy approaches will be left behind.

Exploration in Decline: The Strategy and Capital Disconnect

Over the past decade and a half, global oil and gas companies have grappled with an unsustainable decline in proven reserves (1P), which have fallen by 35% since 2010.2 This trend reflects not only the natural depletion of legacy assets but also systemic weaknesses in exploration strategy and execution. Compounding the issue, industry exploration budgets have been cut in half since the 2015 price crash, leaving little room to pursue new frontiers or test high-potential plays. Major discoveries greater than 500 million BOE of resource make up 53% of resource adds but only represent 18% of total exploration spend since 2010,3,4 underpinning industry's reliance on risk/reward success. Even as many companies shift toward lower-risk, infrastructure-led exploration, the paradox remains that commercial success rates are falling—down by 15 percentage points in the last five years, highlighting inefficiencies in opportunity screening and decision-making.

Demand Is Holding Steady, but Supply Is Faltering

The need for a renewed focus on reserve replacement is underscored by long-term energy outlooks, which consistently project strong hydrocarbon demand through 2050—even in scenarios aligned with announced climate pledges.5,6,7,8,9 However, the current exploration landscape is misaligned with this demand trajectory, with global spending still languishing at half its historical levels. The disparity in performance between OPEC+ and non-OPEC countries is also stark, with the former replacing 68% of reserves compared to 50% for their non-OPEC counterparts.10 Meanwhile, offshore deepwater—once the engine of large-scale discoveries—has seen its annual spend plummet from ~$51 billion in 2010–2015 to less than $20 billion today, resulting in a depleted funnel of opportunities.11

Footnotes

1 Rystad Energy

2 Ibid.

3 Ibid.

4 A&M Analysis, based on publicly available information and/or client data used with permission. Please contact A&M directly for further details on specific reports used.

5 U.S. Energy Information Administation, US EIA Energy Outlook 2023, https://www.eia.gov/outlooks/aeo/pdf/aeo2023_narrative.pdf

6 International Energy Agency, IEA World Energy Outlook 2024, October 2024, https://www.iea.org/reports/world-energy-outlook-2024

7 BP, BP Energy Outlook 2025, July 10, 2024, https://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html

8 ExxonMobil, ExxonMobil Global Energy Outlook: Our view to 2050, 2024. https://corporate.exxonmobil.com/sustainability-and-reports/global-outlook#Keytakeaways

9 Shell Global, Shell Energy Security Scenarios, https://www.shell.com/news-and-insights/scenarios/the-energy-security-scenarios.html; Shell 2025 Energy Security Scenarios, https://www. shell.com/news-and-insights/scenarios/the-2025-energy-security-scenarios.html

10 Rystad Energy

11 Rystad Energy UCube

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.