On August 23, 2023, the U.S. Securities and Exchange Commission (SEC) announced1 the enactment of a series of new and amended rules under the Investment Advisers Act of 1940, as amended (the Advisers Act).2 We refer to these rules collectively as the Private Funds Rules.3 According to the SEC, consistent with its mandate, the new rules are designed to address conflicts of interest and adviser practices that may impose significant risks and harms on investors and private funds. While the rules will have a significant impact on the way advisers operate their businesses and interface with investors, as adopted, the rules did not go as far as many industry participants had feared based on the proposed rules issued earlier in 2023.4

The Private Funds Rules include new and amended rules of significant import to managers of private funds (Private Fund Managers). Certain of the new rules apply only to Private Fund Managers who are SEC-registered investment advisers (SEC-Private Fund Managers). Others apply to Private Fund Managers generally, irrespective of whether they are registered with the SEC or one or more states, are exempt reporting advisers, or are prohibited from registration. The Private Funds Rules also include changes applicable to all SEC-registered investment advisers, including advisers that are not Private Fund Managers. This Client Alert summarizes the Private Funds Rules. In future alerts, we intend to provide further in-depth guidance for Private Fund Managers regarding changes to fund documents and the compliance policies and procedures that will be necessitated by the new rules.

I. The Private Funds Rules

a. Scope

The SEC expressly applied certain of the Private Funds Rules (which

are described further below) to certain types of Private Fund

Managers. In short, SEC-Private Fund Managers must comply with the

Quarterly Statement Rule, the Audit Rule, and the Adviser-Led

Secondaries Rule (each as defined and discussed below). Private

Fund Managers5 must comply only with the Restricted

Activities Rule and the Preferential Treatment Rule (each as

defined and discussed below).

The SEC also enacted an amendment to Section 206(4)-7 of the Advisers Act (the Compliance Rule), which is applicable only to SEC-registered investment advisers (RIAs), including RIAs that are not Private Fund Managers.

b. The Quarterly Statement Rule

In a new rule intended to enhance transparency to investors, Rule

211(h)(1)-2 (the Quarterly Statement Rule) requires SEC-Private

Fund Managers (and Private Fund Managers required to be registered

with the SEC)6 to distribute a quarterly statement to

the underlying investors in each private fund they manage that

includes specified information regarding fees, expenses, and

performance.7 The release also sets forth certain

delivery and formatting requirements with respect to such quarterly

statement(s) as follows:

- If the private fund is not a fund of funds, the statement must be distributed within 45 days after the end of each of the first three fiscal quarters of each fiscal year and 90 days after the end of each fiscal year.

- If the private fund is a fund of funds, then the statement must

be distributed within 75 days after the end of each of the first

three fiscal quarters of each fiscal year and 120 days after the

end of each fiscal year.

The Quarterly Statement Rule requires consolidated reporting for substantially similar pools of assets to the extent doing so would provide more meaningful information to investors and would not be misleading.

The SEC also amended Section 204-2 of the Advisers Act (the Recordkeeping Rule) so that SEC-Private Fund Managers will be required to retain (a) the statements sent; (b) a record of each addressee and the date(s) sent; (c) all records evidencing calculations for expenses, rebates, etc.; and (d) records substantiating the SEC-Private Fund Manager's determination that a private fund client is a liquid fund or an illiquid fund (as that determination dictates some of the information to be included on such statements).

c. The Mandatory Audit Rule

Rule 206(4)-10 (the Audit Rule) requires SEC-Private Fund Managers

(and Private Fund Managers required to be registered with the SEC)

to obtain an annual financial statement audit of the private funds

they advise. The financial statement audit must comply with Rule

206(4)-2 of the Advisers Act (the Custody Rule). This

"new" requirement will not be seen as a departure from

current practice for most SEC-Private Fund Managers who already

have their funds audited in order to comply with the Custody Rule,

as such audits would (and do) satisfy the Audit

Rule.8

d. The Adviser-Led Secondaries Rule

To address another discrete conflict identified by the SEC, Rule

211(h)(2)-2 (the Adviser-Led Secondaries Rule) requires SEC-Private

Fund Managers (a) to obtain a fairness opinion or valuation opinion

in connection with an adviser-led secondary transaction9

and to distribute such opinion to private investors prior to the

due date to elect to participate in such transaction, and (b) to

prepare and distribute to investors a summary of any material

business relationships between the SEC-Private Fund Manager or its

related persons and the independent opinion provider.

e. The Restricted Activities Rule

Rule 211(h)(2)-1 (the Restricted Activities Rule) restricts Private

Fund Managers from engaging in certain activities that the SEC has

determined to be contrary to the public interest and the protection

of investors unless such Private Fund Manager either (a) discloses

such activity or (b) discloses and receives consent for such

activity. To that end, the SEC explicitly lists which restricted

activities require disclosure and which restricted activities

require both disclosure and consent. The enumerated restricted

activities are as follows:

- Disclosure and Consent

- Charging or allocating to the private fund fees or expenses associated with an investigation of the Private Fund Manager or its related persons by any governmental or regulatory authority10

- Borrowing money, securities, or other private fund assets, or

receiving a loan or extension of credit, from a private fund

- Disclosure Only

- Charging the private fund for any regulatory, examination, or compliance fees or expenses of the Private Fund Manager or its related persons

- Reducing the amount of any adviser clawback by actual, potential, or hypothetical taxes applicable to the Private Fund Manager, its related persons, or their respective owners or interest holders

- Charging or allocating fees and expenses related to a portfolio investment on a non-pro rata basis when more than one private fund or other client advised by the adviser or its related persons has invested in the same portfolio company

f. The Preferential Treatment Rule

Rule 211(h)(2)-3(a)(1) and (2) (the Preferential Treatment Rule)

prohibits Private Fund Managers from providing preferential terms

to certain investors in a private fund or a similar pool of

assets11 unless disclosed to current and prospective

investors. According to the SEC, this rule is designed to address

the material, negative effects of specific types of preferential

treatment on investors–typically effected through the

widespread use of side letters.12

Under the Preferential Treatment Rule, Private Fund Managers are specifically prohibited from the following:

- Providing preferential terms to an investor (or investors) relating to redemptions in a private fund or a substantially similar pool of assets that the manager reasonably expects to have a material, negative effect on other investors in the private fund or substantially similar pool of assets

- Providing preferential information regarding the portfolio

holdings or exposures of a private fund, or of a substantially

similar pool of assets, if the manager reasonably expects that

providing such information would have a material, negative effect

on the other private fund investors

Beyond these specific prohibitions, Private Fund Managers are generally prohibited from providing other types of preferential treatment to select investors unless the manager provides written notice of (a) preferential material, economic terms prior to an investor's investment in the private fund; (b) any other preferential terms to all investors after the investor's investment; and (c) at least annually, any preferential terms made available to investor(s) since the last notice.

In a departure from the proposed rule, with respect to preferential redemption terms, the SEC will permit disparate treatment (a) with respect to redemptions required by applicable law, rule, regulation, or order of certain governmental authorities and (b) if the manager has offered the same (preferential) redemption right to all existing investors and will continue to offer the same rights to all future investors in the private fund or similar pool of assets.

With respect to access to preferential portfolio information for select investors sometimes effected through side letters, also in a change from the proposed rule, the Preferential Treatment Rule permits such a practice only if the adviser offers such information to all investors.

g. Related Recordkeeping Rule Changes

The Private Funds Rules also include an amendment to the existing

Recordkeeping Rule that requires SEC-Private Fund Managers to

retain certain records related to their compliance with the Private

Funds Rules.

II. Compliance Rule Annual Review Amendment

As part of the adoption of the sweeping new rules, the SEC enacted an amendment to the Compliance Rule that requires SEC-registered investment advisers, both SEC-Private Fund Managers and RIAs, to document their annual review of compliance policies and procedures in writing. Note, however, that the SEC explicitly noted that the Compliance Rule changes do not mandate a specific format of written documentation, leaving that to the discretion of the adviser in order to "determine what would be appropriate." While, prior to this amendment to the Compliance Rule, SEC-registered investment advisers were (and are) required to conduct an annual review, the review was not required to be documented in writing (although in practice many such advisers document such reviews in writing).

III. Transition Period, Compliance Date, Legacy Status

a. Transition Period; Compliance Date

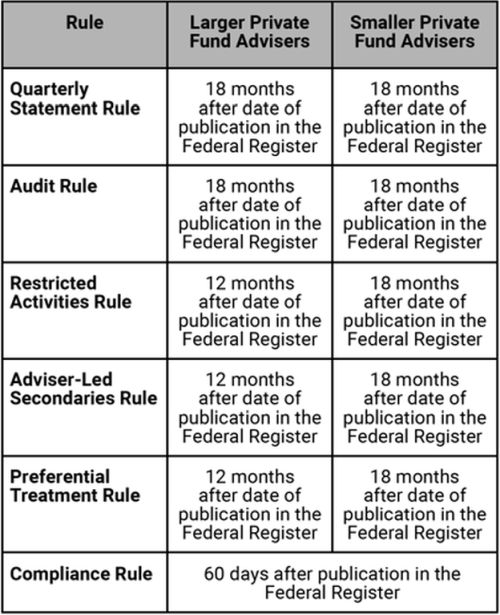

The SEC set forth a timeline as to when a Private Fund Manager must

come into compliance with each applicable Private Funds Rule, which

varies based on the specific Private Funds Rule and whether the

Private Fund Manager is a "Larger Private Fund

Adviser"13 or a "Smaller Private Fund

Adviser,"14 which we have set forth immediately

below. However, it should be noted, as discussed further below,

that the SEC explicitly states which rules (or parts of rules)

require compliance on both a retroactive/backward-looking basis

(e.g., renegotiating contracts and revising existing fund

documents) and a go-forward basis.

b. Legacy Status

The SEC has provided for legacy status for the prohibitions

associated with the Preferential Treatment Rule and certain aspects

of the Restricted Activities Rule (i.e., the items that require

investor consent). The legacy status provisions apply to governing

agreements that were entered into prior to the compliance date if

the applicable rule would require the parties to amend the

agreements. Notwithstanding the 12-to-18-month lead time associated

with the effectiveness of the rules, we encourage Private Fund

Managers to audit their various fund documents and side letters as

soon as possible in order to determine which documents will need to

be renegotiated and/or amended and which will be

"grandfathered" as a result of the legacy status

described above.

IV. Conclusion

As we will explore in greater detail in subsequent alerts, because of a lack of clarity on some items and a wide berth of discretion offered to advisers on others, the Private Funds Rules are likely to give rise to a wide dispersion in compliance and other market practices among Private Fund Managers in the months to come. For instance, for practices that are not prohibited by the rules but are clearly frowned upon by the SEC, the new enhanced disclosure requirements may cause some long-standing practices to fall by the wayside. And while the Private Funds Rules do not go as far as many industry participants had feared based on the proposed rules, the adopting release suggests continued scrutiny of Private Fund Managers in a number of areas in which there is no new rulemaking. For instance, the discussion of the fiduciary duties of Private Fund Managers contained in the rule adopting release cites specific concerns related to the rights of Private Fund Managers to be indemnified by their private fund clients except in the case of (what the SEC clearly views to be an elevated standard of) gross negligence and on their receipt of fees for unperformed services. Even though the SEC chose not to proceed with rulemaking to address these concerns, we expect these areas to continue to invite scrutiny in SEC examinations and investigations. Lastly, while the SEC regulates, among others, Private Fund Managers, the Private Funds Rules seem to imply that they now regulate their advised funds as well, narrowing the distinction between private funds and registered funds. We will continue to monitor any releases and/or guidance from the SEC on any of the topics described herein.

V. Next Steps

The adoption of the Private Funds Rules and the associated amendments to the Compliance Rule and the Recordkeeping Rule will necessitate changes to the fund documents and compliance programs of all Private Fund Managers. From time to time, in advance of the effective date, Lowenstein Sandler will be releasing additional Client Alerts that explore, in greater detail, these important developments to enable clients to update their governing documents and compliance policies and procedures in order to navigate the increasingly treacherous regulatory landscape. We will also monitor not only these regulatory changes but the market practices that evolve to address them.

Footnotes

1. https://www.sec.gov/news/press-release/2023-155. The SEC Chair and several Commissioners also released public statements on its release. See https://www.sec.gov/news/statement/gensler-statement-private-fund-advisers-082323, https://www.sec.gov/news/statement/crenshaw-statement-private-fund-advisers-082323, https://www.sec.gov/news/statement/uyeda-statement-private-fund-advisers-082323, https://www.sec.gov/news/statement/lizarraga-statement-private-fund-advisers-082323 and https://www.sec.gov/news/statement/peirce-statement-doc-registered-investment-adviser-compliance-reviews-08232023.

2. The final Private Funds Rule will become effective 60 days after publication in the Federal Register.

3. https://www.sec.gov/files/rules/final/2023/ia-6383.pdf. See also https://www.sec.gov/files/ia-6383-fact-sheet.pdf.

5. It should be noted that "[t]he final quarterly statement, audit, adviser-led secondaries, restricted activities, and preferential treatment rules do not apply to investment advisers with respect to securitized asset funds they advise. All references to private funds shall not include securitized asset funds."

6. SEC-Private Fund Managers are not required to do this if such statements that comply with the Quarterly Statement Rule are distributed by another person.

7. We will expand on the requirements of the Quarterly Statement Rule, including the specific information to be included in quarterly statements, in a subsequent Client Alert.

8. Because surprise examinations do not meet the requirements of the Audit Rule, they are effectively eliminated as an option for private funds advised by SEC-Private Fund Managers.

9. A "secondary transaction" occurs when an investment manager initiates a transaction offering its private fund investors the option of either selling all or a portion of their interests in a private fund advised by such manager or converting or exchanging such interests for new interests in a new fund advised by such manager.

10. Regardless of any disclosure or consent, under the rule, an adviser may not charge or allocate fees and expenses related to an investigation that results in or has resulted in the imposition of a sanction by a court or governmental authority for a violation of the Advisers Act or the rules promulgated thereunder.

11. The SEC has not defined "similar pool of assets," however, the term's inclusion is designed to capture most commonly used private fund structures in order to prevent advisers from structuring around prohibitions on preferential treatment.

12. While the new rules do not expressly dictate the prohibition of or reduction in the use of side letters (as was originally feared by some), we expect that the enhanced disclosure requirements described in this section may have a chilling effect and present practical challenges with respect to previously negotiated commercial terms, and accommodations going forward for investors who have historically become accustomed to preferential terms.

13. Private Fund Managers with $1.5 billion or more in private funds assets under management.

14. Private Fund Managers with less than $1.5 billion in private funds assets under management.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.