- within Compliance topic(s)

Introduction

The yield curve has long been a closely watched indicator of economic health. When the yield curve inverts, meaning short-term interest rates exceed long-term rates, it is often seen as a harbinger of an impending recession. In recent years, another indicator, the Real-Time Sahm Rule (RTSR), has gained prominence as a timely signal of economic downturns. This paper will delve into the relationship between yield curve inversions, the RTSR, and their implications for company valuations.

The Yield Curve as a Leading Economic Indicator

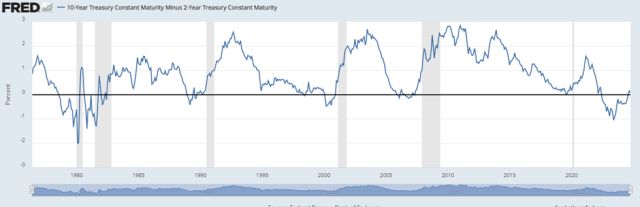

The yield curve's predictive power stems from its ability to reflect market expectations about future economic conditions. When investors anticipate a slowing economy, they often demand higher returns on longer-term bonds, leading to an inverted yield curve. Historically, these inversions have frequently preceded economic downturns, such as the Great Recession of 2008 and the dot-com bubble of 2000. See the chart below from the Federal Reserve Bank of St. Louis that shows how the yield curve dipped below zero prior to a recession.

Source: https://fred.stlouisfed.org/series/T10Y2Y#0

The Real-Time Sahm Rule (RTSR)

The RTSR, developed by Federal Reserve economist Claudia Sahm, provides a real-time assessment of whether the economy is in recession. It is based on the average monthly decline in the unemployment rate over the past three months. If the average monthly decline in the unemployment rate over the past three months falls below a certain threshold— specifically, a half-percentage-point increase from the previous year's low—it suggests that the economy is likely in recession.

Recent Activation of the RTSR

The unemployment rate, which has slowly been trending higher over the past year, along with more recent upticks during the summer to over 4.0%, may trigger the RTSR, indicating a potential recession. Below is the unemployment rate and historical data overlaid with recessions, as provided by the Federal Reserve Bank of St. Louis.

Source: https://fred.stlouisfed.org/series/UNRATE

This activation, combined with the inverted yield curve, strengthens the likelihood of an economic downturn. See the chart below, also from the Federal Reserve Bank of St. Louis, which shows this historical relationship compared to recessions. As evidenced by this chart, the RTSR has been an excellent real-time recession indicator.

Source: https://fred.stlouisfed.org/series/SAHMREALTIME

The Combined Impact of Yield Curve Inversions and the RTSR on Company Valuations

When both the yield curve inverts and the RTSR signals a recession, they together provide a more robust warning to investors and policymakers. This combined indicator can enhance the accuracy of economic forecasts and market predictions, which in turn can significantly impact valuations.

During economic downturns, investor sentiment often becomes more risk-averse, leading to a decline in overall market valuations. This can have a direct impact on individual company valuations, as investors may reassess the future earnings potential and growth prospects of businesses.

The recent activation of the Sahm Rule, combined with the prolonged inverted yield curve, indicates a potential recession. However, the lack of consistent signals from other economic indicators raises questions about the accuracy of these predictions. Regardless, the impact on market performance and valuations is likely to begin soon.

Navigating Valuation Challenges: Four Key Economic Impacts on Companies

- Increased Discount Rates: Higher interest

rates, often associated with economic downturns, can lead to

increased discount rates used in valuation models. This can lower

the present value of future cash flows, reducing company

valuations.

- Decreased Earnings Expectations: Economic

downturns can result in lower revenue and profit growth for many

companies, leading to decreased earnings expectations and lower

valuations.

- Increased Market Volatility: Economic

uncertainty can lead to increased market volatility, making it more

difficult to accurately value companies.

- Sector-Specific Impacts: Certain industries may be more vulnerable to economic downturns than others. Companies in these sectors may experience more significant declines in valuation.

To master the complexities of company valuations in a recessionary environment, it is crucial to focus on several key factors that can reveal potential opportunities and help mitigate risks:

- Earnings Quality: Assess the sustainability of a company's earnings by examining factors such as revenue growth, profit margins, and debt levels.

- Financial Strength: Evaluate a company's financial health through its balance sheet, focusing on elements like cash reserves, debt-to-equity ratio, and working capital.

- Competitive Advantage: Identify companies with unique strengths that can help them weather economic downturns, such as brand recognition, proprietary intellectual property, or innovative business models.

- Valuation Metrics: Traditional valuation metrics may be less reliable during recessions. Consider alternative methods or adjustments to account for prevailing economic conditions.

- Market Dynamics: Monitor market sentiment and investor behavior, as fear and uncertainty can significantly influence valuations.

Company valuations can vary widely during economic downturns. Some may decline significantly, while others may remain constant or even increase in value. By carefully analyzing these factors, investors can identify undervalued companies with potential for growth or stability in a challenging economic climate.

Conclusion

The combined signals from the yield curve inversion and RTSR, indicating a potential economic downturn, have significant implications for company valuations. Investment professionals and fund managers may benefit from consulting with valuation firms to gain a broader perspective and leverage their expertise. Valuation firms can provide valuable insights into industry trends, competitive landscapes, and potential opportunities or risks during a recession. By partnering with valuation firms, investment professionals and fund managers can make more informed decisions and navigate the challenges of a recessionary environment more effectively.

Citation:

Federal Reservse Bank of St. Louis and US Office of Management and Budget, Federal Debt: Total Public Debt as percent of Gross Domestic Product [GFDEGDQ188S], retrieved from FRED, Federal Reserve Bank of St. Louis; https:fred-redesign.stlouisfed.org/series/GFDEGDQ188S, June 13, 2016.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.