This article provides guidance on the recent trends in Environmental, Social, and Governance (ESG), the #MeToo movement (#MeToo), and Black Lives Matter (BLM) impacting corporate governance and the workplace. In the aftermath of the recent police killings of George Floyd, Breonna Taylor, and Jacob Blake, as well as many others, there has been increasing pressure on corporations to take tangible action to address racial injustice in America.

NUMEROUS COMPANIES AND ORGANIZATIONS HAVE responded to these pressures by publicly denouncing racism and discrimination, supporting black-owned businesses, and donating to causes devoted to combating racial injustice. For example, in June 2020, Bank of America pledged $1 billion to help communities address economic and racial inequality. Similarly, Goldman Sachs launched a $10 million Fund for Racial Equity to support the vital work of leading organizations addressing racial injustice, structural inequity, and economic disparity. While the novel coronavirus (COVID-19) pandemic and the events surrounding the BLM movement have intensified discussions about the importance of addressing social injustice, corporate America already was at an inflection point with respect to its role in society, facing pressures from investors, consumers, and regulators to consider a broader range of stakeholders.

What Is ESG?

ESG refers to a broad set of considerations that may impact a company's performance and its ability to execute its business strategy and create long-term value. Socially conscious stakeholders use ESG to measure the sustainability and societal impact of a company and its business activities. While ESG factors can affect a company's bottom line directly, they can also affect a company's reputation, and investors and business leaders are increasingly applying these nonfinancial factors in their analysis to identify the material risks and growth opportunities of a company.

Companies' ESG Efforts

Industry leaders have pushed hard to advance ESG initiatives. For example, in his 2019 Letter to CEOs, BlackRock, Inc.'s Chairman and Chief Executive Officer, Larry Fink, encouraged companies to develop "a clear embedment of your company's purpose in your business model and corporate strategy." According to Fink, "Purpose is not the sole pursuit of profits but the animating force for achieving them" and "profits and purpose are inextricably linked." Thus, companies that fulfill their purpose and responsibilities to stakeholders-including prioritizing board diversity, compensation that promotes stability, and environmental sustainability-reap rewards over the long term.

Likewise, in August 2019, the Business Roundtable issued a Statement on the Purpose of Corporation (Statement) signed by 181 CEOs, expressing "a fundamental commitment to all of our stakeholders," including employees, suppliers, and customers, and not just shareholders. Specifically, the Statement expressed a commitment to delivering value to customers, investing in employees, dealing fairly and ethically with suppliers, and supporting the communities by embracing sustainable practices across businesses.

In line with these goals, following an overwhelming majority vote of 99% of voting shareholders, on February 1, 2021, Veeva Systems, a computer software company, became the first publicly traded company and largest ever to convert to a public benefit corporation (i.e., a for-profit corporation that must consider the interests of various stakeholders, including employees, partners, customers, and shareholders). The company is also revising its certificate of incorporation to include a public benefit purpose.

In response to increasing pressure from different stakeholder groups-including investors, consumers, and governments-for more transparency about their environmental, economic, and social impacts, more companies are also making disclosures in their annual report or in a standalone sustainability report (also referred to as an ESG or corporate social responsibility report).

Nasdaq's ESG Standards for Companies

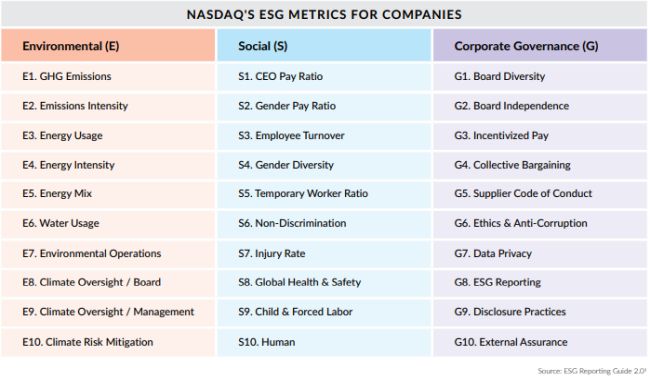

Moreover, various institutions are creating standards and metrics to help integrate ESG into the investment process. For example, in May 2019, Nasdaq launched its new ESG reporting guide for public and private companies. Although Nasdaq does not require its listed companies to issue ESG reporting, it may track the participation of listed companies to better support their efforts. Nasdaq's ESG Reporting Guide includes 10 metrics for each of environmental, social, and corporate governance:

Biden Administration ESG Efforts

The demand for consideration of ESG is not limited to the private sector. As part of his campaign, then-presidential candidate Joseph R. Biden set forth "The Biden Agenda for Women," which promised to pursue "an aggressive and comprehensive plan to further women's economic and physical security and ensure that women can fully exercise their civil rights."

Originally published by Lexis Nexis The Practical Guidance Journal

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.