INTRODUCTION

What is the BOI Reporting Rules of the CTA?

In September 2022, the U.S. Department of the Treasury's Financial Crimes Enforcement Network ("FinCEN") issued the final beneficial ownership information ("BOI") reporting rules (the "BOI Reporting Rules") of the Corporate Transparency Act (31 U.S.C. § 5336), enacted as part of the National Defense Authorization Act for Fiscal Year 2021, as amended ("CTA"). The BOI Reporting Rules require that all entities created or registered to do business in the United States that are not exempt from being classified as "reporting companies" report up to three (3) sets of information regarding:

(1) the "reporting companies" themselves;

(2) the "beneficial owners" of the reporting companies, which includes individuals who either:

(a) own at least 25% of the "ownership interests" of the reporting company; or

(b) exercise "substantial control" over the reporting company;

(3) the "company applicants" of the reporting companies, which includes individuals who either:

(a) directly files the documents that creates or registers the reporting companies with governmental entities; or

(b) is primarily responsible for directing or controlling such filling.

This information will be collected through and stored in the Beneficial Ownership Secure System ("BOSS"), to which only authorized personnel with specific purposes will have access. The BOI Reporting Rules took effect on January 1, 2024, and this Quick Guide aims to give you an overview of the BOI Reporting Rules.

What happens if a reporting company does not report BOI in the required timeframe?

The willful failure to comply with the BOI Reporting Rules, or the willful provision of or attempt to provide false or fraudulent BOI, may result in penalties, including:

- civil penalties of up to $500 for each day that the violation continues; and/or

- criminal penalties, including imprisonment for up to two (2) years and/or a fine of up to $10,000.

Senior officers of a reporting company that fail to file a required BOI report ("BOIR") may be held accountable for that failure. Additionally, a person may be subject to civil and/or criminal penalties for willfully causing a reporting company not to file a required BOIR or to report incomplete or false BOI to FinCEN.

What is the deadline for submitting an initial BOIR?

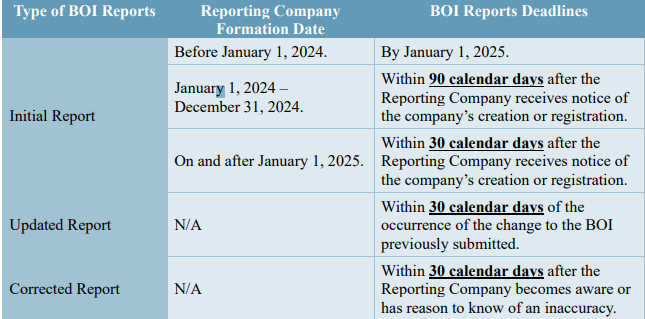

Reporting companies created or registered prior to January 1, 2024 will have one (1) year, until January 1, 2025, to submit an initial BOIR. Reporting companies created or registered during 2024 will have 90 calendar days from formation or registration to submit an initial BOIR. Reporting companies created or registered on or after January 1, 2025 will have 30 calendar days from formation or registration to submit an initial BOIR. Please note that reporting companies are also obligated to submit a corrected and/or updated BOIR, when required. See the timeline chart below for details.

Chart 1: Initial, Corrected, and Updated BOIR Filing Deadlines

What should you do to ensure compliance with the BOI Reporting Rules?

The following six-step approach can help you understand your obligations with respect to the BOI Reporting Rules:

(1) Determine if your company is exempt from being considered a "reporting company" subject to the BOI Reporting Rules.

(2) Identify all "beneficial owner(s)" of your reporting company. (3) Identify all "company applicant(s)" of your reporting company (for reporting companies created/registered on or after January 1, 2024 only).

(4) Collect required information for the reporting company, the "beneficial owner(s)" and the company applicant(s).

(5) File the initial BOIR before the reporting deadline. (6) File an updated or corrected BOIR if there is any change to or inaccuracy in the previously submitted BOIR.

Details regarding each of these steps follow in the next section of this Quick Guide.

SIX-STEP COMPLIANCE APPROACH IN PRACTICE

Step 1. Determine if your company is a "reporting company" subject to the BOI Reporting Rules.

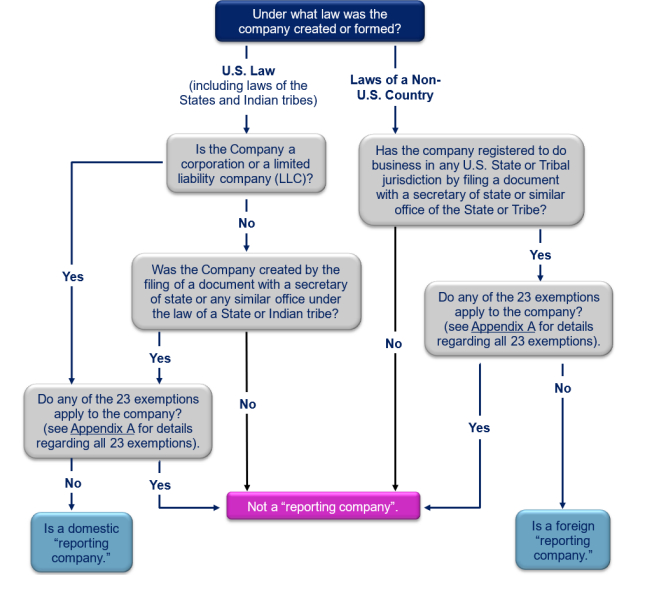

A corporation, limited liability company or any other entity created or registered to do business in the United States by filing a document with a secretary of state or any similar office under the law of a State or Indian tribe is a reporting company subject to BOI Reporting Rules, unlessany one of the twenty-three (23) exceptions to the definition of "reporting company" applies (see Appendix A for detailed criteria in a check-box format to determine the applicability of each exemption):

(1) Reporting Issuer Under Securities Exchange Act of 1934

(2) Governmental Authority

(3) Bank

(4) Credit Union

(5) Depository Institution Holding Company

(6) Money Service Business

(7) Registered Securities Broker or Dealer

(8) Securities Exchange or Clearing Agency

(9) Other Exchange Act Registered Entity

(10) Registered Investment Company or Investment Advisor

(11) Venture Capital Fund Adviser

(12) Insurance Company (13) State-Licensed Insurance Producer

(14) Commodity Exchange Act Registered Entity

(15) Public Accounting Firm

(16) Regulated Public Utility

(17) Financial Market Utility

(18) Pooled Investment Vehicle

(19) Tax-Exempt Entity

(20) Entity Assisting a Tax-Exempt Entity

(21) Large Operating Company

(22) Subsidiary of Certain Exempt Entities

(23) Inactive Entity (in existence on or prior to January 1, 2020)

Chart 2 – "Reporting Company" Definition

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.