Certain U.S.-resident investment managers, their parent companies or their investment advisory clients may be required to report to the Federal Reserve Bank of New York (FRBNY) on Treasury International Capital Form D (TIC D) quarterly snapshot information regarding their cross-border derivatives contracts and the net settlement payments arising from those contracts.

The U.S. Department of the Treasury (Treasury) recently modified TIC D. These changes to TIC D provide an opportunity for investment managers to review their potential reporting obligations, or those of their advisory clients, in anticipation of the first due date for submitting the quarterly report on the modified TIC D, August 20, 2012 (for Q2 2012).1

Reports on TIC D likely are required to be filed only by a small subset of investment managers already required to file reports on TIC SLT and TIC SHC. However, given the potential civil and criminal penalties resulting from failing to file a required TIC D, it is advisable for all U.S. investment managers with significant proprietary derivatives positions and/or derivatives positions under their management to reassess their derivatives positions, and those of their advisory clients, to determine whether they or their advisory clients are obligated to report on TIC D.

This update provides an overview of TIC D and the recent changes to TIC D as potentially applicable to U.S. investment managers, their ultimate U.S. parents and their advisory clients.2

Overview of TIC D

TIC D is a quarterly survey that collects snapshot quarter-end information that meas-ures the amount and changes of U.S. positions in cross-border derivatives contracts and the net settlement payments arising from those contracts. It is required by the Treasury, which is being assisted by the FRBNY as fiscal agent. It is part of the various "TIC" reports adminis-tered by the FRBNY.

Required Reporter

As a general matter, reports on TIC D must be sub-mitted by all entities resident in the United States having wordwide derivative contracts to which they and their U.S.-resident subsidiaries (and certain U.S. "customers") are a party, that in the aggregate satisfy the filing threshold (discussed below).3

The instructions to TIC D provide for consolidation of "customer" positions on foreign exchanges "when [the reporter] serves as broker." The TIC D FAQs, in dismissing any potential custodian reporting obliga-tions, state that "customer derivatives contracts should only be reported when the reporter is acting as counterparty or as broker in the case of exchange traded contracts." As a result, U.S. investment advisory clients should not be considered "customers" of an investment manager unless the manager is a counter-party or transacting party (such as a broker, dealer or underwriter) in the customer's derivatives positions.

Accordingly, if an investment manager is not acting as a counterparty or transacting party for a customer's derivatives positions, those positions should not be consolidated with the manager's derivatives contracts for threshold or reporting purposes. As a corollary, the derivatives positions of each U.S. investment advisory client that is not a "customer" of an investment manager for purposes of TIC D should be treated on a separate basis for their own thresholds and reports.

Reportable Positions

TIC D requires a report of the reporter's aggregate cross-border holdings of derivatives contracts and net settlement payments that arise from such contracts on both (i) an aggregate basis and (ii) a country-by-country basis.4 Positions with foreign residents generally must be reported for the country or geographical area in which the direct counterparty resides (i.e., its country of legal residence).

Cross-border positions include (i) the derivatives positions of the U.S-resident parts of an organization (or of the organization's U.S. customers) with foreign residents, including foreign exchanges and (ii) the derivatives positions of U.S. exchanges when the reporter serves as broker on behalf of foreign residents.

Filing Threshold

A U.S. resident must file TIC D only if the total notional value of worldwide holdings of derivatives for its own, its U.S. subsidiaries' and its applicable U.S. customers' accounts in the aggregate exceeded $400 billion at the end of the calendar quarter reported (notional value test). Once a U.S. resident meets the notional value test, it must file TIC D for the calendar quarter in which it meets the threshold, the remaining calendar quarters in the same calendar year and each quarter in the following calendar year.

In addition, if the total notional value of its worldwide derivative contracts falls below the $400 billion thres-hold, a U.S. resident must continue to file TIC D if its "total net settlements" reported on the aggregate holdings section of TIC D exceeds $400 million for any calendar quarter during the preceding two calendar years (net settlement test).5

Consolidation

A reporter must file a single report of the reportable holdings and transactions of all U.S.-resident parts of its own organization (including applicable "customers"). The reporting entity should be the top U.S.-resident entity within its organization. TIC D reporters should consolidate on the same basis as annual reports submitted to the Securities and Exchange Commission (SEC) or as described in generally accepted accounting principles (GAAP).

Reporting Schedule

TIC D reports are due not later than 50 calendar days following the last day of the calendar quarter being reported.

Changes to TIC D

The revised TIC D and Instructions to TIC D:

- Provide that the reporting requirements apply to foreign exchange swaps, including spot/forward and forward/forward foreign exchange swaps. A TIC D reporter must also report cross currency interest rate contracts with foreign-resident counterparties.

- Impose an accelerated deadline for filing TIC D. Previously, TIC D reporters had 60 days after the end of a calendar quarter being reported to sub-mit a report. The revised TIC D now must be filed 50 days after the end of the reported calendar quarter.

- Require that cross-border derivatives with foreign counterparties be reported based on the geo-graphical area in which the direct counterparty resides, not, for example, based on the currency of the contract, the center of the counterparty's economic activity, the country of counterparty's parent, the country of issuance, or country of any guarantor. Generally, the country of the direct counterparty is determined by the country of its legal residence.

The first due date for submitting the quarterly report on the modified TIC D is August 20, 2012 (for Q2 2012).

Summary of Other Reporting Requirements

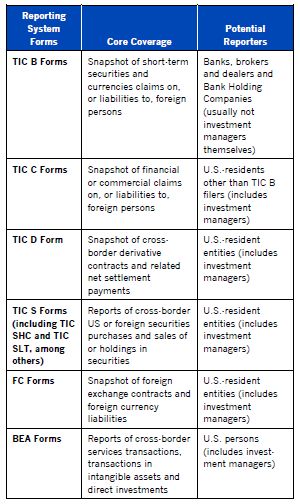

TIC D is one of a number of mandatory surveys that U.S. governmental agencies conduct in order to study economic relationships of U.S. residents with foreign parties. The TIC Forms are one of three sets of report-ing obligations regarding international transactions and investments potentially applicable for U.S. investment managers. The following table provides a brief sum-mary of the various reports required by the Treasury, the U.S. Department of Commerce, and the Federal Reserve.

Penalties for Failure to File

TIC D is authorized and required by an Act of Congress. There is potential civil and criminal liability for failure to file timely and accurate reports for any U.S. person or group subject to the reporting requirements. Any group that fails to provide timely and accurate data may be subject to a civil penalty of between $2,500 and $25,000, or injunctive relief ordering such group to comply, or both. Any U.S. person or group that willfully fails to submit any of the information required in the report on TIC D may be subject to a fine of up to $10,000, and, if an individual, may be subject to imprisonment for up to one year, or both. In addition, the requirement subjects to the same penalties, officers, directors, employees, and agents of any entity with filing obligations, who knowingly participate in such willful violation.

Importantly, the person who will sign the filing must certify that he/she is aware of the penalties and that he/she is sufficiently knowledgeable about the activities and functions of the group on behalf of whom the report is filed and that he/she can knowingly and with reasonable confidence certify that the information provided is accurate and complete.

Conclusion

U.S. investment managers should consider whether they, their ultimate U.S. parent or their advisory clients potentially may be required to file TIC D or other reports regarding cross-border holdings or transac-tions. Investment managers should also ensure that they have reporting and compliance procedures and that any such procedures are updated to comply with the new reporting deadline for TIC D.

Footnotes

1 The original proposed effective date provided in the Federal Register for the changes to TIC D was for Q1 filings. However, the Treasury and the FRBNY have provided guidance that the Q1 report should still be submitted using the prior form on the previous schedule (i.e., 60 calendar days after the end of the applicable calendar quarter).

2 TIC D, related instructions and FAQs are available at: http://www.treasury.gov/resource-center/data-chart-center/tic/Pages/forms-d.aspxhttp://www.treasury.gov/resource-center/data-chart-center/tic/Pages/forms-d.aspx

3 Other entities may also be required to report on TIC D if notified by the FRBNY that they are required to submit a report.

4 "Derivatives contracts" are defined for purposes of TIC D by reference to the FASB Statement No. 133 definition of a derivative contract.

5 The net settlement test refers to the total net receipts and payments made under terms of the reported derivatives contracts, as well as payments for the purchase, sale or closeout of derivatives (reported on TIC D, Part 1, Column 3, Row 7). The net settlement test is designed to permit the FRBNY to continue to collect data for a period of time after a reporter has ceased to meet the notional value test.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.