The Wall Street Transparency and Accountability Act of 2010 (the "Derivatives Act"), which is Title VII of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), became law on July 21, 2010 (the "Enactment Date"). The new law followed less than a year after the Treasury's August 2009 proposal for derivatives regulatory reform, the "Over-the-Counter Derivatives Markets Act of 2009" ("Treasury's Proposal"), and makes good on much of Treasury's Proposal, transforming prior derivatives regulation. It affords both the Commodity Futures Trading Commission (the "CFTC") and the Securities and Exchange Commission (the "SEC") broad authority to regulate, respectively, most swaps and security-based swaps transactions and markets, as well as their participants, while expanding the prudential regulatory authority of applicable bank regulators – the Federal Reserve Board, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation ("FDIC", and collectively, the "Prudential Regulators") – to include regulations relating to derivatives activities (e.g., capital and margin requirements) in their regulation of financial institutions participating in the derivatives markets.

HIGHLIGHTS

- Parallel Regimes for Swaps and Security-Based Swaps. The Derivatives Act tasks the CFTC and the SEC with parallel (often consultative but generally not joint) rulemaking, supervision and enforcement of derivative transactions and most derivative market participants. The CFTC's jurisdiction is based on a broad definition of swaps. The SEC's jurisdiction, on the other hand, is confined to security-based swaps, which are generally swaps based on a single security or loan or referencing a single issuer or issuers in a narrow-based index. Generally, the Derivatives Act mandates that the SEC and the CFTC establish new rules within 360 days after the Enactment Date or by July 16, 2011 (this initial period, the "Initial Rulemaking Period").1

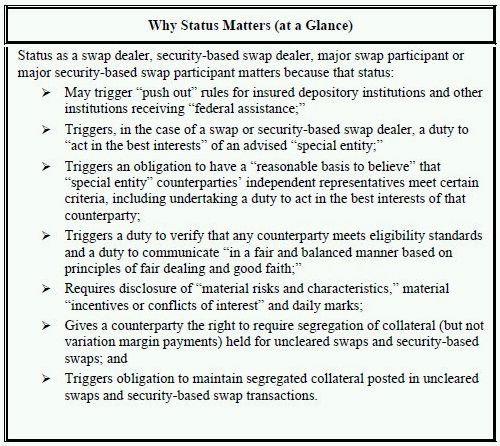

- Certain Key Derivatives Market Participants Subject to New Standards. The Derivatives Act subjects certain categories of key participants in the derivatives markets, namely security-based swap dealers and swap dealers (collectively, "Swap Dealers") and major security-based swap participants and major swap participants (collectively, "Major Participants"), to heightened regulation and standards of conduct by the SEC and CFTC, respectively. The SEC and the CFTC must define certain terms key to determining which market participants are members of these categories during the Initial Rulemaking Period.

- Banks Subject to Limited Push-Out Rules. Banks and their affiliates continue to be permitted to trade certain derivatives, including as swap dealers or security-based swap dealers, with respect to only certain types of derivatives and to use derivatives for hedging directly related to their activities. Banks will be required to spin off or cease derivatives trading not permitted by the Derivatives Act, including commodities and energy derivatives, equity derivatives and uncleared credit default swaps. Institutions required to spin-off or cease derivatives activities that are not permitted will have up to five to six years in which to do so.

- Swap Dealers and Major Participants Subject to Registration, Capital and Reporting Requirements. Swap Dealers and Major Participants (including banks) must, no later than one year after the Enactment Date (July 21, 2011), register with the CFTC, the SEC or both regulators depending on whether their status relates to swaps, security-based swaps or both categories of derivatives. Along with registration, these market participants are subject to a host of new reporting and disclosure rules, minimum capital requirements, operational standards and business conduct rules.

- Swap Dealers and Major Participants Have Obligations to Counterparties and Owe Heightened Duties to Special Entities. The Derivatives Act imposes new duties on Swap Dealers and Major Participants entering into derivatives transactions, which are heightened when a Swap Dealer's or Major Participant's counterparty is one of the "special entities" identified in the Derivatives Act. Advising a designated "special entity" further requires a Swap Dealer or a Major Participant to act in the best interests of that special entity.

- Mandatory Clearing and Exchange Trading. The Derivatives Act mandates clearing for most swaps and security-based swaps through a derivatives clearing organization or clearing agency registered for that purpose with the CFTC or the SEC, respectively, subject to limited exceptions, including for (subject to certain conditions) transactions entered into prior to the effective date of the SEC and the CFTC clearing rules, as applicable.

DISCUSSION

General

Regulatory oversight of over-the-counter ("OTC") derivatives has historically been piecemeal and ultimately lax. While use of OTC derivatives in the financial sector has increased dramatically over the past 20 years, both in terms of the volume and the complexity of derivative products in the market, legislation and related regulation of derivative transactions during that period had largely removed derivatives transactions from the ambit of regulators. Specifically, the Futures Trading Practices Act of 1992, followed by the "Exemption for Certain Swap Agreements" adopted by the CFTC in 1993, excluded most OTC derivatives traded between qualified participants from the scope of the Commodity Exchange Act of 1936, as amended ("CEA"). Similarly, the Financial Services Modernization Act of 1999 (known as the Gramm-Leach-Bliley Act) and the Commodity Futures Modernization Act of 2000 and related rules and regulations excluded the regulation of security-based swap agreements from any form of comprehensive oversight by the SEC. While the SEC retained limited anti-fraud and anti-manipulation authority over security-based swap agreements, the power to regulate offers, sales and trading in these agreements was removed from the scope of its authority.

The Derivatives Act fundamentally alters that regulatory framework. It expands the scope of CFTC and SEC regulation of swaps and security-based swaps, respectively, adding, for example, a prohibition on insider trading under the CEA and authorizing the CFTC to promulgate regulations to prevent manipulation and the delivery of false information. The Derivatives Act expressly repeals and amends provisions of the Gramm-Leach-Bliley Act and provides that a security-based swap is explicitly a "security" for purposes of federal securities laws, making these instruments subject to regulations and rules applicable to other securities. As a result of these and the other changes within the 160 pages establishing the foundation for the new regime, implementation of the Derivatives Act will undoubtedly lead to a significant transformation of the marketplace.

The rules and regulations effecting this transformation remain to be promulgated over the course of a year.2 The CFTC and the SEC are establishing processes to facilitate this rulemaking effort that involve dedicated electronic mailboxes, meeting, comment and review procedures, and public hearings. The CFTC has released a list of 30 rulemaking topics for OTC derivatives. CFTC Chairman Gary Gensler has announced that the CFTC plans to begin publishing proposed rules in the fall, with public comment periods of at least 30 days.3 The actual rules of the road – and their impact on derivatives products, markets and participants – will only become known through the course of the Initial Rulemaking Period. In the meantime, however, it is apparent that market practice will include centralized clearing and exchange trading, and extensive requirements on reporting, disclosure and business conduct, including heightened duties to certain identified counterparties for certain key players – Swap Dealers and Major Participants – as well as limits on participants, economic terms and positions.

PARALLEL REGIMES FOR SWAPS AND SECURITY-BASED SWAPS

The Derivatives Act broadens the power and authority of the SEC and the CFTC under parallel regulatory regimes. The agencies' jurisdictions are divided based on a distinction between derivative instruments – reflecting a historic distinction continued in Treasury's Proposal and through various proposals in the House and the Senate. The CFTC's jurisdiction extends broadly to swaps, while the SEC's jurisdiction more narrowly covers only security-based swaps. Each of the CFTC and the SEC is authorized to independently issue rules subject only to mandatory interagency consultation in certain areas. The CFTC and the SEC must treat functionally or economically similar products or entities in a similar manner, though the agencies are not required to adopt joint rules or to treat these products and entities identically. An exception to the Derivatives Act's parallel rulemaking is that the CFTC, SEC and Federal Reserve Board are required to jointly prescribe regulations for "mixed swaps" (which are defined and discussed below).

The Derivatives Act introduces a dispute resolution mechanism that allows each agency to petition the U.S. Court of Appeals for the District of Columbia Circuit (the "Court of Appeals"), historically the court of review for much of the federal regulatory activity, for review of any rule or regulation that the agency deems conflicting with the jurisdiction and treatment of similar products provisions of the Derivatives Act, not later than 60 days after the date of the rule's publication. The Derivatives Act similarly establishes a formal process for determining jurisdiction, status and rulemaking authority for new products that also includes resolution of disputes between the CFTC and the SEC by the Court of Appeals.

Notably, the Derivatives Act does not reduce the Prudential Regulators' jurisdiction over the regulation of banks and other financial institutions they oversee. For example, Prudential Regulators, in consultation with the CFTC and SEC, are authorized to set the capital and transaction margin requirements for banking entities.

Timing: The CFTC and the SEC are required to issue their final regulations within the Initial Rulemaking Period. As noted above, any disputes between the agencies will be settled pursuant to the resolution mechanism introduced by the Derivatives Act.

Section References: 712, 718

Swaps

Under the CEA as amended by the Derivatives Act, the CFTC has jurisdiction over swap transactions, other than security-based swaps, and related markets and market participants. The term "swap" is fairly comprehensive and includes any agreement or transaction that

- is a put, call or similar option for the purchase or sale of, among others, currencies, commodities, securities, instruments of indebtedness, or other financial or economic interests or property of any kind,

- provides for any purchase, sale or delivery that is dependent on the occurrence of an event or contingency associated with a potential financial, economic or commercial consequence,

- provides on an executory basis for the exchange of one or more payments based on the value or level of, among others, currencies, commodities, securities, instruments of indebtedness, or other financial or economic interests or property of any kind, which transfer the financial risk associated with a future change without also conveying a current or future ownership interest,

- is an agreement or transaction that is commonly known to the trade as a swap, or

- any "combination or permutation" of any of those transactions. Interest-rate swaps and derivative contracts that reference broad-based indices are examples of swaps.

The term "swap" expressly excludes certain commodity futures and similar transactions: options and other transactions already subject to regulation under the Securities Act of 1933, as amended (the "Securities Act"), and/or the Securities Exchange Act of 1934, as amended (the "Exchange Act"); notes, bonds and debt that are "securities" under the Securities Act; underwriting agreements; any foreign exchange swap or any foreign exchange forward; and any agreement with a Federal Reserve Bank, the U.S. government or an agency thereof as counterparty.

Section Reference: 721

Security-Based Swaps

The amendments to the Securities Act and the Exchange Act bring regulation of security-based swaps under the jurisdiction of the SEC. The Derivatives Act provides that a "security-based swap" includes any swap that is based on (i) a narrow-based security index, (ii) a single security or loan, or (iii) the occurrence, non-occurrence, or extent of the occurrence of an event relating to a single issuer of a security or the issuers in a narrow-based security index (provided that such event must directly affect the financial statements, financial condition or financial obligations of the issuer).

The term "security-based swap" excludes any agreement, contract or transaction that meets the definition of a security-based swap only because such agreement, contract or transaction references, is based upon, or settles through the transfer, delivery or receipt of an exempted security unless such agreement, contract or transaction is of the character of, or is commonly known in the trade as, a put, call or other option.4

Section References: 725, 761

Security-Based Swaps Regulated as Securities

Under the Derivatives Act, a security-based swap is a "security" as defined in Section 2(a) of the Securities Act and Section 3A of the Exchange Act, thereby making these instruments subject to the regulations and rules applicable to most other securities. The definitions of "purchase" and "sale" in both the Securities Act and the Exchange Act are likewise modified so that entering into, an assignment or other transfer, and early unwind of a security-based swap constitute a purchase or sale of that security-based swap. And, under the Securities Act as amended by the Derivatives Act, any offer to sell or sale of a security-based swap by or on behalf of the issuer of the securities referenced or on which such security-based swap is based, constitutes an offer to sell or sale of such securities.

Furthermore, while purchases and sales of most other types of securities can qualify for exemptions from registration under the various provisions of Section 3 and 4 of the Securities Act (e.g., private placements, secondary market trading, etc.), the Derivatives Act amends Section 5 of the Securities Act to require that, when purchases and sales of security-based swaps are contemplated to persons who are not eligible contract participants (within the meaning of the CEA as amended by the Derivatives Act), the purchase and sale must be registered and a conforming prospectus delivered, and there are no exceptions or exemptions from this requirement under the Derivatives Act.

The Derivatives Act also includes conforming amendments to many provisions of the Securities Act and the Exchange Act, which have the effect of bringing the regulation of security-based swaps squarely within the ambit of the SEC and imposes the SEC's antifraud and anti-manipulation oversight of all swap agreements. For example, the provisions of Section 13 (beneficial ownership) and Section 16 (short swing profits) of the Exchange Act now include security-based swaps within their ambit to the extent that the SEC exercises rulemaking authority, subject to consultation with the Prudential Regulators and Treasury, to deem the purchase or sale of a security-based swap to be the acquisition or sale of beneficial ownership of the applicable equity security. See Goodwin Procter's July 27, 2010 Public Company Advisory.

Timing: The Derivatives Act does not mandate a particular timeline with respect to consultation with the Prudential Regulators and Treasury, or the promulgation of rules to incorporate security-based swaps into the reporting requirements of the Exchange Act.

Section References: 717, 762, 766, 768

Mixed Swaps

Notably, both the CFTC and SEC, along with the Federal Reserve Board will jointly issue regulations for mixed swaps, which are classified as security-based swaps by amendments to the CEA and the Securities Act. Supervision over this category, therefore, falls to the SEC as the agency with authority over security-based swaps. "Mixed swaps" are any security-based swap that is based on the value of one or more interest or other rates, currencies, commodities, instruments of indebtedness, indices or economic interest or property of any kind, or the occurrence, non-occurrence or the extent of the occurrence of an event or contingency associated with a potential financial, economic or commercial consequence.

Timing. The joint regulations for mixed swaps must be issued during the Initial Rulemaking Period.

Section References: 712, 721, 761

Foreign Exchange Swaps and Forwards

The CFTC has authority, under the Derivatives Act, to regulate foreign exchange swaps and forwards as swaps. Foreign exchange swaps and/or forwards, however, generally would no longer be treated as swaps subject to the CFTC's regulation upon Treasury's written determination that they should not be so regulated and were not structured to evade the Derivatives Act. Any such determinations by Treasury will be effective upon their submission to the appropriate congressional committee. Notwithstanding any written determination by Treasury, all foreign exchange swaps and forwards must be reported to either a swap data repository or, if such repository is unavailable, to the CFTC or SEC, as applicable. Furthermore, cleared or exchange traded foreign exchange swaps and forwards will not be exempt from any of the Derivatives Act's provisions prohibiting fraud or manipulation even if otherwise excluded from the CFTC's regulation following determinations by Treasury.

Section References: 721, 722

KEY DERIVATIVES MARKET PARTICIPANTS

The Derivatives Act identifies certain participants in the derivatives market that will be subject to comprehensive regulation and standards of conduct: Swap Dealers (i.e., security-based swap dealers and swap dealers) and Major Participants (i.e., major security-based swap and major swap participants). Notably, however, it leaves substantial elements of the tests for inclusion in these categories to SEC and CFTC rulemaking with less than clear guidance for those rules.

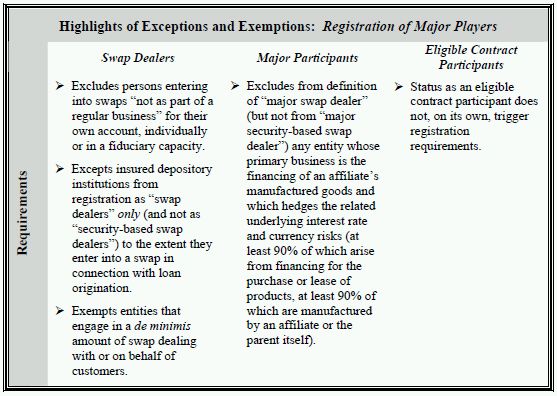

Swap Dealers and Security-Based Swap Dealers

The Derivatives Act defines "swap dealer" as including any person who (i) holds itself out as a dealer, (ii) "makes a market in swaps," (iii) regularly enters into swaps as an ordinary course of business for its own account, or (iv) engages in any activity that would cause such person to be known as a dealer or market maker in swaps, except that an insured depository institution ("IDI") will not be considered a swap dealer if it offers to enter into a swap in connection with loan origination activities.5 With respect to security-based swaps, the parallel category "security-based swap dealer" is similarly defined. Notably, the Derivatives Act contemplates that a market participant may be a swap and/or a security-based swap dealer in one or more types of derivatives.

Section References: 721, 761

Major Swap Participants and Major Security-Based Swap Participants

Under the Derivatives Act, a "major swap participant" or "major security-based swap participant" refers to any person that is not a dealer and (i) maintains a "substantial position" in outstanding swaps or security-based swaps, excluding positions held primarily for hedging or mitigating commercial risks, or (ii) creates "substantial counterparty exposure that could have serious adverse effects on the financial stability of the United States banking system or financial markets," through its outstanding swaps or security-based swap transactions or (iii) is a financial entity6 that is "highly leveraged relative to the amount of capital such entity holds and that is not subject to capital requirements" established by an appropriate banking regulator and maintains a "substantial position" in outstanding swaps or security-based swaps in any major swap or security-based swap category.

The Derivatives Act requires the CFTC and the SEC to define "substantial position" as the threshold that the applicable agency determines to be prudent for the "effective monitoring, management, and oversight of entities that are systemically important or can significantly impact the financial system of the United States." It would take into account a person's relative position in uncleared versus cleared swaps and may take into consideration the value and quality of collateral held against counterparty exposures. The Derivatives Act does not provide further guidance as to the determination of the levels at which financial entities would be considered "highly leveraged."

The definition of "major swap participant" specifically excludes an entity that primarily provides financing and utilizes swaps for the purpose of hedging underlying commercial risks related to interest rate and foreign currency exposures, 90% or more of which are attributable to financing that "facilitates the purchase or lease of products, 90% or more of which are manufactured by the parent company or another subsidiary of the parent company."

Similar to the regulation of swap and security-based swap dealers, the Derivatives Act contemplates that a market participant may be a major swap and/or a security-based swap participant in one or more types, classes or categories of derivatives.

Section References: 721, 761

BANKS AND THE "PUSH-OUT" PROVISIONS (OR THE PROHIBITION AGAINST FEDERAL ASSISTANCE)

Identifying whether a derivatives market participant is a Swap Dealer or a Major Participant will be important to all market participants – and particularly important to IDIs and their affiliates and other institutions receiving the broadly-defined "federal assistance." The Derivatives Act imposes a substantially less drastic "push-out" rule than the proposal originally advocated by Senator Blanche Lincoln (D-AR),7 but it will require certain banking entities to spin-off or cease certain derivatives trading activities. Additionally, the so-called "Volcker rule" imposed by Section 619 of the Dodd-Frank Act will generally prohibit banking entities, including IDIs and their affiliates, from engaging in proprietary trading with respect to derivatives, except as part of a customer driven business or for hedging purposes. The Derivatives Act also expressly requires IDIs to comply with this limitation.

The rule prohibits "federal assistance" to any "swaps entity" with respect to any swap, security-based swap or other activity of the swaps entity. The statute includes within the definition of "federal assistance" the use of any advances from any Federal Reserve credit facility or discount window that are not part of a program or facility eligible under the Federal Reserve Board's lending authority with broad based eligibility under Section 13(3) of the Federal Reserve Act FDIC insurance or guarantees for the purpose of making any loan to any swaps entity purchasing any stock, equity interest or asset of any swaps entity guaranteeing any loans or debt of any swaps entity or entering into any assistance arrangement, loss sharing or profit sharing with any swaps entity. "Swaps entity" is defined to include any Swap Dealer or Major Participant registered with the SEC or the CFTC, as applicable, other than Major Participants that are IDIs. As a result, IDIs will be required to spin off to separately capitalized affiliates derivatives trading that is not expressly permitted, including commodities and energy derivatives, equity derivatives and uncleared credit default swaps.

The affiliates of IDIs that are part of a bank holding company or savings and loan holding company and are spun off as a result of the prohibition on federal assistance will be required to comply with Sections 23A and 23B of the Federal Reserve Act in addition to any other requirements imposed by the relevant Prudential Regulator (or SEC and CFTC, as applicable). The Derivatives Act treats the credit exposure arising out of derivatives transactions, including swaps and security-based swaps, as credit transactions, which are a type of covered transaction. Guarantees provided by an IDI or its subsidiaries on behalf of a swaps entity are also credit transactions, and an investment in a swaps entity's equity is also a covered transaction. Accordingly, these types of transactions are subject to the quantitative limits and other requirements of Sections 23A and 23B, including, in the case of a credit transaction, collateralization requirements.8

The prohibition on federal assistance does not apply to IDIs and their affiliates that limit their swap activities to (i) hedging and other similar risk mitigating activities directly related to their activities, and (ii) acting as swaps entities for swaps or security-based swaps involving rates or reference assets that are permissible for investment by a national bank under the National Bank Act and, in the case of credit default swaps and security-based swaps, are cleared through a registered derivatives clearing organization or clearing agency.9 Generally, such reference assets include, among others, investment grade debt securities, gold and silver, foreign exchange and interest rates and exclude commodities and equity securities.

The Financial Stability Oversight Council (the "FSOC") has the authority under the Derivatives Act to determine whether the rules promulgated under Section 716 of the Derivatives Act are insufficient to "effectively mitigate systemic risk and protect taxpayers." Notably, the FSOC will make such determinations on an institution-by-institution basis (which would require a vote of two-thirds of the FSOC members). The process following such determination is unclear for the relevant agencies, which may be required to promulgate new rules.

Timing. The prohibition against federal assistance will become effective two years after the effective date of the Derivatives Act. (See footnote 1 which discusses the effective date of the Derivatives Act). Banking entities may have up to 24 months to spin off a "swaps entity" as determined by the applicable Prudential Regulator (after consultation with the SEC or the CFTC, as applicable). Such 24-month transition periods may be further extended an additional year for potentially up to five to six years elapsing before a banking entity must comply with the Derivatives Act's push-out rule.

Section Reference: 716

REGULATION OF SWAP DEALERS AND MAJOR PARTICIPANTS

Registration

Swap Dealers and Major Participants are required to register with the CFTC and the SEC, as applicable. The Derivatives Act imposes dual registration regardless of whether a registrant is a depository institution or is registered with the other agency, and there is no exception for a registered broker-dealer if such registrant participates in both the security-based swap and swap markets. Registered market participants are subject to a wide range of new regulatory requirements: capital and margin, segregation of assets, reporting and recordkeeping, and business conduct rules that are heightened in respect of certain counterparties.

Timing. While general rulemaking will take place within the Initial Rulemaking Period, the CFTC and the SEC are authorized to register of certain Swap Dealers and Major Participants in advance and in anticipation of the effective date of the rules required by the Derivatives Act. In any event, such market participants will be required to register with the CFTC and SEC, as applicable, by July 21, 2011.

Section References: 712, 731, 764

Capital and Margin Requirements

Swap Dealers and Major Participants will be subject to certain minimum capital requirements and minimum initial and variation margin requirements, in particular for uncleared swaps and security-based swaps. The CFTC and the SEC, as applicable, will impose those requirements for market participants for which there is no Prudential Regulator. The appropriate banking agency, in consultation with the two commissions, will impose parallel requirements for Swap Dealers and Major Participants for which there is a Prudential Regulator. The Prudential Regulators, the SEC and the CFTC are required to consult at least annually and "to the maximum extent practicable" establish "comparable" minimum capital and minimum initial and variation margin requirements for all Swap Dealers and Major Participants.

The Derivatives Act requires that the capital requirements for a party must take into account the risks associated with that party's other swap transactions and its other activities. In general, the capital and margin requirements must "help ensure the safety and soundness of the swap dealer or major swap participant," and be appropriate for the risk associated with the non-cleared swaps held by a Swap Dealer or Major Participant.

The Derivatives Act authorizes the imposition of margin requirements, including for both initial and variation margin, in order to preserve the financial integrity of the swaps markets as well as the stability of the United States financial system. The Derivatives Act requires the Prudential Regulators, the CFTC and the SEC, as applicable, to permit the use by Swap Dealers and Major Participants of non-cash assets as collateral to satisfy these requirements.

Capital and margin requirements for swaps that are not cleared by a registered derivatives clearing organization or clearing agency are anticipated to be higher than those set for swaps that are centrally cleared, in part, to "offset the greater risk" they pose to individual Swap Dealers and Major Participants.

Timing. Timing for compliance with the capital and margin requirements will be triggered by the promulgation of the relevant rules and upon the registration of the Swap Dealer and Major Participant with the applicable agency.

Section References: 731, 764

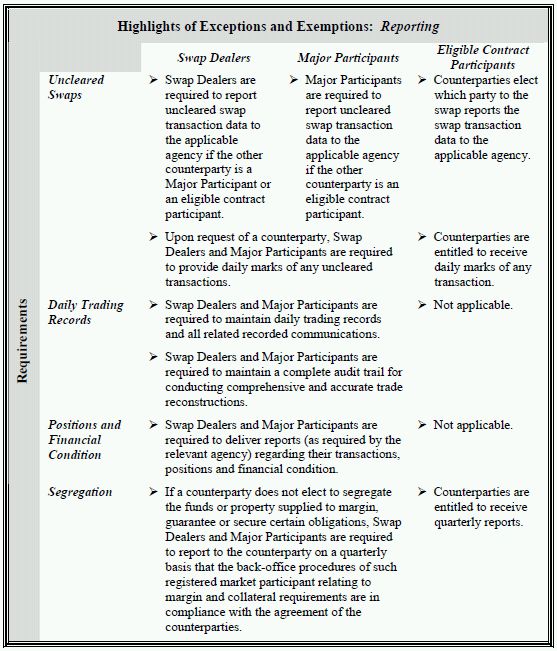

Segregation of Assets

The Derivatives Act provides for the mandatory segregation of assets received in connection with cleared swaps and security-based swaps. Specifically, it requires that any person that accepts collateral to margin, guaranty or secure a swap cleared through a registered derivatives clearing organization be registered with the CFTC as a futures commission merchant, while any person that accepts collateral to margin, guaranty or secure a security-based swap cleared through a registered clearing agency be registered with the SEC as a broker-dealer or as a security-based swap dealer. Commingling is prohibited generally with a specific exception for broker-dealers, security-based swap dealers and futures commission merchants, who may commingle customer money, securities and other property so long as it is deposited in one or more bank or trust company accounts or with a clearing agency or derivatives clearing organization, as the case may be.

A counterparty that provides funds or other property to a dealer as initial margin, or otherwise as collateral, for a swap or security-based swap that is not cleared is entitled to request that the dealer segregate the margin and maintain the collateral in a separate account carried by an independent third-party custodian. If the counterparty does not elect segregation of its funds or other property, the dealer is obligated to deliver quarterly reports to the counterparty, certifying that the dealer's back office procedures for margin and collateral requirements are in compliance with the swap or security-based swap agreement. Unlike earlier proposals in the House and Senate, the Derivatives Act's segregation requirements do not apply to variation margin.

Section References: 724, 763

Reporting and Recordkeeping

Each registered counterparty (i.e., each Swap Dealer and Major Participant) is required to report to the applicable agency any transaction entered into by such counterparty by the earlier to occur of 90 days after the enactment of the Derivatives Act (i.e., by October 19, 2010) and the promulgation of the relevant reporting rules. Such reports will include information regarding the positions and financial condition of such counterparty.

Each registered Swap Dealer or Major Participant must further designate a chief compliance officer to monitor and ensure compliance with the Derivatives Act's requirements. The chief compliance officer will issue annual reports describing its policies and procedures. Absent final rules, it is not clear who, in addition to the applicable supervising agency, will be the recipients of such reports or if such reports will be publicly available.

In addition to mandatory reporting requirements, Swap Dealers and Major Participants will be required to maintain books and records pertaining to the swaps or security-based swaps held by such entities, which books and records shall be kept open to inspection and examination by the relevant agency. Such records will be required to include daily trading records, any related recorded communications as well as complete audit trails for conducting trade reconstructions.

Timing. As noted above under "Capital and Margin Requirements," timing for compliance with the general reporting and recordkeeping requirements will be triggered by the promulgation of the relevant rules (required during the Initial Rulemaking Period) and upon the registration of the Swap Dealer and Major Participant. Notably, swaps and security-based swaps entered into prior to the enactment of the Derivatives Act must be reported to a registered data repository or the appropriate commission not later than 180 days after the Enactment Date (i.e., by January 17, 2011). Interim rules for reporting of uncleared swaps entered into prior to enactment must be promulgated within 90 days after the Enactment Date (i.e., by October 19, 2010).

Section References: 723, 729, 731, 763, 764

Business Conduct Rules Applicable to All Counterparties

Under the Derivatives Act, the CFTC and the SEC will adopt rules governing business conduct standards for Swap Dealers and Major Participants. These standards will require that each registered counterparty (i) comply with a standard of care for a Swap Dealer or Major Participant to verify that a prospective counterparty meets applicable eligibility standards, (ii) adequately disclose information about the material risks and characteristics of the transaction and any material incentives or conflicts of interest it may have in connection with the transaction, and (iii) communicate in a fair and balanced manner based on principles of "fair dealing and good faith." Registered market participants must also comply with the rules to be promulgated relating to timely and accurate processing, documentation, netting and valuation of transactions.

Section References: 731, 764

Additional Duties to Special Entities

The Derivatives Act imposes new, greater duties on Swap Dealers and Major Participants in transactions with certain "special entities," including federal and state agencies, municipalities and other political subdivisions, and pension, endowment and retirement plans. Generally, the Derivatives Act imposes a "duty to act in the best interests" of the special entity and requires that Swap Dealers and Major Participants make a reasonable effort to enable the determination that a swap is in the best interests of the special entity.

A Swap Dealer or Major Participant that enters into a swap or security-based swap with a special entity must have a reasonable basis to believe that the special entity has an independent representative that, among other requirements, has sufficient knowledge to evaluate a transaction and its risks, that is further not subject to statutory disqualification, that is independent and that undertakes a duty to act in the best interests of the special entity.

A Swap Dealer or Major Participant that acts as an advisor to a special entity may not (i) employ any device or scheme to defraud any special entity, (ii) engage in any transaction or course of business that operates as a fraud or deceit on any special entity, or (iii) engage in any act or course of business that is fraudulent, manipulative or deceptive. It remains unclear whether the duties to these "special entities" will be of an ongoing nature. The language in the Derivatives Act suggests that certain minimum business conduct requirements remain applicable throughout the term of the transaction, including the duty to "communicate in a fair and balanced manner based on principles of fair dealing and good faith" and the prohibition on engaging in any "course of business" that is fraudulent, manipulative or deceptive.

Section References: 731, 764

Timing: The SEC's and the CFTC's rulemaking for segregation of assets, reporting and recordkeeping, business conduct and duties to special entities is required to occur during the Initial Rulemaking Period.

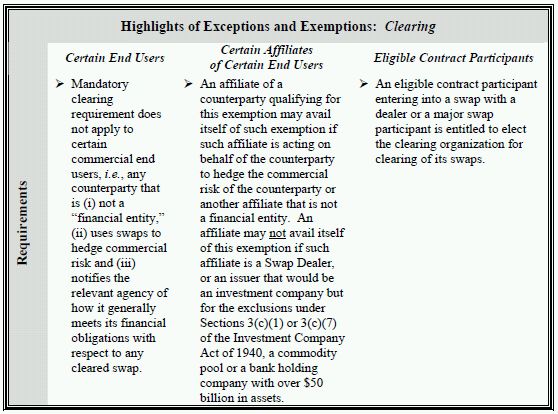

MANDATORY CLEARING FOR MOST DERIVATIVES

The Derivatives Act establishes mandatory clearing for any swap or security-based swap if a registered clearing organization accepts that swap or security-based swap for clearing and either the CFTC or the SEC determines that such swap or security-based swap, as applicable, must be cleared. The Derivatives Act includes a requirement of "open access" to registered clearing organizations and clearing agencies. In essence, registered clearing organizations will be required to have rules prescribing that all swaps and security-based swaps, respectively, with the same terms and conditions are economically equivalent and may be offset by each other. Such swaps or security-based swaps will have to be cleared through a registered clearing organization or clearing agency.

Following proposals made in the Senate, the Derivatives Act grants narrow exemptions from certain clearing requirements to any persons, other than financial entities, who use swaps to hedge or mitigate commercial risk and who notify the relevant agency how they generally meet their financial obligations associated with entering into non-cleared swaps. A public company will only be able to avail itself of this end-user exemption if its audit committee has reviewed and approved the decision to enter into a swap or security-based swap in reliance on such exemption.

An affiliate of a counterparty qualifying for this exemption may generally avail itself of the exemption if the affiliate is acting on behalf of the counterparty when utilizing a swap to hedge or mitigate the commercial risk of the counterparty or other affiliate that is not a financial entity. An affiliate would not be permitted to avail itself of this exemption if the affiliate were, for example, (i) a Swap Dealer, (ii) a Major Participant, (iii) an issuer that would be an "investment company" but for the exclusions provided under Sections 3(c)(1) and 3(c)(7) of the Investment Company Act of 1940, as amended, (iv) a commodity pool, or (v) a bank holding company with over $50 billion in consolidated assets.

With respect to any swap or security-based swap not subject to mandatory clearing and entered into with a Swap Dealer or Major Participant, the counterparty to such transaction is entitled to require clearing and to select the derivatives clearing organization that will be used for clearing such swap or security-based swap.

Timing. No later than one year after the Enactment Date of the Derivatives Act (i.e., by July 21, 2011), the CFTC and the SEC are required to promulgate rules governing the submission by clearing agencies and derivatives clearing organizations for review of swaps and security-based swaps. Upon a determination by the CFTC or the SEC, as applicable, that a swap or security-based swap is required to be cleared, the relevant market participant will also be required to clear certain transactions pursuant to the rules promulgated during the Initial Rulemaking Period.

Section References: 723, 763

MANDATORY EXCHANGE TRADING FOR MOST DERIVATIVE TRANSACTIONS

Following recommendations of experts, the Derivatives Act imposes mandatory exchange trading for all cleared swaps and security-based swaps on a designated contract market, national securities exchange, registered or exempt swap execution facility or security-based swap execution facility, as applicable. The Derivatives Act includes a specific exemption from mandatory exchange trading for swaps or security-based swaps that either had not been accepted by a clearing organization or if no exchange or swap execution facility makes the swap or security-based swap available for trading. To that end, if a transaction falls within the commercial end-user exemption, trading such swap or security-based swap on an exchange apparently may not be required.

Additionally, it is unlawful for any person other than an "eligible contract participant" to enter into any swap not subject to the rules of a board of trade. Section 6 of the Exchange Act is amended to flatly prohibit effecting a trade in a security-based swap with or for any person that is not an eligible contract participant unless effected on a registered securities exchange. Accordingly, meeting the definition of eligible contract participant will continue to be a threshold requirement for entering into an uncleared and non-exchange-traded swap or security-based swap.

"Eligible contract participant" has been redefined to include (i) government entities, political subdivisions and other instrumentalities, agencies or departments that own or invest at least $50 million on a discretionary basis, (ii) individuals that invest at least $10 million on a discretionary basis (or at least $5 million if the contract is entered into to manage a risk associated with an asset owned or liability incurred, or reasonably likely to be owned or incurred), and (iii) entities (including corporations, partnerships, organizations or trusts) that have total assets exceeding $10 million (or that have a net worth exceeding $1 million and enter into an agreement in connection with the conduct of the entity's business or to manage the risk associated with an asset or liability owned or incurred).

Timing. The timeline for the mandatory exchange trading will be based on the timeline applicable for the mandatory clearing requirement.

Section References: 721, 723, 763

DERIVATIVES CLEARING ORGANIZATIONS, SWAP EXECUTION FACILITIES AND SWAP DATA REPOSITORIES

As described below, derivatives clearing organizations, clearing agencies and swap data repositories must register with the CFTC and the SEC, as applicable, and registration subjects them to substantial obligations in the areas of compliance, risk management, recordkeeping, reporting and disclosure. The Derivatives Act sets out core principles applicable to clearing organizations' operations and conduct such as adequate financial and operational resources, appropriate admission and eligibility standards and default rules and procedures. Qualification as a clearing organization requires the appointment of a compliance officer and annual reporting. Derivatives clearing organizations, clearing agencies and swap repositories are also subject to additional conflict of interest rules.

Mandatory Reporting for Transactions

Counterparties to swap transactions that are not required to be cleared are required to report such transactions to a swap repository or, if no swap repository accepts the transaction, directly to the CFTC or the SEC, as applicable. Transactions in place prior to the enactment of the Derivatives Act will be exempt from mandatory clearing only so long as they are reported to the applicable entity in compliance with the Derivatives Act and applicable regulations.

The Derivatives Act requires clearing organizations, exchanges and swap execution facilities to report transaction information to the CFTC and the SEC, as applicable. The CFTC and the SEC, in turn, are required to arrange for aggregate data on swap trading volumes and positions to be made publicly available in a manner that does not disclose the business transactions and market positions of any person. Additionally, the Derivatives Act imposes "real-time public reporting" on both the clearing organizations, exchanges and swap execution facilities, and the agencies, which entails making transaction and pricing data publicly available "as soon as technologically practicable." Such data will be required to be available in a form and at such times as the agencies deem appropriate to "enhance price discovery."

Section Reference: 727

CLEARING ORGANIZATION REQUIREMENTS

The Derivatives Act requires clearing organizations for derivatives to register with the CFTC and the SEC, as applicable. The CFTC may, however, exempt an organization from registration if it determines that such organization is subject to comparable regulation by another federal regulator. Derivatives clearing organizations and clearing agencies are also subject to other requirements, which include, among others, certain core principles, margin and risk management, default rates and procedures, settlement procedures and corporate governance. They will be further required to maintain records of all activities related to their clearing businesses and to report such information to the applicable agency.

Unlike previous legislative efforts, the Derivatives Act does not explicitly impose specific limits on ownership of clearing organizations by Swap Dealers. However, the agencies are authorized to include in their respective rules limits on the control of (or the voting rights of) any clearing organization that clears swaps by, among others, a bank holding company with total consolidated assets of $50 billion or more, a Swap Dealer, Major Participant, or associated person of a Swap Dealer or Major Participant.

Timing. No later than 180 days after the enactment of the Derivatives Act, the CFTC and the SEC must adopt rules to mitigate conflicts of interest applicable to derivatives clearing organizations and clearing agencies.

Section References: 725, 726, 728, 733,734, 735, 763, 765, 766

To read Part 2 of this article please click here

Footnotes

1. The Derivatives Act provides that its provisions will take effect on the later of (i) 360 days after the Enactment Date and (ii) to the extent any provision requires rulemaking, not less than 60 days after publication of the final rule or regulation implementing such provision. See Sections 754 and 774. Notably, the Derivatives Act provides for rulemaking periods of both "1 year" and "360 days" after the Enactment Date. For example, the CFTC is required to adopt rules governing a derivatives clearing organization's submission of a swap for clearing with such agency within "1 year." Similarly, rules for registration of Swap Dealers and Major Participants will provide for registration with the CFTC or SEC, as applicable, no later than "1 year" after the Enactment Date.

2. Further, House Financial Services Committee Chairman Barney Frank (D-MA) and Senate Banking Committee Chairman Christopher Dodd (D-CT) have noted that additional changes to the Derivatives Act are likely and that additional legislation will be proposed prior to the expiration of the Initial Rulemaking Period. ISDA News, Issue 5, 2010.

3. See Speech by SEC Chairwoman: Moving Forward: the Next Phase in Financial Regulatory Reform by Chairman Mary L. Schapiro (July 27, 2010); Remarks Before SIFMA Post- Financial Reform Conference, Chairman Gary Gensler, U.S. Commodity Futures Trading Commission (July 15, 2010). The SEC, CFTC and other regulatory authorities anticipate receiving significant additional resources. The CFTC's proposed budget for 2011 will increase from $168.8 million to $261 million, and the SEC intends to add 800 new positions in response to the legislative reform. "CFTC wants budget boost, is ready to write swap rules" Bloomberg Businessweek, July 29, 2010; "SEC may add 800 new positions as part of reform" Reuters, July 19, 2010.

4. Security-based swaps also exclude any "identified banking product" or agreements that reference government securities and, thus, the Derivatives Act excludes identified banking products from regulation and supervision by the CFTC and the SEC under the CEA and the Exchange Act. Section 206 of the Gramm-Leach-Bliley Act defines the phrase "identified banking product" to include, among others, a deposit account, savings account, certificate of deposit, a letter of credit issued or loan made by a bank, a debit account at a bank arising from a credit card or similar arrangement, a participation in a loan which the bank funds or participates in, and any swap agreement (other than an equity swap sold directly to a qualified investor as defined in Section 3(a)(54) of the Securities Act).

This exclusion, however, is not applicable to an identified banking product that (i) is a product of a bank that is not under the regulatory jurisdiction of an appropriate federal banking agency, (ii) meets the definition of "swap" in the CEA or security-based swap as defined in the Exchange Act, and (iii) has become known to the trade as a swap or security-based swap or has otherwise been structured as an identified banking product for the purposes of evading the CEA, the Securities Act or the Exchange Act. Additionally, each federal banking agency is also authorized to determine that an identified banking product of a bank under its jurisdiction will not be excluded from regulation under the CEA or the Exchange Act if that product would meet the definition of swap or security based swap and has become known to the trade as a swap or security-based swap or has otherwise been structured for the purposes of evading the CEA, the Securities Act or the Exchange Act.

5. The Derivatives Act mandates a de minimis exemption for transactions on behalf of a person's own account, or, as a fiduciary, for another person's account, with the CFTC and SEC Rulemaking to provide additional criteria to qualify for this exemption. The term "swap dealer" excludes any person who, not as part of a regular business, enters into swaps for such person's own account (individually or in a fiduciary capacity).

6. "Financial entities" are swap and security-based swap dealers, major swap and security-based swap participants, commodity pools, private funds as defined in Section 202(a) of the Investment Advisers Act of 1940, as amended, employee benefit plans as defined in paragraphs (3) and (32) of Section 3 of the Employee Retirement Income Security Act of 1974, as amended, and persons "predominantly engaged in activities that are in the business of banking, or in activities that are financial in nature" described in Section 4(k) of the Bank Holding Company Act.

7. Under Senator Lincoln's April 2010 proposal (which was approved by the Senate Committee on Agriculture, Nutrition and Forestry) banks would have been required to spin-off all derivatives activities, including those permitted under the Derivatives Act.

8. Another provision of the Dodd-Frank Act (Section 610) amends the statute governing lending limits of national banks by including within the single obligor limitation any credit exposure of a person arising out of a derivative transaction between a national bank and the person. This change will also apply to savings associations because savings associations are generally subject to the national bank lending limit statute in the same manner and to the same extent as national banks. The Dodd-Frank Act also provides (in Section 611) that an insured state bank may engage in a derivative transaction only if the law of the state in which the bank is chartered imposes lending limits that take into consideration credit exposure to derivative transactions.

9. 12 U.S.C. Section 24 (Seventh) permits investment in a range of assets including, without limitation:

promissory notes, drafts, bills of exchange, and other evidences of debt; coin and bullion; extensions of credit; investment securities under such limitations and restrictions as the Comptroller of the Currency may by regulation prescribe; debt securities that are considered investment securities, generally marketable obligations, evidencing indebtedness of any person, copartnership, association, or corporation in the form of bonds, notes and/or debentures; and U.S. government or agency obligations, participations, or other instruments.

The National Bank Act, however, clearly prohibits dealing in equity securities. The prohibition does not apply to any depository institutions under receivership, conservatorship or a bridge bank under the Federal Deposit Insurance Act.

Goodwin Procter LLP is one of the nation's leading law firms, with a team of 700 attorneys and offices in Boston, Los Angeles, New York, San Diego, San Francisco and Washington, D.C. The firm combines in-depth legal knowledge with practical business experience to deliver innovative solutions to complex legal problems. We provide litigation, corporate law and real estate services to clients ranging from start-up companies to Fortune 500 multinationals, with a focus on matters involving private equity, technology companies, real estate capital markets, financial services, intellectual property and products liability.

This article, which may be considered advertising under the ethical rules of certain jurisdictions, is provided with the understanding that it does not constitute the rendering of legal advice or other professional advice by Goodwin Procter LLP or its attorneys. © 2010 Goodwin Procter LLP. All rights reserved.