- within Accounting and Audit topic(s)

- within Criminal Law, Strategy and Family and Matrimonial topic(s)

- with Finance and Tax Executives

- in United States

Key Takeaways:

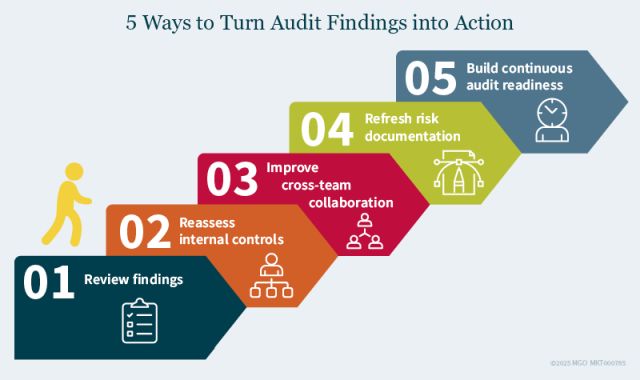

- Post-audit season is an ideal time to reassess controls, documentation, and cross-functional accountability.

- Turn audit findings into action to improve financial reporting and reduce long-term risk exposure.

- Build a continuous audit-ready culture to support sustainable compliance and operational efficiency.

—

Audit season is over — but your work isn't. For your organization, this is the moment to turn regulatory compliance into strategic advantage. Many companies treat the audit as a once-a-year event, but the most resilient, growth-minded businesses know the real opportunity lies in what happens next.

Here's how your business can use the post-audit window to strengthen internal controls, mitigate risk, and drive operational improvements that last.

Audit Findings: A Strategic Starting Point

Whether your organization's audit concluded with no identifiable deficiencies or revealed significant control-related concerns, audit findings are more than just a compliance formality. They offer critical insight into the operational integrity of your financial reporting processes.

Take time to assess not just what deficiencies were found, but why they occurred. Was it a control design gap, a documentation issue, or a resource constraint? Aligning these insights with broader process reviews can turn your audit output into an input for better financial governance.

Review and Refresh Internal Controls

After audit season, your internal control environment is front and center. That makes this an ideal time to examine whether your controls are:

- Well-designed for today's reporting environment

- Operating consistently across departments

- Supported by documentation that tells the full story

Give particular attention to controls that depend on subjective judgment, manual intervention, or informal approvals. These may appear sufficient during walkthroughs but can reveal weaknesses under auditor testing or become pressure points as your organization grows or faces heightened regulatory expectations.

Improve Accountability Across Functions

Audit preparation tends to highlight fragmented ownership of key financial and operational processes. When legal, reporting, and IT teams work independently during audit season, it can create challenges in data consistency, delays in reconciliation, and conflicting assumptions.

Use the post-audit periods to establish a framework for cross-functional ownership of areas with elevated risks — such as inventory valuation, regulatory disclosures, or system-generated reporting. Clarifying roles and strengthening collaboration ahead of the next reporting cycle can reduce friction and improve audit readiness.

Update Risk Assessments and Documentation

Has your company undergone significant growth, added new systems, or expanded into new markets? If so, your risk profile has likely changed — but your documentation might not reflect that yet.

Post-audit is the perfect time to:

- Reevaluate materiality thresholds

- Refresh control matrices

- Update process narratives

- Archive walkthroughs and test results

Doing this now reduces the burden — and risk — of scrambling to document everything next year.

Shift Toward Continuous Audit Readiness

For private companies, audit readiness means more than just preparing once a year. Increasingly, private organizations are adopting a continuous audit ready mindset to reduce year-end surprises and build confidence across internal and external stakeholders.

Implement quarterly internal control assessments — a standard practice of public companies — or co-source key functions if internal bandwidth is limited. This is especially useful in technical areas like tax, regulatory reporting, valuation inputs, and information technology general controls (ITGCs).

Make the Most of the Post-Audit Window

Your company's ability to act on audit outcomes now will shape the quality and efficiency of next year's audit — and beyond.

The post-audit period is a chance to:

- Convert findings into process improvements

- Create better alignment across teams

- Reassess internal controls considering your growth

- Build confidence among investors, board members, and stakeholders

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.