Last week, the Massachusetts Attorney General's office released a webinar and business guidance to help companies comply with upcoming regulations on junk fees and negative option contracts. The webinar and guidance cover a lot of ground, but here are some highlights.

"Junk Fees"

The goal of the "junk fees" regulation is to provide transparency in pricing so that consumers have a sense of the total cost of a product or service from the first moment they see a price advertised. Here are some tips for complying with the junk fee regulations.

- Companies must display the "total price" up-front. The total price should include all mandatory fees that a consumer must pay, but can exclude taxes, shipping, and optional fees.

- Companies don't need to include fees that will depend on consumer selections up-front, but as soon as a consumer makes a selection that impacts the price, businesses must update the total price. For example, when displaying the price of hotel rooms, a company may start with the lowest available price, but once a consumer selects a room and indicates the length of the stay, the total price must be updated.

- Fees that aren't reasonably avoidable—such as credit card fees when there aren't other payment options—or fees that are built in unless a consumer opts out should both be included in the total price.

- Fees for things a reasonable consumer would expect to be part of the purchase should be included in the total price. For example, the guidance states that "if a hotel requires guests to pay a fee to use towels, the hotel must include the towel fee in the Total Price." (If you're a consumer looking for a hotel, our guidance at Ad Law Access states that you may want to consider a hotel that doesn't charge separately for towels.)

- The guidance document clarifies that the "regulations do not require sellers to individually identify and describe particular components of the Total Price." However, if a company chooses to describe a fee that is part of the Total Price, it "must describe the nature and purpose of that fee...." That can be done with a concise phrase, as long as it's accurate. (Again, if the fee is mandatory, it still needs to be included in the price.)

The guidance provides this illustration:

Negative Options

A "negative option" contract is a contract that renews automatically when no action is taken by consumers. (Most subscriptions fall into this category.) Here are some tips for complying with the negative option regulations.

- Companies must generally provide consumers with reminders of upcoming charges and how to cancel each billing cycle. For subscriptions that renew month-to-month, the notice may be provided when a customer is charged. For subscriptions that are longer than month-to-month, notice is required 5-30 days before every charge.

- For purposes of determining the notice requirement, the duration is the time interval between acceptance of the negative option feature and the date the consumer must cancel to avoid a new or additional charge, not necessarily the contract term itself.

- Companies must provide consumers with a method to cancel that is at least as easy for them to access and use as the method the consumers use to sign up.

- Companies that allow consumers to sign up by phone must allow phone cancellation. If a person is unavailable to take a call, the seller must either employ an automated system to effectuate cancellation or include an adequate voicemail system that affirmatively identifies the information a consumer must provide in the voicemail to effect cancellation.

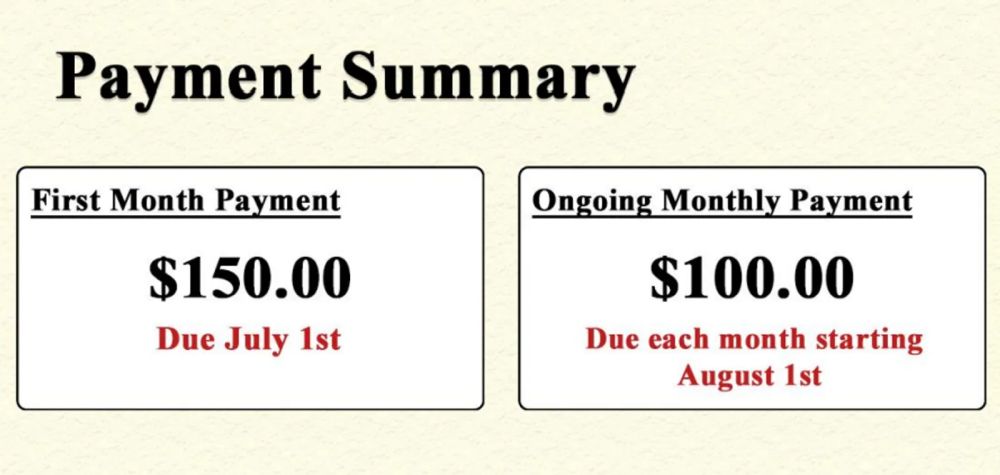

- The guidance also addresses the intersection of the two pieces of the regulation – how to display the total price for a negative option product with recurring charges and mandatory one-time fees. The total price may be displayed as the total price for a single negative option term. If the first month includes additional fees, the total price for that term must include those. However, the seller could also accurately display the price for subsequent terms.

The guidance provides this illustration:

The regulations take effect on September 2, 2025. During the webinar, Assistant Attorney General Eric Carnevale reminded viewers that the regulations include both an AG right of enforcement and a private right of action. We expect to see active enforcement in this area. If you haven't looked at how you display prices recently, now may be a good time to do that.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.