We explore elements of a capital reduction demerger, the steps typically involved and highlight some of the common practical issues.

Previous articles have looked at the reasons for the creation of a corporate group structure and how, due to changing circumstances, groups may need to be adjusted or indeed broken up, how that is done and the various forms that a demerger may take. One of those forms of demerger being the so-called capital reduction demerger.

What is a capital reduction demerger?

In many circumstances, a capital reduction demerger can offer the most tax-efficient way to split up a group of companies and it is increasingly used in advance of the sale of a trading company to separate out property or investment assets from the main trading company (Tradeco).

The basic elements of a capital reduction demerger are well understood and the steps involved typically entail:

- The forming of a new company (Newco);

- Newco acquires the shares in Tradeco by way of a share for share exchange (i.e., Newco buys shares in Tradeco from the current shareholders with the consideration being the issue of shares in Newco). This step will also create the necessary capital required to undertake the capital reduction;

- The relevant business and assets/subsidiaries of Tradeco will be separated (usually by transferring those that are not to be demerged to Newco);

- The shares in Newco will be split into A and B shares (each class of shares being entitled to share the relevant business/assets of Newco);

- A further new company (Newco 2) is formed; and

- Newco reduces its share capital by cancelling the B shares and transferring the relevant business/assets to Newco 2 in exchange for Newco 2 issuing shares in Newco 2 to the B shareholders

In implementing such a structure care needs to be taken to ensure the demerger is effected in a way which corresponds not simply with the essential elements outlined above, but also in compliance with overriding company law obligations including those as to the lawfulness of any distributions which take place in accordance with the demerger.

Although each situation is different, and the need for specific advice is paramount, to illustrate some of the practical issues and considerations, set out below is an example, based upon the typical steps involved outlined above.

Capital reduction demerger example

Please note the following is an example intended only to highlight some of the common practical issues and considerations. Each situation is unique and requires bespoke advice.

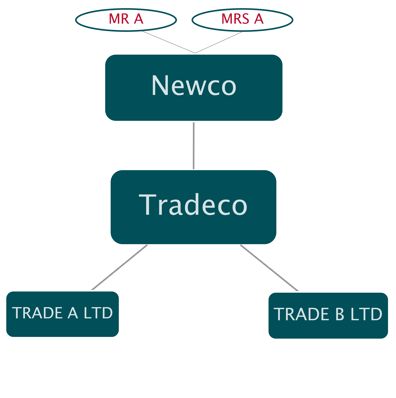

Tradeco whose share capital comprises 100 ordinary shares of £1 each is owned by Mr and Mrs A.

Tradeco has 2 wholly owned trading subsidiaries (Trade A Ltd and Trade B Ltd).

Trade B Ltd also owns a property that was previously used within the business but is now rented out to a 3rd party (the Investment Property). The investment Property has a current market value of £1m (having been originally acquired for £500K).

Trade B Ltd has distributable reserves of £600K while Tradeco currently has no distributable reserves.

Mr and Mrs A have received an offer for the business (£5m excluding the Investment Property).

After taking advice it is decided to extract the Investment Property via a capital reduction demerger.

Capital reduction demerger steps

The steps involved to implement the proposed capital reduction demerger are as follows:

Step 1: incorporate Newco with the intention of Newco becoming the holding company of Tradeco

Step 2 (share for share exchange): Newco acquires the shares in Tradeco by way of a share for share exchange (i.e., Newco buys the shares in Tradeco from Mr and Mrs A with the consideration being the issue of shares in Newco to Mr and Mrs A).

This step will also create the necessary capital required to undertake the capital reduction.

This is because, to prevent an unlawful distribution on the demerger at Step 6 (and to look to ensure the directors are therefore properly protected against any liability or claims), the amount of capital that is reduced should be equal to the market value of the shares/assets that are demerged.

It is therefore important that a valuation of the group (split between the business/assets to be demerged - in this case the Investment Property - and the business/assets to be retained) is obtained prior to this step.

On the basis the trading business is valued at £5m and investment property valued at £1m, the consideration for acquiring the 100 ordinary shares in Tradeco will be the issue of 6 million ordinary shares of £1 each in Newco to Mr and Mrs A.

In our example this should not prejudice any of the tax reliefs – the reliefs are predicated on Mr and Mrs A holding the same class and proportion of shares before and after the transfer (not the same number) and for capital gains tax purposes the £6m ordinary shares in Newco will be deemed to have been acquired by Mr and Mrs A at the same time and same price as they acquired their original shares in Tradeco (i.e. the base cost of their 6m new shares in Newco will remain £100 for capital gains tax purposes - they do not get a tax free base cost uplift just because they now hold 6m shares rather than 100 shares).

By issuing shares in Newco equivalent to the current market value of the group we are, however, able to demonstrate (once the shares are redesignated at Step 4 below) that, on the demerger, the capital reduction (at Step 6) equates to the value of the business/assets being demerged, which in turn avoids further potential company law and tax issues.

We have seen it suggested that to avoid the time and cost of obtaining a valuation one could simply issue new shares in Newco equal to the shares in issue in Tradeco which, in this example, would entail issuing 100 shares in Newco on the acquisition of Tradeco (or 99 shares with the single subscriber share in Newco already being held by Mr or Mrs A on incorporation of Newco).

This causes complications because the shares in Newco will generally be deemed to be issued at a premium (equal to the difference between the nominal value of the shares and market value of Tradeco which, as it owns the subsidiaries, will be the market value of the group). This "premium" would be credited to a merger reserve that would then need to be converted to share capital prior to Step 6 in order to allow the "capital" to be reduced.

Whilst, from an accounting perspective, we understand that it may be possible not to recognise a premium as set out above, if not doing so the question then arises as to how the directors satisfy themselves that the capital reduced at Step 6 equals the market value of what is being demerged. Furthermore, on any subsequent sale of the retained group the buyer's advisers will want to satisfy themselves the capital reduction demerger was valid which, absent valuations, will be difficult to do.

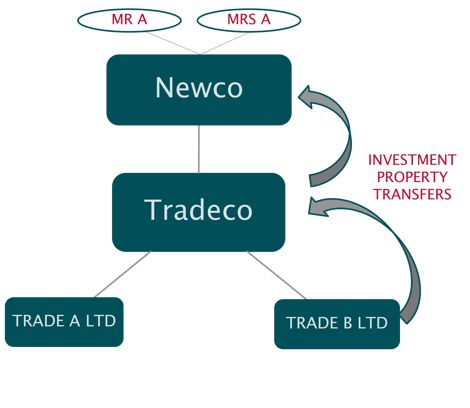

Step 3 (hive up): The Investment Property will be transferred to Newco. In the present case, this will involve two transfers: (i) a transfer from Trade B Ltd to Tradeco; and then (ii) a transfer from Tradeco to Newco.

How these transfers are to be effected (sale or dividend in specie) needs to be considered and this is something that, along with the company law and practical impacts, is often overlooked.

In the present example, Trade B Ltd has sufficient distributable reserves (equating to the book value of the Investment Property) so it can transfer the Investment Property to Tradeco by way of a dividend in specie.

Tradeco, however, does not have any distributable reserves so the Investment Property will need to be transferred to Newco for consideration.

The above is included in our example to emphasise the importance of considering the specific circumstances surrounding a demerger, and the consequences of splitting assets out of the existing group, as this can involve the need to incur cost.

Any demerger will invariably involve moving a business or assets prior to the demerger, to enable the relevant business or assets to be demerged to be separated out. As highlighted, this can involve aspects of company law and practical implications, as well as the tax implications, which need to be assessed. A failure to address these implications in initial planning can lead to consequences being overlooked until it comes to implementation, in turn causing potential delays and complications.

It will generally be easier to move (investment) assets rather than trades as moving trades will generally require an assessment of numerous commercial issues. In practice we would consider and advise upon the commercial issues, but these are beyond the scope of this article. The key point is that early planning and co-ordination between the tax, legal and accounting advisers is essential to avoid complications and delays in the implementation of the demerger.

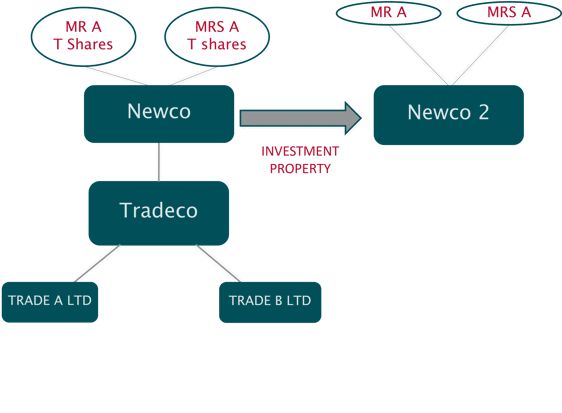

Step 4 (reclassification of shares): The next step is for shares in Newco will be split into two categories, in our example 1million P shares and 5m T shares (the P shares being entitled to the Investment Property and the T shares to the trading business/subsidiaries)

As noted above by having valued the group (and split the valuation between the business and Investment Property) prior to Step 2 and the issuing of the requisite number of shares in Holdco, this step should be straightforward.

Step 5: incorporate Newco 2

Step 6 (capital reduction and demerger): Newco will reduce its share capital by cancelling the 1million P shares and transferring the Investment Property to Newco 2 in exchange for Newco 2 issuing shares in Newco 2 to Mr and Mrs A (as the P shareholders).

As noted above, by having valued the Investment Property, it can be demonstrated that:

- the consideration given by Mr and Mrs A (in the form of the cancellation of their P shares) equals the value of the shares in Newco 2 so there is no distribution for tax purposes (and the relevant tax reliefs can apply); and

- there is no unlawful distribution for company law purposes.

By way of an important reminder, a capital reduction only becomes effective once accepted by the Registrar of Companies for filing, and not when the documents are signed and dated. The Registrar of Companies does now accept filings of capital reductions online where a company has an authentication code, so this can speed up the process, and same day filings are also possible.

Conclusion

The above example illustrates how a capital reduction demerger can be used to demerge investment assets prior to a sale of the trading business in a tax-efficient manner.

The example also illustrates the need for tax advisers to liaise with legal advisers and accountants in order to avoid any commercial delays and pitfalls.

Weightmans have extensive experience in advising on structuring, restructuring, and implementing all forms of demergers, including capital reduction demergers. We can provide both tax structuring advice and legal support on implementation. If acting on an implementation-only basis we will liaise with your accountants and/or tax advisers to achieve the desired commercial objectives in a timely and cost-efficient manner, bringing to bear our experience in this area.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.