- with readers working within the Utilities industries

As the Employment Law Department of Esin Attorney Partnership, we are pleased to share with you our monthly newsletter.

This newsletter provides a summary of the recent legal developments in relation to employment matters in Türkiye.

Presidential Decree on the Redetermination of the Late Payment Penalty Rate

Decree Publication Date: 12 March 2024

Summary

Presidential Decree No. 8256 ("Decree"), published in the Official Gazette dated 12 March 2024 and numbered 32487, stipulates that if the premium payments of the insured and other receivables of the Social Security Institution ("SSI") are not paid in full and in due time, for the unpaid amount, a late payment penalty of 3% will be applied for each month in the first three months starting from the due date for the payment.

Important Details

- Pursuant to Article 89 of the Social Security and General Health Insurance Law No. 5510 ("Law"), if the SSI's premiums and other receivables are not paid in full and in due time, the unpaid portion will be increased by applying a late payment penalty of 3% for each month in the first three months starting from the due date for the payment.

- The President is authorized to increase the late payment penalty for premiums and other receivables owed to the SSI by 3% for each month in the first three months, as stipulated in the Law, by up to two times, or reduce it to 1%.

- Pursuant to the Decree, the legal penalty rate of 3% will be applied, as effective from 1 April 2024.

The Communique of the Ministry of Labor and Social Security on "Amendment to the Communique on Workplace Hazard Classes Regarding Occupational Health and Safety"

Communique Publication Date: 5 March 2024

Summary

The Communique on the Amendment to the Communique on Workplace Hazard Classes Regarding Occupational Health and Safety ("Communique"), published by the Ministry of Labor and Social Security ("Ministry") in the Official Gazette dated 5 March 2024 and numbered 32480, amended the hazard classes of works carried out in workplaces and introduced some new fields of work.

Important Details

- Pursuant to the Communique, the NACE code for workplaces engaged in "Maintenance and repair of other professional electronic equipment" activities listed with NACE code 33.13.04, which was classified as "hazardous," has been changed to 33.13.90. Workplaces engaged in "Maintenance and repair of loaded electronic circuits/cards" activities with the NACE code 33.13.05 are included in the list as "hazardous."

- With the Communique, the following are included in the list as activities related to workplaces in the "less hazardous" class: "Virtual office, serviced office, and shared office service activities" with the NACE code 82.11.02; "Refurbishment service activities of computers and computer peripherals (laptops, desktop computers, modems, game consoles)" with the NACE code 95.11.02; "Refurbishment service activities of communication equipment and equipment (mobile phones, smart phones)" with the NACE code 95.12.02; "Bagel production" with the NACE code 10.71.04; and "Watch refurbishment service activities (smart watches without phone feature)" with the NACE code 95.25.03. In addition, "Transfer printing services for fabrics and textile products" with the NACE code 13.30.05 are classified as "hazardous" and included in the list.

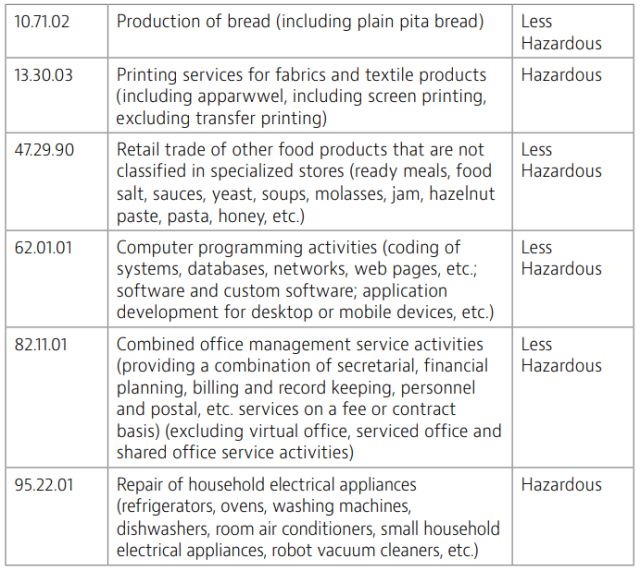

- Finally, the contents of the fields of activity, where certain

classifications were previously listed, have been amended

as follows:

General Directorate of Pension Services of the Social Security Institution published the General Letter on "Occupational Accident and Occupational Disease Recourse Procedures"

General Letter Publication Date: 4 March 2024

Summary

The general letter ("General Letter") published by the General Directorate of Pension Services of the Social Security Institution on 4 March 2024 introduced a regulation regarding the recourse procedures in cases of occupational accidents and occupational diseases.

Important Details

- The General Letter instructed that, for the income and allowances to be paid to the beneficiaries due to death as a result of an occupational accident or occupational disease, no recourse should be made to the beneficiaries (who are in the position of a third party) who are at fault in the occurrence of the occupational accident or occupational disease, or to the beneficiaries of the other insured individuals (who are in the position of a third party) who are at fault in the occurrence of the occupational accident if more than one insured individual died as a result of the same occupational accident.

Constitutional Court Decision on the Calculation of Temporary Incapacity Benefit

Decision Publication Date: 21 March 2024

Summary

The Constitutional Court ("Court"), in its decision dated 1 February 2024 and numbered 2021/61, which was published in the Official Gazette dated 21 March 2024 and numbered 32496 ("Decision"), ruled to annul provisions that are "...in case of illness and maternity..." and "...in case of maternity and sickness, in the 12 months preceding the date of the onset of incapacity for work..." in the first sentence of paragraph 1 of Article 17 of the Social Security and General Health Insurance Law No. 5510, and the second sentence of the same article, which is as follows: "However, for those who have been notified of short-term insurance premiums for less than 180 days in the last year preceding the date of the onset of incapacity for work, the daily earnings to be taken as the basis for the allowance in case of sickness and maternity cannot exceed twice the lower limit of the daily premium-based earnings on the date of the onset of incapacity for work."

Important Details

- In the reasoning for the Decision, the Court stated that the preamble of the Law dated 15 April 2021 and numbered 7316 aims to prevent unfair gains through situations such as high reporting of premium amounts or fraudulent insurance prior to maternity and sickness cases. Therefore, the average of the last 12 months should be taken into account instead of the last three months in determining the daily earnings to be taken into consideration for the allowance in cases of maternity and sickness. However, the Court annulled the relevant provisions, stating that this situation also causes the victimization of insured individuals who do not have ulterior motives.

- The Decision will enter into force as of 21 December 2024.

Positive Discrimination Project for Women's Employment Organized by İŞKUR (Turkish Employment Agency) Commenced

Summary

With the Positive Discrimination Project for Women's Employment ("PDPWE"), employers have the opportunity to train the labor force they need without incurring any additional costs and to find the right employees. Within the scope of the PDPWE, employers will be able to find female candidates with the qualifications they have determined themselves, or they will be able to send a request to İŞKUR to find candidates.

Important Details

- Requirements for the Employer to Receive

Support

- Operating in the manufacturing sector

- Having at least two insured employees

- Being registered with İŞKUR

- Committing to employ individuals for at least twice the duration of the support payment

- Requirements for Participants to be Supported

- Being an unemployed female individual registered with İŞKUR of the date of employment,

- Being a citizen of the Republic of Türkiye as of the date of employment

- Not being insured within the scope of long-term insurance branches in the last month before the date of employment

- Being older than 18 years and younger than 35 years as of the date of employment

- Not being the employer's spouse, blood or in-law up to the second degree

- Not being subject to a waiting period within the scope of the vocational training course or on-the-job training program organized by İŞKUR

- Not being sanctioned for not participating in courses or programs as of the date of employment

- Not having been employed in any workplace under the same tax number to which the workplace in question is affiliated with in the 12-month period prior to the date of employment

- Expenses to be covered under the PDPWE

- Employers are provided with premium tax and salary support up to TRY 25,000 per month for each female employee they employ within the scope of the PDPWE.

- If a female employee has a child between 0 and 66 months while being in the scope of the PDPWE, monthly childcare support of TRY 3,000 will be provided.

- Application, place, time, and duration of the

project

- All employers who meet the application requirements for the PDPWE can apply at the Provincial Directorates and Service Centers of the Labor and Employment Agency and via İŞKUR's e-branch.

- The PDPWE is implemented in Adana, Adıyaman, Ankara, Bitlis, Bursa, Denizli, Diyarbakır, Gaziantep, Hatay, İstanbul, İzmir, Kahramanmaraş, Kayseri, Kilis, Kocaeli, Konya, Kütahya, Malatya, Manisa, Mardin, Mersin, Osmaniye, Samsun, Şanlıurfa, and Tekirdağ.

- The project's duration is, at a maximum, three months.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.