- within Technology topic(s)

- in United States

- within Media, Telecoms, IT and Entertainment topic(s)

In the past, the world was simple. Contracts were concluded with a handshake or drawn up on paper and signed by hand. Today, despite digitally signed contracts, it can happen that a billion-dollar deal is void because of a formal error. The digital world is complex and we regularly do things whose legal consequences we do not think about.

1. Introduction

The world used to be simple.

Contracts were concluded with a handshake or drawn up on paper and

signed by hand. Today it can happen that a billion dollar business

transaction is null and void due to a formal error in the digital

signature.

The digital world is complex and we regularly do things without properly weighing the legal consequences.

- We enter into contracts when we click a button on the Internet.

- We use scanned signatures like originals.

- We use digital signature services from cloud providers.

The question therefore arises: What actually applies when things get serious – if we want to conclude an agreement that is legally enforceable? When do I enter into a contract? Who has to prove that the contract was concluded? Which legal requirements apply?

In the following we analyze these questions in relation to the digital conclusion of contracts under private law, as they typically occur in business transactions.

2. Technical implemention

Three aspects are central to the legal enforceability of contractual agreements:

- Content of the contract: What was agreed?

- Expression of will: Were identical expressions of will made?

- Identity: Who are the parties to the agreement?

Only when these three aspects are clear, i.e. when a contract has been concluded, can one discuss rights and obligations from the agreement.

In the following we explain the technical implementation of these three aspects, as they lead to essential conclusions.

2.1. Make the content of the contract unchangeable

In the physical world, this is clear: we put the contract in writing, and the paper is relatively unchangeable. In the case of digital contracts, which are available in the form of a PDF file, for example, things are more complicated. PDF files can be replicated and modified.

To render a PDF file immutable, a checksum must be calculated and inserted into the document. A change to the document always results in a changed checksum. If I have two documents with the same checksum, I can be sure that their content is absolutely identical. We need this checksum in the following step.

2.2 Prove the expression of will

Orally or in writing, handshake or signature. Both are possible as an expression of will, but the signature has clear advantages in terms of provability. Digitally, things get more involved. To sign, both parties take the checksum generated above and sign it. That means that they encrypt them. The encryption relies on two keys, one secret and one public. With the public key, I can check whether the encryption has been carried out with the secret key.

This means that if I have a checksum that matches my document and the public key of the other party, I can prove that the party signed the document with their private key.

This is technically complex, but takes place millions of times a day. The entire Internet is based on the technologies described. 1

The digital signing of a document now works as follows:

- Generate document.

- Calculate checksum.

- Have the checksum signed by parties.

- Insert signed checksums into the document.

Done: I can prove that the owners of the private keys knew and signed the contract. Now we use the "signing" borrowed from cryptography, and we have a simple electronic signature.

From a purely technical point of view, this process is absolutely "safe". With today's technology, it takes me an infinite amount of time to attempt fraud.2

To clarify: All optical features inserted into the document such as images of signatures, logos, stamps etc. are completely irrelevant and only serve to please the user. Technically and legally, these elements are meaningless.

2.3 Identity

Unfortunately, a simple digital signature doesn't prove anything. For example, I can easily deny that I had a private key. With that I have a contract with signed content. But I can't prove who the other party is.

This is where legal regulation comes into play. It defines how the identity of the parties is to be determined and linked to the signatures. There are three levels:

- Simple: No guidelines whatsoever. Everything is allowed. Low assurance.

- Advanced: The assurance that the link between the three factors can be verified must be «substantial».

- Qualified: «High» assurance that the link is correct. The requirements vary depending on the jurisdiction.

3. Implementations available in Switzerland

3.1 Simple signature

Various implementations with the "simple signature" level are available on the market. Above all, Docusign is a well-known representative. Here you get a link that displays the document and enables it to be signed. The user types or draws his name and this is inserted into the document as a picture. The process described above is run in the background and a signed checksum is inserted into the document.

If we analyze this process, we have the following components:

- A checksum is calculated for the content of the contract.

- The expression of will takes place as a click or by typing the name.

- The identity is unchecked. The connection to a perso can only be made via the custom link sent by the sender to the recipient's email.

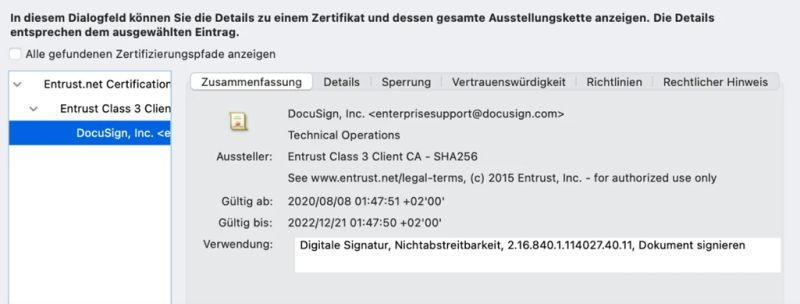

If we dig a little deeper, we can find out that the checksum was signed by Docusign and not by a secret key that is only known to the owner of the email address.

In summary, with a simple Docusign signature you can only ensure that the company Docusign knew the content of the document.

In the best case scenario, sending a link via email creates a very weak link between the person and activities on the Docusign platform. The evidential value should tend towards zero.

3.2 Advanced signature (FES)

Various providers enable advanced electronic signatures (FES). In Switzerland, these are subject to regulation with regard to the collection and linking of the factors (ZertES). In the context of the free assessment of evidence (Art. 157 ZPO), courts will attach increased evidential value to advanced electronic signatures. In order to achieve the required security, the providers have come up with various methods, especially for identification, in order to achieve substantial security with regard to identification. There is a small boom in enteprise-intenral processes. Using the combination of company email address and security with regard to the identity of the employees, a solid procedure can be constructed that is sufficient for many business transactions.

Swisscom offers a specialty in Switzerland with the argument that identification is required by law when handing over a SIM card and that a substantial level of security is thus achieved. A user can trigger a signature using an SMS code. The potential problem here is that the link between the contractual partner and his mobile number has to be established, which cannot always be taken for granted. It is also questionable whether it will be possible at the crucial moment to obtain evidence of the identity of the number owner.

The advanced signature in combination with an appropriate identification method can be an adequate compromise for many contracts. Before using the advanced electronic signature, however, it should be clarified whether the corresponding contract or type of contract must be in writing (written form requirement; form required by law). For most contract types, this is not the case by law (e.g. employment contract, purchase order). Legal norms that require a handwritten signature can be found in consumer business (B2C), e.g. in tenancy law or consumer credit. Assignments of claims (assignments) and certain corporate law transactions also require the written form. In addition, formal requirements can be regulated in the contracts themselves (so-called contractual written form reservations), which is often the case with written contracts.

With an FES, a form invalidation arises in these cases. The contract did not come about and has no legal effect.

3.3 Qualified electronic signature (QES)

The qualified electronic signature (QES) is the counterpart to the handwritten signature. It offers legal certainty with regard to formal requirements, because it is explicitly "on a par with a handwritten signature" 3 and meets all legal formal requirements. Anyone who signs with a QES does not have to worry that a contract has not been concluded due to a lack of formal requirements.

Compliance with the formal requirements does not say anything about the evidential value of the document. Neither the ZPO (Swiss code of civil procedure) nor the ZertES (Swiss digital signature law) contain any special guildelines regarding the evidential value of electronic signatures. If the authenticity of the document or the signature is disputed, it can be assumed, according to the general principles of evidence assessment and teaching, that the qualified electronic signature has a higher (if not full) evidential value. The Federal Administration's Validator Service can be used to check whether a document has a qualified electronic signature equivalent to a handwritten signature and when the document was signed (qualified time stamp).

In order to achieve this high level of security, however, the legislator makes extensive requirements (ZertES; VZertES):

- The checksums must be signed using certificates from providers recognized in Switzerland. 4 The certificates of numerous foreign providers (eg Adobe Sign, DocuSign) are generally not legally valid in Switzerland. 5

- Anyone who wants to sign with QES must also be personally identified in advance at a verified registration office and receive secure means of access with which they can release (i.e. sign) a signature in the future.

There is an exception for identification for financial intermediaries (e.g. banks): A QES can also be issued online using video identification. Here it is legally argued that identification takes place via video chat "among those present". However, the signature is only valid between the parties. Reusability in other business relationships is excluded.

In typical implementations, the user goes through a video interview and approves the signature using an SMS code. In this way, contracts with great evidential value can be concluded at a distance. The disadvantage compared to the simple methods is that the identification and signature are expensive (~ 20 CHF) and that the hurdle for the user is quite substantial. It takes 10 to 15 minutes to complete the process.

As attractive as the advantages of QES are, their widespread use is unfortunately not very common today. A negligible proportion of the population has the option of permanently using a qualified signature. The ad-hoc method via video identification is reserved for financial intermediaries and is also time-consuming and expensive.

4. Summary

In summary, the status quo is as follows:

- Docusign and similar processes have at most a ceremonial value.

- Qualified procedures (QES) are legally resilient, but time-consuming and expensive for users.

- Advanced procedures (FES) are a compromise and their usefulness needs to be assessed case by case. They cannot be used for all types of contracts.

The optimal solution, which – similar to a handwritten signature – is easy to use for all types of contract, does not yet exist. Digitization only works for a specific application, weighing costs and benefits as well as legal requirements.

5. Outlook

The central problem for the evidential value of digital signatures is the link to a natural person. The physical registration and video process are tedious and expensive, and pre-registration has only proven to be useful for a few people.

However, there is a silver lining on the horizon. Identification methods based on artificial intelligence (KI or AI) offer "substantial" security, and in combination with manual controls even "high" security. These highly automated processes enable faster and more convenient usage of qualified electronic signatures. The regulators in Switzerland and the EU seem to see this in a similar way. There is well-founded hope that the legal security of qualified signatures can be combined with a user-friendly process in the foreseeable future.

The development remains dynamic and we hope to see significant progress in 2022.

January 2022 | Authors: Dr. Thorsten Hau (CEO fidentity), Dr. Martin Eckert

Footnotes:

1 The Internet protocol HTTPS, which is used when surfing the Internet uses asymetric encryption. The content is encrypted and signed using exactly the same methods.

2 An attack requires 10 to the power of 64 years of computing time. For comparison: th[e universe has only existed for 10 to the power of 10 years.

3 https://www.fedlex.admin.ch/eli/cc/27/317_321_377/de#art_14

4 The following four providers are currently recognized: Swisscom (Switzerland) AG, QuoVadis Trustlink Switzerland AG, SwissSign AG and the Federal Office for Information Technology and Telecommunications.

Originally published 13 January 2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.