- within Tax topic(s)

- in European Union

- with readers working within the Accounting & Consultancy, Metals & Mining and Transport industries

Continuation funds are rapidly becoming a game-changer in private equity, representing a more nuanced approach to managing investments beyond their original term. They provide fund managers with a variety of opportunities, while also presenting complexities that demand careful navigation.

PRACTICAL REASONS TO FORM A CONTINUATION FUND:

Continuation funds have a growing presence in the secondaries market. Globally, continuation funds represented approximately 12% of sponsor-backed exit volume in 2023, up from 7% in 2022. Continuation funds are expected to hit critical mass in 2024, with Pitchbook projecting exits via continuation funds to surpass 100 such transactions in 2024. This rapid rise can be attributed to the numerous advantages they offer both managers and investors.

CONTINUATION FUNDS ARE ESTABLISHED TO:

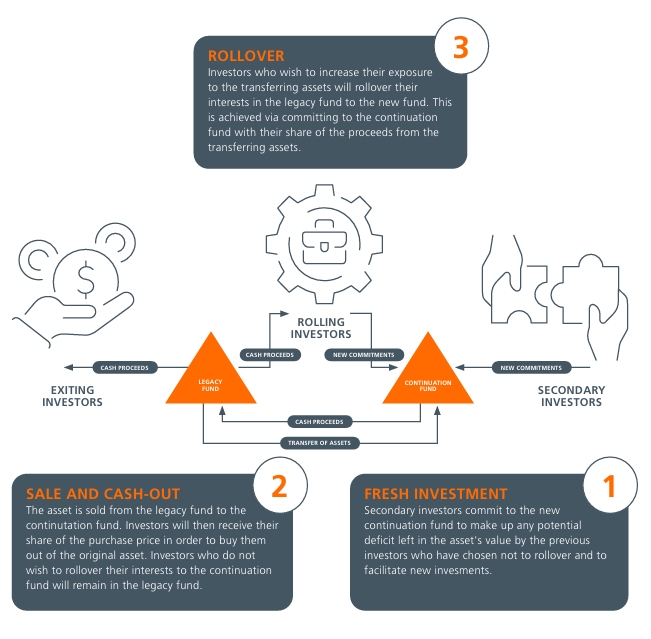

PROCESS FOR ESTABLISHING A CONTINUATION FUND:

Creating a continuation fund requires precise preparation and collaboration. Here is a breakdown of the key stages:

STEP 1 PORTFOLIO EVALUATION AND STRATEGY PLANNING

Conduct a comprehensive assessment of the existing portfolio, evaluating the performance, growth prospects and market conditions of each investment. Using this information, determine which assets should be moved to the continuation fund. Next, define the strategic objectives for the continuation fund, considering factors such as desired investment horizon, targeted returns and alignment with the overall fund strategy.

STEP 2 INVESTOR CONSULTATION AND CONSENT

Engage with existing investors and any applicable Limited Partner Advisory Committee (LPAC) to gauge appetite for participation in the continuation fund and, where required, secure consent for the proposed strategy. Determining how many investors intend to roll over their interest will help you organise the fund more efficiently. Furthermore, an initial LPAC approval is important to encourage investor confidence in the transaction. Be open about the rationale for the continuation fund, potential risks and rewards, and implications for existing investors.

STEP 3 LEGAL AND REGULATORY FRAMEWORK ESTABLISHMENT

Work with legal counsel to establish the legal and regulatory framework for the continuation fund. This includes deciding on the best structure to use. For example, is a single continuation fund holding multiple assets appropriate or would it be better to have multiple continuation funds each holding a single asset? Multiasset strategies, while once uncommon, made up approximately 59% of the volume of continuation fund transactions in 2023 - a significant increase from 41% in 2022. The best structure to use is often determined by considerations such as timing, cost, investor base, characteristics of asset(s) and flexibility to raise new capital. Additionally, verify compliance with relevant laws and regulations by creating necessary fund documentation, such as partnership agreements, offering memoranda, and subscription documents.

STEP 4 ASSET VALUATION AND PRICING, INDEPENDENT FAIRNESS OPINION

Conduct a thorough valuation of the portfolio assets being transferred to determine their fair market value. This provides the pricing mechanism for the continuation fund. The most important aspect is avoiding conflicts of interest, a solution to this is for managers to rely on buyer valuations through an auction guided by a financial advisor. Determining the final purchase price can be difficult and continuation funds are increasingly using methods such as deferred payment mechanisms. These allow investors to make payments over time, with the asset's performance influencing the final cost. An independent fairness or valuation opinion can provide an unbiased assessment of the terms of the transaction, helping to build trust and transparency between GPs and LPs, and mitigate against potential conflicts of interest. A third-party validation may facilitate securing the necessary consents from LPs, streamlining the process and enhancing the chances of a successful transaction. In certain jurisdictions, an independent fairness opinion may also be necessary to ensure compliance with regulatory requirements.

STEP 5 INVESTOR ONBOARDING AND CAPITAL COMMITMENTS

Secure capital contributions from existing and new investors. Facilitate the onboarding process for new investors, while ensuring regulatory compliance and conducting due diligence.

STEP 6 GOVERNANCE FRAMEWORK ESTABLISHMENT

Set up a strong governance framework for the continuation fund, describing the decision-making authority, reporting requirements and accountability mechanisms. Appoint a governing body, such as an LPAC, as early as possible to oversee fund operations and ensure alignment with investor interests.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]