- within Antitrust/Competition Law topic(s)

- in United States

- within Antitrust/Competition Law topic(s)

- in United States

- within Accounting and Audit, Law Department Performance and Consumer Protection topic(s)

The East African Community Competition Authority ("EACCA") has announced that, from 1 November 2025, it will begin accepting notifications of mergers with cross-border effects. This marks a significant development in the region's competition law landscape.

The EACCA's jurisdiction covers eight EAC partner states, namely: Burundi, Democratic Republic of Congo, Somalia, Kenya, Rwanda, South Sudan, Uganda, and Tanzania (collectively, the "Community"). The new regime will therefore apply to mergers that have a cross-border effect within the Community.

Merger notification thresholds

Under the East African Community Competition Act, 2006 as amended by the Competition (Amendment) Act, 2010 and the Competition (Amendment) Act, 2023, a merger – which is defined as:

"the acquisition of shares, business or other assets whether inside or outside the community resulting in the change of control of a business, part of a business or an asset of a business in the community in any manner and includes a take-over."

– must be notified to the EACCA if it meets the following financial threshold:

- if the combined turnover or assets in the Community of the merging undertakings, whichever is higher, equals to or exceeds USD 35 million; and

- if at least two undertakings to the merger or acquisition have a combined turnover or assets of USD 20 million in the community, unless each of the parties to a merger achieves at least two-thirds of its aggregate turnover or assets in the Community within one and the same partner state.

This means that any transaction meeting the definition of a merger and which exceeds the aforementioned financial threshold will require prior approval from the EACCA before implementation.

Notification and merger filing fees

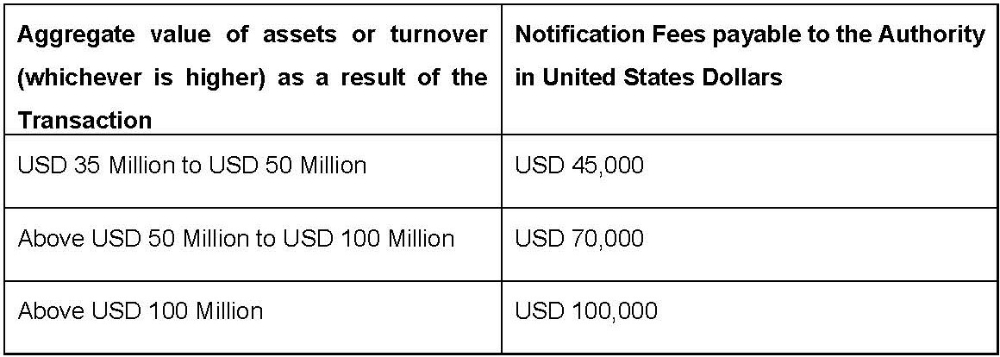

The EACCA notes that all merger notifications must be in the prescribed form, attaching a copy of the transaction agreement and any other relevant documents, and must be accompanied with the prescribed filing fee, which is calculated as per the table below:

Importantly, the EACCA has advised that once a cross-border merger is notified to the EACCA, there is no requirement to notify the national competition authorities in any of the EAC partner states. However, any merger proceedings already initiated or pending before a national authority prior to 1 July 2025 must be finalised by that authority.

Implications for businesses

Undertakings engaging in transactions that meet or exceed the threshold should therefore not lose sight of this important development. In this regard, a failure to notify a notifiable transaction, or proceeding to implement such a transaction without obtaining the EACCA's prior approval, may result in a financial penalty of up to 10% of the undertaking's annual turnover within the Community for the preceding financial year.

Conclusion

Undertakings operating in the EAC or considering mergers within the community, should therefore ensure compliance with the notification requirements to facilitate smooth transactions and avoid statutory sanctions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.