- within Finance and Banking topic(s)

- in United States

- within Insurance topic(s)

- with readers working within the Banking & Credit and Insurance industries

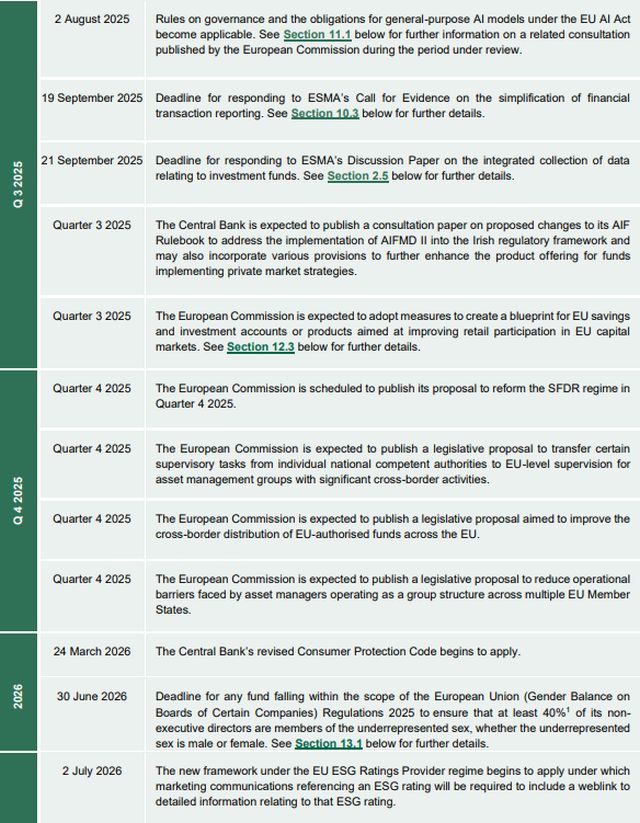

1 APPROACHING DEADLINES

2 UCITS & AIFMD

2.1 ESMA publishes its technical advice to the European Commission on the review of the UCITS Eligible Assets Directive

On 26 June 2025, ESMA published its technical advice on the review of the UCITS Eligible Assets Directive2 (Advice).

The Advice is in response to a mandate issued to ESMA by the European Commission in 2023 and follows its Call for Evidence last year in which it sought feedback from stakeholders on required changes to the UCITS regime. In its Advice, ESMA has proposed changes to both the UCITS Directive itself3 and the UCITS Eligible Assets Directive.

The key proposals put forward by ESMA in its Advices include:

- The requirement to perform a look-through approach in determining whether or not an instrument provides exposure to eligible assets or ineligible assets.

- An obligation to ensure that at least 90% of the UCITS portfolio provides exposure to eligible assets.

- The ability to invest a maximum of 10% of the UCITS portfolio in instruments which provide either direct or indirect exposure to ineligible assets such as commodities, real estate or crypto assets for example.

- The removal of the presumption of liquidity and negotiability for listed instruments.

While the European Commission will have regard to the Advice in considering any revisions to the UCITS framework, it is not bound by the proposals put forward by ESMA. This means that any proposed changes to the UCITS framework put forward by the European Commission may not fully align with ESMA's recommendations set down in the Advice.

A copy of the Advices is available here.

For a more detailed analysis of the Advices and potential implications for UCITS funds, please access our briefing on the topic which is available here.

| Key Action Points | While the European Commission is not bound by the proposals put forward by ESMA in its Advices, those managing UCITS funds may want to consider the recommendations put forward by ESMA in its Advices and potential impact on existing UCITS portfolios and investment strategies. |

2.2 ESMA publishes proposed rules governing use of liquidity management tools under the UCITS and AIFMD frameworks

Under revisions to the UCITS and AIFMD frameworks made by the Directive (EU) 2024/927 (Omnibus Directive), an obligation to use at least two liquidity management tools (LMTs) by all UCITS funds and open-ended AIFs will apply from April 2026.

These LMTs must be selected from a list set down in the Omnibus Directive which comprise of (i) redemption gates, (ii) extension of notice periods, (iii) in-kind redemptions, (iv) redemption fees, (v) swing pricing, (vi) dual pricing, (vii) side pockets and (viii) anti-dilution levies. In addition, fund managers must have the ability to suspend subscriptions/redemptions and to apply side pockets in certain circumstances.

On 15 April 2025, ESMA published its proposed framework relating to the use of liquidity management tools (LMTs) by UCITS funds and open-ended AIFs under the Omnibus Directive, This comprises of:

- A final report containing its draft regulatory technical standards on the characteristics of LMTs (Draft RTS); and

- A final report containing its draft guidelines on the selection and calibration of LMTs (Draft Guidelines).

The European Commission has 3 months to consider the Draft RTS, with the ability to extend this review period by a further month.

ESMA has proposed that in-scope fund managers with funds in existence before the date of application of the finalised guidelines be given 12 months from the application date of the RTS to comply with its finalised guidelines in respect of those funds.

A copy of the Draft RTS is available here.

A copy of the Draft Guidelines is available here.

For a more detailed analysis of this development, please refer to our briefing on the topic which is available here.

| Key Action Points | While the Draft RTS and related Draft Guidelines are not final (and thus may change), inscope fund management companies should plan to assess their existing LMT arrangements against the rules proposed by ESMA to identify any changes that may need to be made in order to comply with the new regulatory framework if it is implemented in the manner put forward by ESMA. |

2.3 List of permitted activities of Irish UCITS management companies and Irish AIFMs to be extended under revised UCITS and AIFMD frameworks

Under the Omnibus Directive, which amends both the UCITS and AIFMD frameworks and which must be transposed into national law by April 2026, EU Member States were granted a number of national discretions.

On 8 May 2025, the Irish Department of Finance published a feedback statement (Feedback Statement) to its November 2024 consultation paper under which it sought feedback on how national discretions under the Omnibus Directive should be exercised by Ireland (Consultation Paper).

The Feedback Statement confirms as follows:

- Irish AIFMs and Irish UCITS management companies may be

authorised by the Central Bank from 16 April 2026 to engage in the

following ancillary activities and non-core services:

- administration of benchmarks (available to both Irish authorised AIFMs and Irish authorised UCITS management companies)

- credit servicing activities (available to Irish authorised AIFMs only)

- as part of the "non-core" services offering:

- an Irish authorised UCITS management company may provide receipt and transmission of orders relating to financial instruments4 .

- an Irish authorised UCITS management company or AIFM may perform the same functions and activities that they already perform for an AIF/UCITS respectively for the benefit of a third party provided that conflicts of interest are appropriately managed.

- All AIFs which originate loans, whether domiciled in Ireland or elsewhere, will be prohibited from granting loans to Irish consumers.

- An Irish domiciled UCITS or AIF will not be able to appoint a depositary outside of Ireland.

A copy of the Feedback Statement is available here.

| Key Action Points | Irish authorised UCITS management companies and Irish authorised AIFMs may want to consider the additional permissions which will be available, subject to the prior approval of the Central Bank of Ireland, from April 2026 in the context of their existing and proposed business lines. |

2.4 ESMA publishes reports on leverage within AIFs and leverage in UCITS using Absolute VaR approach

On 24 April 2025, ESMA published two separate reports relating to the use of leverage within EU domiciled funds.

The first of these reports focuses on leverage within AIFs (ESMA AIF Report) and the second report focuses on leverage in UCITS funds which use the Absolute VaR approach (ESMA UCITS Report).

The ESMA AIF Report notes that hedge fund AIFs display the highest levels of leverage, that the limits imposed on Irish domiciled GBP LDI funds increase the resilience of the sector and that real estate funds could be considered systemically relevant in jurisdictions where groups of real estate funds own a large share of the underlying market for real estate assets.

The ESMA UCITS Report provides (i) an overview of the use of the absolute VaR approach by UCITS funds, (ii) the types of UCITS funds that typically use this approach, (iii) the levels of gross leverage of those funds, (iv) risk metrics for potentially leveraged UCITS and hedge funds under AIFMD and (vi) potential risk implications associated with such exposures.

A copy of both reports is available here.

2.5 ESMA publishes Discussion Paper on Integrated Collection of Data of Investment Funds

On 23 June 2025, ESMA published a discussion paper on the integrated collection of data relating to investment funds (Discussion Paper).

In the Discussion Paper, ESMA seeks feedback on the development of an integrated reporting system of supervisory data for investment funds. The objective of this framework is to reduce the reporting burden for entities in the asset management sector and to enhance data sharing between competent authorities.

The Discussion Paper:

- outlines the current position of asset managers' reporting obligations at both EU and national level under AIFMD, UCITS, the MMFR and other regulatory frameworks

- assesses the overlaps and inconsistencies between those reporting frameworks

- presents several options to improve the consistency, efficiency and effectiveness of the existing reporting obligations for fund managers under different regimes

- outlines the main priorities in order to achieve appropriate integration of fund reporting.

ESMA expects to submit a report on the development of an integrated collection of supervisory data for investment funds to the European Commission in Quarter 2 2026.

The deadline for responding to the Discussion Paper is 21 September 2025.

A copy of the Discussion Paper is available here.

To view the full article, click here.

Footnotes

1. This requirement will be deemed satisfied when the number of non-executive directors from the underrepresented sex on the board of directors of the relevant company aligns with the number set down in the schedule to the relevant regulations.

2. Directive 2007/16/EC

3. Directive 2009/65/EC

4. Irish authorised AIFMs are already permitted to provide such services under the existing AIFMD framework

Originally published 15 July 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]