- within Finance and Banking topic(s)

- in United States

- with readers working within the Banking & Credit and Law Firm industries

- within Finance and Banking topic(s)

- in United States

- with readers working within the Banking & Credit and Law Firm industries

- within Finance and Banking, Media, Telecoms, IT, Entertainment and Corporate/Commercial Law topic(s)

1 Legislative and regulatory framework

1.1 In broad terms, which legislative and regulatory provisions govern alternative investment funds in your jurisdiction?

The establishment and functioning of alternative investment funds (AIFs) in India are regulated by the Securities and Exchange Board of India (SEBI) through the comprehensive framework provided in the SEBI (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations'), as amended from time to time. Along with these regulations, SEBI issues guidelines and circulars that help to shape the regulatory landscape for AIFs.

AIFs must also adhere to various regulatory frameworks, including:

- the SEBI (Intermediaries) Regulations, 2008;

- the Prevention of Money Laundering Act, 2002;

- the SEBI (Foreign Portfolio Investor) Regulations, 2019 (if AIFs are receiving the foreign investments from foreign portfolio investors);

- the Foreign Exchange Management Act, 1999 and applicable rules and regulations thereunder such as:

-

- the Foreign Exchange Management (Non-debt Instruments) Rules, 2019;

- the Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019;

- the Foreign Exchange Management (Overseas Investment) Rules, 2022; and

- the Foreign Exchange Management (Overseas Investment) Regulations, 2022; and

- the Income Tax Act, 1961 and the applicable rules thereunder.

An AIF excludes funds governed by:

- the SEBI (Mutual Funds) Regulations, 1996;

- the SEBI (Collective Investment Schemes) Regulations, 1999; or

- any other regulations under the purview of the SEBI for the regulation of fund management activities.

Additionally, the AIF Regulations provide specific exemptions from registration for entities such as:

- family trusts established for the benefit of 'relatives' as defined in the Companies Act, 1956;

- employee welfare trusts or gratuity trusts established for the welfare of employees; and

- 'holding companies' as defined in Section 4 of the Companies Act, 1956.

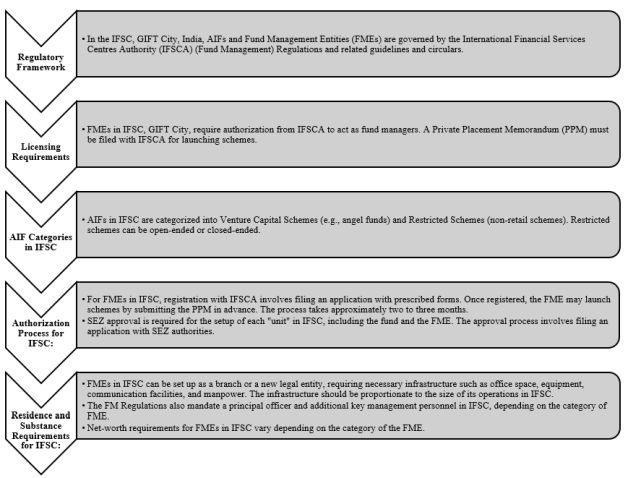

In the International Financial Services Centre (IFSC), situated in Gujarat International Finance Tec (GIFT) City, funds and the entities responsible for their management – termed 'fund management entities' (FMEs) – operate under the regulatory jurisdiction of the International Financial Services Centres Authority (IFSCA). The regulatory framework governing these entities is defined by the IFSCA (Fund Management) Regulations, 2022 ('FM Regulations'), which are complemented by additional guidelines and circulars issued by the IFSCA.

1.2 Do any special regimes or provisions apply to specific types of alternative investment funds?

Category I AIFs:

- Investment focus: Start-ups, early-stage ventures, social ventures, small and medium-sized enterprises (SMEs), infrastructure and other sectors deemed socially or economically desirable by government or regulators.

- Includes: Venture capital funds (VCFs), SME funds, social impact funds, infrastructure funds, special situation funds and others as specified.

- Clarification: Funds perceived to have positive spillover effects on the economy, eligible for incentives or concessions. The trusts or companies formed under this category are construed as 'venture capital companies' or 'VCFs' as specified under the Income Tax Act.

Category II AIFs:

- Investment scope: Excludes Categories I and III.

- Financial operations: Do not undertake leverage or borrowing beyond day-to-day operational requirements and as permitted by the AIF Regulations.

- Includes: Private equity funds, debt funds without specific government or regulatory incentives.

Category III AIFs:

- Investment strategy: Employ diverse or complex trading strategies; may use leverage, including through derivatives (listed or unlisted).

- Includes: Hedge funds, funds aimed at short-term returns and other open-ended funds without specific government or regulatory incentives.

Specified AIFs under Regulation 19 of the AIF Regulations:

- Angel funds:

-

- A sub-category of VCFs under Category I AIFs. They are allowed to make investments in start-ups.

- Investors include:

-

- individuals with:

-

- net tangible assets of at least INR 20 million, excluding the value of the principal residence and early-stage investment experience;

- serial entrepreneur experience; or

- at least 10 years' senior management experience;

- bodies corporate with a net worth of at least INR 100 million; and

- AIFs or VCFs registered under regulations.

- Special situation funds (SSF):

-

- Category 1 AIFs specialising in special situation assets aligned with their investment objectives, and eligible to act as a resolution applicant under the Insolvency and Bankruptcy Code, 2016.

- An applicant can seek registration as an SSF, adhering to Chapter II of the SEBI Regulations.

- Each SSF scheme must specify its corpus, as determined by SEBI.

- Exclusive acceptance of investments from other AIFs is prohibited, except those classified as SSFs.

- Corporate debt market development funds:

-

- Formed as a trust with a registered deed under the Registration Act, 1908.

- Seek registration as an AIF under Chapter II of the AIF Regulations.

- Closed-ended funds with a 15-year tenure, extendable with SEBI's approval.

- Units offered to asset management companies and specified debt-oriented schemes of mutual funds.

- Investments in line with the SEBI (Mutual Funds) Regulations, 1996.

- Manager or sponsor maintains a continuing interest of at least INR 50 million.

- Borrowing limit of up to 10 times the corpus, subject to SEBI's conditions.

Large-value funds (LVFs)/accredited funds: An LVF for accredited investors refers to an AIF or a scheme within an AIF. In this context:

- every investor – excluding the manager, sponsor and employees or directors of the AIF, as well as employees or directors of the manager – must qualify as an accredited investor; and

- each accredited investor must make a minimum investment of INR 700 million.

AIF categories in the IFSC in GIFT City:

- Authorised FMEs:

-

- Target accredited investors or those investing above a specified threshold via private placement.

- Invest in start-ups or early-stage ventures through the Venture Capital Scheme.

- Family investment funds investing in permitted asset classes should register as authorised FMEs.

- Registered FMEs (non-retail):

-

- Gather funds from accredited investors or those exceeding a specified threshold through private placement.

- Invest in securities, financial products and permitted asset classes through restricted schemes.

- Permitted to offer portfolio management services and act as investment managers for the private placement of investment trusts (real estate investment trusts (REITs) and infrastructure investment trusts (InvITs)).

- Have the flexibility to engage in activities allowed for authorised FMEs.

- Registered FMEs (retail):

-

- Collect funds from all investors or a specific section under one or more schemes.

- Invest in securities, financial products and permitted asset classes through retail or restricted schemes.

- Can act as an investment manager for the public offer of investment trusts (REITs and InvITs).

- Have the authority to launch exchange-traded funds.

- Empowered to undertake activities allowed for authorised FMEs and registered FMEs (non-retail).

1.3 Do the legislative and regulatory provisions governing alternative investment funds have extra-territorial reach?

The AIF Regulations encompass provisions that extend their reach beyond India's borders. In case of breaches involving both the AIF Regulations and the Foreign Exchange Management Act (FEMA) Regulations, SEBI and the Reserve Bank of India (RBI) have regulatory powers. Notably, these powers are not limited to actions against the AIF alone but extend to the AIF's manager, sponsor and its respective promoters.

In accordance with Regulation 15(1)(a) of the AIF Regulations, AIFs are permitted to invest in securities of companies incorporated outside India, subject to the following conditions or guidelines set forth by the RBI and SEBI:

- SEBI Circular SEBI/HO/IMD/DF1/CIR/P/2018/103/2018 of 3 July 2018 and SEBI Circular CIR/IMD/DF/7/2015 of 1 October 2015 set out the legal framework under which overseas investment by AIFs and VCFs takes place. This framework encompasses the allocation of investment limits on a 'first come, first served' basis, contingent upon availability within the block limit. The 2015 circular specifies that not more than 25% of an AIF's investible funds can be invested overseas. Further, provisions within the framework govern:

-

- the conditions for investment;

- the approval procedure;

- the timeline for investment;

- disclosure requirements; and

- regulatory compliance.

- Overseas investments by AIFs and VCFs are subject to the Foreign Exchange Management (Transfer or Issue of Any Foreign Security) Regulations, 2004, including amendments and related directions as issued by the RBI from time to time. Such AIFs and VCFs must also comply with any other FEMA regulations and RBI guidelines, as amended from time to time, with respect to any structure which involves the overseas direct investment route. AIFs and VCFs must report on the utilisation of overseas limits within five working days through the SEBI intermediary portal. Failure to utilise the allotted overseas limit within the stipulated six-month period will necessitate reporting to SEBI within two working days post-expiry. In the event of a decision to surrender the allocated overseas limit, reporting to SEBI is required within two working days of the date of such determination. These disclosure requirements are aimed at facilitating the monitoring of utilisation of overseas investment limits allotted by SEBI.

- As outlined in SEBI Circular SEBI/HO/AFD-1/PoD/CIR/P/2022/108 of 17 August 2022, the requirement to have an Indian connection has been removed for AIFs and VCFs making overseas investments. AIFs and VCFs are only permitted to invest in investee companies overseas which are incorporated in jurisdictions in which the securities market regulator is either:

-

- a signatory under Appendix A of the International Organization of Securities Commission's (IOSCO) Multilateral Memorandum of Understanding (MoU), such as Luxembourg and the Netherlands; or

- a signatory to a bilateral MoU with SEBI, such as the United States, Mauritius and Singapore.

Further, to address the impact of the Prevention of Money Laundering Act, 2002 and the FEMA Regulations on AIFs, and in alignment with the Financial Action Task Force's (FATF) anti-money laundering guidelines, SEBI issued a Master Circular on Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) on 15 October 2019, along with subsequent circulars to ensure adherence to the specified guidelines.

In the event of non-compliance with the AIF Regulations or any SEBI directions, Section 15EA of the SEBI Act, 1992 provides for the imposition of penalties of at least INR 100,000, which may extend to INR 100,000 for each day that the failure persists, with a maximum penalty of INR 10 million or three times the gains derived from the failure, whichever is higher. Furthermore, the SEBI circular of 1 October 2015 prescribes reporting standards for FDI in AIFs. Failure to adhere to the prescribed reporting norms for AIFs will entail severe consequences, including a prohibition on the non-compliant entity from receiving any additional foreign investment, including indirect foreign investment. Furthermore, such non-compliance will be considered a contravention of the FEMA, thereby subjecting the entity to potential penalties and/or the confiscation of any currency, security or other assets associated with the contravention.

1.4 Are any bilateral, multilateral or supranational instruments in effect in your jurisdiction of relevance to alternative investment funds?

SEBI sought to foster international collaboration by signing a bilateral MoU on 28 July 2014 with securities market regulators from 27 member states of the European Union/European Economic Area (EEA). This MoU is centred on consultation, cooperation and the exchange of information pertinent to the supervision of AIF managers. Notably, India has also extended its collaborative efforts by signing a separate bilateral MoU with Gibraltar on 2 February 2018.

SEBI has bolstered global regulatory partnerships through multiple MoUs with international counterparts, including IOSCO multilateral and bilateral MoUs. These collaborations facilitate cross-border cooperation and information exchange for regulatory and enforcement purposes. A comprehensive list of SEBI's MoUs with securities regulators worldwide can be found at www.sebi.gov.in/department/office-of-international-affairs-36/oia-bilateral.html

This collaborative approach is aligned with global regulatory efforts, particularly within the framework of IOSCO. Regulatory bodies worldwide work collectively to enforce laws and regulations within their jurisdictions, fostering a cohesive regulatory environment. India, which is a signatory to various bilateral tax and investment protection treaties, prioritises the resolution of double taxation issues related to income. This commitment is especially crucial for cross-border fund structures and investments, emphasising India's dedication to facilitating seamless and compliant cross-border financial activities.

1.5 Which bodies are responsible for regulating alternative investment funds in your jurisdiction? What powers do they have?

SEBI is the primary regulator of India's securities market, with a mission to:

- protect investors' interests; and

- oversee the development of the market.

SEBI has extensive powers under the SEBI Act and the AIF Regulations, including the ability to:

- conduct inspections, searches and seizures;

- impose penalties; and

- bar individuals from accessing capital markets.

SEBI also offers non-binding guidance on the interpretation of the AIF Regulations. In accordance with the SEBI Circular of 21 July 2016 and Rule 9(l)(1) of the Prevention of Money Laundering (Maintenance of Records) Amendment Rules, 2015, SEBI-registered intermediaries must conduct the initial know-your-customer (KYC) process for their clients. This includes in-person verification and the prompt uploading of investor/client data to both the Central KYC Records Registry and the KYC Registration Agency system within 10 days of establishing an account-based relationship with an investor/client.

The RBI, as the central bank, operates under the RBI Act 1934, as amended from time to time and regulates foreign exchange through the FEMA Regulations. The RBI's jurisdiction covers:

- foreign exchange inflows;

- downstream investments;

- sectoral caps;

- pricing norms; and

- anti-money laundering.

The RBI compels regulated entities to report suspicious transactions to the Financial Intelligence Unit – India (FIU-India).

Additionally, FIU-India, operating under the Department of Revenue within the Ministry of Finance, functions as the central national agency tasked with receiving, processing, analysing and disseminating information pertaining to suspicious financial transactions.

Further, the income tax authorities oversee the taxation of both funds and their investors, ensuring compliance through filing requirements and audits. Under the tax rules, the income tax authorities are empowered to recover tax either from the trustee or from the beneficiaries (ie, investors) directly. The trustee has the option to settle the entire tax liability at the AIF level. Additionally, the trustee, acting as a representative assessee, has the authority to recover from investors any taxes paid on their behalf.

In the IFSC located in GIFT City, funds and FMEs are governed by the FM Regulations and the guidelines and circulars issued by the IFSCA. The primary objectives of the IFSCA are to:

- enhance the ease of conducting business within the IFSC; and

- establish a regulatory framework of global standards.

Beyond overseeing the types of transactions conducted within the IFSC, the IFSCA is tasked with regulating the operations of entities engaged in business transactions within the IFSC.

These authorities are proactive regulators that engage with industry organisations and stakeholders to enhance the regulation of AIFs. They issue guidance, FAQs and master circulars for clarity, and often release consultation papers and draft guidelines to seek feedback before major regulatory changes.

1.6 To what extent do the regulators cooperate with their counterparts in other jurisdictions?

SEBI has cemented its commitment to international regulatory cooperation through the signing of diverse agreements. These include the IOSCO multilateral MoUs, supplemented by the IOSCO enhanced multilateral MoUs, along with bilateral MoUs. These agreements collectively aim to elevate cross-border cooperation and foster seamless information exchange for regulatory and enforcement purposes.

In addition to these global initiatives, SEBI has fostered international collaboration by signing a bilateral MoU on 28 July 2014 with securities market regulators from 27 member states of the European Union/EEA. This MoU is centred on consultation, cooperation and the exchange of information pertinent to the supervision of AIF managers. Notably, India has also extended its collaborative efforts by signing a separate bilateral MoU with Gibraltar on 2 February 2018.

India has also entered into bilateral tax information exchange agreements with 21 jurisdictions and is a party to the Multilateral Convention of Mutual Administrative Assistance in Tax Matters. As such, it can exchange information with such jurisdictions, subject to the receipt of valid requests.

Crucially, India's membership of the FATF underscores its active role in global efforts to combat money laundering and terrorist financing. The RBI, in collaboration with the FATF, engages in collaborative endeavours with fellow member nations. These include:

- executing essential measures;

- conducting assessments; and

- advocating for the universal acceptance and implementation of relevant measures on a global scale.

2 Form and structure

2.1 What types of alternative investment funds are typically found in your jurisdiction?

The various types of alternative investment funds (AIFs) commonly encountered in India are described in question 1.2.

2.2 How are these alternative investment funds typically structured?

In accordance with the SEBI (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations'), the Securities and Exchange Board of India (SEBI) allows the establishment of an AIF in the form of:

- a trust;

- a limited liability partnership (LLP);

- a company; or

- a body corporate.

However, trusts are the prevailing choice for AIF structures due to specific legal, regulatory, tax and commercial considerations.

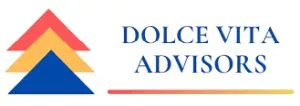

Structure:

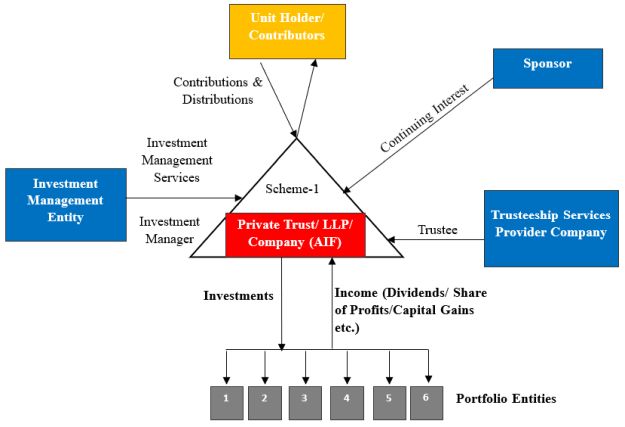

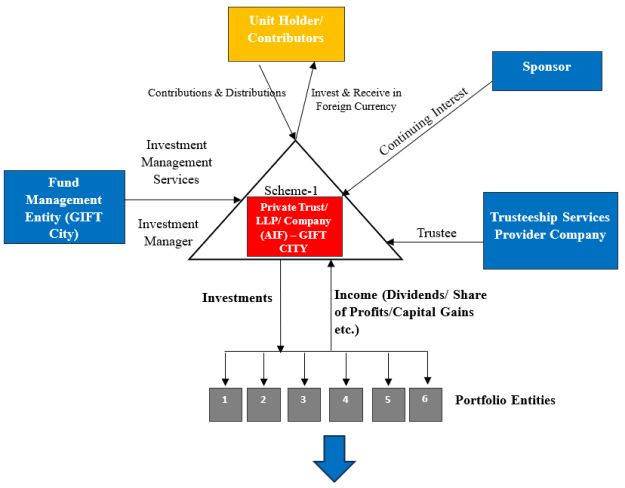

Structure in the International Financial Services Centre (IFSC) Gujarat International Finance Tec City:

Inbound investments (AIFs in IFSC)

- Offshore shares, debt, derivatives, mutual funds etc

- Securities listed on IFSC exchange

- Companies in IFSC

- Indian shares, debt, derivatives, mutual funds etc

- Indian listed and unlisted companies

- Units of AIFs, REITs, InvITs

Outbound investments (AIFs in the IFSC):

- Offshore shares, debt, derivatives, mutual funds etc

- Foreign Securities listed on IFSC exchange

- Companies in IFSC

Under Indian law, a trust does not possess a distinct legal identity and relies on the legal personality of the trustee. Consequently, the trustee has the legal ownership of the trust property, while investors are the beneficial interest holders in the trust. Investment management agreements are formal legal documents that grant investment managers the authority by trustees to oversee and manage capital on behalf of investors.

In contrast, LLPs and companies possess separate legal identities, with investors participating as partners or shareholders in LLPs and companies registered as AIFs, although such arrangements are relatively uncommon.

Certain vehicle types – such as family trusts, employee stock ownership plan trusts, employee welfare trusts, gratuity trusts and securitisation trusts – are excluded from the definition of an AIF.

2.3 What are the advantages and disadvantages of these different types of structures?

Company:

| Advantages | Disadvantages |

| It possesses a distinct legal identity and perpetual continuity. | Establishing a company entails meticulous planning, paperwork and navigating through various stages before formal registration. |

| The liability of shareholders is limited to their invested capital. | Essential components such as the capital structure, constitution, and accounts must be made public through the submission of the necessary documents to the registrar of companies. |

| It features the separation of ownership and management, with the authority vested in the board of directors. | It is subject to more stringent compliance and reporting requirements, leading to increased operational costs. It must also adhere to rigorous accounting and auditing standards. |

| It is a legal entity that may sue and be sued in its own name. | The dissolution process can also be more time-consuming compared to that for trusts. |

LLP:

| Advantages | Disadvantages |

| It has a separate legal identity and a perpetual existence. | Designated partners bear unlimited liability to ensure partnership compliance with applicable laws; and personal assets of partners may be attached in case of fraudulent actions against LLP creditors |

| Partners enjoy limited liability, which is tied to their capital contributions. | Some financial institutions may be restricted from investing in an LLP, limiting capital-raising opportunities. |

| It is subject to fewer compliance requirements than a company. | LLPs with foreign partners may face exchange control limitations on investments in investee companies. |

| There is no limit on the number of partners, subject to a 1,000-investor restriction imposed by the AIF Regulations; and there is no requirement for a trustee in AIF management. | The establishment and dissolution processes can be lengthier than those for trusts. |

Trust:

| Advantages | Disadvantages |

| It is relatively easy to establish and wind up, providing flexibility in pursuing commercial objectives. | A notable disadvantage is the potential imposition of tax at the maximum marginal rate if the trust is structured as a discretionary trust or if the beneficial interests of investors remain uncertain, as seen in hedge funds, particularly for Category III AIFs. |

| It is subject to fewer statutory disclosure requirements compared to companies or LLPs. | |

| Regulatory compliance under the Trusts Act is minimal, resulting in management cost savings. | |

| Launching multiple schemes under a single trust structure offers a flexibility that may not be as feasible for LLPs and companies. |

Each legal structure has its own advantages and disadvantages, making the choice of structure dependent on specific business needs and objectives.

2.4 What are the most widely used alternative investment funds structures used in your jurisdiction?

The trust stands out as the pre-eminent AIF structure, driven by its alignment with specific legal, regulatory, tax and commercial considerations.

Of the different categories of AIFs, Category II is favoured due to its flexibility in structuring investment strategies and its sector-agnostic nature. This category accommodates the formation of private equity funds and real estate funds. In India, the Category II AIF is extensively adopted, given its versatility, enabling managers to articulate comprehensive investment policies and objectives for the AIF.

2.5 Is there a preferred alternative fund structure for particular investment strategies (ie, hedge fund/private credit/private equity)?

Hedge funds: Hedge funds serve as investment vehicles that draw in private investors and strategically employ a diverse array of trading and investment strategies across domestic and international markets. They actively oversee their portfolios, utilising both long and short positions in traditional securities, alongside holdings in listed and unlisted derivatives.

Category III AIFs exhibit versatility by investing across a spectrum that includes:

- securities of both listed and unlisted investee companies;

- derivatives;

- complex or structured products; and

- other AIF units.

They can be either open-ended or closed-ended funds, with the latter adhering to a minimum tenure of three years. They are preferred investment strategies for hedge funds and private investment in public equity (PIPE) funds. They employ a wide array of trading strategies and leverage, encompassing investments in both listed and unlisted derivatives. Notably, the government provides no specific incentives or concessions for investments in these funds. Category III AIF funds, focusing on public equities, exhibit lower liquidity risk. Conversely, those engaged in real estate and private equity ventures carry a higher level of risk.

Private credit and private equity: 'Private credit' refers to a form of debt financing extended by non-bank lenders or funds that is not publicly issued or traded in open markets. The private credit market has garnered substantial attention from both high-net-worth individuals and institutional investors due to its distinct characteristics and appeal.

Private equity funds serve as investment vehicles created to aggregate capital from institutional investors and high-net-worth individuals. These funds leverage the pooled capital to acquire equity stakes in private companies, strategically aimed at generating significant returns on investment.

Category II funds are specifically designed for private equity, private credit and distressed assets funds. An AIF falling under this category can exclusively invest in securities, encompassing:

- non-convertible debentures;

- convertible cumulative debentures;

- optionally convertible debentures; or

- other variations of debt securities.

AIFs, including Category II funds, are constrained to investing solely in shares and securities, as outlined in Section 2(h) of the Securities Contracts (Regulations) Act, 1956. An important restriction for AIFs is the prohibition against providing loans. However, this restriction does not apply to special situation funds (SSFs). It is imperative that SSFs adhere to the due diligence requirements mandated by the Reserve Bank of India for their investors.

Specifically, a debt fund registered under Category II primarily focuses on investing in debt or debt securities of both listed and unlisted investee companies in accordance with its stated objectives.

2.6 Are alternative investment funds required to have a local administrator appointed?

In India, the establishment of an investment fund necessitates mandatory registration as an AIF, unless the fund qualifies for a specific exemption. SEBI mandates that an AIF must be managed by a fund manager that is established in India. This regulatory requirement ensures that AIFs operating in the Indian market are overseen by managers which are locally based and accountable to the Indian regulatory authorities.

According to the AIF Regulations, a manager appointed by an AIF to oversee its investments can be an individual or an entity based in India. Managers are commonly structured as companies or LLPs. Investments made by an AIF are categorised as investments by residents under exchange control norms, contingent upon both the manager and the sponsor of the AIF being residents owned (with more than 50% ownership) and controlled. Where either the manager or the sponsor does not meet the criteria of being resident-owned or controlled, investments made by the AIF are designated as 'downstream investments' or 'indirect foreign investments' by the AIF. In such instances, compliance with the Foreign Exchange Management Act becomes mandatory.

In the IFSC, fund management entities have the flexibility to take on various forms, including:

- companies, trusts, LLPs or branches thereof; or

- any other form specified by the IFSC Authority.

2.7 Are alternative investment funds required to appoint a local custodian to hold assets? If yes, what legal protections are in place to protect the alternative investment fund's assets?

In India, AIFs must appoint a custodian for the safekeeping of their assets, as per the regulatory framework established by SEBI. The custodian plays a crucial role in ensuring the security and protection of the AIF's assets.

The sponsor or manager of the AIF must engage a custodian registered with SEBI for the safekeeping of securities if the corpus of the AIF exceeds INR 5 billion. A Category III AIF must appoint a custodian, irrespective of its corpus size. Additionally, in the case of Category III funds dealing with commodity derivatives involving physical settlement, the appointed custodian is responsible for safeguarding the received securities and goods.

Furthermore, for Category I and Category II AIFs engaged in credit default swaps, the sponsor or manager must:

- appoint a custodian registered with SEBI; and

- adhere to specific terms and conditions stipulated by SEBI.

Further, in recently published consultation paper, SEBI mandated all AIFs, regardless of corpus, to appoint a custodian.

2.8 Is it possible for an alternative investment fund to redomicile to your jurisdiction? If yes, what considerations are required and what are the steps involved?

Regulation 2(1)(q) of the AIF Regulations specifies that a 'manager' is an individual or entity appointed by the AIF to oversee its investments. As per SEBI's practical requirements, the investment manager is expected to be an individual or entity located in India. In situations where foreign managers seek to establish funds domiciled in India, the investment manager may take the form of a subsidiary or a distinct entity set up within India.

Currently, there are no provisions allowing the re-domiciliation of funds into India. An AIF must be established within India, taking the form of a trust, a company or an LLP.

3 Authorisation

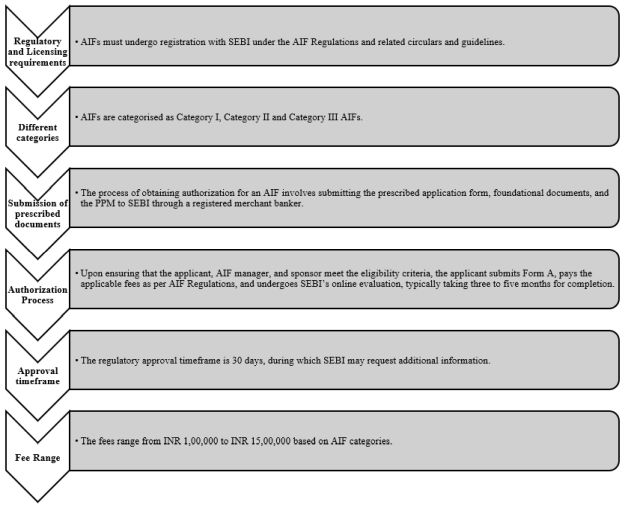

3.1 Must alternative investment funds be authorised or licensed in your jurisdiction?

Alternative investment funds (AIFs) must register with the Securities and Exchange Board of India (SEBI) under the SEBI (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations'), necessitating the submission of a private placement memorandum (PPM) to SEBI.

Within the International Financial Services Centre (IFSC), situated in Gujarat International Finance Tec (GIFT) City, India, funds and entities acting as fund management entities operate under the regulatory framework established by the International Financial Services Centres Authority (IFSCA) and must be registered with IFSCA.

Please see question 3.3 and question 1.1 for more information.

3.2 If so, what criteria must be satisfied to obtain authorisation? Do any restrictions apply in this regard?

In deciding whether to grant a certificate and authorisation, SEBI assesses eligibility based on the following conditions:

- The applicant's constitutional documents (memorandum of association for a company, trust deed for a trust or partnership deed for a limited liability partnership (LLP)) must authorise it to operate as an AIF.

- The applicant must be restricted by its constitutional documents from making a public invitation for securities subscriptions.

- In the case of a trust, the trust instrument must be in the form of a deed and must have been duly registered under the Registration Act, 1908.

- If the applicant is an LLP, it must be properly incorporated and the partnership deed must have been duly filed with the registrar of companies under the Limited Liability Partnership Act, 2008.

- If the applicant is a body corporate, it must be established under central or state laws and must be permitted to engage in AIF activities.

- The applicant, sponsor and manager must be considered fit and proper persons based on the criteria specified in Schedule II of the SEBI (Intermediaries) Regulations, 2008.

- The key investment team of the manager must have at least one key member of personnel with a relevant certification and another with professional qualifications in finance, accountancy, business management, commerce, economics, capital market or banking, as specified by SEBI.

- The manager or sponsor must have the necessary infrastructure and manpower for effective operations.

- The applicant must clearly outline the investment objective, targeted investors, proposed corpus, investment style or strategy and proposed tenure of the fund or scheme at the time of registration.

- Verification must be conducted to ensure that neither the applicant nor any entity established by the sponsor or manager has previously been refused registration by SEBI.

3.3 What is the process for obtaining authorisation of alternative investment funds and how long does this usually take?

SEBI has established a prescribed application form for AIF registration, which must be accompanied by the AIF's foundational documents and the PPM. This submission is facilitated through a SEBI registered merchant banker. Key parties to the AIF, such as the manager and sponsor, must provide certain declarations and undertakings, along with a disciplinary history.

Upon ensuring that the applicant, the AIF manager and the sponsor meet the eligibility criteria, the next step involves the submission of an application for the issuance of a certificate under the designated categories outlined in the AIF Regulations. This application is facilitated through the completion of Form A, as delineated in the First Schedule of the AIF Regulations. Concurrently, the applicant must remit the non-refundable application and registration fees, the details of which are stipulated in the Second Schedule of the AIF Regulations.

A registered merchant banker, appointed by the manager, conducts a thorough vetting of the placement memorandum and declarations. If deemed adequate, a due diligence certificate is issued by the merchant banker, stating that the disclosures are sufficient for submission to SEBI, along with the relevant documents. The merchant banker is also responsible for incorporating SEBI's comments into the placement memorandum. An exemption is granted to large-value funds for accredited investors, subject to specific conditions.

The entire application process is conducted online. According to the AIF Regulations, SEBI is mandated to approve or reject the application within 30 days. SEBI may request additional information or documents during this period. Usually, the establishment and registration process typically takes three to five months, encompassing the time required for SEBI's evaluation of the application. This includes the timeframe for submission of the fund documentation and AIF application (pre-formation formalities), which usually takes around a month.

Amount to be paid as fees (as per Second Schedule of AIF Regulations):

| Application fee | INR 100,000 |

| Registration fee for Category I AIFs other than angel funds | INR 500,000 |

| Registration fee for Category II AIFs other than angel funds | INR 1 million |

| Registration fee for Category III AIFs other than angel funds | INR 1.5 million |

| Scheme fee for AIFs other than angel funds | INR 100,000 |

| Re-registration fee | INR 100,000 |

| Registration fee for angel funds | INR 200,000 |

| Registration fee for corporate debt market development funds (specified AIF as provided under Regulation 19 of these regulations) | INR 500,000 |

Process flow for setting up an AIF in India as per the AIF Regulations:

The establishment and registration process with the IFSCA typically takes two to three months, encompassing the time required for SEBI to evaluate the application.

Process flow for setting up an AIF in GIFT City:

4 Management and advisory relationships

4.1 How are alternative investment fund managers and advisers typically structured in your jurisdiction?

According to the Securities and Exchange Board of India (SEBI) (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations'), a manager appointed by the AIF to oversee its investments may take the form of either a person or an entity situated in India. Ordinarily, these managers are established as companies or limited liability partnerships (LLPs).

The manager of a SEBI-registered AIF must be established in India. During the certification process, SEBI will evaluate the professional qualifications and experience of the manager's key investment team, who will serve as employees, partners or directors of the investment manager. The SEBI application necessitates the investment manager to showcase the essential infrastructure required for effectively managing AIFs.

Within the International Financial Services Centre (IFSC), fund management entities (FMEs) have the flexibility to adopt various structures, such as a company, an LLP or a branch thereof. Alternatively, they can choose any other form as specified by the International Financial Services Centres Authority (IFSCA).

In the case of AIFs within the IFSC, FMEs can also be established as a branch of an entity already registered or regulated by a financial sector regulator in India or a counterpart in a foreign jurisdiction that engages in similar activities. This setup, whether a branch or a new legal entity, must possess adequate infrastructure – including office space, equipment, communication facilities and manpower – commensurate with the scale of its operations in the IFSC. Additionally, if an FME opts to establish a branch in the IFSC, the branch operations must be segregated from those of the registered entity outside the IFSC. The IFSCA (Fund Management) Regulations, 2022 ('FM Regulations') also require the FME to have a principal officer and additional key management personnel in the IFSC, depending on the category of FME.

4.2 What are the advantages and disadvantages of these different types of structures?

For a thorough exploration of the pros and cons related to various structural choices, please see question 2.3. Additionally, question 8.2 offers valuable insights into the tax considerations relevant to AIF managers and investment advisers.

4.3 Must alternative investment fund managers be authorised or licensed in your jurisdiction?

Investment managers of AIFs need not register separately with SEBI in order to manage the AIF. Regulation is directed at the fund rather than the manager, and the manager is automatically registered when the fund completes its registration process. However, anyone offering investment advice for remuneration to clients or other entities must be registered with SEBI as an investment adviser under the SEBI (Investment Adviser) Regulations, 2013.

Additionally, in the case of an FME in the IFSC, located in Gujarat International Finance Tec (GIFT) City, authorisation from the IFSCA is required to engage in such activities.

4.4 If so, what criteria must be satisfied to obtain authorisation? Do any restrictions apply in this regard?

Requirements in India:

- The AIF manager must be based in India, with key investment team members being employees, partners or directors of the manager.

- SEBI will assess the professional qualifications and experience of the investment team during the registration process.

- At least one key team member must have a professional qualification in finance, accountancy, business management, commerce, economics, capital markets or banking from a university or institution recognised by the central government, a state government or a foreign university. Alternatively, a charter from the CFA Institute or any other qualification specified by SEBI will be accepted.

- At least one key team member must hold certifications as specified by the SEBI periodically.

- The manager or sponsor must have the necessary infrastructure and manpower to effectively discharge its activities.

Requirements in GIFT City:

- Infrastructure:

-

- FMEs in the IFSC can be established as a branch or a new entity.

- An FME's infrastructure – including office space, equipment, communication facilities and manpower – must be proportionate to its operations. The office should be dedicated, secured and accessible only by authorised person(s) of the FME.

- For a branch set-up, there must be effective ringfencing of operations from the registered entity outside the IFSC.

- Key personnel requirements:

-

- The FM Regulations mandate a principal officer and additional key management personnel in the IFSC, depending on the category of FME.

- Net worth requirements:

-

- Authorised FMEs: $75,000.

- Registered FMEs (non-retail): $500,000.

- Registered FME (retail): $1 million.

- Applicant and key individual requirements:

-

- The applicant, principal officer, directors/partners/designated partners, key managerial personnel and controlling shareholders must be fit and proper individuals at all times. A person is deemed 'fit and proper' if they have a record of fairness and integrity, including financial integrity, good reputation, character and honesty.

- Disqualifications would include:

-

- convictions for moral turpitude, economic offences or securities law violations;

- pending recovery proceedings or winding-up orders;

- insolvency, unreleased discharge or unsoundness of mind;

- orders restraining financial product dealings within the last three years;

- any adverse regulatory orders within the last three years;

- financial unsoundness, wilful defaulter status or fugitive economic offender declaration; and

- any other disqualification specified by the authority.

4.5 What is the process for obtaining authorisation and how long does this usually take?

AIF managers: As detailed in question 4.3, there is no requirement for a manager to seek a separate registration or licence for managing AIFs other than approvals as mentioned in the SEBI (Investment Adviser) Regulations, 2013.

FMEs in GIFT City:

- The IFSC in GIFT City operates as a special economic zone (SEZ), necessitating approval from SEZ authorities for each 'unit', including funds and FMEs.

- To register as an FME, an application must be submitted to the IFSCA in the prescribed format.

- Upon receiving registration, the FME can proceed to launch its scheme by submitting the private placement memorandum (PPM) to the IFSCA in advance.

- The setup and registration process with the IFSCA typically takes around two to three months.

4.6 What other requirements or restrictions apply to alternative investment fund managers and advisers in your jurisdiction?

The following additional requirements/restrictions/obligations apply to AIF managers:

- The AIF, key management personnel, trustee, trustee company, directors of the trustee company, designated partners or directors of the AIF, managers and their key management personnel must adhere to the specified Code of Conduct outlined in the Fourth Schedule of the SEBI (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations').

- The manager and either the trustee, the trustee company, the board of directors or the designated partners of the AIF are collectively responsible for ensuring compliance with the Code of Conduct specified in the Fourth Schedule of the AIF Regulations.

- The manager is accountable for every decision of the AIF, ensuring compliance with:

-

- regulations;

- the terms of the placement memorandum;

- agreements with investors;

- the fund documents; and

- the applicable laws.

- The manager is responsible for ensuring that AIF decisions comply with established policies and procedures, as well as other internal policies, subject to conditions specified by SEBI.

- The manager may form an investment committee (by any name) to approve AIF decisions, subject to conditions specified by SEBI.

- If the corpus of the AIF exceeds INR 5 billion, the sponsor or manager must appoint a custodian registered with the SEBI for safeguarding securities.

- The manager is prohibited from providing advisory services to any investor other than the clients of a co-investment portfolio manager, as specified in the SEBI (Portfolio Managers) Regulations, 2020, for investments in securities of investee companies where the AIF managed by it makes investments.

- The manager, trustee, trustee company, board of directors or designated partners must ensure the segregation and ring-fencing of assets and liabilities of each scheme of an AIF. This extends to segregating and ring-fencing bank accounts and securities accounts for each scheme.

- The manager must appoint a compliance officer responsible for monitoring compliance with the provisions of the act, rules, regulations, notifications, circulars, guidelines, instructions and any other directives issued by the SEBI.

4.7 Can an alternative investment fund manager impose restrictions on the issue, redemption or transfer of interests in the funds under management?

An AIF manager has the authority to impose limitations on the issuance, redemption or transfer of interests concerning the AIFs under its management.

Investors/contributors are not permitted to solicit or transfer/pledge any of their units, capital commitment, interests, rights or obligation with regard to the AIF without the prior written consent of the investment manager, which may be denied by the investment manager. The transfer is subject to the following requirements:

- The proposed transferee/pledgee is an eligible person;

- The proposed transfer/pledge will be subject to the execution of necessary documentation by the transferee/pledgee and the transferor/pledgor, as may be stipulated/prescribed/required by the investment manager; and

- The proposed transfer/pledge will not contravene any applicable law or policy of the government or otherwise is not prejudicial to the interests of the trust/fund. In the event of the transfer of units by a contributor, the new contributor will execute a deed of adherence acknowledging that it will be bound by the terms and conditions of the trust documents, in accordance with the form specified in the contribution agreement.

Conditions for redemption:

- Closed-ended AIFs: Closed-ended AIFs have the authority to limit transfers or redemptions of investor interests at the discretion of their investment managers. Closed-ended AIFs are not allowed to provide priority exit rights to investors.

- Open-ended funds: For open-ended funds, the circumstances under which a manager can restrict redemptions are subject to detailed disclosures in the PPM or as required by law. The suspension of redemptions is permissible only under exceptional circumstances, serving the best interests of the AIF investors. During the suspension period, new subscriptions cannot be accepted by the manager. Any suspension of redemptions for open-ended schemes must be promptly reported to SEBI.

Post the redemption of units and payment of consideration, the contributor will cease to be entitled to any rights in respect thereof and accordingly its name will be removed from the list of contributors with respect to such units. Units that are not redeemed by the AIF will be redeemed as per the applicable laws after the term comes to an end.

4.8 Are there any requirements regarding the ownership of alternative investment fund managers? If so, please provide details.

The investment manager of an AIF is acknowledged as a regulated entity according to the AIF Regulations. By virtue of this recognition, an AIF manager is eligible to receive up to 100% foreign investment through the automatic route, circumventing the need for government approval, unless the manager has engaged in other unregulated financial services activities.

The AIF Regulations do not prescribe a maximum limit for investments by the fund manager or sponsor. However, through its informal guidance, SEBI has emphasised that the quantum of investment by the fund manager or sponsor should align with the continuing interest obligations applicable to the AIF, ensuring coherence and compliance with regulatory requirements.

Category I and II AIFs: The manager of a SEBI-registered AIF must be established in India. The manager or sponsor of the AIF must maintain a continuing interest in the AIF, constituting a minimum of 2.5% of the corpus or INR 50 million, whichever is lower. This interest must take the form of a direct investment in the AIF and should not be facilitated through the waiver of management fees.

Category III AIFs: For Category III AIFs, the stipulated continuing interest is higher, set at a minimum of 5% of the corpus or INR 100 million, whichever is lower.

Moreover, the manager or sponsor must transparently disclose its investment in the AIFs to investors. This disclosure ensures clarity and openness regarding the financial involvement of the manager or sponsor in the AIF, fostering trust and transparency within the investment framework.

Angel funds: The manager or sponsor must maintain a consistent stake in the angel fund of at least 2.5% of the corpus or INR 5 million, whichever is lower. Importantly, this continuing interest must not be achieved through the waiver of management fees.

Corporate debt market development funds: The manager or sponsor must maintain a continuing interest in the fund amounting to no less than INR 50 million. This commitment must be in the form of a direct investment in the fund and should not be fulfilled through the waiver of management fees.

Change in control: SEBI typically asks AIF managers during the application stage to provide information on the shareholding or partnership interest of the manager entity. Regulation 20(13) of the AIF Regulations stipulates that any change in control of the manager or sponsor requires notification with and approval by SEBI. SEBI may impose fees and set other conditions, with which the AIF must comply. SEBI has issued the following circulars providing guidance on the process and fee payment requirements of change in control:

- SEBI Circular SEBI/HO/AFD-1/PoD/P/CIR/2022/155 of 17 November 2022 provides as follows in relation to the fee for a change in control of manager/sponsor or a change in manager/sponsor of an AIF:

-

- A fee, equivalent to the AIF's registration fee, is applied for changes in control or management.

- The fee must be paid by the manager or sponsor within 15 days and cannot be passed on to investors.

- If both the manager and sponsor change simultaneously, only a single registration fee is charged.

- No fee is charged in specific scenarios, such as where the manager is taking control by replacing the sponsor or where sponsors are exiting in AIFs with multiple sponsors.

- Prior approval given by SEBI is valid for six months from the approval date.

- According to SEBI Circular CIR/IMD/DF/14/2014 of 19 June 2014, read with SEBI Circular CIR/IMD/DF/16/2014 of 18 July 2014, the following process must be followed by AIFs in case of a change in control:

-

- Existing unit holders that do not wish to continue after the change should be given an exit option. They must be given at least one month to express their dissent.

- For open-ended schemes, two exit options are available:

-

- buying out units from dissenting investors at market price; or

- redeeming units by selling underlying assets.

- For closed-ended schemes, the exit option involves buying out units from dissenting investors. Prior to this, the units' valuation is determined by two independent valuers and the exit is at a value not less than the average of the two valuations. The entire process, from the last date of the offer for dissent, should be completed within three months.

- SEBI Circular SEBI/HO/IMD-1/ DF9/CIR/2022/032 of 23 March 2022 has streamlined the process for approving changes in the control of the sponsor and/or manager of an AIF involving a scheme of arrangement under the Companies Act, 2013. The key points are follows:

-

- Applications for the change in control must be submitted to SEBI before filing with the National Company Law Tribunal (NCLT).

- Upon ensuring compliance with the regulatory requirements, SEBI will grant in-principle approval.

- The in-principle approval is valid for three months from the date of issuance. During this period, the applicant must apply to the NCLT.

- Within 15 days of the NCLT order, the applicant must submit:

-

- an application for final approval;

- a copy of the NCLT order approving the scheme;

- a copy of the approved scheme;

- a statement explaining any modifications and reasons; and

- details of compliance with SEBI's in-principle approval conditions.

4.9 Can alternative investment fund managers delegate to third-party investment managers or investment advisers? If yes, please provide details of any specific requirements.

The manager has the option to establish an investment committee, subject to conditions set by the SEBI. Members of the investment committee must ensure that their decisions align with specified policies. However, this provision does not apply to an AIF where each investor, excluding certain individuals affiliated with the fund:

- has committed to investing at least INR 700 million; and

- has provided a waiver regarding compliance with this regulation, as specified by SEBI.

Further, managers are bound by the SEBI Guidelines CIR/MIRSD/24/2011 on Outsourcing of Activities of 15 December 2011. SEBI's outsourcing principles emphasise adherence to regulatory guidelines, such as the following:

- The manager must conduct thorough due diligence when selecting and monitoring third-party services.

- A comprehensive policy must be in place to guide outsourcing activities.

- A risk management programme must be established.

- Outsourcing must not compromise obligations to customers and regulators.

- All outsourcing relationships must be governed by written contracts outlining rights, responsibilities and expectations.

- Additionally, steps must be taken to ensure the protection of confidential information from unauthorised disclosure.

The outsourcing of core business activities and compliance functions is prohibited.

4.10 Can alternative investment fund manager provide investment management services to clients other than alternative investment funds? If yes, do any additional requirements apply?

Managers can extend their investment management services beyond AIFs. However, in doing so, they must:

- provide the relevant services;

- meet licensing requirements; and

- serve an appropriate clientele.

Importantly, these extended services must not conflict with the regulations governing AIFs. Top of Form

They can engage in the following activities:

- They can provide portfolio management services to designated mandate accounts by obtaining registration under the SEBI (Portfolio Managers) Regulations, 1993.

- They can also cater to retail funds in accordance with the SEBI (Mutual Funds) Regulations, 1996.

- Where resident Indian clients are advised, the manager must secure registration under the SEBI (Investment Adviser) Regulations, 2013.

The manager is restricted from offering advisory services to any investor except the clients of the co-investment portfolio manager, as outlined in the SEBI (Portfolio Managers) Regulations, 2020. This restriction specifically applies to investments in securities of investee companies where the AIF managed by the manager is making an investment.

To comply with SEBI regulations, managers must meet some requirements, which are outlined in questions 4.4 and 4.6.

5 Marketing

5.1 Is the marketing of alternative investment funds subject to authorisation in your jurisdiction?

The Securities and Exchange Board of India (SEBI) (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations') and the International Financial Services Centres Authority (IFSCA) (Fund Management) Regulations, 2022 ('FM Regulations') stipulate that AIFs can raise funds through private placement, facilitated by the issuance of a private placement memorandum (PPM). These regulations provide detailed guidelines on the specific information required to be disclosed within the PPM. Given the confidential nature of PPMs, they cannot be marketed directly. Instead, only a concise summary document is shared and discussed. Distributors exclusively engage with clients, while the fund pitch and detailed explanations are conducted by the fund management team, ensuring adherence to confidentiality and regulatory protocols.

SEBI Circular SEBI/HO/AFD/PoD/CIR/2023/054 of 10 April 2023 grants AIF managers the authorisation to engage potential investors through SEBI-registered intermediaries such as independent advisers and portfolio managers. In this circular, SEBI clarified that investors onboarded in the AIF through registered intermediaries would participate via a 'direct plan' and should not be subject to any placement fee by the AIF, as these investors are already being charged by the registered intermediaries.

Conversely, managers also have the option to approach potential investors through distributors, constituting an 'indirect plan'. For Category I and II AIFs, up to one-third of the total distribution fee/placement fee may be paid to distributors upfront, with the remaining fee disbursed on an equal trilateral basis over the fund's tenure. In the case of Category III AIFs, any distribution fee/placement fee is to be charged to investors solely on an equal trilateral basis. Notably, no upfront distribution fee/placement fee should be directly or indirectly charged by Category III AIFs to their investors.

Marketing AIFs through a PPM necessitates registration and approval from the local regulator, SEBI. In the context of a fund in the International Financial Services Centre (IFSC) at Gujarat International Finance Tec City, the fund management entity (FME) must proactively submit the PPM to the IFSCA for advance review. Notably, for venture capital schemes in the IFSC, the filing of scheme documents follows a streamlined process, known as the 'green channel', allowing schemes to be immediately opened for subscription by investors upon filing with the IFSCA.

5.2 If so, what criteria must be satisfied to obtain authorisation? Do any restrictions apply in this regard?

The PPM serves as the pivotal legal marketing document for an AIF, encompassing comprehensive material information. Regulation 11 of the SEBI (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations') stipulates that the PPM must encompass essential details, including information about:

- the AIF;

- its manager;

- the key investment team;

- the sponsor;

- the fund's investment objective, strategy and process;

- the target investors;

- the corpus;

- associated fees and expenses;

- the fund's leverage approach; and

- restrictions on redemptions, transfers and withdrawals.

The PPM should also address:

- potential conflicts of interest;

- risk factors; and

- the disciplinary history of involved parties.

In cases where the AIF discloses a manager's track record, a benchmarking report is required. SEBI has prescribed a standardised PPM format for most AIFs, exempting angel funds and those with each investor committing a minimum capital contribution of INR 700 million.

For IFSC funds, the PPM must outline:

- the investment objective;

- the target investors;

- the proposed corpus;

- the investment style;

- the methodology;

- tenure;

- fees;

- risk management practices;

- leverage calculation; and

- key management personnel.

It should also include relevant information about the FME and the scheme.

5.3 What is the process for obtaining authorisation and how long does this usually take?

See question 5.1 for additional context on this query. Typically, the documentation process for marketing and the AIF application takes two to three weeks. Conversely, the vetting and approval of the application, along with associated documentation by SEBI, typically takes around two months.

5.4 To whom can alternative investment funds be marketed?

AIFs are designed for private placement and can be marketed exclusively to a select group of sophisticated and private investors, encompassing:

- funds of funds;

- government institutions;

- corporations;

- public sector undertakings;

- private banks;

- insurance companies;

- eligible pension funds;

- global development financial institutions;

- multilateral organisations; and

- high-net-worth individuals.

Indian entities such as banks, insurance companies and pension funds are subject to sectoral regulators' specific investment restrictions in AIF units. Therefore, their investments must adhere to these sectoral regulations in addition to compliance with the AIF Regulations.

AIFs have the flexibility to attract investments from retail investors, including high-net-worth individuals, with minimum ticket sizes specified by the AIF Regulations or the FM Regulations. For SEBI-registered AIFs, the standard minimum ticket size is INR 10 million, although angel funds and special situation funds have reduced requirements of INR 2.5 million and INR 100 million respectively. Exceptions to the minimum ticket size are granted for:

- accredited investors;

- deemed accredited investors; and

- employees, directors and partners of the investment manager.

SEBI has introduced the notion of an 'accredited investor' in India. This accreditation is primarily determined by:

- net-worth criteria; and

- endorsement from an accreditation agency.

Accredited investors are expected to be well informed and well advised on investment matters. Consequently, regulatory relaxations have been instituted to facilitate the involvement of accredited investors and the pooling of such investors in large-value funds.

For IFSC funds, the minimum ticket size is $150,000, with similar exemptions for:

- accredited investors;

- deemed accredited investors; and

- employees, directors and partners of the investment manager.

5.5 What are the content criteria that marketing materials for alternative investment funds must satisfy?

Marketing materials for AIFs must adhere to the specified requirements outlined in the AIF Regulations. The PPM must encompass comprehensive information about both the AIF and the AIF manager, with further details provided in question 5.2.

5.6 What other requirements or restrictions apply to marketing materials for alternative investment funds?

The AIF Regulations strictly limit the marketing of AIFs to private placement through the issuance of a PPM. Public advertising for investment by the manager is not permitted.

AIFs are marketed through private placement, involving the issuance of a PPM to individuals or entities both within and outside India. However, no AIF can have more than 1,000 investors.

If an AIF is established as a company, it must adhere to the private placement procedures outlined in the Companies Act, 2013.

To understand the direct and indirect plan of SEBI, please see question 3.1.

5.7 Can alternative fund managers from other jurisdictions market alternative investment funds in your jurisdiction without authorisation?

An AIF is restricted from making a public offer or extending invitations to the general public for the subscription of its units. Instead, it is exclusively authorised to raise funds through private placement, targeting sophisticated investors.

For resident Indians, offshore investments are subject to adherence with:

- the conditions outlined in the Foreign Exchange Management (Non-debt Instruments) Rules, 2019; and

- the Liberalised Remittance Scheme of the Reserve Bank of India.

The marketing offshore funds in India must be approached with caution; and if the offer meets the criteria for a public offering under Indian law, registration of the offering document is obligatory.

5.8 Is the appointment of local marketing entities required in your jurisdiction?

Individuals offering 'investment advice' to resident Indians must obtain registration in accordance with the SEBI (Investment Adviser) Regulations, 2013. Thus, local marketing entities may be appointed subject to a condition that they are regulated by SEBI. Offering marketing through unregulated entities is not permitted. Therefore, the promotion of offshore funds to Indian residents should be structured with legal counsel.

5.9 Is it possible to market alternative investment funds to retail investors in your jurisdiction? If so, are there specific requirements?

Please see question 5.4.

6 Investment process

6.1 Do any investment or borrowing restrictions apply to the portfolios of alternative investment funds?

Alternative investment funds (AIFs) are limited to investing solely in shares and securities as defined under Section 2(h) of the Securities Contracts (Regulations) Act, 1956. AIFs are not permitted to extend loans. However, this prohibition does not apply to special situation funds (SSFs), which are allowed to obtain 'stressed loans' according to Clause 58 of the Master Direction – Reserve Bank of India (Transfer of Loan Exposures) Directions, 2021 (upon their inclusion in the Annex of the Master Direction). These SSFs must adhere to the due diligence requirements for their investors mandated by the Reserve Bank of India.

In the International Financial Services Centre (IFSC), closed-ended schemes of restricted (non-retail) funds and family investment funds may venture into physical assets such as real estate, bullion, art and other physical assets specified by the IFSC Authority (IFSCA). Nevertheless, investments by an IFSC fund in India are subject to the conditions applicable to foreign investments in India. Depending on the nature of the investment and the investment strategy, this could affect the nature of instruments/securities in which investments may be made and regulatory approvals may be required for certain investments.

The conditions applicable to Category I and II AIFs are as follows:

- There is a maximum investment of 25% of investable funds in one portfolio company. As per the SEBI (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations'), 'investable funds' are defined as "the corpus of the scheme of Alternative Investment Fund net of expenditure for administration and management of the fund estimated for the tenure of the fund".

- Large-value funds (LVFs) in Categories I and II can invest up to 50% of their investable funds in one portfolio company.

- Category I AIFs may have additional restrictions based on sub-category – for example, infrastructure funds must invest at least 75% in infrastructure projects.

The conditions applicable to Category III AIFs are as follows:

- A maximum of 10% of their investable funds may be invested in one portfolio company. However, in case of listed equity, the 10% limit applies to either the investable funds or the net asset value (NAV) of the scheme.

- LVFs in Category III can invest up to 20% of their investable funds in one portfolio company. However, in case of listed equity, the 20% limit applies similarly to either the investable funds or the NAV.

The conditions applicable to FMEs in the IFSC are as follows:

- FMEs are restricted from investing more than 10% of the scheme's corpus. In the case of restricted, open-ended schemes, the upper limit for investments in the securities of unlisted companies is 25% of the scheme's corpus.

- Any substantial deviation from the fund strategy may be implemented, contingent upon obtaining consent from at least two-thirds of the investors by value.

Borrowings: Category I and II AIFs are restricted from borrowing funds directly or indirectly, and from engaging in any form of leverage, except to fulfil temporary funding needs for a maximum of 30 days, on up to four occasions per year, and not exceeding 10% of the investable funds.

In contrast, Category III AIFs have the flexibility to employ leverage or borrowings, contingent upon investor consent and subject to a maximum limit defined by the Securities and Exchange Board of India (SEBI), which currently stands at twice the NAV. Adequate disclosures are essential for both investors and SEBI.

SEBI Order QJA/KS/AFD-1/AFD-1-SEC/27020/2023-24 of 31 May 2023 pertains to Category I AIFs – specifically infrastructure funds – and provides that the pledging the securities of portfolio entities to raise capital at the portfolio entity level goes against the AIF Regulations.

Under the IFSCA (Fund Management) Regulations, 2022, there are no borrowing or leverage limitations, as long as the private placement memorandum includes appropriate disclosures. Furthermore, the respective FME must establish a robust risk management framework aligned with the scheme's complexity and risk profile.

6.2 Are there any specific legal or regulatory requirements regarding investments in particular assets?

The AIF Regulations mandate specific portfolio composition requirements for different categories and sub-categories of AIFs.

For Category I AIFs, the requirements are as follows:

- Venture capital funds must invest at least two-thirds of their investible funds in unlisted equity shares or equity-linked instruments of venture capital undertakings or companies listed or proposed to be listed on small and medium-sized enterprise (SME) exchanges. Additionally, up to one-third of their investible funds can be invested in initial public offerings of venture capital undertakings, debt instruments, preferential allotment of equity, or equity-linked instruments of financially weak companies and special purpose vehicles created for investment purposes.

- SME funds must allocate a minimum of 75% of their investible funds to unlisted securities, partnership interests of venture capital undertakings, or investee companies that are SMEs or listed on SME exchanges.

- Social venture funds should invest a minimum of 75% of their investible funds in unlisted securities or partnership interests of social ventures.

- Infrastructure funds must invest at least 75% of their investible funds in unlisted securities, partnership interests of venture capital undertakings, investee companies or special purpose vehicles involved in infrastructure projects.

Category II AIFs must commit at least 50% of their investible funds to unlisted investee companies.

Category III AIFs have no specific portfolio allocation restrictions, except for the general diversification requirement, enabling them to:

- invest in:

-

- listed or unlisted investee companies;

- derivatives; and

- complex products; and

- engage in commodity derivatives with physical settlement.

Funds of funds, which invest in units of other AIFs, are categorised as Category I, II or III. They can invest in a manner corresponding to their category within the AIF framework, with no allowance for investing in other funds of funds AIFs.

7 Reporting, governance and risk management

7.1 What key disclosure requirements apply to alternative investment funds in your jurisdiction?

A private placement memorandum (PPMs) must include comprehensive information on the alternative investment fund (AIF). This includes crucial details such as:

- the background of the key investment team of the manager;

- the identified target investors;

- the specified tenure of the AIF or scheme;

- the outlined investment strategy; and

- the employed risk management tools.

The Securities and Exchange Board of India (SEBI) (Alternative Investment Funds) Regulations, 2012 ('AIF Regulations') do not impose legislative requirements concerning the disclosure of information by AIFs related to environmental, social and governance (ESG) factors. Nevertheless, funds have the flexibility to incorporate ESG considerations as an investment strategy, leveraging them to attract capital from investors that align with such principles.

In contrast, the International Financial Services Centres Authority (IFSCA) (Fund Management) Regulations, 2022 ('FM Regulations') establish an ESG framework for fund management entities (FMEs). FMEs managing assets exceeding $3 billion must:

- comply with sustainability-related requirements; and

- establish pertinent policies on governance and sustainability.

The AIF Regulations stipulate various disclosure requirements that AIFs must fulfil periodically. These encompass:

- financial, risk management, operational, portfolio and transactional information; and

- details about regulatory inquiries or legal actions in any jurisdiction.

Additionally, AIFs categorised as either Category I or Category II must annually furnish financial specifics of their portfolio companies and information concerning significant risks and corresponding mitigation strategies. For Category III AIFs, these reports must be submitted on a quarterly basis within 60 days of the quarter's end. SEBI retains the authority to request any necessary clarification or information from the investment manager, with compliance expected within the specified timeframe.

Please see the disclosures mandated for AIFs in the PPM, detailed in question 5.2, for specific information.

7.2 What key reporting requirements apply to alternative investment funds in your jurisdiction?

Know-your-customer (KYC) requirements: As per the SEBI Circular of 21 July 2016, coupled with Rule 9(l)(1) of the Prevention of Money Laundering (Maintenance of Records) Amendment Rules, 2015, SEBI-registered intermediaries must conduct the initial KYC process for their clients. This involves in-person verification and the timely uploading of investor/client data to both the Central KYC Records Registry and the KYC Registration Agency systems within 10 days of establishing an account-based relationship with an investor/client.

During the application stage, AIF managers are frequently required by SEBI to disclose the shareholding/partnership interest of the manager entity. Any change of control within the manager/sponsor necessitates notification and approval processes, involving both investors and SEBI.

Reporting requirements: AIFs must submit reports to SEBI on a quarterly and annual basis. Managers must also furnish information and reports to SEBI, as requested periodically, within the stipulated deadlines. Category III AIFs specifically must submit quarterly reports on the leverage undertaken.

In addition to regulatory reporting, AIFs must deliver annual reports to investors, encompassing financial information and pertinent risks. Notably, investors often include contractual provisions requiring managers to furnish additional information regarding the fund and its portfolio entities.

Additionally, the manager must generate a compliance test report and promptly submit it to the relevant entities based on the AIF's structure. In the case of an AIF established as a trust, the report must be submitted to both the trustee and the sponsor. For other AIF structures, the CTR is to be submitted directly to the sponsor.

New reporting guidelines: The AIF Regulations and the SEBI Master Circular for AIFs of 31 July 2023 mandate the submission of quarterly reports by AIFs to SEBI. These reports play a crucial role in the monitoring and regulation of AIFs' activities.

In a collaborative effort with industry associations such as the Indian Venture and Alternate Capital Association and Equalifi, SEBI has introduced a revised reporting format. This initiative aims to standardise the compliance standards and simplify reporting processes for AIFs.

7.3 What key governance requirements apply to alternative investment funds in your jurisdiction?

The AIF Regulations establish a comprehensive organisational framework to ensure the effective governance of AIFs. This framework defines the roles, responsibilities and liabilities of key entities, including the sponsor, manager, trustee and, where applicable, the decision-making investment committee. The AIF Regulations institute a fiduciary duty for AIF managers and sponsors, emphasising the prioritisation of investor interests. Mandated disclosure of conflicts of interest to investors is a key requirement, with AIF managers responsible for implementing policies to identify, monitor and mitigate such conflicts. The signing and recording of the PPM are central processes to fund management, involving comprehensive review, approval and subsequent signatures by relevant stakeholders including trustees and sponsors.

The key entities for ensuring good governance include the following: