- within Finance and Banking topic(s)

- within Finance and Banking topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United Kingdom

- with readers working within the Accounting & Consultancy, Advertising & Public Relations and Basic Industries industries

Introduction

In recent years, the Financial Intelligence Unit, India ("FIU-IND") has significantly sharpened its enforcement approach under the Prevention of Money Laundering Act, 2002 ("PMLA"). The agency, which serves as India's central authority for analysing suspicious financial transactions, has increasingly demonstrated an assertive posture in investigating and prosecuting AML compliance violations. From imposing substantial monetary penalties to mandating sweeping internal reforms, FIU-IND's actions reflect a robust shift toward active supervision and accountability.

This regulatory evolution has implications for a broad range of businesses, particularly those classified as PMLA reporting entities ("REs") under the PMLA. The recent trend signals a move beyond traditional banking institutions, encompassing regulated financial institutions, NBFCs, payment gateway companies, and crypto service providers.

Common Grounds for Prosecution

An analysis of recent enforcement orders reveals several recurring themes:

1. Maintenance and reporting of financial transactions: The most prevalent compliance failure relates to the maintenance and reporting of financial transaction records. Under Section 12 of the PMLA and Rule 3 of the PML Rules, REs are mandated to maintain comprehensive documentation of all financial transactions to enable proper audit trails. However, many institutions were either unable to furnish such records on demand or failed to structure their data systems in a way that supports regulatory reconstruction.

2. Delayed or failure to file Suspicious Transaction Reports: A second, and more critical, failure is the delayed or failure to file Suspicious Transaction Reports ("STRs"). STR filing is a fundamental requirement of AML enforcement. Despite generating alerts or facing apparent red flags, several entities neglected to file suspicious transaction reports on time, with some failing to do so altogether. In cases where suspicious transaction reports were eventually filed, they often fell outside the statutory seven-day reporting window, exposing the entity to cumulative penalties, since each day's delay is treated as a separate violation.

3. Deficiencies in Know Your Customer Process: The third major compliance lapse involves shortcomings in "know your customer" processes and inadequate due diligence. These typically include incomplete documentation, weak verification protocols for beneficial ownership, and a lack of ongoing client profiling. In some instances, entities outsourced these obligations to unregulated third parties, thereby introducing systemic risk. The reliance on such arrangements without supervisory control or audit oversight led to regulatory intervention.

Failure of Internal Control Mechanisms

Insight: These deficiencies indicate not just procedural gaps but a cultural disregard for the importance of internal compliance. The lack of auditability and accountability around decision-making processes undermines the integrity of the entire AML framework. It leaves entities vulnerable to both regulatory and reputational risks.

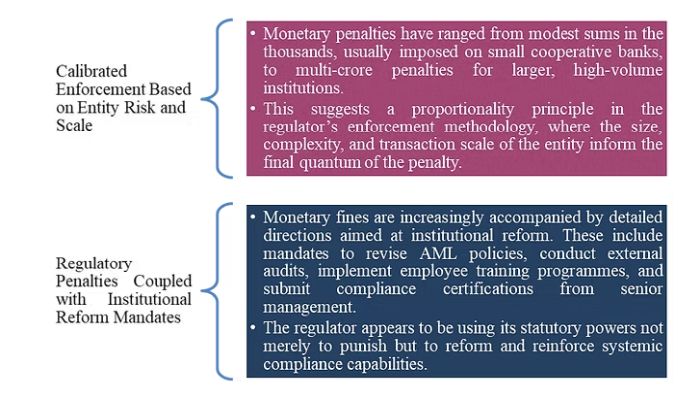

Nature and Quantum of Penalties

Corrective Action During Proceedings

In several cases, FIU-IND closed proceedings or reduced penalties where the regulated entity demonstrated proactive remediation during the investigation.

Insight: This regulatory behaviour indicates a preference for genuine, substantive compliance over symbolic adherence. It also provides a window of opportunity for entities under scrutiny to address gaps and demonstrate a commitment to systemic improvement.

Historical Oversight and Retrospective Action

High-Risk Business Models Under Focus

Entities operating with complex digital or decentralised platforms have received disproportionately high regulatory attention, including:

Insight: The rationale is evident, such entities typically handle high volumes, facilitate cross-border transactions, and may rely on third-party agents for customer onboarding, all of which elevate money laundering risks. These business models often operate outside traditional financial infrastructure, making it imperative for them to adopt rigorous compliance protocols that match or exceed those expected of conventional banks. The trend underscores a regulatory expectation that innovation must not come at the cost of compliance, and that technological sophistication must be matched with AML readiness.

Regulatory Expectations and Governance Culture

The analysis of FIU-IND's orders makes one thing clear:

"Compliance is no longer a middle-office function; it is a board-level responsibility. Principal Officers and Designated Directors are not merely nominal appointments; they are personally accountable for institutional adherence to AML obligations. Several orders have required certifications signed by these individuals, reflecting the personal liability embedded in the compliance framework."

Moreover, companies are expected to demonstrate a culture of compliance that permeates all levels of the organisation. This includes periodic internal audits, training for frontline employees, integration of regulatory alerts into client monitoring systems, and independent review of high-risk accounts. Institutions that fail to operationalise these expectations will find themselves exposed not just to penalties but also to loss of credibility with investors, regulators, and customers alike.

Three Immediate Steps If You Receive a FIU-IND Show Cause Notice

Receiving a FIU-IND show cause notice from FIU-IND is not a routine correspondence; it is a regulatory inflexion point that demands urgent, coordinated action.

Treating the notice as an opportunity for institutional correction, rather than merely a legal threat, has, in several cases, influenced the outcome of proceedings. FIU-IND has shown a consistent willingness to reward transparency, accountability, and proactiveness.

Strategic Takeaways for Indian Companies

For Indian companies, particularly those engaged in financial services or offering technology-driven financial solutions, the lessons are unequivocal. Compliance with PMLA is not a checkbox exercise; it is a dynamic, ongoing obligation that requires institutional investment in people, systems, and processes.

Insight: companies must adopt a preventive rather than reactive approach to compliance. Waiting for regulatory scrutiny to discover gaps is no longer a viable strategy. Instead, companies must actively identify vulnerabilities, fix systemic shortcomings, and document remedial actions. As enforcement deepens and expectations evolve, only those organisations with a robust culture of compliance, guided by leadership commitment, will be positioned to navigate the emerging regulatory landscape without disruption.

Conclusion

The recent trend in FIU-IND prosecutions highlights a maturing enforcement ecosystem grounded in precision, accountability, and sectoral equity. Indian companies, especially those operating in or adjacent to the financial system, must recognise that AML/CFT compliance is now an essential facet of corporate risk management. The cost of non-compliance is no longer limited to financial penalties; it encompasses reputational damage, operational delays, and governance scrutiny. By prioritising preventive compliance and fostering institutional resilience, Indian businesses can not only meet the regulatory bar but also build trust and credibility in a market that is increasingly guided by ethical finance and lawful conduct.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]