- within Strategy topic(s)

- within Strategy, Government, Public Sector and Energy and Natural Resources topic(s)

Background

The Electronics Manufacturing Sector in India has experienced significant growth over the past decade, emerging as one of the fastest-growing and most strategic industries globally due to ongoing digitisation.

With electronics permeating nearly every sector of the economy, the industry holds immense economic and technological significance.

The Ministry of Electronics and Information Technology (MeitY) had notified the Phased Manufacturing Programme, National Policy on Electronics 2019, and Production Linked Incentives (PLI) to boost electronics manufacturing in the country.

As a result of these initiatives, the domestic production of electronic goods increased five times from INR 1.90 lakh crore (USD 30 Billion) in FY2014-15 to INR 9.52 lakh crore in FY2023-24 (USD 115 Bn) (industry figures) at a Compound Annual Growth Rate (CAGR) of more than 17%.

Further, the PLI scheme for Large Scale Electronics Manufacturing (LSEM) has also catalysed growth of electronics manufacturing led by mobile phones, resulting in exponential growth in electronics export from INR 81,822 crores in FY 2020-21 to INR 2,41,157 crores in FY 2023-24 at the CAGR of more than 43%.

India's electronics manufacturing landscape has evolved in phases—from assembling finished goods to sub-assemblies and now advancing into deep component manufacturing.

To help India move up the electronics value chain, it is crucial to foster a supportive ecosystem for domestic manufacturing of components and sub-assemblies.

Components are the heart of electronics products and constitute a significant part of the total value of the finished product

Domestic component manufacturing would not only lead to a significant increase in the domestic value addition but also result in savings in significant foreign exchange by reducing imports.

Accordingly, the Central Government has launched the Electronics Component Manufacturing Scheme ('ECMS'), notified on April 8, 2025, to achieve "Atmanirbharta in electronics supply chain ecosystem" by offering incentives for component manufacturing in India. Guidelines for the Operation of the Electronics Component Manufacturing Scheme have also been issued on April 26, 2025.

Salient features of the Scheme

- ECMS aims to deepen the manufacturing ecosystem, reduce import dependency, and establish India as a global hub for electronics production.

- The scheme has a total budget outlay of INR 22,919 crores.

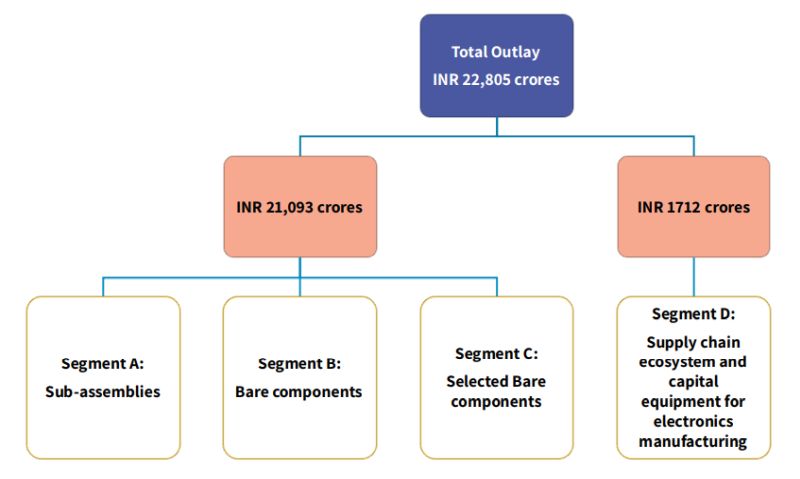

- The target segments under the Scheme and the outlay for each of the segments are depicted in the diagram below:

- The overall tenure of the scheme is 6 years with a 1 year gestation period, i.e., March 31, 2032.

- The gestation period is applicable for target segments (A), (B) and (C).

- Financial Year (FY) 2024-25 shall be treated as the base year for the computation of turnover linked incentive under the scheme.

- The applicant may opt for a gestation period of one year and in such cases, the base year would be FY 2025-26.

- The applicant may choose FY 2025-26 or FY 2026-27 as 1st year of incentive.

- The incentive shall be given for a period of 6 consecutive years from the 1st year of incentive opted by the applicant.

- For applicants selecting FY 2025-26 as the 1st year of incentive, the incentive period shall be from FY 2025-26 to FY 2030-31.

- For applicants selecting FY 2026-27 as the 1st year of incentive, the incentive period shall be from FY 2026-27 to FY 2031-32.

- For target segments (D), the scheme shall be open for applications initially for a period of 2 years from May 1, 2025. The fiscal support shall be available for investments made within 5 years from the date of acknowledgement of the application.

Governance Mechanism

- The scheme will be implemented by the Ministry through a nodal agency serving as the Project Management Agency (PMA).

- PMA will handle application receipt, scrutiny, issuance of acknowledgement letters, and submission of appraisal reports.

- MeitY will constitute a Governing Council (GC) chaired by the MeitY Secretary, with members from NITI Aayog, Department of Expenditure, Economic Affairs, DPIIT, DoT, and the Ministry of Heavy Industries.

- The GC will review appraisal reports from PMA and recommend proposals to the competent authority for approval.

Incentives

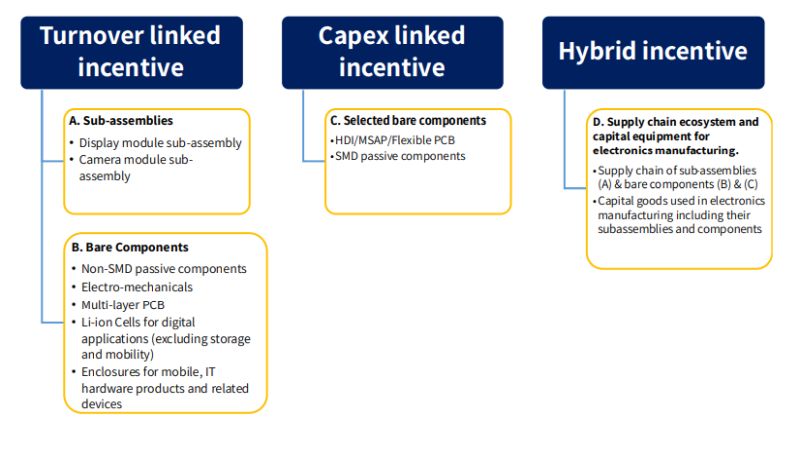

There are three types of incentives offered to the target segments under the scheme, as outlined below:

Basis of Incentives

Turnover linked incentive

- The incentive shall be given on net incremental sales (over the base year), multiplied by the incentive rate as given in Annexure I.

- For disbursement of turnover linked incentives, the incremental sales and cumulative incremental investment shall be mandatory criteria.

- Out of the total turnover linked incentive eligible rate, 1 % shall be disbursed only on meeting the cumulative incremental employment threshold criteria as per Annexure I.

- In cases where an applicant meets incremental sales threshold and cumulative incremental investment threshold but is unable to meet cumulative incremental employment threshold, the turnover linked incentive shall be disbursed after deducting 1 % (of incentive rate) from the eligible rate.

CAPEX incentive

- The incentive shall be given on eligible incremental capital expenditure, multiplied by the incentive rate as given in Annexure I.

- For the disbursement of CAPEX incentive, meeting the investment threshold and commencement of commercial production shall be mandatory criteria.

- Out of the total capex incentive rate (25%), 5% of the capex shall be disbursed only on meeting cumulative incremental employment threshold as per Annexure I.

- In cases where an applicant meets the investment threshold and commencement of commercial production but is unable to meet the cumulative incremental employment threshold, the capex incentive shall be given by deducting 5% (of incentive rate) from the eligible rate.

Qualifications and eligibility

General

- Greenfield as well as brownfield investment for the target segment shall be eligible.

- Separate applications for each Target Segment product.

- Multiple applications for the same product covered under the target segment shall not be eligible.

- If an applicant is having foreign direct investment (FDI), it should be in compliance with the FDI Policy circular 2020.

- As per cabinet approval dated March 28, 2025 (CD-076/2025), those acknowledged applications under the SPECS (notified vide notification no. W-18/30/2019-IPHW-MeitY dated April 1, 2020), which could not be considered due to limited budget availability, would be considered under ECMS for approval if they meet qualification and eligibility criteria under the scheme.

- Manufacturing through contract manufacturer(s) will not be considered eligible under the scheme.

- The applicants may outsource a few parts of manufacturing process to domestic manufacturers on a job work basis. However, such job work should not form a significant part of manufacturing.

- Ineligibility for incentive for any particular year shall not restrict the applicant from claiming incentive for subsequent years during the tenure of the scheme, provided eligibility criteria are met for such subsequent years.

- Ineligibility for incentive for any particular year shall not restrict the applicant from claiming incentive for subsequent years during the tenure of the scheme, provided eligibility criteria are met for such subsequent years.

- Eligibility under this scheme shall not affect eligibility under any other scheme and vice versa.

- However, investments/sales incentivised under any other scheme of the Government of India shall not be eligible for incentive under this scheme.

- The Scheme also provides for product specific criteria for incentive.

For Segments (A), (B) and (C)

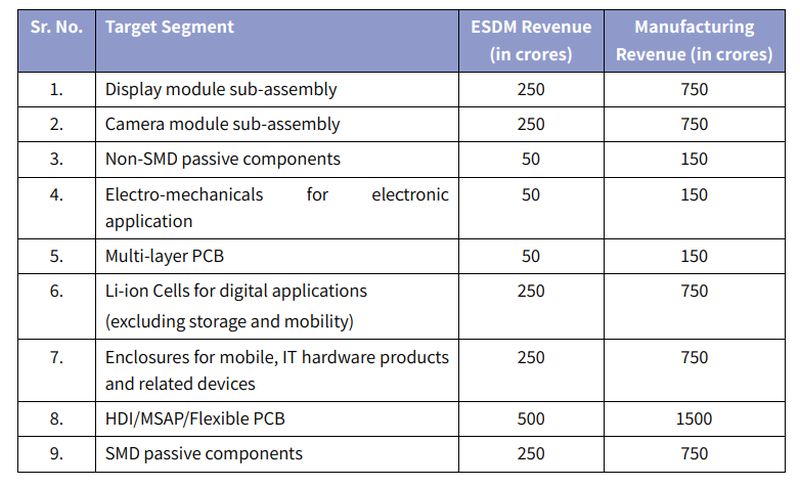

- The applicant, its group companies and joint ventures (JV) shall be required to meet either the minimum consolidated global ESDM revenue or manufacturing revenue for FY 2023-24 as indicated below:

- Companies using the calendar year must report revenue on a financial year basis.

- For JV applicants, revenue will be a weighted average based on shareholding. If the ESDM company holds the majority, JV revenue counts as ESDM revenue; otherwise, it will be treated as manufacturing revenue.

- The applicant, not meeting the global ESDM revenue threshold but meeting the manufacturing revenue threshold, shall submit details showing its technological capability for the target segment such as inhouse capability, binding term sheet agreement with a technology partner, Transfer of Technology agreement or any other relevant supporting document demonstrating technological capability.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]