On Budget Day 2024, the Dutch government announced that the gradual scaling back of the 30%-ruling to a 10%-ruling would be reversed. Instead, a 27%-ruling would be introduced, and the government announced that the salary norms would be increased exceeding the standard indexation. Until recently, the concrete plans were unclear. On 28 October last, the Dutch government sent the second amendment to the 2025 Tax Plan bill to the House of Representatives, in which the plans regarding the 30%-ruling are outlined. In this newsletter, we will elaborate on the details of the changes to the 30%-ruling and discuss the potential implications for you as an employer or employee.

Background

The 30%-ruling is a tax facility for foreign employees with specific expertise working in the Netherlands. Under this scheme, subject to conditions, employers can provide up to 30% of the employee's capped salary up to the WNT-standard (WNT-norm, in 2025: € 246,000) (Capped Wage) tax-free. The facility has been scaled back during the past years.

One of these measures concerns the gradual scaling back of the 30%-ruling to a 10%-ruling, which entered into force on 1 January 2024. The introduction of the scaling back of the 30%-ruling to a 10%-ruling evoked many reactions within the Dutch business community. In response to these reactions, the Ministry of Finance conducted a research on the effectiveness and the efficiency of the 30%-ruling and the ET-scheme earlier this year. This research showed that the gradual scaling back of the 30%-ruling to a 10%-ruling has a negative effect on the Dutch business climate and that maintaining a flat rate results to lower administrative burdens.

Therefore, as of 1 January 2025, the gradual scaling back of the 30%-ruling will be reversed.

Introduction of the 27%-ruling

The government has proposed to introduce a flat rate up to 27% of the Capped Wage as of 1 January 2027. This effectively turns the 30%-ruling into a 27%-ruling. For the years 2025 and 2026, the flat rate will be 30% of the Capped Wage for all incoming employees.

Increase of the salary norms

To qualify for the 30%-ruling, an incoming employee must possess specific expertise that is either not available or scarcely available in the Dutch labor market. This expertise requirement is primarily determined based on a salary norm. In 2024, incoming employees are considered to possess specific expertise if their taxable salary exceeds € 46,107. For incoming employees under 30 years old with a qualifying master's degree, this salary norm is € 35,048 in 2024.

The government has proposed to increase these salary norms as of 1 January 2027. This increase exceeds the standard indexation. The salary norm will be increased from € 46,107 to € 50,436 (subject to indexation). For incoming employees under 30 years old with a qualifying master's degree, the salary norm will increase from € 35,048 to € 38,338 (subject to indexation). It should be noted that the salary norms are indexed annually. Consequently, there will be an increase in the salary norms effective 1 January 2025, in addition to the previously mentioned increase on 1 January 2027.

Transitional arrangements

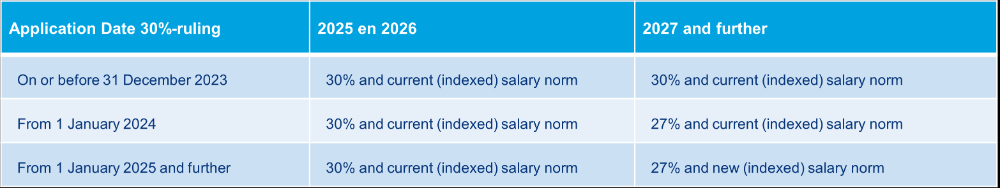

The following transitional rules have been announced:

- Incoming employees who applied the 30%-ruling before 2024

For this group, the flat rate of 30% will remain effective throughout the entire duration of the 30%-ruling. Additionally, they will retain the old (indexed) salary norms. This group will not be affected by the 27%-ruling and the increase in salary norms as of 1 January 2027.

- Incoming employees who applied the 30%-ruling for the first time in 2024

For this group, the flat rate of 27% will apply starting on 1 January 2027. However, they will retain the old (indexed) salary norms for the entire duration.

- Incoming employees who will apply the 30%-ruling for the first time in 2025 and further

For this group, no transitional rules will apply. Starting on 1 January 2027, the 27%-ruling and the increased (indexed) salary norms will apply.

Transitional rules and change of employer

In the event of a change of employer, the transitional law will remain applicable with the new employer, provided that a new employment contract is concluded within three months after the termination of employment with the previous employer.

Partial foreign taxpayer status and Capped Wage

The abolishment of the partial foreign taxpayer status, effective as of 1 January 2025, will proceed as planned. Additionally, the capping of the 30%-ruling to the Capped Wage, which entered into effect on 1 January 2024, will remain in effect.

Seconded Employees (from the Netherlands to a different country)

For seconded employees, it is proposed to limit the maximum tax-free allowance to 27%. Unlike incoming employees, no exception will be made for employees whose secondment started before 2024. However, the tax-free allowance for all seconded employees will be a maximum of 30% in the years 2025 and 2026.

Next steps

Despite the reversal of the gradual reduction of the 30%-ruling to a 10%-ruling, the newly announced changes impose significant administrative burdens, especially for payroll professionals. We recommend carefully determining the applicable salary norms for employees.

The 2025 Tax Plan, including the amendments, still requires approval from the Dutch Parliament. Should the proposals be adopted, these changes may have implications for certain employees.

After reading this newsletter, do you need further clarification on the potential consequences? Or are you interested in a no-obligation consultation? If so, please contact your Loyens & Loeff adviser or one of our tax advisers from our Employment & Benefits team. We will be happy to assist you.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.