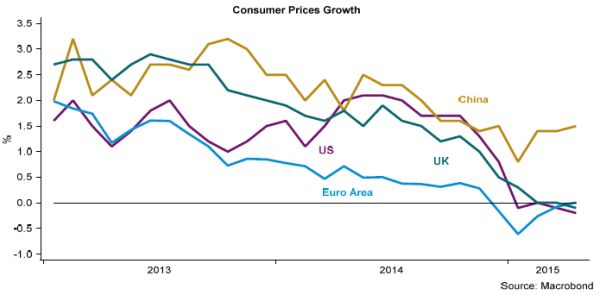

Global inflation levels remain subdued. Here we look at inflation in some of the larger economies to assess the current situation and what may happen over the remainder of the year.

Global Inflation Rates

In the UK headline annual inflation fell to -0.1%, the first negative rate since 1960. Falling petrol, food, gas & electricity and airfare inflation rates all contributed to the decline in April. Inflation will remain around zero for a few months yet, with the lower oil price effect staying in place until the anniversary of the sharp oil price drop later this year. At this point, the effect of the oil price drop will fall out of the annual rate of growth, pulling the inflation rate higher.

In the US inflation has fallen to -0.2%. The main driver of the fall into deflation has been energy prices which are more than 19% lower than a year ago. If we exclude energy, inflation is considerably higher at 1.8%, highlighting the strong downward pressure the oil price is exerting on headline inflation.

In the Euro Area headline inflation is currently zero, having moved into negative territory at the end of 2014. Energy price deflation is still the main drag, with such prices down almost 6% from a year ago. As in the other economies, once the anniversary of the oil price drop is reached, inflation should start to move higher. However, there are some countries which may struggle to rid their economies of deflationary effects. Greece, Portugal and Spain all had very weak or, in fact, negative inflation rates even before the oil price began to drop sharply.

In China, inflation is 1.5% and is being propped up by higher food prices. However, the consumer prices data is at odds with other data. For example, producer prices have been falling since early 2012. On top of this, in Q1, nominal GDP growth fell below real GDP growth for the first time since the financial crisis. This suggests that the economy may already be in deflation.

Clearly the sharp drop in the oil price has had a large effect on inflation across the world. The Brent oil price hit a low of around $47 per barrel in January. However, since then, the price has risen by around 40% to its current level of almost $66 per barrel. Although it should be noted that this level is still considerably lower than the peak of over $110 per barrel which was reached in the middle of 2014. This recent move, together with the base impact later this year, will help to pull energy price inflation upwards, and with it global inflation levels. Further out, the outlook for inflation will be reliant on, amongst other things, the outlook for labour markets and wage growth.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.