- within Intellectual Property topic(s)

- in United States

- within Intellectual Property topic(s)

- in United States

- with readers working within the Media & Information industries

- within Intellectual Property, Immigration and Technology topic(s)

If you are a technology company or a franchisor the Cyprus IP Box is for you!

1. What qualifies under the Cyprus IP Box

According to Cyprus Income Tax Law (Article 9(1)(k)):

A qualifying IP asset is:

- a patent,

- a computer program (copyrighted software), or

- other IP that is the result of R&D activity and not a marketing-related intangible.

To benefit, the IP owner must also meet the nexus requirement — i.e., the IP income must come from its own R&D activities (or outsourced to unrelated parties) that created the IP.

2. What does not qualify

- Trademarks

- Brand names

- Image rights

- Customer lists

- Marketing intangibles

- Franchise or license fees primarily for brand use or know-how that is not R&D-based

For instance, marketing material and franchise agreements, intangible assets such as trademarks, brands, image rights are not considered qualifying intangible assets.

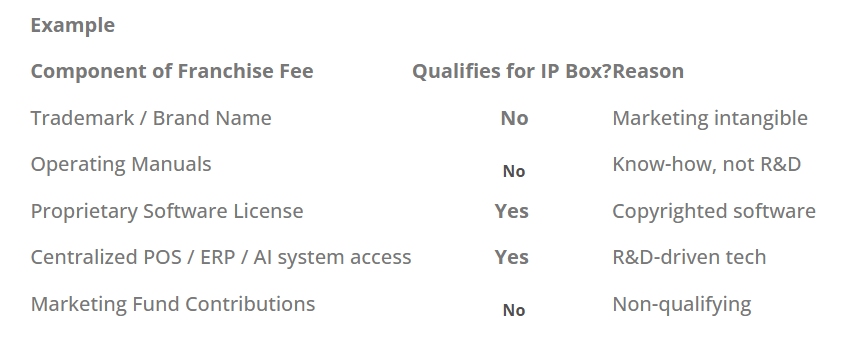

3. Franchise agreements — how they fit

- If the franchise agreement mainly covers brand, trademark, and marketing support, → Not qualifying IP as it is marketing focussed.

- If the agreement licenses use of proprietary software systems, internal platforms, or technology that were developed through qualifying R&D, → Qualifying IP (subject to nexus test).

In other words, franchise agreements could be subject to the reduced Cyprus Corporation Tax rate of 2.5% if they do not relate to marketing activities but rather to proprietary software systems.

In practical terms, if your franchise model relies on the franchisee using the franchisor's proprietary software, operating system, or tech tools that were developed in-house, the portion of franchise income attributable to that IP could fall under the Cyprus IP Box.

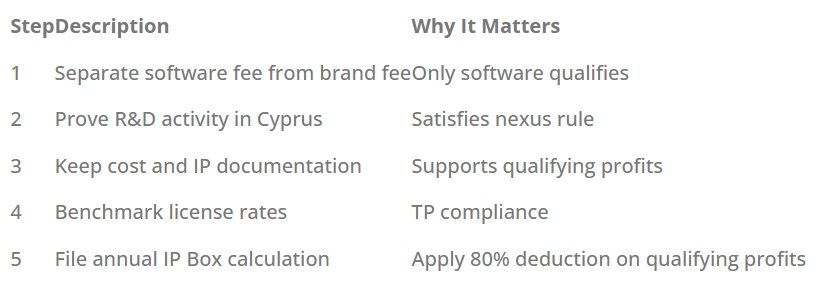

But you'll need to:

- segregate the income streams contractually (software vs brand),

- demonstrate R&D activity in Cyprus or by the Cyprus entity, and

- document the nexus link (development costs → IP asset → income).

How should the franchise agreement be structured in order to qualify for the Cyprus IP Box Regime.

1. Separate the income streams in the contract

Cyprus tax authorities and transfer pricing rules (as well as OECD BEPS Action 5) expect you to segregate income clearly by function.

So instead of one undifferentiated "franchise fee," break it down, for example, like this:

Example clause (simplified)

"The Franchisee shall pay to the Franchisor:

(a) a Software Licence Fee equal to 3% of Gross Revenue, for the use of the Franchisor's proprietary management software systems and related support; and

(b) a Brand Royalty Fee equal to 2% of Gross Revenue, for the use of the Franchisor's trademarks, trade names, and brand identity."

This ensures:

- (a) can potentially qualify under the IP Box (if the software is developed and owned by the Cyprus entity and meets nexus requirements),

- (b) remains outside the regime (as it's marketing-related).

2. Demonstrate that the software is "qualifying IP"

The Cyprus entity must show:

- It developed or enhanced the software internally (or via unrelated contractors),

- It owns the economic rights to the software, and

- The software is protected under copyright law (registered or inherently copyrighted).

This can be supported by:

- R&D cost breakdowns (Cyprus entity's development costs, payroll, etc.),

- Technical documentation and version control logs,

- Copyright registration (optional but helpful),

- Functional descriptions showing the system's innovation or custom development.

3. Keep a nexus-tracking file (mandatory for IP Box)

Cyprus IP Box uses the Modified Nexus Fraction:

You must maintain:

- R&D costs incurred in Cyprus,

- costs for acquired IP or outsourced R&D (to related/unrelated parties), and

- calculations showing how these link to income from the franchisees' use of the software.

It is strongly advisable keeping this in an annual Excel workbook or TP file.

4. Support with Transfer Pricing (TP) documentation

A Transfer Pricing study is a study performed by independent tax experts at a fee where they express their opinion as to the reasonableness of the rates used in commercial agreements using 3rd party evidence, benchmarking and industry data.

A Transfer Pricing Study should:

- identify the distinct IP assets (software vs brand),

- allocate fees based on comparable licensing benchmarks,

- and demonstrate that the 3% and 2% (or whatever ratio you use) is arm's length.

That allocation protects your structure if challenged by the Cyprus Tax Department.

5. Summary — How to make it IP Box compliant

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]