Contents

- Corporation Tax

- Special Contribution for defence

- Capital Gains Tax

- Personal Income Tax

- Social Insurance

- Value Added Tax

- Immovable Property Tax

- Transfer fees by the Land Registry department

- Trust

- Stamp Duties

- Double Taxation agreements

- Tax rates applicable in EU member states

- Tax Calendar

- Penalties

Corporation Tax

Cyprus tax resident companies

All companies tax resident of Cyprus are taxed on all income accrued or derived from all sources in Cyprus and abroad.

Non-Cyprus tax resident companies

A non-Cyprus tax resident company is taxed on income accrued or derived from a business activity which is carried out through a permanent establishment in Cyprus. A permanent establishment is a fixed place of business through which the business of an enterprise is wholly or partly carried on. The term permanent establishment includes a place of management, a branch, an office, a factory and a workshop.

A Company is a tax resident of Cyprus if it is managed and controlled in Cyprus. There is no exact definition of management and control. However, the basic requirements for management and control are as follows:

- The residency of the majority of the directors.

- The location where the board meetings of the Company are held.

- The location of the formation of the general policy of the Company.

Corporation tax rates

The following tax rates apply to companies:

|

Tax Rates (%) |

|

|

Semi - government organizations |

25 |

|

Other Companies |

10 |

Exemptions

|

Type of Income |

Exemption Limit (%) |

|

Profit from the sale of securities |

100 |

|

Dividends |

100 |

|

Interest not arising from the ordinary activities or closely related to the ordinary activities of the Company (passive) (if related then fully taxable - active) |

50 |

|

Profits of a permanent establishment abroad, under certain conditions (more than 50% of the income of the permanent establishment abroad derives from trading activities and the tax rate applicable overseas is not significantly lower than the tax rate applicable in Cyprus) |

100 |

Tax deductions

All expenses incurred, which are wholly and exclusively for the purpose of the trade are allowable including the following:

|

Type of Expense |

Exemption Limit (%) |

|

Donations to approved charities |

100 |

|

Bad debts of any business |

100 |

|

Entertaining expenses for business purposes |

Up to CY£10.000 Nil, if the expense exceeds 1% of the income |

|

Expenditure for scientific research |

100 |

|

Employer’s contribution to social insurance and approved funds on employees’ salaries |

100 |

|

Expenditure on patents or patent rights or royalties |

100 |

|

Interest in relation to the acquisition of business assets used in the business |

Deductions not allowed

|

Type of Expense |

Non-tax deductible Limit (%) |

|

Any expenses for private use |

100 |

|

Fines and penalties |

100 |

|

Mortgage fees |

100 |

|

Unrealised foreign exchange loss |

100 |

|

Payment for immovable property tax |

100 |

|

General provision of doubtful debts |

100 |

|

Contributions to Social Cohesion Fund |

100 |

|

Any expenses not made wholly and exclusively for the purpose of the trade |

100 |

Tax losses

The tax loss incurred during the year, which cannot be set off against other income, is carried forward to be utilized from the first available future taxable profits. This provision is applicable for all losses incurred from 1997 onwards.

Set-off of group losses are allowable only with profits of the corresponding fiscal year. Both Companies should be Cypriot companies and should be members of the same group for the whole year of assessment.

Two companies are deemed to be members of the group if:

- One is by 75% subsidiary of the other; and

- Both companies are by 75% subsidiaries of a third company (direct and indirect control).

A partnership or a sole trader converted to a limited liability company can transfer tax losses into the company for future utilization

Losses from permanent establishment abroad can be set off with profits of the company in Cyprus. Subsequent profits of the permanent establishment abroad are taxable up to the amount of losses allowed.

Annual Wear and Tear Allowances on Fixed Assets

The following allowances which are given as a percentage on the cost of acquisition deducted from the chargeable income:

|

Fixed Assets |

(%) |

|

A. Plant and Machinery |

|

|

Plant and Machinery |

10 |

|

Furniture and fittings |

10 |

|

Televisions and videos |

10 |

|

Industrial carpets |

10 |

|

Boreholes |

10 |

|

Machinery and tools used in an agricultural business |

15 |

|

B. Motor vehicles (except saloons) and motorcycles |

20 |

|

C. Computer Hardware and software |

20 |

|

Hardware and operating systems |

20 |

|

Application software |

|

|

Up to CYP 1.000 |

100 |

|

Over CYP 1.000 |

33 1/3 |

|

D. Tractors, excavators, trenches, cranes, bulldozers |

25 |

|

E. Buildings |

|

|

Commercial Buildings |

3 |

|

Industrial, agricultural and hotel buildings |

4 |

|

Flats |

3 |

|

Metallic greenhouse structures |

10 |

|

Wooden greenhouse structures |

33 1/3 |

|

F. Boats |

|

|

Sailing vessels |

4.5 |

|

Steamers, tugs and fishing boats |

6 |

|

Shipmotor launches |

12.5 |

|

New cargo vessels |

8 |

|

New passenger vessels |

6 |

|

Used cargo/passenger vessels |

Over their useful lives |

|

G. Tools |

|

|

Tools in general |

33 1/3 |

Special type of companies

a. Shipping and Ship Management Companies.

- No income tax is payable on the profits earned or dividends paid by a Cyprus shipping company which owns ships under the Cyprus flag and operates in international waters, or on the salaries of officers and crew of such ships.

- Cypriot companies not having ships under the Cyprus flag are subject to the ordinary corporation tax rate of 10%.

- Local or international ship management and crew management businesses (incorporated or unincorporated) have the option to be taxed either at the rate of 4.25% or at rates equal to 25% of the rates used to calculate tonnage tax of vessels under management which are registered outside Cyprus.

b. Insurance companies

Profits of insurance companies are liable to corporation tax similar to all other Companies, except in the case where the corporation tax payable on taxable profit of life insurance business is less than 1,5 % on gross premium. In this case the difference is paid as additional corporation tax.

Special Contribution For Defence

Special contribution for defence is imposed on income earned by Cyprus tax residents. Non tax residents are exempt from special contribution for defense. It is charged at the rates shown in the table below.

Tax Rates

|

Individuals |

Legal Entities |

|

|

% |

% |

|

|

Dividend income from Cyprus resident |

||

|

Companies |

15 |

Nil |

|

Dividend income from non-Cyprus resident |

||

|

Companies |

15 |

*Nil (Exemption) |

|

Interest income arising from the ordinary |

||

|

activities or closely related to the ordinary |

||

|

activities of the business (Active income) |

Nil |

Nil |

|

Other interest (Passive income) |

10 |

10 |

|

Interest from saving certificates, development |

||

|

bonds and deposits with the Housing Finance |

||

|

Corporation |

3 |

10 |

|

Interest accruing to provident fund |

Nil |

3 |

|

Rental income minus 25% |

3 |

3 |

|

Profits of semi-government organizations |

N/A |

3 |

Exemption

Dividend income from abroad is exempted from defence contribution provided that the Company receiving the dividend owns at least 1% of the ordinary share capital of the Company paying the dividend and:

- more than 50% of the income of the company paying the dividends derives directly or indirectly from trading activities or

- the foreign tax is not significantly lower than the tax rate payable in Cyprus. When the exemption does not apply, the dividend income is subject to defence contribution at the rate of 15%.

Special Contribution For Defence Special contribution for defence is imposed on income earned by Cyprus tax residents. Non tax residents are exempt from special contribution for defense. It is charged at the rates shown in the table below.

Exemption

Dividend income from abroad is exempted from defence contribution provided that the Company receiving the dividend owns at least 1% of the ordinary share capital of the Company paying the dividend and:

- more than 50% of the income of the company paying the dividends derives directly or indirectly from trading activities or

- the foreign tax is not significantly lower than the tax rate payable in Cyprus. When the exemption does not apply, the dividend income is subject to defence contribution at the rate of 15%.

Refund

An individual, whose annual income (including interest), does not exceed the amount of CY£7.000 then the rate is reduced to 3%.

Payments

Special contribution for defence on rental income and trading profits is payable in 6 monthly intervals on 30 June and 31 December each year. In the case of interest and royalties received gross any defence due is payable at the end of the month following the month in which they were received.

Deemed dividend distribution

If a Cyprus resident Company does not distribute a dividend within two years from the end of the tax year then:

- 70% of accounting profits (after some adjustments) are deemed to have been distributed. • 15% special contribution for defence is imposed on deemed dividend distribution applicable to shareholders (individuals and companies) who are residents of Cyprus.

- Deemed distribution is reduced with payments of actual dividends which have already been paid during the two years from the profits of the relevant year.

When an actual dividend is paid after the deemed dividend distribution, then defence tax is imposed only on the additional dividend paid. Dissolution of companies

The total profits of the last five years prior the dissolution not yet distributed as dividends are deemed to be distributed in the dissolution and will be subject to Special Defence Contribution at the rate of 15% applicable to shareholders.

These provisions do not apply in the case of dissolution under reorganization, in accordance with certain pre-requisites set out in regulations and where the shareholders are nonresidents in the Republic.

Reduction of capital

In the case of a reduction of capital of a company, any amounts due or paid to the shareholders up to the amount of the undistributed taxable income of any tax year calculated before the deduction of losses from prior years, will be considered as distributed dividends subject to special defence contribution at 15% (after deducting any amounts which have been deemed as distributable profits)

These provisions do not apply where the shareholders are non-residents in the Republic.

Tax credit for foreign tax paid

Any tax suffered abroad on income which is subject to special defence contribution will be credited against any defence contribution payable on such income irrespective of the existence of a double taxation treaty.

Capital Gains Tax

Capital gains tax is imposed on gains from the disposal of immovable property situated in Cyprus including gains from the disposal of shares in companies, which own immovable property situated in the Republic and such shares are not listed in any stock market.

Tax rate and determination of profit

The tax is imposed on the net profit from disposal at the rate of 20%.

The net profit is calculated as the disposal proceeds, less the greater of the cost or market value on 1 January 1980 adjusted for inflation. Inflation is calculated using the official Retail Price Index.

Exemptions

The following disposals of immovable property are not subject to Capital Gains Tax:

- Transfer arising on death.

- Gift made from parent to child or between husband and wife or between up to third degree relatives.

- Gift to a company where the company’s shareholders are members of the donor’s family and the shareholders continue to be members of the family for five years after the date of the transfer.

- Gift by a family company to its shareholders, provided such property was originally acquired by the company by way of donation. The property must be kept by the donor for at least 3 years.

- Gift to charities and Government.

- Transfer as a result of reorganization.

- Exchange or disposal of immovable property under the Agricultural Land (Consolidation) Laws.

- Gain on disposal of shares, which are listed on any Stock Exchange.

Lifetime exemptions for individuals

Individuals can deduct from the capital gain the following:

|

CY£ |

|

|

Disposal of principal private residence |

50.000 |

|

Disposal of agricultural land by a farmer |

15.000 |

|

Any other disposal |

10.000 |

The above exemptions are given only once and not for every disposal. An individual claiming a combination of the above is only allowed a maximum exemption of CY£50.000.

Personal Income Tax

Taxation

Cyprus tax residents are taxed on all income accrued or derived from all sources in Cyprus and abroad. Non-tax resident individuals are taxed on income accrued or derived from sources in Cyprus only provided that they are physically in Cyprus when earning this income.

Cyprus tax residents

An individual is considered to be tax resident in Cyprus if he stays in Cyprus more than 183 days in the year of assessment.

Tax residents are taxable on the following income:

- Income from business in Cyprus and outside Cyprus.

- Income from any office or employment.

- Dividends and interest.

- Rents and royalties in Cyprus and abroad.

- Pensions and annuities in Cyprus.

Non-tax residents The non-tax residents are taxable on the following income:

- Income from a permanent establishment situated in Cyprus.

- Income from any office or employment exercised in Cyprus.

- Pensions derived from past employment exercised in Cyprus.

- Rent from property situated in Cyprus.

- Any amount or consideration in respect of any trade goodwill reduced by any amount incurred for the purchase of such trade goodwill

- The gross income derived by an individual from the exercise in Cyprus of any profession or vocation the remuneration of public entertainers and the gross receipts of any theatrical, musical or other group of public entertainers.

Personal tax rates

Tax rates applicable to individuals:

|

Chargeable Income |

Chargeable Income |

Amount of Tax |

Accumulated Tax |

|

CY£ |

% |

CY£ |

CY£ |

|

0 – 10.000 |

Nil |

Nil |

Nil |

|

10.001 – 15.000 |

20 |

1.000 |

1.000 |

|

15.001 – 20.000 |

25 |

1.250 |

2.250 |

|

Over 20.000 |

30 |

Foreign pension is taxed at the rate of 5%. An annual exemption of CY£2.000 is granted.

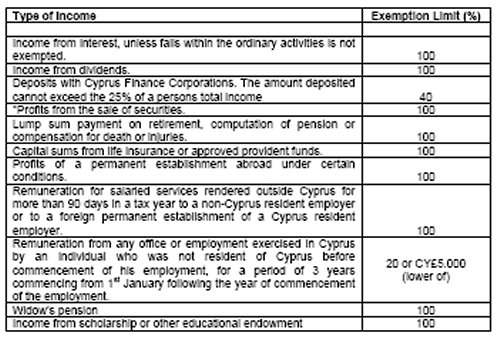

Exemptions from income tax

* Securities are defined as shares, bonds, debentures, founders shares and other securities of companies or other legal persons, incorporated in Cyprus or abroad and options thereon.

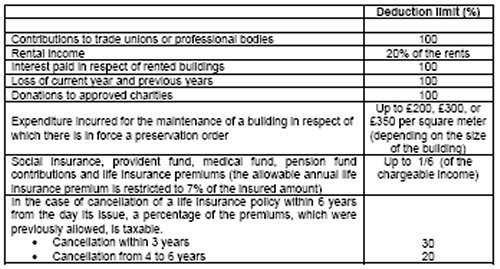

Tax Deductions from Income

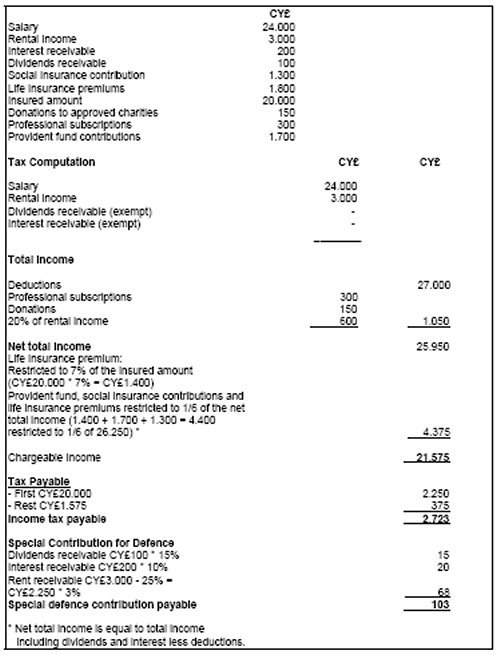

Example of Personal Tax Computation

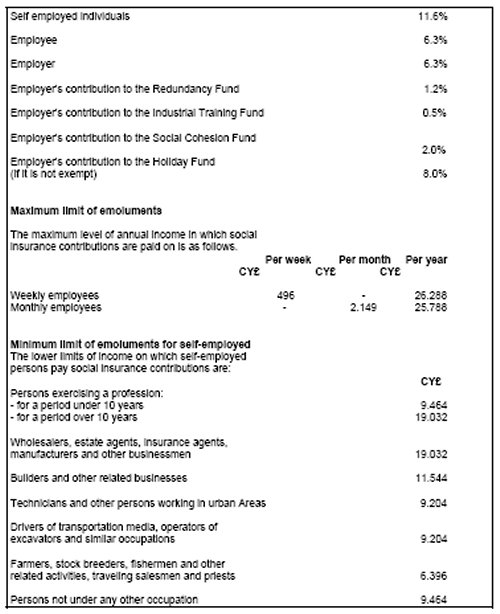

Social Insurance

Contribution Rates

To view the next part of this article, please click below

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.