- within Environment topic(s)

- within Antitrust/Competition Law, Food, Drugs, Healthcare, Life Sciences and Wealth Management topic(s)

I Introduction

On 8 November 2024, President von der Leyen announced that the EU Commission would put forward a proposal to streamline its ESG regulations through an Omnibus Simplification Package. On 26 February 2025, the EU Commission published two Omnibus packages, including legislative proposals on the postponement of reporting deadlines and reduction of scope of reporting companies. In this update, we will provide an overview of these recent developments regarding the Omnibus Simplification Package.

I.1 Background on the Omnibus Simplification Package

Over the past year, the European Green Deal (the EU's overarching policy framework for reaching climate neutrality by 2050) has become subject to criticism, particularly regarding the cost of compliance for companies. As a part of this trend, a push could be observed to revisit and potentially reopen discussions on already existing EU sustainability legislation, such as:

- the Corporate Sustainability Reporting Directive

(CSRD), which came into effect on 5 January 2023 (please

be referred to our earlier blog on this). The CSRD requires

in-scope companies to report sustainability information according

to mandatory European Sustainability Reporting Standards (ESRS) and

requires the Commission to adopt such standards through delegated

acts;

- the Corporate Sustainability Due Diligence Directive

(CSDDD), which came into effect on 24 July 2024 (please be

referred to our earlier blog and cheat sheet on this). The CSDDD establishes on

the one hand a corporate due diligence duty and reporting

obligations to ensure prevention of (potential) adverse impacts on

human rights and the environment for in-scope companies on its

operations, subsidiaries and supply chains. On the other hand, the

CSDDD (currently) imposes the obligation to adopt and put into

effect a transition plan for climate change mitigation which aims

to ensure, through best efforts, that the business model and

strategy of in-scope companies are compatible with the Paris

Agreement; and

- the EU Taxonomy Regulation (EU Taxonomy), which came into effect on 12 July 2020 (please be referred to our earlier blog on this). EU Taxonomy Regulation describes a framework to classify economic activities performed in the EU as 'green' or 'environmentally sustainable'. The classification system purports to assist investors to understand how sustainable a financial product is. To achieve this, the proportion of underlying environmentally sustainable activities related to the product should be presented as a percentage. Setting harmonised requirements at a European level through the EU Taxonomy Regulation both prevents barriers from forming and removes existing barriers.

One of the most recent examples is the Draghi report of 9 September 2024 on the future of European competitiveness (the Draghi report, which can be found here). According to the Draghi report, the accumulation of EU sustainability legislation may significantly impact the EU's competitiveness. The Draghi report suggests that the EU might benefit from simplification of the sustainability regulatory environment.

On 29 January 2025, the EU Commission proposed the Competitiveness Compass to streamline legislation and boost European competitiveness. This included the Omnibus Simplification Package, aimed at simplifying sustainability regulations and reducing reporting burdens for companies, especially small- and medium-sized companies (SMEs). On 12 February 2025, the Commission emphasized this goal in its 2025 Work Programme. The first Omnibus Simplification Package focuses on sustainable finance reporting (i.e. CSRD), sustainability due diligence (i.e. CSDDD), and taxonomy (i.e. EU Taxonomy). The actual Omnibus proposals, consisting of two pieces of legislation, were published on 26 February 2025 (the Omnibus).

II First Omnibus – 'Stop the Clock' on the CSRD and CSDDD

The first Omnibus that was published (which is available here) contains a 'stop the clock' proposal to postpone the reporting deadline by two years for the second and third wave in-scope companies under the CSRD. Furthermore, the first Omnibus aims to postpone both the transposition deadline of the CSDDD by EU member states and as well as the entry into application of the CSDDD with one year.

II.1 Current 'waves' under the CSRD and proposed postponement under first Omnibus

The CSRD entered into force on 5 January 2023. The CSRD is currently scheduled to apply to large undertakings (both listed and unlisted), SMEs with securities listed on the EU regulated markets and parent undertakings of large groups, as well as to certain non-EU parent undertakings. The entry into application of the reporting requirements introduced by the CSRD is phased in according to different categories of undertakings, starting this year (2025) with the first wave consisting of large public interest entities with more than 500 employees for the financial year 2024. The second wave, consisting of other large undertakings, with the initial reporting obligations for these companies slated to commence in 2026 for the 2025 financial year. However, the first Omnibus aims to postpone the second wave by two years, thereby extending the reporting deadline to 2028 for the 2027 financial year.

II.2 Current waves under the CSDDD and proposed postponement under first Omnibus

The CSDDD entered into force on 25 July 2024. According to the current rules under the CSDDD, EU member states should transpose the CSDDD by 26 July 2026. Under the Omnibus the transposition deadline for EU member states will be postponed until 26 July 2027. The entry into application is now set in three waves:

III Second Omnibus – 'Simplification' of CSRD, CSDDD and EU Taxonomy

The second Omnibus aims to reduce the burden of the CSRD and the CSDDD by at least 25%. This includes simplifying sustainable finance reporting and due diligence requirements to support the European Green Deal's goals. The second Omnibus also encourages voluntary sustainability reporting, benefiting companies with strong sustainability profiles and those in transition.

III.1 Alignment of the scope of both the CSRD as well as the CSDDD

First of all, it seems that the scope of the CSRD and CSDDD will be more closely aligned via the Omnibus. This alignment is intended by the EU Commission to simplify compliance for companies within these thresholds, as they will have consistent reporting obligations across both directives. It is important to note that the Omnibus does not fully align the CSRD and CSDDD, which is incongruent with the EU Commission's objective of "simplifying" the CSRD and CSDDD.

III.2 Companies in-scope under CSRD

A key change to the scoping of the CSRD is that only (very) large undertakings will be in-scope. Under the amended CSRD, the scoping thresholds will be:

| Average number of employees | More than 1,000 |

| Turnover | Either above EUR 50 million or a balance sheet above EUR 25 million |

These thresholds are to be determined on a stand-alone and, if applicable, consolidated basis.

With these increased thresholds, listed SMEs will no longer be subject to the CSRD.

A non-EU undertaking will still be subject to the CSRD either because it:

- has securities listed on a regulated market in the EEA and they meet the thresholds set out above (either on a standalone or consolidated basis); or

- is the ultimate parent undertaking of a group that generates over EUR 450 million in the Union for each of the last two consecutive years and has either a large subsidiary undertaking in the EU or has an EU branch that generated over EUR 50 million.

At the request of the Commission, EFRAG has submitted a sustainability reporting standard for voluntary use by SMEs that are not in scope of the reporting requirements (VSME standard). Companies out-of-scope of the CSRD are not subject to mandatory reporting requirements, may use the proportionate voluntary standard to be adopted by the Commission as a delegated act, based on the VSME standard developed by EFRAG and are protected by the value-chain cap from excessive information requests from larger companies within scope.

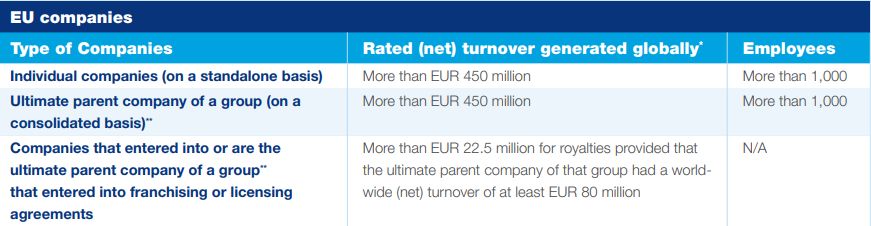

III.3 Companies in-scope under CSDDD

The EU Commission proposes not to amend the current thresholds under the CSDDD to be considered in-scope. Therefore, the existing thresholds under the CSDDD remain in place:

IV Proposed amendments of the CSRD under the second Omnibus

The CSRD requires in-scope companies to report sustainability information according to mandatory European Sustainability Reporting Standards (ESRS) and requires the Commission to adopt such standards through delegated acts.

IV.1 The Omnibus aims to reduce the reporting burden of the CSRD by:

- Stop the clock on reporting requirements: The EU Commission's separate proposal (the first Omnibus) aims to postpone the reporting requirements for the second wave and the third wave by two years (please be referred to par. II.1). This postponement seeks to prevent these undertakings from incurring unnecessary costs by having to report for financial years 2025 or 2026, only to be subsequently relieved of this requirement.

- Reducing the scope. The EU Commission plans to reduce the number of companies required to report by 80% (by amending the scope, please be referred to par. III.2).

- Strengthening the value-chain reporting: The EU Commission plans to extend the value-chain cap and strengthened, applying directly to the reporting in-scope company rather than just limiting what ESRS can specify. It will protect all in-scope companies with up to 1000 employees, not just SMEs. The limit will be defined by the voluntary standard adopted by the EU Commission as a delegated act, based on the VSME standard developed by EFRAG (please be referred to ix below). This change will significantly reduce the trickle-down effect of the CSRD).

- Restrictions on information requests: The EU Commission proposes on restrictions on information requests along the value chain. This could limit the extent of data collection and reporting required from companies, thereby reducing the administrative burden associated with compliance under both the CRSD and EU Taxonomy. This value-chain cap would be extended and strengthened: it would apply directly to the reporting company instead of being only a limit on what ESRS can specify. It would protect all undertakings with up to 1,000 employees rather than just SMEs as is currently the case.

- Eliminating sector-specific standards: The EU Commission plans to exclude sector-specific reporting standards, with the aim to avoid an increase in the number of prescribed datapoints that in-scope companies should report.

- Removing the transition to reasonable assurance: The EU Commission plans to remove the possibility of moving from a requirement for limited assurance to a requirement for reasonable assurance. This, with the aim to provide clarity that there will be no future increase in costs of assurance for in-scope companies.

- Streamline and simplify ESRS: The EU Commission plans to adopt a delegated act to revise the first set of ESRS within six months of this proposal's entry into force. The revision aims to simplify and streamline the ESRS by reducing mandatory datapoints, prioritizing quantitative over narrative data, and distinguishing between mandatory and voluntary datapoints. It will also clarify unclear provisions, improve consistency with EU legislation, and enhance interoperability with global standards. The goal is to ensure undertakings report only material information and simplify the standards' structure and presentation.

- Implementing an "opt-in" regime. The EU Commission plans to implement an "opt-in" regime for large companies with specific turnover criteria. This "opt-in" approach will eliminate compliance costs for large enterprises with over 1,000 employees and a net turnover not exceeding EUR 450 million, provided they do not claim their activities are environmentally sustainable under the EU Taxonomy. It also allows these enterprises to report on activities that meet some of the EU Taxonomy's technical criteria, encouraging a gradual environmental transition and supporting the goal of increasing transition finance.

- Introducing a voluntary reporting standard. For companies not required to report sustainability information, the EU Commission proposes a voluntary standard based on the VSME standard developed by EFRAG. This standard would be adopted as a delegated act.

According to the EU Commission, this approach enhances flexibility and reduces compliance costs while encouraging voluntary sustainability reporting.

IV.2 Adjacent proposed amendments to the EU Taxonomy under the second Omnibus

The second Omnibus also deals with the reporting obligations under or promulgated by the EU Taxonomy which are partly related to the CSRD. The main points in relation to the proposed amendments of the EU Taxonomy under the second Omnibus to note are as follows:

- Opt-in regime for large companies: Companies with over 1,000 employees but a net turnover below EUR 450 million are exempt from reporting under the EU Taxonomy unless they assert that their activities are (partially or fully) Taxonomy-aligned. If such a claim is made, they must disclose turnover and CapEx KPIs, and may voluntarily disclose their OpEx KPI. According to the EU Commission, this proposed approach eliminates the compliance cost for those not claiming alignment and provides flexibility for reporting on activities meeting certain technical screening criteria without fulfilling all of them, fostering a gradual environmental transition.

- Digital taxonomy: A digital taxonomy for the Union sustainability reporting standards will be necessary to tag reported information in accordance with these standards. The EU Commission will adopt this digital taxonomy via a Delegated Act, following technical advice from European Securities and Market Authority.

- Support for SMEs: In the 2025 Technical Support Instrument round, the EU Commission plans to launch a multicountry project titled "Improving Sustainability Reporting for Businesses." According to the EU Commission, this project aims to enhance EU member states' capacity to support companies, particularly SMEs, in implementing CSRD and EU Taxonomy reporting requirements. It will also be relevant for non-listed SMEs facing growing demands for sustainability information from financial and value chain partners.

V Proposed amendments of the CSDDD under the second Omnibus

The CSDDD requires companies to identify and address adverse human rights and environmental impacts in their own operations, those of their subsidiaries and their chains of activities.

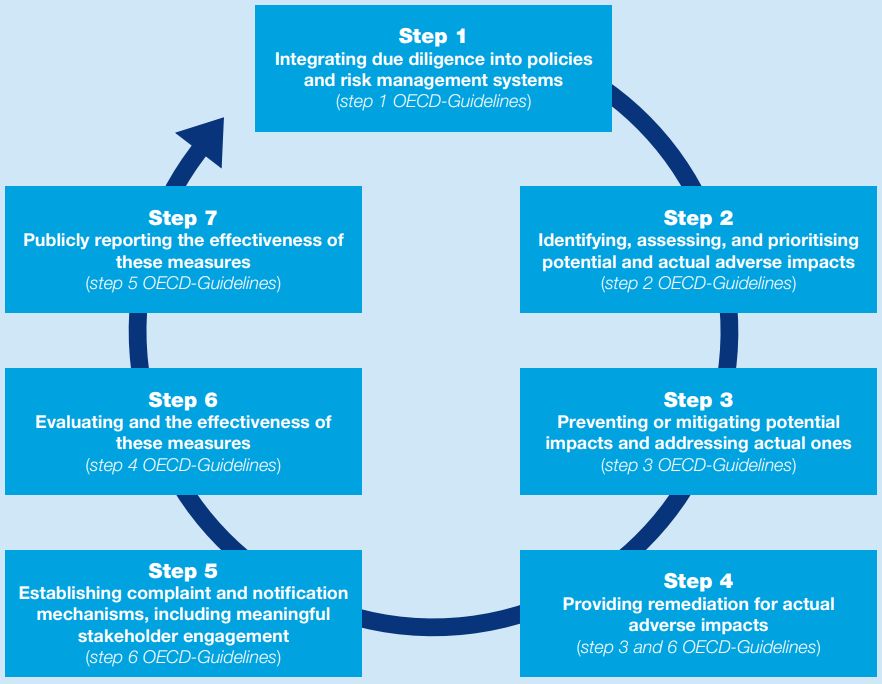

V.1 Current Due diligence obligations under the CSDDD

The CSDDD requires in-scope companies to conduct risk-based human rights and environmental due diligence by carrying out the following actions:

This due diligence process applies to:

- In-scope company's own operations;

- Operations of subsidiaries; and

- Business partners across their chains of activities.

V.2 The Omnibus aims to reduce the burden of due diligence obligations under the CSDDD for (complex) chains of activities by:

- Targeting due diligence to direct business partners: The EU Commission proposes to tailor obligations for indirect business partners to cases of circumvention or when there is information indicating likely or actual adverse impacts. This means that the Omnibus limits due diligence measures primarily to an in-scope company's own operations, subsidiaries, and direct business partners. In-scope companies must conduct in-depth assessments at the level of direct business partners (in the current version indirect business partners are also included). However, if there is plausible information suggesting adverse impacts at the level of indirect business partners, in-scope companies are required to assess these situations further. According to the EU Commission, this approach reduces unnecessary compliance burdens while ensuring significant risks are addressed as in line with the main objective of the CSDDD.

- Removing the duty to terminate business relationships as a last resort: The EU Commission proposes to terminate business relationships in cases of severe adverse impacts. Under the Omnibus, in-scope companies should suspend the relationship while continuing to work with the business partner towards a solution, using any increased leverage resulting from the suspension.

- Clarifying stakeholder engagement scope: The EU Commission proposes to clarify that in-scope companies are only required to engage with 'relevant' stakeholders, limiting the scope to those directly linked to the specific stage of the due diligence process under the CSDDD. The definition of 'relevant' stakeholders is simplified to include only workers, their representatives, and individuals or communities directly affected by the in-scope company's operations. This includes those affected by pollution or land use by business partners of an in-scope company. Furthermore, in-scope companies are only required to engage with relevant stakeholders linked to specific stages of the due diligence process under the CSDDD. According to the EU Commission, this targeted approach ensures meaningful engagement without overextending efforts. Additionally, the stages of the due diligence process requiring ('relevant') stakeholder engagement are further limited, focusing on the most critical interactions.

- Limitation on information request from direct business partners only: The EU Commission proposes that in-scope companies under the CSDDD only will be allowed to seek information from direct business partners within its chain of activities which have more than 500 employees. This envisaged amendment will further reduce spill-over effects of the CSDDD.

- Removing aspects of the civil liability clause and rules regarding representative actions: The EU Commission proposes on the removal of the specific EU-wide civil liability regime under the CSDDD. However, on the other hand, the EU Commission appears willing to maintain the obligations for effective access to justice for injured parties as a result of an in-scope company being held liable for a failure to comply with its due diligence obligations under the CSDDD. The EU Commission will leave civil liability under the CSDDD to the discretion of EU member states (as was previously the case with directors' liability, which was included in an earlier version of the CSDDD), suggesting a shift by the EU Commission towards a more flexible and less punitive approach under the CSDDD. More specifically, the EU Commission proposes that the requirement for EU member states to allow representative actions will be removed, which in practice leaves it up to EU Member States to provide for this or not. For example, in the Netherlands, there already is a sophisticated class action regime under which collective actions may still be possible with respect to liability under the CSDDD.

- Clarifying principles regarding pecuniary penalties: The EU Commission proposes to remove the minimum cap for fines (currently, the maximum limit of pecuniary is not less than 5 % of the net worldwide turnover of the in-scope company) and the EU Commission will develop guidelines on the pecuniary penalties. According to the EU Commission, this aims to ensure penalties are effective, proportionate, and dissuasive.

- Reducing the frequency of monitoring exercises: The EU Commission proposes to extend the intervals for regular assessments of due diligence measures under the CSDDD from one year to five years. According to the EU Commission, this change significantly reduces the administrative burden on in-scope companies and their business partners (often SMEs). However, in-scope companies must still conduct ad hoc assessments if there are indications that measures taken are inadequate or ineffective, ensuring timely responses to emerging risks.

- Bringing forward the adoption of the first set of implementing guidelines: the EU Commissions proposes to postpone the providing of it guidelines and best practices on how to conduct due diligence in accordance with the obligations under the CSDDD, including appropriate measures for remediations and on how to identify and engage with 'relevant' stakeholders from December 2025 until 26 July 2026.

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.