- within Technology topic(s)

Last April, the People's Bank of China (the "PBoC") and the State Administration of Market Regulation (the "SAMR") jointly released the Rules to Administrate Beneficial Owner Information (the "BOI Rules") requiring filing of the beneficial owner information by entities in China. The BOI Rules can be deemed as the counterpart of the Corporate Transparency Act of the US. It is applicable to all the qualified entities established in China, regardless whether they are privately owned, State owned or foreign invested.

The BOI Rules took effect on November 1, 2024. To comply with the BOI Rules, entities must make BOI filing timely as required by the BOI Rules. Failure to timely and correctly file the BOI will be subject to punishment by both the PBoC and the SMAR.

Who Should Make the BOI Filing?

According to the BOI Rules, unless otherwise exempted, all companies, partnerships, branches of foreign companies, as well as other entities specifically identified by the PBoC and the SAMR, are required to register their BOI. So far, neither the PBoC nor the SAMR has identified any special entity, in addition to the above, to be subject to the BOI filing.

The BOI Rules exempt small-sized entities from filing the BOI after they swear as truth meeting the following conditions:

- Their registered capital is not higher than RMB 10 million (or its equivalent in foreign currency);

- Their shareholders or partners are all natural persons;

- The actual control or the benefits of them belong only to the natural persons who are all the registered shareholders or partners; and

- The shareholders or partners exercise control over or receive benefit from them solely through means of equity or partnership interests.

How to identify the Beneficial Owner(s)?

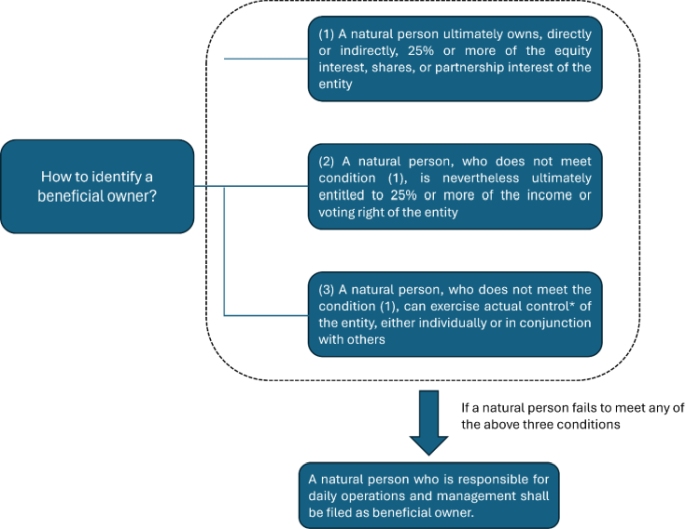

The process defined by the BOI Rules to determine the beneficial owners can be simply illustrated as follows:

In identifying its beneficial owners, an entity applicant should pay special attention to the following points:

- An entity may have multiple beneficial owners. If multiple beneficial owners are determined, all must be reported for filing.

- If a natural person meets condition (1), he or she should be thus determined as a beneficial owner, and no further examination on conditions (2) and/or (3) is necessary. Only if condition (1) is not satisfied, should conditions (2) and (3) be further examined.

- If a natural person meets both conditions (2) and (3), he or she should be reported as a beneficial owner who meets both conditions for filing.

What Information Should be Filed as BOI?

General Information

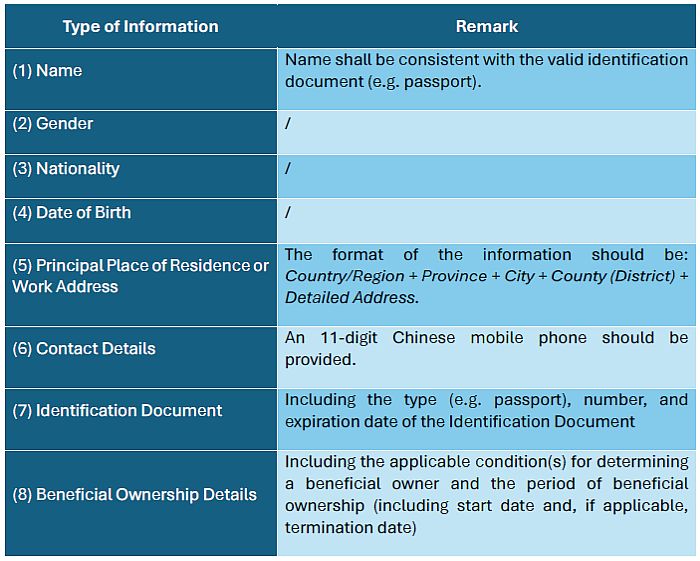

Once a beneficial owner has been determined, the following general information of the beneficial owner should be filed:

Additional Information

Subject to the condition(s) met as a beneficial owner, the following additional information of the beneficial owner should be provided:

When and How to Complete the Filing Procedure?

Time Requirement:

Entities established before November 1, 2024 must file for BOI before November 1, 2025.

Entities established after November 1, 2024 must file for BOI at the time of establishment.

Filing Procedure:

The SAMR is responsible for collecting the filings. The applicants can file the BOI electronically at the websites of the local counterparts of the SAMR. The fling should be made in accordance with the guidance issued by the SAMR and, if any, the local SAMR's procedure booklet.

Legal Consequences of Non-Compliance

If an entity fails to conduct BOI filing in a timely manner or provides incorrect or inaccurate information, the entity may be punished by both the SARM and the PBoC:

- The SAMR may punish the entity in reference to the liabilities upon the relevant entity's failure or untrue filing of its entity registration; and

- The PBoC may require the entity to rectify the filing within a specified timeframe. Should the entity fail to do so promptly, a monetary penalty of up to RMB 50,000 may be imposed.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.