- within Tax and Coronavirus (COVID-19) topic(s)

- with readers working within the Property and Construction & Engineering industries

The State Revenue Office of Victoria (SRO) and Revenue New South Wales (Revenue NSW) have released revenue rulings (Rulings) outlining their respective positions (see SRO and Revenue NSW) on when medical and allied health practices need to pay payroll tax to doctors and practitioners.

According to the Rulings, these practices must pay payroll tax for payments made to practitioners providing services on behalf of the practice.

Similar Rulings are also in place in Queensland and South Australia.

The Rulings reinforce decisions from the New South Wales Court of Appeal in Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2021] NSWCA 40 and the Victorian Court of Appeal in Commissioner of State Revenue (Vic) v The Optical Superstore Pty Ltd [2019] VSCA 197 (following the High Court of Australia's refusal to grant special leave to the taxpayer).

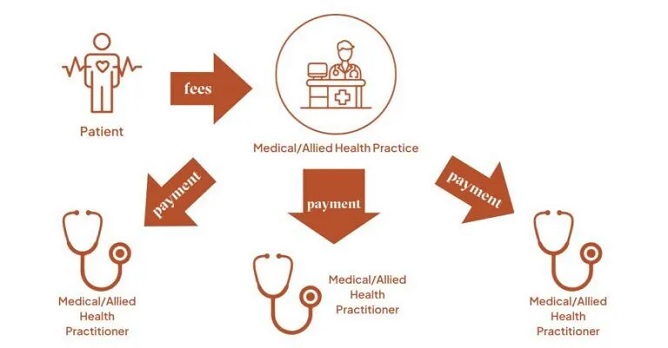

Diagram of Fund

Relevant Contracts

Practices operating on this structure shown above are subject to payroll tax, whether payments go directly to practitioners or to their entities (like companies or trusts) under contract with the practice. It's important to note that the names given to relationships don't prevent them from being considered relevant contracts.

How We Can Help – Review of Business Structures and Payroll Tax

Despite the broad impact of these Rulings, not all medical and allied health practices are automatically liable for payroll tax.

Liability depends on the business structure used in a given financial year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]