- within Finance and Banking topic(s)

- in United States

- with readers working within the Banking & Credit industries

- with readers working within the Retail & Leisure industries

- within Privacy, Government and Public Sector topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

ASIC has become quite active in taking action against Australian Financial Services ("AFS") Licensees in relation to non-compliance with the financial requirements described in the Corporations Act and Regulatory Guide 166 ("RG166").

What happened?

Earlier this year, ASIC cancelled an AFS Licence after finding that the licensee:

- Had a net deficiency of assets over liabilities for three (3) years;

- Failed to meet financial holding requirements for three (3) years; and

- Failed to have adequate financial resources to provide the financial services under the AFS Licence

This should not be surprising given that one of the most fundamental requirements for every AFS Licensee is to have adequate financial resources to provide the financial services authorised by their AFS Licence.

ASIC is not just concerned with the actual financial health of AFS Licensees' businesses. This year, ASIC has also suspended and cancelled several AFS Licences, because the AFS Licensee failed to submit their audit and financial reports to ASIC within the statutory timeframes. The submission of audit and financial reports may seem like an administrative task and can be easily overlooked by AFS Licensees, but it is another important financial requirement that AFS Licensees must comply with.

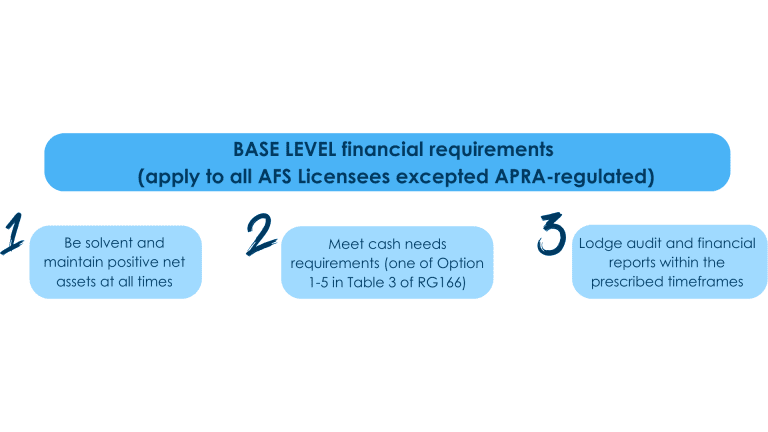

Base level financial requirements

As a reminder, AFS Licensees (except those regulated by APRA) are subject to the following base level financial requirements:

- AFS Licensees must be solvent and maintain positive net assets at all times;

- AFS Licensees must meet the cash needs requirement in accordance with one of the five (5) options outlined in Table 3 of RG166 and show that they have sufficient resources to meet their anticipated cash flow expenses; and

- AFS Licensees must lodge audit and financial reports within the prescribed timeframes.

Some AFS Licensees are subject to additional financial requirements. Click here for an overview of the financial requirements that apply to AFS Licensees.

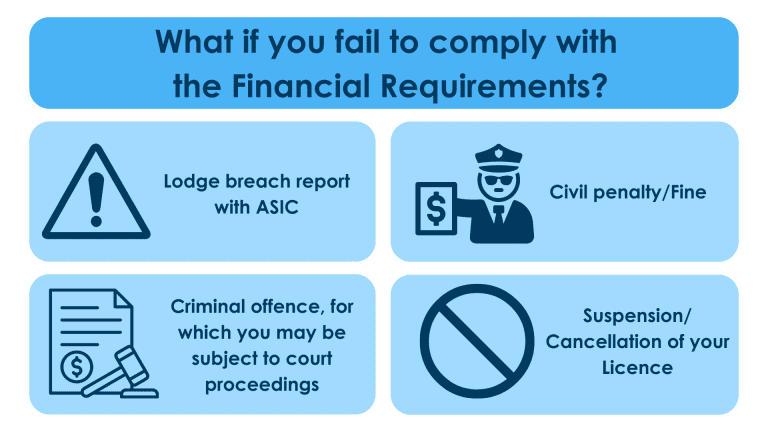

What happens if an AFS Licensee is not compliant with its financial obligations?

A failure to comply with financial obligations has severe consequences, including enforcement action by ASIC:

- If an AFS Licensee becomes aware that it will no longer be able to meet its financial requirements, or it already does not meet its financial requirements (breach), then it will need to take steps to rectify the breach (if possible) and lodge a breach report with ASIC in accordance with breach reporting obligations and RG78.

- Fines can be imposed if the financial obligations are contravened.

- The failure to lodge annual financial reports can amount to a criminal offence, for which the AFS Licensee, and its directors, can be charged in court. ASIC has referred such offences to the Commonwealth Director of Public Prosecutions before – an example can be found here.

- In more serious cases of non-compliance such as repeated failures to lodge annual financial reports, ASIC also has the power to suspend and/or cancel the AFS Licence.

Background

Between January and August 2024, ASIC suspended or cancelled at least seven (7) AFS Licences for failing to meet the financial requirements, including the requirement to have adequate financial resources and the requirement to lodge financial statements and audit reports.

Furthermore, ASIC its strategic priorities for 2024-25, which include acting against non-lodgement of financial reports. It is crucial, therefore that AFS Licensees ensure that they are meeting with their financial obligations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.