- within Finance and Banking topic(s)

- in United States

- with readers working within the Banking & Credit industries

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Securities & Investment and Law Firm industries

ASIC has implemented changes and updated RG 26 following the implementation of reforms extending the financial reporting and auditing obligations under Chapter 2M of the Corporations Act 2001. We have summarised the changes that impact Australian Financial Services Licensees ("AFS licensees").

Disclosure obligations of the AFS licensee auditor in relation to their resignation

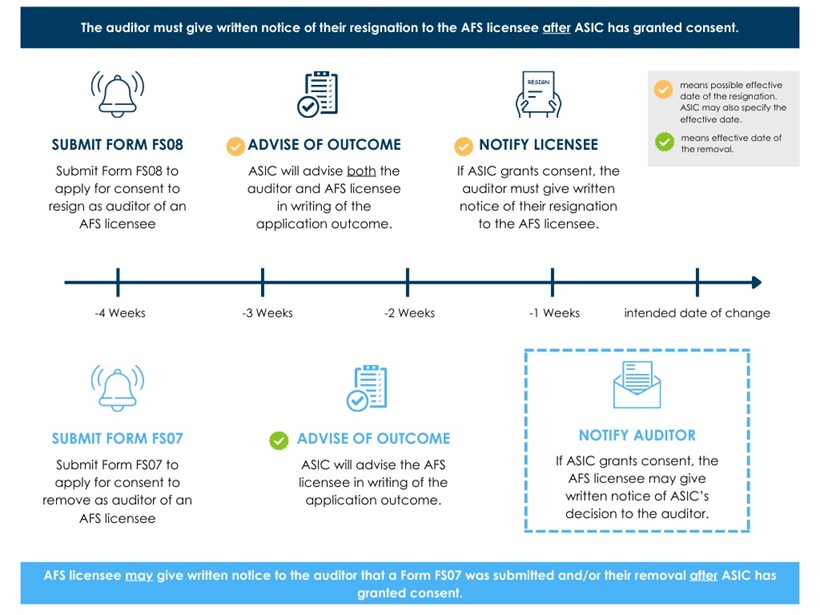

Under section 990G(1)(a) of the Corporations Act, an AFS licensee auditor must notify ASIC in writing if they wish to resign by submitting a Form FS08. The application must be submitted at least four (4) weeks prior to intended date of change (RG 26.116).

ASIC will advise both the auditor and the AFS licensee in writing of the application outcome. If ASIC grants the auditor consent to resign as an AFS licensee auditor, the auditor must give written notice of their resignation to the AFS licensee. Notice cannot be given to the AFS licensee until after ASIC gives consent.

Under the updated RG 26.7, the outgoing auditor is expected to bring to ASIC's attention "any matters connected with their ceasing to hold office that may impact on the integrity of the audit function." In addition to the existing examples highlighted in the original RG 26, ASIC notes that details of any disagreement with management or directors includes disagreements with management or directors of a responsible entity, corporate director, superannuation trustee, AFS licensee or credit licensee. RG 26.28 notes that disagreements concerning whether a breach exists that needs to be reported is another example of a disagreement that the outgoing auditor should tell ASIC about when submitting the Form FS08.

Disclosure obligations by the AFS Licensee in relation to the removal of an auditor

Under section 990F of the Corporations Act, an AFS licensee must notify ASIC in writing to remove their auditor by submitting a Form FS07 Application for consent from ASIC to remove an auditor of an Australian financial services licensee ("Form FS07") at least four (4) weeks before the intended date of change.

Unlike a Form FS08, the AFS licensee does not have an obligation to notify the auditor in writing that the Form FS07 was submitted. However, ASIC recommends best practice is to notify the auditor and notes in Information Sheet 290 that their "decision to grant consent to a removal will take into consideration whether the auditor has been put on notice, or if reasonable attempts have been made to notify the auditor of the application." If ASIC grants consent to remove the auditor, the AFS licensee may notify the auditor in writing, but this must be after the AFS licensee has received notification of ASIC's decision.

Under section 990D(1) of the Corporations Act, if the auditor has died or is prohibited from acting as an auditor of an AFS licensee, then the AFS licensee must notify ASIC as soon as practicable by submitting a Form FS09.

Do not assume that ASIC has consented to the resignation and removal of the auditor

RG 26.9-26.10 notes that the outgoing auditor must continue to act as the auditor until ASIC gives consent. ASIC will not give their consent "merely because a proposed incoming auditor has commenced work".

Effective date of the auditor's resignation is different to the effective date of the auditor's removal

ASIC has clarified that the effective date of the auditor's resignation is different to the effective date of their removal. If ASIC consents to the resignation of the AFS licensee auditor, the resignation will take effect on either:

- the day specified in the notice of resignation given by the auditor to the AFS licensee;

- the day ASIC gives their consent; or

- a day that ASIC specifies.

If ASIC consents to the removal of the AFS licensee auditor, the removal will take effect on the day ASIC gives consent (RG 26.106).

RG 26.107 outlines that if a person or firm becomes ineligible to act as auditor of the AFS licensee, then the licensee can remove that person or firm without ASIC's consent.

Regulation 7.8.16 of the Corporations Regulations 2001 (Cth) outlines that an AFS licensee auditor becomes ineligible when the person:

- is not a registered company auditor;

- is in debt of more than $5,000 to an AFS licensee or a related body corporate of the AFS licensee;

- has a substantial holding in a company that is in debt of more than $5,000 to an AFS licensee or a related body of the AFS licensee;

- is a partner or employee of the AFS licensee;

- where the AFS licensee is a company, is:

- an officer of the company;

- a partner, employer or employee of an officer of the company;

- a partner or employee of an employee of an officer of the company.

If these circumstances apply, section 990F of the Corporations Act allows the AFS licensee to remove the AFS licensee auditor by submitting a Form FS09.

Circumstances that may result in a change of auditor

Up until October 2024, the circumstances that may result in a change of auditor were:

- loss of auditor independence due to a conflict of interest situation;

- deliberate disqualification by an auditor; and

- changes in the structure of an audit firm due to a merger, acquisition or dissolution (RG 26.11).

ASIC has now included the following two (2) additional circumstances that may result in a change of auditor:

- auditor ineligibility, incapacity or death; and

- disqualification of an auditor by a court.

Reasonable timeframes for submitting auditor resignation, removal and replacement applications

ASIC now considers that lodging an application for consent at least four weeks before the intended date of change, instead of three weeks, is reasonable (RG 26.116). The application for consent can be lodged at any time of the year, subject to specific circumstances mentioned above i.e. auditor ineligibility. However, ASIC does not have the power to allow the resignation, removal or replacement to take effect before giving consent or backdate the day consent is given.

Further Reading

- ASIC updates guidance for auditors following extension to financial reporting and audit obligations (Media Release)

- ASIC Regulatory Guide 26 Resignation, removal and replacement of auditors

- ASIC Information Sheet 290 Resignation and Removal of auditors of Australian financial services

- Form FS08 Application for consent from ASIC to resign as an auditor of an Australian financial services licensee

- Form FS09 Notification of cessation of an auditor of an Australian financial services licensee

- Treasury Laws Amendment (2022 Measures No. 4) Act 2023 (Cth) which extended the financial reporting and auditing obligations under Chapter 2M of the Corporations Act 2001 (Cth) ("Corporations Act")

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.