- in South America

- in South America

- within Tax, Energy and Natural Resources and International Law topic(s)

- with readers working within the Banking & Credit and Media & Information industries

Meta Platforms Inc. ("Meta") (formerly Facebook Inc.) is now a widely recognized force in the markets for social networks (such as Facebook or Instagram), communication services (such as WhatsApp), and online advertising. With its global power and high-valued data generated from 3.6 billion users, Meta have not only been able to provide enhanced services to its customers through targeted advertising but have also established itself as a dominant player in respective industries. As a result, its operations, especially in the realm of data collection, have raised an eyebrow of the competition authorities around the world. The Turkish Competition Authority ("TCA") is one of these many watchdogs that have scrutinized the data related practices of Meta.

In January 2021, WhatsApp users started to receive an in-app notification with respect to the Terms of Service and Privacy Policy. These related to the much-debated privacy policy change of WhatsApp. The notification primarily focused on key updates regarding WhatsApp's data processing practices as a Meta subsidiary, businesses' use of Meta-hosted services to store and manage WhatsApp chats, and WhatsApp's partnerships with Meta to offer integrations across its products. The update was criticized by many as a "take it or leave it" policy, since it required individuals who wish to continue using the service to accept the new policy.

The said update soon caught the interest of the competition watchdog of Turkey. The TCA swiftly launched an investigation, aiming to determine whether Meta Platforms Inc., Meta Platforms Ireland Limited, WhatsApp Inc. and WhatsApp LLC (collectively referred to as "Meta") abused its dominant position and violated Article 6 of the Law No. 4054 on the Protection of Competition ("Competition Act"). The TCA's investigation explicitly referred to the WhatsApp's latest policy update, and Meta's data collection practices. Correspondingly, the TCA also decided to implement an interim measure1 by obliging Meta to suspend WhatsApp's policy updates which were meant to enter into force by February 8th, 2021, and notify the users of this suspension.

Following an investigation that took nearly two years, on October 20th, 2022, the Turkish Competition Board ("Board") rendered its lengthy WhatsApp Decision2, in which the Board decided that Meta abused its dominant position by complicating the activities of its competitors in the relevant markets and by creating entry barriers through merging the data it collects from Facebook, Instagram, and WhatsApp services (the so-called core services). As a result, a heavy fine amounting to approximately TRY 350 million (approx. USD 12 million) was imposed on Meta, along with some behavioural remedies.

In this article, we will briefly explain the TCA's assessment regarding Meta's dominance, data-driven concerns, and regulatory approaches. We will also touch upon TCA's stance on the interaction between the data protection law and competition law. At the last part of our article, we will dive into the TCA's assessment of the practices of Meta.

Meta's Dominance

The TCA not only carried out its own market research to establish relevant market definitions in its WhatsApp Decision, but also referenced the cases3 and sector inquiries4 from all over the world. While reaching out to its conclusion, the TCA conducted a number of substitutability assessments between different services available in the market (such as Pinterest, Snapchat), to probe the limits of the relevant markets. This was also the first time that the TCA took on assessing a potential "attention markets" definition, as it was brought up by Meta on several occasions as a defence. As a result, the TCA determined the relevant markets within the scope of the investigation as: (i) personal social networking services, (ii) consumer communication services, and (iii) online display advertising services.

There were several factors considered during the assessment of the dominant position of Meta, such as the monthly and daily active user numbers, frequency of use of the relevant services and consumer preferences, entry barriers, and buyer power. The TCA stressed that these markets display significant network externalities and feedback loops, creating natural entry barriers. As a result of these assessments, it was determined that Meta holds a dominant position in markets for personal social networking services (Facebook), consumer communication services (WhatsApp), and online display advertising services.

Data-Driven Concerns and Regulatory Approaches

Data is a critical proxy for both business development processes and revenue generation methods in digital markets, as it provides a significant competitive advantage to undertakings. Therefore, as per the TCA's assessment, unfair, or abusive practices towards data may limit competition in the market or create barriers to entry or growth in the markets.

In addition, complex data collection and utilisation processes of undertakings may raise concerns under different branches of law, such as data protection law and consumer law. One of the key issues discussed by the TCA was whether competition law is enforceable towards data related practices of undertakings, and if data privacy legislation should take primacy. The TCA noted that an undertaking's data related practices may simultaneously trigger competition law and data privacy legislation enforcement, hence, found itself responsible to act to protect competition.

While the investigation was initiated following the privacy policy update of WhatsApp, the TCA later shifted its focus from the policy update to Meta's data gathering and combination/aggregation practices.

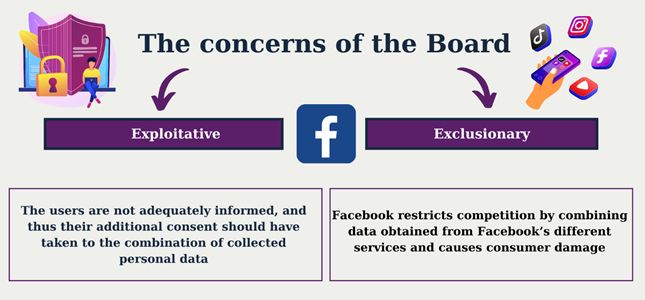

It is safe to say that the investigation has been influenced by the Bundeskartellamt's Facebook decision5 from 2019 in some parts. However, the TCA preferred a different route in its assessment, and examined Meta's conduct from the perspective of exclusionary abuse in detail, instead of the Bundeskartellamt's exploitative abuse approach. Before taking this route, however, the TCA still assessed whether the exploitative abuse approach should be tried in this case. While considering whether Meta's data gathering practice is excessive and exploitative, the TCA found it useful to refer to privacy laws and the limits of "explicit consent". Although the CJEU's opinion was yet to be published by the time of the TCA's decision, the TCA's approach towards privacy laws overlaps with the assessment of the CJEU under the Bundeskartellamt-Facebook case6. As a reminder, the CJEU has ruled, in a request for preliminary ruling raised in Bundeskartellamt-Facebook case, that the competition authorities may take data protection rules into consideration when weighing interests in decisions under competition law.

Exclusionary Practices

Following its assessments into excessiveness of the data gathering practices, the TCA found it more feasible to assess Meta's data aggregation practices across different services through the lens of the exclusionary concerns. The TCA explicitly stated that the exploitative concerns can be resolved by various means, such as informing consumers, transparency and strengthening data privacy policies.

The TCA notes that the data related exclusionary abuse may take many forms, such as discrimination in access to data, prevention of data portability/interoperability, and merging/aggregation of data across different services. These behaviours result in the exclusion of competitors or the creation or strengthening of entry barriers.

Meta is merging and aggregating the data it generates across its different services such as Facebook, Instagram and WhatsApp, the TCA states. Combining data in this fashion enables Meta to strengthen its entrenched market position. The TCA found that aggregating data enables Meta to create so called "super profiles" of its users. This data advantage and "super profiles" increase the value of Meta's display advertising services in the eyes of advertisers, fortifying entry barriers.

The TCA also evaluated whether it is possible for its competitors to match the data of Meta, through acquiring similar sets of data from third-party providers. In this regard, the TCA assessed the data that can be obtained from these third-party providers from the perspective of 4 V characteristics, namely volume, velocity, variety, and value. The TCA found that competitors are unable to match Meta, as the data obtained from third parties fail on all four accounts under 4 V analysis when compared to Meta's walled garden.

The TCA found that Meta's practices create an entry barrier for both social networking and online display advertising services markets, and Meta's growing importance to advertisers is evident in the distribution of advertising purchase. TCA indicates that advertisers prefer to advertise on Meta products more than any other competitor platform, likely due to Meta's data aggregation practices. By fortifying the barriers to entry through its data aggregation practices, Meta locks advertisers to its services, reducing the possibility of new competitors. The lack of new entrants would result in higher spend on Meta services by advertisers, the TCA notes, that results in advertisers reflecting these costs to consumers. In light of these, the TCA found that Meta abused its dominant position by complicating the activities of its competitors in the relevant markets and by creating entry barriers through merging the data it collects from Facebook, Instagram, and WhatsApp services.

Conclusion

The WhatsApp decision of the TCA was a decision of many "firsts". This was the first time the TCA evaluated "attention markets" arguments in detail. While we were seeing some data related abuse cases of the TCA in the form of data portability, the WhatsApp decision was the first time that the TCA evaluated data merging/aggregation practices as an abuse. Also, the TCA took a different approach to Meta's practices compared to Bundeskartellamt and assessed Meta's conduct through the lens of exclusionary concerns.

Apart from the hefty administrative fine, the TCA ordered Meta to document that it has ceased the activities that are considered as an abuse. However, the TCA refrained from providing further details, and let the Meta to come up with alternative solutions. In order to comply with the decision, it is possible for Meta to cease the data aggregation practices altogether, however, it may also try to convince the TCA that it has done enough by proposing less radical solutions.

We will need to see whether Meta's defences and arguments will be accepted during the annulment lawsuit stage, should Meta challenge the decision before the courts.

There were a number of strong arguments brought forward by Meta, and the TCA will need to defend its position rather vigorously. For example, Meta argued that the allegations on competitor harm raised on data aggregation is rather speculative, as the findings of the TCA failed to put forward how or why the data aggregation might lead to higher prices, reduced quality or reduced innovation. The findings and the analyses of the TCA do not involve any factual or numerical evidence that the conduct reduces the number of undertakings operating in the market or increases the cost of advertising or reduces consumer welfare, Meta claimed. The defences concerning the lack of analysis on the substantial and potential effects on the market are also notable. Meta sets forth that in order to conduct a potential effects analysis, the TCA should have considered all relevant circumstances and apply the as-efficient competitor test to meet the relevant standard of proof. As for the social networking market, Meta pointed out to the relatively new entrants to the market, such as Snapchat and TikTok, and emphasized their rapid growth.

We will see whether courts will accept these notable arguments from Meta and reverse the TCA's "decision of many firsts".

Footnotes

1. TCA's decision dated 11.01.2021 and numbered 21-02/25-10.

2. TCA's decision dated 20.10.2022 and numbered 22-48/706-299.

3. Some examples of the cases are as follows: Case M.9660, Google/Fitbit; European Comission Facebook/WhatsApp decision COMP/M.7217; Bundeskartellamt, Decision B6-22/16.

4. Some examples of the studies and market inquiries are as follows: ACCC (2019), "Digital Platforms Inquiry; CMA (2020), "Online Platforms and Digital Advertising", Market Study Final Repor;, Bundeskartellamt (2018), "Online Advertising, Series of Papers on Competition and Consumer Protection in the Digital Economy"; OFCOM (2019), "Online Nation - 2019 Report".

5. Bundeskartellamt, Decision B6-22/16.

6. CJEU, C-252/21.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.