Valuation involves as much ‘Art’ as it does ‘Science’ and the reality is that much of this statement is driven by the concept of goodwill.

In technical financial terms, goodwill is the excess of a purchase price paid over the book value of the net assets sold, in other words, the intangible value that a buyer pays for. In the abstract, goodwill represents the inherent value of a going concern business, attributable to widespread positive recognition for a product and/or level of service by the public, generally by virtue of being able to generate sustainable cash flow as a result of this recognition – so what exactly does this mean?

Essentially, the assets of a business are worth the cash flow they are able to generate. Risk and future stability of cash flows are considered by a prudent buyer through a review of qualitative features of a business, ultimately influencing the level of goodwill that a buyer is willing to pay for.

In assessing these qualitative features a buyer will focus on such factors as:

- Economic dependence on the owner(s);

- Customer base – tenure, relationships, diversity, concentration (% of revenue);

- Intellectual property- proprietary nature, differentiation from competitors, patent life;

- Management team – tenure, capability, loyalty;

- Underlying technology- technological competence, life cycle;

- Contracts with suppliers/customers – terms, conditions, barriers to exit;

- Appropriate scale –geography to match customer needs;

- Systems / Processes – limited dependence on individual know-how;

- R&D – capability, track record, pipeline; and

- Quality of assets & capacity – growth potential, need for future capital investment.

One of the most common challenges private company owners face, particularly owners of small to mid-market businesses, relates to point number one above, managing the reliance on the owner(s) to generate cash flow through existing relationships with customers, presence in the business community etc. A buyer will ask the question what happens to the business if the owner gets hit by the proverbial ‘beer truck’?

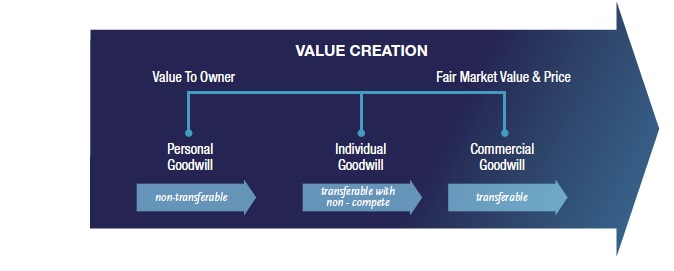

If the goodwill is perceived to be personal in nature i.e. representing an economic advantage enjoyed as a result of an individual’s unique abilities, good name and reputation, it will not represent commercial value as it is not transferable by contract or otherwise. However, if economic advantage accrues to a business by virtue of its relationship with a given individual who has abilities, business contacts, good name and reputation and if the economic well-being of the business would be harmed should that individual leave the employ of said business and compete with it, such goodwill would be categorized as being individual in nature. In contrast with personal goodwill, individual goodwill does not expire at the time of the loss of said individual. Rather, the business has the capacity to substitute another individual to fill the role and as a result this type of goodwill can have commercial value. In an open market transaction, often, non-competition agreements are utilized to provide comfort to a buyer that individual goodwill can be successfully transitioned.

That said, the more a business owner can do to mitigate a buyer’s perceived risk, the more value and ultimately goodwill they can create. The capability and competency of a second level of management can be a key factor when a buyer is assessing what level of goodwill they are willing to pay for. As an example, an owner/operator should be focused on transitioning relationships with key customers and suppliers to others within their organization and formalizing these key relationships through proper documentation when possible.

Although truly delegating responsibilities can prove difficult for many private company owners, in our experience, there are no ‘stupid’ buyers and during the due diligence process when a buyer is ultimately given access to management, suppliers and select customers, the buyer will be in a position to quickly determine how well relationships have been transitioned and what reliance still exists based on the role the current owner(s) continue to play in the business.

Undertaking such relevant initiatives will help to minimize risk and are critical to creating value by shifting goodwill away from personal capabilities and relationships towards something that is more diverse and commercial in nature as demonstrated in the figure below.

What Other Measures Can Be Taken To Capture Goodwill?

In addition to addressing the strength of each of the identified qualitative features identified in the preceding points 1 through 10, goodwill can also be captured through a competitive divestiture process whereby a buyer is motivated to share in some of the synergies they believe they will create. This can include such things as headcount reduction, incremental revenue through cross selling opportunities, reduction of distribution costs etc. Buyers typically don’t want to pay for value they believe they will create, especially given the perceived risk associated with realizing some or all of the synergy component, but if faced with a competitive bidding process and up against a strong negotiating team they may be pressured into sharing some of this prospective upside. Sometimes this motivation is driven from outside influences such as a buyer’s desire to keep a competitor from buying a target company but regardless, one thing is certain, underlying goodwill must be justified as being more than just thin air.