- within Environment topic(s)

SEC Examination Update

On December 17, 2020, the Securities and Exchange Commission (SEC) issued a statement regarding the renaming of the agency's fomer Office of Compliance Inspections and Examinations to the Division of Examinations (DoE).

The DoE is now conducting all examinations remotely, and seems to be doing so at an even faster pace than previously. Since the beginning of 2020, we have seen a significant uptick in the number of examinations, in particular of advisers who have not previously been examined.

Other than a handful of exams at large hedge fund managers directed as their use of alternative data, we have not noted any particular focus on the types of advisers examined, as exams have covered hedge fund advisers, private equity fund advisers, other private fund advisers, and advisers of other alternative asset classes. We have also seen numerous examinations of SEC-registered investment advisers based in Europe, Asia and Australia.

For its fiscal year ending September 30, 2019, DoE reported having completed 3,089 exams, roughly equal to the number for the prior year, representing approximately 15% of all SEC registered advisers. DoE also reported that for the same period approximately 150 examinations (or about 5%) resulted in referrals to the SEC's Division of Enforcement. Although this enforcement referral rate is lower than what we have historically seen, this may be explained by the increased number of total exams being completed. Former SEC Chairman Jay Clayton noted in his November 17, 2020 testimony on oversight of the SEC before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, that for fiscal year ending September 30, 2020, DoE conducted nearly 3,000 examinations, again covering approximately 15% of all registered investment advisers, despite significant disruptions caused by the COVID-19 pandemic.

We have not seen any significant changes in the principal areas of focus of DoE examinations. However, as discussed below, DoE very recently published a risk alert on common deficiencies observed in adviser compliance programs. Among the key areas of focus that we have seen in recent examinations, especially examinations of private fund advisers, and which in many cases have been confirmed by DoE's annual statement of examination priorities and public statements of senior DoE staff, are:

- Material Non-Public

Information (MNPI) - This topic was given particular

prominence in DoE's June 2020 Risk Alert relating to private fund

managers. In particular, DoE will review:

- trading records for unusually successful trades, trades that do not match an adviser's stated investment strategy, and trades that take place around the time of public company announcements;

- meetings, communications and relationships with public company insiders, and the processes used by compliance personnel to monitor such meetings, communications and relationships;

- positions held by an adviser's personnel on portfolio company boards of directors, creditor committees or other positions providing potential access to non-public information;

- the use and effectiveness of information barriers;

- relationships with private fund investors who are corporate insiders;

- the use of restricted lists and trading of companies on restricted lists; and

- the use of alternative data, which was newly identified in DoE's 2020 Exam Priorities.

- Fees and Expenses - DoE continues as always to focus on issues related to fees and expenses, including the adequacy of disclosure to clients, the accuracy of fee calculations, and the manner of allocating expenses (including in particular broken-deal expenses) among client and affiliate accounts, especially when client and affiliate accounts participate in co-investments on a side-by-side basis.

- Conflicts of

Interest - This can take many forms, including:

- allocation of investment and trading opportunities;

- side-by-side management of different client accounts, or different client accounts and proprietary accounts, using the same or similar strategies;

- arrangements with or services provided by affiliated entities or service providers;

- principal transactions, cross transactions and other transactions where the adviser or any other affiliated party may have an interest; and

- allocation of expenses between the adviser and clients or co-investors.

- Marketing Materials and

Performance Presentations - DoE typically reviews

marketing materials carefully for a variety of issues, including:

- accuracy of statements in marketing materials, and compliance with stated investment guidelines, restrictions or other representations;

- accuracy of and back-up support for past performance presentations;

- potentially misleading uses of selective examples of past investment performance or recommendations; and

- use of fund credit lines, whether they have been adequately disclosed, and the effect such lines of credit may have on performance or reported IRR.

- Cybersecurity - DoE staff members are beginning to ask more detailed questions about advisers' cybersecurity policies and procedures, and in particular whether any incidents have occurred and how they were handled.

- Valuations - DoE continues to focus on valuation issues, including in particular valuation of less liquid assets.

DoE Issues Additional Topic-Specific Risk Alerts

In 2020, DoE staff also issued several risk alerts relevant to advisers to private funds.

On June 23, 2020, DoE issued Observations from Examinations of Investment Advisers Managing Private Funds providing an overview of certain compliance issues observed by DoE in examinations of private equity and hedge fund advisers. This risk alert discusses many practices which have been the subject of SEC enforcement actions involving private fund advisers over the past several years, in particular, (1) conflicts of interest, (2) fees and expenses, and (3) policies and procedures relating to MNPI. This risk alert serves as a valuable reminder of some basic steps advisers to private equity and/or hedge funds can take to reduce and avoid regulatory scrutiny in three crucial areas. For more information, please see our client alert.

On July 10, 2020, DoE issued an alert discussing cybersecurity issues specific to ransomware in response to DoE's observing an apparent increase in the sophistication of ransomware attacks on SEC registrants. This risk alert provided a number of observations on enhancing cybersecurity preparedness and operational resiliency to address ransomware attacks. The risk alert also encouraged firms to monitor the cybersecurity alerts published by the Department of Homeland Security Cybersecurity and Infrastructure Security Agency.

On August 12, 2020, DoE issued an alert addressing select COVID-19 compliance risks and considerations for broker-dealers and investment advisers. DoE has identified a number of COVID-19- related issues, risks, and practices relevant to SEC-registered investment advisers and broker-dealers which fell broadly into the following six categories: (i) protection of investors' assets; (ii) supervision of personnel; (iii) practices relating to fees, expenses, and financial transactions; (iv) investment fraud; (v) business continuity; and (vi) the protection of investor and other sensitive information.

On September 15, 2020, DoE issued an alert focusing on safeguarding client accounts against credential compromise and highlighting "credential stuffing" - a method of cyber-attack that uses compromised client login credentials that can potentially result in the loss of customer assets and unauthorized disclosure of sensitive personal information. This risk alert suggested a number of practices that firms have implemented to help protect client accounts, and encouraged firms to consider reevaluating and potentially limiting their current practices, and exploring whether the firm's staff are properly trained on how they can better secure their accounts.

Finally, on November 19, 2020, an alert was published providing an overview of notable compliance issues identified by DoE related to Rule 206(4)-7 (the Compliance Rule) under the Investment Advisers Act of 1940, as amended (the Advisers Act). This risk alert discussed compliance deficiencies noted where DoE observed advisers that (i) did not devote adequate resources, such as information technology, staff and training, to their compliance programs, (ii) designated chief compliance officers who lacked sufficient authority within the adviser to develop and enforce appropriate policies and procedures for the adviser, (iii) were unable to demonstrate that they performed an annual review or whose annual reviews failed to identify significant existing compliance or regulatory problems, (iv) did not implement or perform actions required by their written policies and procedures, (v) utilized policies and procedures that contained outdated or inaccurate information about the adviser, including off-the-shelf policies that contained unrelated or incomplete information, or (vi) did not maintain written policies and procedures or that failed to establish, implement, or appropriately tailor written policies and procedures that were reasonably designed to prevent violations of the Advisers Act.

SEC Enforcement Update

During this past year, the SEC's Division of Enforcement has continued to face a number of headwinds, somewhat limiting the number of enforcement actions across the board and, in particular, those involving private funds.

- First, as former Division of Enforcement Director Avakian recently noted, DoE has been more actively playing a larger role in addressing misconduct through the exam process with deficiency notices and remediation. While this has resulted in fewer cases being referred to the Division of Enforcement, DoE is focused on the same issues that have spawned enforcement actions in prior years, particularly on issues that implicate undisclosed conflicts of interest. However, once enforcement actions are initiated, they are no less arduous than in prior years, and the penalties have not materially decreased.

-

- Second, the coronavirus pandemic disrupted government agencies across all sectors, particularly with respect to initiating new investigations or prosecuting new actions. Division of Enforcement staff are working from home, and investigations (including witness testimony) are being conducted almost entirely remotely, causing additional complications.

- Finally, the Division of Enforcement has continued to deal with the staffing shortages highlighted last year. While the hiring freeze has been lifted, the limited hiring that has taken place has not been sufficient to make up for the years of attrition. The Asset Management Unit, the specialized unit within the Division of Enforcement that focuses on advisers to private funds, remains much smaller today than it was four years ago.

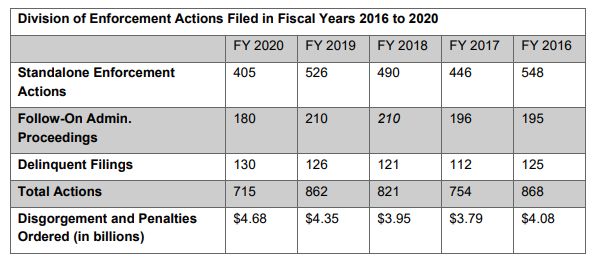

Notwithstanding all of the hurdles that the SEC has faced over the past year, the Division of Enforcement has remained active and aggressive, as evidenced by the number of actions the SEC brought against private fund advisers and the penalties levied in those actions. On November 2, 2020, the Division released its Annual Report for Fiscal Year 2020, and there are a few key takeaways.

- In spite of the headwinds posed by the global COVID-19 pandemic, the SEC brought 715 enforcement actions in FY 2020, representing only a 17% decrease from FY 2019. It also obtained record-breaking monetary remedies with total penalties and disgorgement reaching $4.68 billion, an 8% increase from 2019.

- Adviser cases accounted for 87 standalone actions in the past year. The percentage of cases involving advisers to private funds or investment companies decreased, shrinking to 21% from 36% in 2019, largely due to the conclusion of the Share Class Selection Disclosure Initiative, in which investment advisers failed to make required disclosures relating to their selection of mutual fund share classes that paid the adviser (as a dually-registered broker-dealer) or its related entities or individuals a fee pursuant to Rule 12b-1 of the Investment Company Act of 1940, as amended (the Investment Company Act), when a lower-cost share class for the same fund was available to the client.

- Insider trading cases increased slightly from 6% of the actions filed in 2019 (30 actions) to 8% of the 2020 actions (33 actions).

- The impact of COVID-19 on the SEC was substantial -- by mid-March the entire division had shifted to telework and began conducting all operations remotely. While the enforcement actions brought in 2020 were the fewest Division of Enforcement actions since 2013, when the SEC brought 686 actions, the relatively slight decrease in actions is notable, especially considering that the SEC brought 492 enforcement actions after the transition to telework.

- Relatedly, the SEC received 23,650 TCRs (tips, complaints, and referrals) in 2020, a substantial increase over the 16,850 TCRs received in 2019. The increase seems largely driven by the pandemic, as the number of TCRs received between mid-March and the end of the fiscal year represented a 71% increase from the same time period in 2019. Notably, the SEC opened more inquiries and investigations than it had in 2019.

The Annual Report reiterated the SEC's continued focus on insider trading and other illegal trading activities. In particular, the SEC highlighted the importance of "robust corporate controls and compliance policies around the use and safeguarding of material nonpublic information." We expect the Division of Enforcement to continue to look for MNPI cases involving advisers to private funds, particularly where investment professionals, as part of their employment, come into contact with non-public information.

There is continued uncertainty as a result of the current political climate, and the presidential election results may lead to a different SEC composition with different priorities, particularly in the fund space. For example, on May 19, 2020, President Trump signed Executive Order 13924, Regulatory Relief to Support Economic Recovery, which laid out a number of "principles and best practices" that federal agencies should consider in rulemaking and enforcement. While the possible interpretations of this order have not yet been tested, and its ongoing existence is uncertain with respect to the incoming Biden administration, several of the provisions may further curtail enforcement actions. For instance, the Order emphasizes that fact-finders in regulatory proceedings must apply the rule of lenity (construing ambiguities against the government), and that agencies should not pursue enforcement actions where "the regulated party attempted in good faith to comply with the law." However, while recent Division of Enforcement activity in the private funds arena has been subdued relative to prior years, the SEC is still focused on similar actions - whether through the Division of Enforcement or DoE.

The bottom line for private fund advisers is that while recent Division of Enforcement activity in the private funds arena has not been quite as active as prior years, the SEC is still focused on similar actions - whether through the Division of Enforcement or DoE. The new administration could easily reallocate its resources, which may result in increased referrals and more enforcement actions over the next year. While there may be a period of rebuilding and the SEC is unlikely to immediately ramp up prosecution to the levels of years past, it will almost certainly begin to bring an increased number of actions against private fund advisers.

Particular SEC Division of Enforcement areas of focus over the past year are noted below.

Principal and Cross Trades

The SEC brought enforcement actions regarding improper principal

trades. In February, the SEC settled charges against investment adviser Lone

Star Value Management LLC for carrying out a series of cross trades

among a fund in which the CEO had a 35% ownership stake and other

Lone Star funds. Lone Star settled the allegations for violations

of Sections 206(3) and (4) of the Advisers Act and the Compliance

Rule. Please see our March 18, 2020 post for more information.

In a similar vein, the SEC settled with an investment adviser for cross trading securities between approximately forty client accounts that it advised. According to the settlement order, the adviser prearranged buys and sells of the same security in the same amount from one client account to another. The SEC also noted that certain trades were in fact principal transactions and were made without the required disclosures and consent. The order attributes these violations to the lack of adequate policies and procedures in place regarding cross and principal trading. The adviser agreed to violations of Sections 206(3) and (4) of the Advisers Act and the Compliance Rule and a $450,000 civil monetary penalty in settlement of these allegations.

Undisclosed Cash Solicitations

The SEC issued two orders against VALIC Financial Advisors

Inc. (VFA) in August 2020, finding that VFA violated Advisers

Act Rule 206(4)-3, the "cash solicitation rule," by

paying a for-profit company owned by Florida K-12 teachers'

unions in exchange for being made a preferred financial services

partner for members. The SEC also alleged that VFA provided false

or misleading disclosures to its clients about the fees the clients

were charged as a result of VFA's directive to third-party

advisers in a wrap fee program it sponsored to allocate client

assets to higher-cost "no-transaction fee" share classes,

when in most cases lower-cost share classes were available. Please

see our August 11, 2020 post for more detail.

Fees and Expenses

The SEC issued two orders against VALIC Financial Advisors

Inc.(VFA) in August 2020, finding that VFA violated Advisers

Act Rule 206(4)-3, the "cash solicitation rule," by

paying a for-profit company owned by Florida K-12 teachers'

unions in exchange for being made a preferred financial services

partner for members. The SEC also alleged that VFA provided false

or misleading disclosures to its clients about the fees the clients

were charged as a result of VFA's directive to third-party

advisers in a wrap fee program it sponsored to allocate client

assets to higher-cost "no-transaction fee" share classes,

when in most cases lower-cost share classes were available. Please

see our August 11, 2020 post for more detail.

Fees and Expenses

The SEC remains concerned about undisclosed fees and expenses

charged to clients. In April, the SEC settled with a private equity fund adviser for

charging the portfolio companies of a private fund it managed for

the services of its in-house group of operating partners without

fully disclosing this practice and the related conflicts to

investors. In particular, the SEC took issue with how the fund

adviser emphasized the value added and role played by its

Operations Group in generating investment returns, but failed to

provide full and fair disclosure that it would separately charge

the fund's portfolio companies for those services or the

potential associated conflicts. Please see our May 7, 2020 post for more information.

In May, the SEC found that a private fund adviser and its owner misused over $1 million of fund assets. According to the settlement order, the owner routinely purchased two airline tickets for the same trip, but later cancelled the more expensive ticket, submitted it for reimbursement to be paid as a fund expense, and travelled on the less expensive ticket. The SEC also alleged that the owner temporarily borrowed money from the fund account to settle a personal trade. The SEC barred the owner from the investment industry and required both the owner and the fund adviser to pay a $100,000 civil penalty. Please see our May 21, 2020 post for more information.

The SEC also issued an order imposing sanctions against private equity adviser Rialto Capital Management, LLC (Rialto) for violations of the Advisers Act relating to expense allocation. The settlement addressed Rialto's allocation of expenses for certain "third-party tasks" performed by in-house employees, which was allowed under the relevant fund documents with consent of the limited partner advisory committee (LPAC). Yet the SEC took issue with the practice of fully allocating certain expenses to the funds rather than proportionately to co-investors, as well as the manner in which the expenses were disclosed to the LPAC for approval. Please see our August 13, 2020 post for more information.

The SEC settled with a registered investment adviser for material misstatements and omissions to investors related to the annual operating expenses of four money market funds that it managed. According to the settlement order, the adviser caused the funds to reimburse amounts to the adviser which had previously been waived by the adviser, or reimbursed by the adviser to the funds, which resulted in the funds charging expenses that exceeded their contractual limits, causing investors to incur millions of dollars in additional fund expenses. The adviser omitted this from a description of the funds' annual operating expenses in the funds' prospectuses, thereby misstating the expenses investors paid when buying and holding the funds' shares.

Conflicts of Interest

On December 8, 2020, the SEC issued a settled order charging UK-based

investment adviser BlueCrest Capital Management Limited (BlueCrest)

in connection with the management of a proprietary fund, BSMA

Limited (BSMA), that primarily was owned and invested in by senior

traders and officers of BlueCrest. The SEC found that BlueCrest

made material misstatements and misleading omissions to current and

prospective investors regarding its (i) transfer of top-performing

traders from its flagship client fund, BlueCrest Capital

International (BCI) to BSMA, (ii) replacement of those traders with

an underperforming algorithm and (iii) associated conflicts of

interest. The SEC also found that BlueCrest failed to disclose

certain material facts about the algorithm to BCI's independent

directors, whom we represented in connection with the SEC's

confidential investigation of BlueCrest. The SEC found that

BlueCrest willfully violated non-scienter antifraud provisions of

the Securities Act of 1933 and Investment Advisers Act of 1940, as

well as the Advisers Act's compliance rule. Without admitting

or denying the SEC's findings, BlueCrest agreed to a

cease-and-desist order, a censure, and payment of disgorgement and

prejudgment interest of $132,714,506 and a civil penalty of

$37,285,494, for a total of $170 million, which will be placed into

a fair fund to compensate harmed investors.

Valuation

With ongoing economic uncertainty applying pressure, the SEC has

continued to focus on valuation issues surrounding portfolio

investments. A recent pair of SEC actions demonstrate this trend.

In December 2019, the SEC filed a complaint against a private fund

adviser, SBB Research Group, LLC, and two of its executives for a

multi-year fraud involving the overvaluation of structured notes.

The charged executives told prospective investors they used

"fair value" in recording investments, but allegedly used

their own novel valuation method that inflated investment value,

causing SBB to overstate historical performance and overcharge

investor fees. Then, on February 26, 2020, the SEC issued a settled

order instituting administrative proceedings

against SBB's auditor, RSM US LLP, for failing to catch

SBB's valuation fraud over years of audits. Please see our

April 9, 2020 post for more information.

Similarly, the SEC took issue with the valuation process utilized by Semper Capital Management, LLC, finding that it overvalued certain odd lot positions acquired by a mutual fund it advised (SEMMX) by using round lot pricing. According to the settlement order, Semper should have disclosed that its valuation practices for odd lot positions in bonds were a material contributor to SEMMX's reported performance, and its failure to do so constituted an omission of material information from certain statements to investors that attributed the fund's reported performance to investments rising toward fundamental values. Finally, the SEC noted that Semper failed to adopt policies and procedures that were reasonably designed to address Semper's public disclosures concerning the attribution of SEMMX's reported performance.

Fund administrators have also been the target of the SEC's focus on valuation issues. The SEC recently settled with an independent fund administrator pursuant to Section 203(k) of the Advisers Act for its role in "causing" violations by the fund adviser in connection with funds the administrator serviced pursuant to a contract with the adviser. The SEC alleged that the fund administrator failed to escalate concerns about what the administrator learned through the due diligence process, namely that the adviser had recorded unauthorized transfers from the funds and fund expenses as receivables, the latter artificially inflating the NAV of the Funds. In addition, once the fund administrator began to provide services, it continued the practice of accounting large withdrawals as receivables, and also, on instructions from the adviser, inflated monthly income by recording a performance "true-up." This resulted in investors receiving monthly statements with materially inflated account balances and returns. The SEC considered the remedial acts taken by the fund administrator, including self-reporting and implementing policies and procedures to address issues surrounding fund accounting and valuation.

Form 13Ds

In September, the SEC settled with Welsh, Carson, Anderson &

Stowe for failing to provide appropriate updates in its Form 13Ds

for five private funds it managed. The SEC found that Welsh Carson

failed to amend its 2016 13D filing once it abandoned plans to take

a prosthetics care company private and instead decided to liquidate

its entire position. In settlement of these allegations, Welsh

Carson agreed to pay $100,000 in civil penalties.

Advertising/Marketing Materials

The SEC settled charges with Old Ironsides Energy, LLC

stemming from the inclusion of a "track record" in fund

marketing materials that identified a large legacy investment with

strong, positive returns as an investment which the adviser had

direct management in partnership with project operators, when, as

alleged by the SEC, it was actually an investment in a private fund

advised by a third party. Though the settlement order observed that

the adviser had a policy in place that prohibited the use of false

or misleading performance results in fund marketing materials, the

SEC found that the adviser had failed to implement it. Please see

our April 28, 2020 post for more information.

In May, the SEC obtained the appointment of a receiver over investment adviser TCA Fund Management Group Corp. (TCA), its affiliate TCA Global Credit Fund GP Ltd. (TCA-GP), and several funds managed by TCA to protect investors from a fraudulent scheme allegedly conducted by TCA. The complaint filed by the SEC alleges that TCA improperly recognized revenue by booking loan fees as revenue upon execution of term sheets, and booking investment banking fees for borrowers when an agreement was signed and before they materialized. This, in turn, led to an inflated NAV and false performance results which were included in the promotional materials distributed to investors.

Custody Rule

Continuing to focus on violations of the Custody Rule, the SEC settled with SQN Capital for failing to timely

distribute annual audited financial statements prepared in

accordance with Generally Accepted Accounting Principles (GAAP) to

the investors in one private fund that it advised for each fiscal

year from 2012 through 2019, and another private fund that it

advised for each fiscal year from 2014 through 2019. The SEC also

took issue with SQN Capital's failure to adopt and implement

written policies and procedures reasonably designed to prevent such

violations.

Similarly, the SEC settled with TSP Capital for failing to timely distribute annual audited financial statements prepared in accordance with GAAP to the investors in the largest private fund that it advised for each fiscal year from 2014 through 2018, or even to retain an auditor for the years after 2015, thus violating Section 206(4) of the Advisers Act and Rule 206(4)-2 thereunder.

Policies and Procedures Related to MNPI

The SEC has placed a high-priority on the policies and procedures

that investment advisers have in place to protect against the

misuse of MNPI. The SEC brought an enforcement action against an

adviser for failing to implement written policies and procedures to

protect against the misuse of MNPI, especially given that the

adviser's business model and trading strategy focused on

trading the equity of small market capitalization public companies

for which there may have been minimal trading and little or no sell

side analyst coverage. The SEC identified several activities that

highlighted the importance of MNPI policies: (1) routine

communication with insiders; (2) entering into nondisclosure

agreements with issuers to gain access to financial information and

engage in strategic communications; (3) communicating with

investment bankers; (4) participating in confidentially-offered

deals, such as secondary offerings and PIPE transactions; and (5)

publishing its own research articles on the internet. The SEC found

that the policies in place were not reasonably designed to prevent

misuse of MNPI because they did not address any business-specific

risks and lacked any guidance regarding when trading in securities

should be restricted.

The SEC entered into a settlement agreement with another adviser for similar issues related to MNPI policies. In that case, following an investment in a portfolio company, the adviser obtained a seat on the company's board. While the adviser's representative sat on the board and allegedly received information, the adviser purchased the portfolio company's stock during the company's open trading window. According to the SEC's order, the adviser failed to establish appropriate procedures with respect to publically-listed companies in its investment portfolio on whose boards it had an employee-representative. Additionally, the SEC found that the policies and procedures that were in place did not provide specific requirements for compliance staff concerning the identification of relevant parties with whom to inquire regarding possession of potential MNPI and the manner and degree to which the staff should explore MNPI issues with these parties, nor did compliance staff document sufficiently that they had inquired with the relevant parties whether they had received MNPI.

SEC Policy and Rulemaking Updates

The SEC was active on the rulemaking front in 2020, and a number of proposed or adopted rules will affect advisers to private funds. The discussion below does not include a number of interim measures implemented by the SEC or its staff in response to the effects of the ongoing COVID-19 crisis on the financial markets.

Proposed and Adopted Rules

SEC Revises Marketing Rule for Registered Investment Advisers

On December 22, 2020, the SEC announced final rules under the Investment Advisers Act of 1940, as amended "Advisers Act" to govern advertisements by registered investment advisers and payments to solicitors. The amendments create a single marketing rule that draws from and replaces the current advertising and cash solicitation rules, rule 206(4)-1 and rule 206(4)-3, respectively. These amendments reflect market developments and regulatory changes since the advertising rule's adoption in 1961 and the cash solicitation rule's adoption in 1979. The SEC also made related amendments to Form ADV and rule 204-2, the books and records rule.

The SEC received more than 90 comment letters on the proposal1. The marketing rule, amended books and records rule, and related Form ADV amendments will be effective 60 days after publication in the Federal Register. The SEC has adopted a compliance date that is 18 months after the effective date to give advisers a transition period to comply with the amendments.

Definition of Advertisement

The amended definition of "advertisement" contains two

prongs: one that captures communications traditionally covered by

the advertising rule and another that governs solicitation

activities previously covered by the cash solicitation rule.

- First, the definition includes any direct or indirect communication that an investment adviser makes that: (i) offers the investment adviser's investment advisory services with regard to securities to prospective clients or private fund investors, or (ii) offers new investment advisory services with regard to securities to current clients or private fund investors. The first prong of the definition excludes most one-on-one communications, provided they do not contain hypothetical performance, and contains certain other exclusions.

- Second, the definition generally includes any endorsement by a current or former client or private fund investor, or any testimonial by any third party (e.g., placement agents) for which an adviser provides cash and non-cash compensation directly or indirectly.

The Adopting Release provided that information included in a private placement memorandum ("PPM") about the material terms, objectives, and risks of a private fund offering is not an advertisement of the adviser. However, whether particular additional information included in a PPM constitutes an advertisement of the adviser depends on the relevant facts and circumstances. For example, if a PPM contained related performance information of separate accounts the adviser manages, that related performance information is likely to constitute an advertisement.

Further, private fund account statements, transaction reports, and other similar materials delivered to existing private fund investors, and presentations to existing clients concerning the performance of private funds they have invested in (for example, at annual meetings of limited partners) also would not be considered advertisements under the marketing rule.

General Prohibitions - The new marketing rule prohibits the following advertising practices:

- making any untrue statement of a material fact, or omitting a material fact necessary to make the statement made, in light of the circumstances under which it was made, not misleading;

- making a material statement of fact that the adviser does not have a reasonable basis for believing it will be able to substantiate upon demand by the SEC;

- including information that would reasonably be likely to cause an untrue or misleading implication or inference to be drawn concerning a material fact relating to the adviser;

- discussing any potential benefits without providing fair and balanced treatment of any associated material risks or limitations;

- referencing specific investment advice provided by the adviser that is not presented in a fair and balanced manner;

- including or excluding performance results, or presenting performance time periods, in a manner that is not fair and balanced; and

- including any information that is otherwise materially misleading.

To view the full article, please click here.

Footnote

1. The Proskauer comment letter was cited 13 times in the Adopting Release, including in connection with some of the key proposals that were not ultimately adopted.

2020 Proskauer Annual Review And Outlook For Hedge Funds, Private Equity Funds And Other Funds

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.