- within Wealth Management topic(s)

Article by

Christopher B. Horn, ![]() ,

J. Paul Forrester,

,

J. Paul Forrester, ![]() ,

Julie A. Gillespie,

,

Julie A. Gillespie, ![]() Carol Hitselberger,

Carol Hitselberger, ![]() Paul A. Jorissen,

Paul A. Jorissen, ![]() ,

Jason H.P. Kravitt,

,

Jason H.P. Kravitt, ![]() ,

Stuart Litwin

,

Stuart Litwin ![]() ,

Elizabeth A. Raymond

,

Elizabeth A. Raymond ![]() ,

Angela M. Ulum

,

Angela M. Ulum ![]() and

Jon D. Van Gorp

and

Jon D. Van Gorp ![]() .

.

Originally published date on October 4, 2011

Keywords: SEC, conflict of interest, securitization transactions, Rule 127B, asset-backed securities

Executive Summary

- The SEC has issued proposed Rule 127B pursuant to Section 621 of the Dodd-Frank Act.

- Rule 127B prohibits a securitization participant (i.e., an underwriter, placement agent, initial purchaser, sponsor or any affiliate or subsidiary of any such party) from engaging in a transaction that would result in a "material conflict of interest" with respect to an investor.

- This prohibition is in effect for the period ending on the first anniversary of the first closing of the sale of the asset-backed security. However, Rule 127B does not specify the date on which the period begins.

- Rule 127B covers transactions between a securitization participant and an investor. Rule 127B does not cover any transaction between investors or between securitization participants.

- SEC commentary provides "interpretive guidance" on many aspects of Rule 127B, including the following two-part test for determining whether a material conflict of interest exists:

- A securitization participant benefits directly or indirectly from a short transaction or from permitting a third party to structure the ABS or select the assets in a way that facilitates or creates an opportunity for that third party to benefit from a short transaction; and

- There is a substantial likelihood that a reasonable investor would consider the conflict important to its investment decision.

- SEC commentary also provides several examples of the application of Rule 127B.

- Rule 127B contains exceptions for risk-mitigating hedging activities, liquidity commitments and bona fide market making.

- Rule 127B applies to "asset-backed securities" as defined by the Dodd-Frank Act (which, for purposes of Rule 127B, includes synthetic asset-backed securities).

- Rule 127B applies to public and private offerings of asset-backed securities.

- Rule 127B contains no safe harbor for foreign issuers or foreign transactions.

- Compliance is required upon issuance of final Rule 127B, unless final Rule 127B contains a transition period.

- Comments are due on December 19, 2011

Introduction

On September 19, 2011, the US Securities and Exchange Commission (the "SEC") issued proposed Securities Act Rule 127B ("Rule 127B") prohibiting certain conflicts of interest in securitization transactions.1 Rule 127B implements Section 621 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") as codified in new Section 27B of the Securities Act of 1933 (the "Securities Act").2

Rule 127B applies to transactions involving assetbacked securities ("ABS"), as that term is defined in Section 3(a)(77) of the Securities Exchange Act of 1934 (the "Exchange Act").3 Rule 127B applies to registered public offerings of Exchange Act ABS as well as private offerings of Exchange Act ABS, regardless of whether such private offerings are conducted in reliance on Rule 144A, Regulation D or another safe harbor from the registration requirements of the Securities Act.

Deadline for Comments

Comments on the Proposed Rule are due on December 19, 2011.

Compliance Date

The Proposing Release does not specify a compliance date. Unless the adopting release provides otherwise, Rule 127B will become effective upon the issuance of final rule.

Overview of Rule 127B

Section 621 of the Dodd-Frank Act prohibits securitization participants from entering into "any transaction that would involve or result in any material conflict of interest with respect to any investor in a transaction arising out of such activity." Section 621 is intended to "prohibit underwriters, sponsors and others who assemble asset-backed securities from packaging and selling those securities and profit from the securities' failures."4

Prior to undertaking its rulemaking under Section 621, the SEC invited comments regarding how it should craft a proposed conflicts-of-interest rule.5 During that prerulemaking comment process, market participants urged the SEC to tailor its conflictsof- interest rule in a way that satisfies the intent of Section 621, as described above, without causing unnecessary adverse impacts on the markets for ABS by inadvertently prohibiting otherwise normal and commonly accepted features of many ABS transactions.6

In proposing Rule 127B, the SEC chose to issue a rule that tracks almost identically the broad provisions of Section 621 of the Dodd-Frank Act. Rule 127B reads as follows:

a) Unlawful activity. An underwriter, placement agent, initial purchaser, or sponsor, or any affiliate or subsidiary of any such entity, of an asset-backed security (as such term is defined in section 3 of the Securities Exchange Act of 1934 ( 15 U.S.C. 78c), which for the purposes of this rule shall include a synthetic assetbacked security), shall not, at any time for a period ending on the date that is one year after the date of the first closing of the sale of the asset-backed security, engage in any transaction that would involve or result in any material conflict of interest with respect to any investor in a transaction arising out of such activity.

b) Excepted activity. The following activities shall not be prohibited by paragraph (a) of this section:

1) Risk-mitigating hedging activities. Risk-mitigating hedging activities in connection with positions or holdings arising out of the underwriting, placement, initial purchase, or sponsorship of an asset-backed security, provided that such activities are designed to reduce the specific risks to the underwriter, placement agent, initial purchaser, or sponsor associated with such positions or holdings; or

2) Liquidity commitment. Purchases or sales of asset-backed securities made pursuant to and consistent with commitments of the underwriter, placement agent, initial purchaser, or sponsor, or any affiliate or subsidiary of such entity, to provide liquidity for the asset-backed security; or

3) Bona fide market-making. Purchases or sales of asset-backed securities made pursuant to and consistent with bona fide marketmaking in the asset-backed security. In the Proposing Release, the SEC acknowledges the concerns of ABS market participants that the rule not be overly broad, but chose to address those concerns by issuing, and requesting comment on, "interpretive guidance" in the Proposing Release.7 The following is a discussion of Rule 127B, as supplemented by the interpretive guidance provided by the SEC.

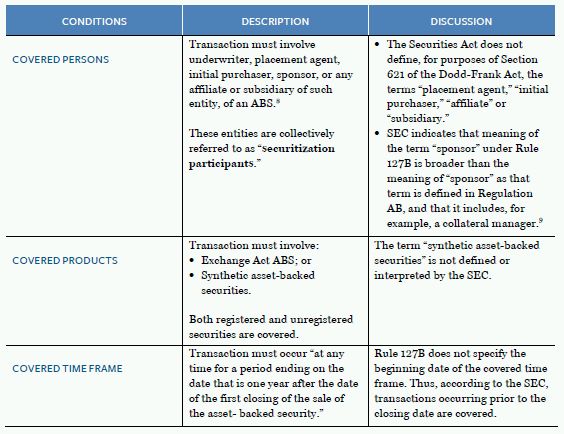

FIVE CONDITIONS REQUIRED IN ORDER FOR RULE 127B TO APPLY

The Proposing Release describes five conditions that must be present in order for Rule 127B's prohibition on conflicts of interest to apply to a particular transaction. Those five conditions are summarized in the following chart.

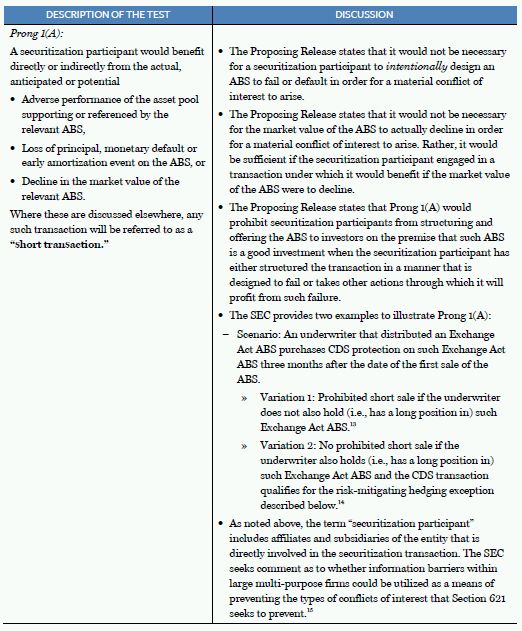

TWO-PART TEST FOR IDENTIFYING MATERIAL CONFLICTS OF INTEREST

The Proposing Release contains a two-part test for identifying "material conflicts of interest." This test is included in the Proposing Release as an interpretation and is not included within the text of Rule 127B itself.

The SEC noted the difficulty in avoiding an interpretation that construes material conflicts of interest either too narrowly (thus failing to capture the full range of transactions that involve the types of conflicts that the Dodd-Frank Act was intended to prevent) or too broadly (thus curtailing the willingness of securitization participants to engage in securitization transactions).10 In examining the legislative history of Section 621 of the Dodd-Frank Act, the SEC concluded that Section 621 was not intended to curtail the legitimate function of the securitization markets, but, rather, was intended to target and eliminate specific types of improper conduct.11 Thus, in the view of the SEC, the "activities associated with the typical structuring of a non-synthetic ABS would not be prohibited by the proposed rule."12

The SEC's two-part test is discussed in the chart below. In order for the test to be met, either Prong 1(A) or Prong 1(B) must be met and Prong 2 must be met.

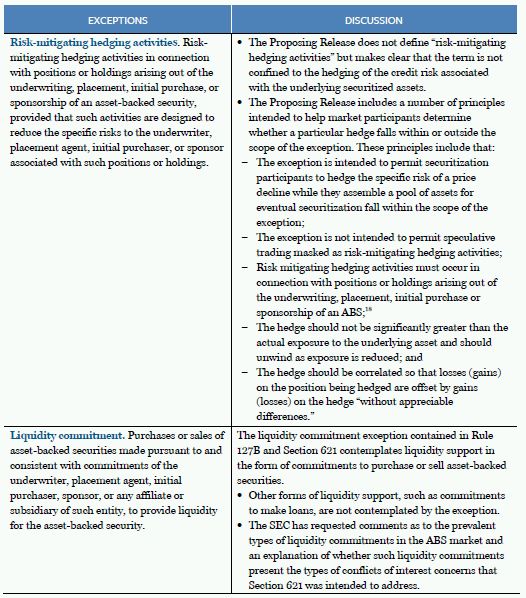

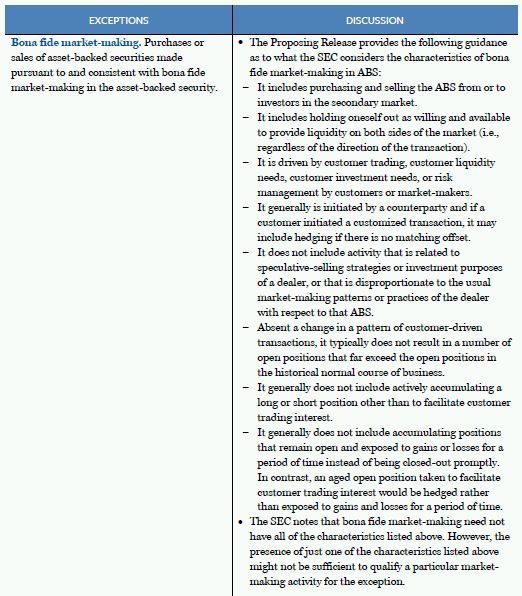

EXCEPTIONS FOR HEDGING, LIQUIDITY COMMITMENTS AND MARKET MAKING

Description of the Exceptions

The exceptions contained in Rule 127B are modeled on the exceptions contained in Section 621 of the Dodd-Frank Act. These exceptions are discussed in the following chart.

Scope of the Exceptions and the Volcker Rule

In the Proposing Release, the SEC notes that Section 619 of the Dodd-Frank Act (the "Volcker Rule") contains exceptions for market-making activities19 and risk-mitigating hedging.20 In the SEC's view, the Volcker Rule is intended to address conflicts of interest stemming from proprietary trading by banks and non-bank financial firms. In light of the common purpose of the Volcker Rule and Rule 127B:

- The SEC "may consider whether aspects of the rules adopted to implement [the Volcker Rule] should be applied to [Rule 127B] in the future"21 and

- The SEC's "preliminary belief is that the exceptions for risk-mitigating activities and bona fide market-making activities for purposes of proposed Rule 127B should be viewed no less narrowly than the comparable exceptions for such activities under the Volcker Rule."22

Extraterritorial Application of Rule 127B

The provisions of Section 621 and Rule 127B (including the definition of "asset-backed security" as used therein) do not contain any limitations on the jurisdictional reach of those provisions. Unlike the risk retention rules, for example, Rule 127B contains no safe harbor for foreign issuers or foreign transactions. Many market participants are likely to be very concerned about the potentially broad jurisdictional reach of Rule 127B, especially in light of the fact that the securitization participants covered by Rule 127B include affiliates and subsidiaries of the entities that are directly involved in the securitization transaction.

Conclusion

The very broad scope of Section 621 of the Dodd- Frank Act caused concern among many market participants that the SEC would propose a conflicts-of-interest rule that prohibits many common practices in ABS transactions. Although several aspects of Rule 127B are likely to draw heavy comment, Rule 127B and the related interpretive guidance indicate a clear intention on the part of the SEC to craft a rule that is narrowly tailored and designed to prohibit only those types of conflicts that are of particular concern to the SEC.

Footnotes

1 See SEC Release No. 34-65355, available at: http://www.sec.gov/rules/proposed/2011/34-65355.pdf (the "Proposing Release").

2 Section 27B of the Securities Act, reads as follows:

(a) IN GENERAL.—An underwriter, placement agent, initial purchaser, or sponsor, or any affiliate or subsidiary of any such entity, of an asset-backed security (as such term is defined in section 3 of the Securities and Exchange Act of 1934 (15 U.S.C. 78c), which for the purposes of this section shall include a synthetic assetbacked security), shall not, at any time for a period ending on the date that is one year after the date of the first closing of the sale of the asset-backed security, engage in any transaction that would involve or result in any material conflict of interest with respect to any investor in a transaction arising out of such activity.

(b) RULEMAKING.—Not later than 270 days after the date of enactment of this section, the Commission shall issue rules for the purpose of implementing subsection (a).

(c) EXCEPTION.—The prohibitions of subsection (a) shall not apply to—

(1) risk-mitigating hedging activities in connection with positions or holdings arising out of the underwriting, placement, initial purchase, or sponsorship of an asset-backed security, provided that such activities are designed to reduce the specific risks to the underwriter, placement agent, initial purchaser, or sponsor associated with positions or holdings arising out of such underwriting, placement, initial purchase, or sponsorship; or

(2) purchases or sales of asset-backed securities made pursuant to and consistent with—

(A) commitments of the underwriter, placement agent, initial purchaser, or sponsor, or any affiliate or subsidiary of any such entity, to provide liquidity for the assetbacked security, or

(B) bona fide market-making in the asset backed security.

(d) RULE OF CONSTRUCTION.—This subsection shall not otherwise limit the application of section 15G of the Securities Exchange Act of 1934.

(e) EFFECTIVE DATE.—Section 27B of the Securities Act of 1933, as added by this section, shall take effect on the effective date of final rules issued by the Commission under subsection (b) of such section 27B, except that subsections (b) and (d) of such section 27B shall take effect on the date of enactment of this Act.

3 The term "asset-backed security" is defined in Section 3(a)(77) of the Exchange Act as "a fixed income or other security collateralized by any type of self liquidating financial asset (including a loan, a lease, a mortgage, or a secured or unsecured receivable) that allows the holder of the security to receive payments that depend primarily on cash flow from the asset, including – (i) a collateralized mortgage obligation, (ii) a collateralized debt obligation, (iii) a collateralized bond obligation, (iv) a collateralized debt obligation of asset-backed securities; (v) a collateralized debt obligation of collateralized debt obligations; and (vi) a security that the [SEC] by rule determines to be an asset-backed security for purposes of this section." Section 3(a)(77) of the Exchange Act provides that the term asset-backed security "does not include a security issued by a finance subsidiary held by the parent company or a company controlled by the parent company, if none of the securities issued by the finance subsidiary are held by an entity that is not controlled by the parent company."

4 See Proposing Release at 12, quoting from the Congressional Record.

5 The comments received by the SEC prior to its proposal of Rule 127B are available at http://www.sec.gov/comments/df-title-vi/conflicts-ofinterest/ conflicts-of-interest.shtml

6 See, e.g., the letter from the American Securitization Forum, dated October 21, 2010 (available at: http://www.sec.gov/comments/df-title-vi/conflicts-ofinterest/ conflictsofinterest-6.pdf ).

7 The SEC seeks comment as to whether some aspects of the interpretive guidance should be moved to the text of Rule 127B itself. See, e.g., Proposing Release at 46 (request for comment #32). The SEC's preliminary decision to include most of the key operative details in interpretive guidance rather than in the text of Rule 127B itself represents a departure from the approach used by the SEC in its previous securitization-related rulemakings under the Dodd-Frank Act. The approach taken by the SEC in the Proposing Release, if adopted, could lead to uncertainty and market disruption if the SEC changes its interpretive guidance outside of the rulemaking process. As a result, some market participants may prefer that the key elements of the SEC's interpretive guidance be included within the text of Rule 127B. This approach could reduce the potential for uncertainty and disruption because a rule cannot be amended except in accordance with the requirements of applicable administrative law, which generally require that a proposed rule amendment be published and that the public have the opportunity to comment.

8 According to the SEC, these persons structure the ABS and control the securitization process, and thus they may have the opportunity to engage in activities that Rule 127B and Section 621 are intended to prevent. See Proposing Release, at 19-20.

9 See Proposing Release at 20.

10 The SEC discusses this balancing of considerations in detail on pages 35-37 of the Proposing Release.

11 See Proposing Release, at 36 (noting that the SEC is "not aware of any basis in the legislative history of Section 621 to conclude that this provision was expected to alter or curtail the legitimate functioning of the securitization markets, as opposed to targeting and eliminating specific types of improper conduct" and that "as a preliminary matter, we believe that certain conflicts of interest are inherent in the securitization process, and accordingly that Section 27B and our proposed rule should be construed in a manner that does not unnecessarily prohibit or restrict the structuring and offering of an ABS").

12 Id. at 79. The SEC noted that "we preliminarily agree that most activities undertaken in connection with the securitization process would not be prohibited by the proposed rule, including but not limited to: providing financing to a securitization participant, deciding not to provide financing, conducting servicing activities, conducting collateral management activities, conducting underwriting activities, employing a rating agency, receiving payments for performing a role in the securitization, receiving payments for performing a role in the securitization ahead of investors, exercising remedies in the event of a loan default, exercising the contractual right to remove a servicer or appoint a special servicer, providing credit enhancement through a letter of credit, and structuring the right to receive excess spreads or equity cashflows." Id. at 80.

13 See Example 1 in the Proposing Release at p. 68.

14 See Example 2 in the Proposing Release at p. 69.

15 See Proposing Release at 83-88.

16 See Example 4B in the Proposing Release at pp. 74-75. In that example, the SEC states that "[a]lthough the securitization participant [in that example] would not receive direct compensation for facilitating the short transaction we believe it would be appropriate to impute a benefit to the securitization participant for creating the opportunity for the third party to profit from its short transaction. For example, the securitization participant may receive compensation from its role in connection with the ABS or compensation from future business that the third party promises to direct to the securitization participant." Id. at 75. It is unclear whether the SEC would impute a benefit to the securitization participant in circumstances where such a promise by a third party was not made.

17 See Proposing Release at 89-95.

18 See Examples 3B and 3C on pp. 70-72 of the Proposing Release for an illustration of this principle in the context of a synthetic ABS transaction.

19 Section 619(d)(1)(B) of the Dodd-Frank Act exempts "the purchase, sale, acquisition, or disposition of securities and other instruments ... in connection with underwriting or market-making related activities, to the extent that any such activities permitted by this subparagraph are designed not to exceed the reasonably expected near term demands of clients, customers, or counterparties."

20 Section 619(d)(1)(C) of the Dodd-Frank Act exempts "riskmitigating hedging activities in connection with and related to individual or aggregated positions, contracts, or other holders of a banking entity that are designed to reduce the specific risks to the banking entity in connection with and related to such positions, contracts, or other holdings."

21 See Proposing Release at 81-82.

22 Id. at 82.

Visit us at mayerbrown.com

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2011. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.