- within Corporate/Commercial Law topic(s)

- with Finance and Tax Executives

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Advertising & Public Relations industries

Shareholder activism in the public real estate investment trust (REIT) sector has accelerated in recent years, with over 100 public campaigns and related engagements launched since 2020. As M&A markets regain momentum and interest rates stabilize, activists are increasingly targeting REITs, especially those trading at discounts to net asset value. The sector's distinctive structural features, which have historically created barriers to significant stake building, unsolicited bids and hostile takeovers, have contributed to an uptick in activist campaigns as a mechanism for prompting change.

For REIT boards and management teams, understanding this evolving landscape, recognizing vulnerability indicators, and taking proactive steps toward preparedness have become essential components of prudent corporate management. This article examines major activism trends of 2025, highlights notable REIT campaigns and outcomes, discusses structural defenses unique to the REIT sector, and offers guidance for boards and management teams for activism preparedness in 2026 and beyond.

Activism Across Sectors Remained Strong in 2025

Shareholder activism across all US-listed companies remained robust in 2025, with approximately 400 public campaigns and related engagements initiated — not including private, non-public campaigns. Overall public campaign volume dipped slightly in early 2025 amid tariff-related uncertainty and a softer M&A environment, but activity rebounded in the second half of the year. Activists returned to the field with renewed confidence as interest rates began to stabilize, the M&A market strengthened, and post-election clarity emerged on antitrust enforcement.

Several market trends continue to spur activism across sectors. Pressure from pension funds, hedge funds, and mutual funds for stronger returns encourages support for strategic, operational, or governance reforms that could lift valuations. Evolving governance norms emphasizing accountability and board independence have empowered shareholders to challenge management decisions more effectively, while the declining usage of traditional structural defenses such as classified boards has lowered barriers to activist engagement and impact.

Despite companies improving their preparedness and defensive sophistication, activist confidence remains high. Institutional investors are increasingly receptive to plausible cases for change, creating fertile ground for campaigns. A growing number of companies face "swarming," where multiple well-known activists target the same company simultaneously but not as formal groups, intensifying pressure and expanding the range of potential outcomes. Activists are also increasingly eager to hold CEOs and senior executives directly accountable for operational or strategic underperformance. Notably, 2024 and 2025 saw a record number of CEO and other high-profile management changes linked to activist campaigns, underscoring the growing willingness of boards to consider leadership transitions under shareholder pressure. At the same time, several established investors with significant capital, reputation, and influence are embracing public activism for the first time, further broadening the activist universe.

REIT Sector Activism: 5-Year Lookback

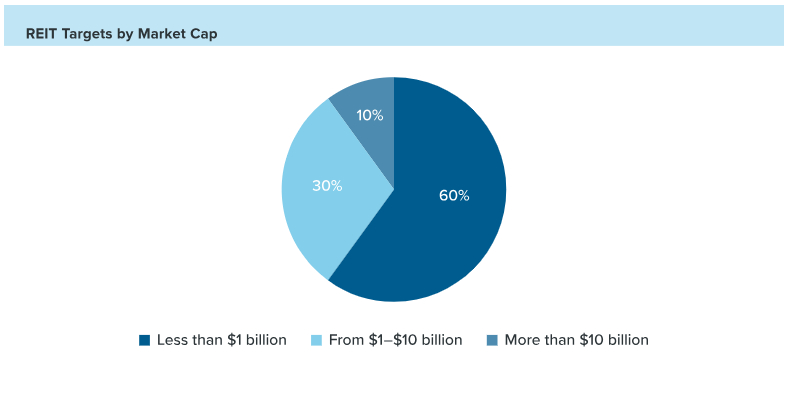

Over the past five years, the REIT sector ranked among the industries most targeted by activists, alongside industries such as business services, pharmaceuticals, software and other financial services. Approximately 100 public campaigns have been initiated in the sector since 2020.1 Activist campaigns typically pursue multiple objectives: About half advocate for a sale of the company or the initiation of a strategic review, about half seek board or management changes, and about a fifth are initiated in connection with or to support proposed M&A or an unsolicited bid. Consistent with broader market trends, activism at REITs is concentrated in the small- and mid-cap space. Approximately 60% of targets fall between $1 million and $1 billion in market cap, 30% fall between $1 billion and $10 billion, and 10% exceed $10 billion.

Over 90% of all REIT activist campaigns conclude before reaching any kind of shareholder vote. Since 2020, about 25% of campaigns resulted in formal settlements, about 20% led to the execution on core objectives of the activist, and about 20% achieved or were followed by some degree of success or change from an activist perspective — such as board refreshment, committee formation, strategic transaction pursuit, or enhanced disclosure —in each case without formal agreements or ballots. While proxy contests involving director nominations are high profile, they represented only about a quarter of the activism situations, and only 8% of REIT-related activism campaigns went to a shareholder vote.

Proxy contests at REITs since 2020 illustrate activists' mixed success at the ballot box. At Apartment Investment and Management Company, Land & Buildings won one of three director seats up for election, securing a seat for one of its two nominees. At Ashford Hospitality Trust, Blackwells Capital pursued a withhold campaign that resulted in narrow support margins for most company nominees and two subsequent director resignations. Conversely, dissident candidates failed to win any seats at National Health Investors, Whitestone REIT and Crown Castle despite vigorous activist campaigns. These results reflect a broader market patterns. Company slates prevail more often, although sometimes by narrow margins, and outcome certainty is rare, creating risk for both activists and incumbents. Boards averse to the uncertainty of a contested election commonly prefer settlement even when confident in their position.

Why Activists Target REITs

The REIT sector in 2025 is demonstrating considerable resilience, supported by steady income growth across much of the industry. Several structural forces continue to underpin performance. Elevated construction costs and tighter financing have curbed new supply. Long-term demand drivers — particularly AI, cloud computing, and e-commerce — continue to support data centers and modern industrial facilities. Many REITs are delivering consistent earnings and dividend growth. Leasing momentum is strengthening with higher renewals and improved tenant retention. Capital access is gradually normalizing as interest rates stabilize, particularly for high-quality operators.

Performance across REIT industries and subindustries, however, is not uniform, and activists focus on these divergences. Strong results in data centers, healthcare, and parts of industrial real estate contrast with slower recoveries in office and certain residential markets. In some instances, public REIT share prices trade at discounts to estimated net asset value (NAV), reflecting broader investor caution about interest rates and macroeconomic risk. Activists often view these valuation gaps as opportunities to argue that the market is underappreciating underlying real estate value.

Activists also track the headwinds shaping parts of the sector. Economic and policy uncertainty has slowed corporate decision-making. Localized oversupply in certain Sun Belt residential submarkets and select industrial corridors continues to weigh on fundamentals. Structural challenges persist in the office sector, including elevated vacancies and uneven demand recovery. Some tenants in retail, technology, and other space-intensive industries are reassessing footprints or deferring commitments. In addition, a significant amount of commercial real estate debt is approaching maturity, creating refinancing considerations for balance sheets under pressure.

Taken together, these dynamics create conditions that activists perceive as ripe for engagement. Valuation discounts provide a foundation for arguments that public-market pricing does not fully reflect intrinsic real estate value. Performance dispersion allows activists to benchmark REITs more aggressively against sector leaders. Operational and refinancing pressures become focal points in critiques of strategy or capital allocation. As capital markets stabilize, activists see expanded pathways to pursue value-creation agendas, including asset sales, joint ventures, balance-sheet adjustments, or, in some cases, advocating for a strategic review or potential sale of the company.

New Tactics and Escalation Paths

Two defining features of contemporary activist campaigns are their escalation strategies and savvy media use. Activists often start with private outreach or public letters. If met with resistance, they may escalate their campaigns by leaking materials to the press, announcing a public stake, issuing press releases, filing proxy materials and launching dedicated campaign websites. This process is designed to exert heightened pressure on boards while minimizing initial confrontation. Once the company is drawn into the spotlight, its options may be narrowed and its negotiating leverage may be reduced.

Activists no longer necessarily rely solely on investor letters, press releases and media leaks as means of communicating with investors. They increasingly wage campaigns in the digital arena as well, such as on X, Reddit and other online platforms followed by shareholders, which can significantly amplify pressure. Campaigns may now start with tactics such as pairing a report challenging financial integrity with a coordinated social media push, in some cases aimed at retail investors.

The media component introduces a further layer of asymmetry. Public companies are bound by strict disclosure rules under the federal securities laws, including Regulation FD, which prohibits selective disclosures of material information. Activists, by contrast, can publish, post and tweet claims and theories with less regulatory exposure. This asymmetry often allows them to attempt to shape narratives with comparative freedom and less downside. The proliferation of free encrypted email and other messaging platforms further adds to the asymmetry, because activists and other actors can anonymously communicate inflammatory messages to board members, shareholders, the media and regulators without significant accountability.

The SEC's adoption of the universal proxy rules in 2022 introduced another element that activists can leverage in their favor. Under this regime, companies and activists continue to distribute separate proxy cards when soliciting proxies as before, but all cards must include the slate of director nominees of both the company and the activist, allowing voting shareholders to "mix and match" their voting instructions for any combination of candidates from both slates. The new system has increased the confidence of certain activists in their ability to secure the election of a minority of dissident director candidates to a board. Uncertainty regarding the impact of the universal proxy card on director elections has also increased pressure on boards to settle with activists, granting activists representation on boards without the need to run a full proxy contest.

How Activists Profile REITs

Activists are drawn to REITs for a combination of structural, financial, and market-driven reasons. Because REITs hold large portfolios of income-producing properties, their underlying assets are relatively straightforward for outsiders to value, creating a foundation for activists to frame "value-unlocking" proposals. Robust disclosure requirements — covering funds from operations (FFO), adjusted funds from operations (AFFO), same-store results, tenant metrics, property-level performance, and executive compensation — further enhance transparency and allow activists to benchmark REITs with unusual precision. This level of visibility enables activists to model leverage adjustments, capital allocation shifts, or share repurchases with relative confidence.

Persistent discounts to NAV make potential underperformance highly visible. Activists often view these valuation gaps as actionable evidence that the public markets may be undervaluing a REIT's real estate portfolio. These gaps are then used to support calls for asset sales, portfolio simplification, spin-offs, or a shift toward purer-play strategies that activists believe could command higher multiples.

Governance considerations also shape activist targeting. A launching point for many activist campaigns in the sector involves alleged outsized general and administrative (G&A) costs relative to total assets. While G&A can encompass a variety of recurring and non-recurring costs, a significant portion of these costs is typically represented by executive compensation. Activists can readily determine a target REIT's G&A load relative to total assets and benchmark it against peers. The lower the value of total assets, the higher a G&A load will be on a relative basis, even if actual dollar compensation is consistent with that of peers.

A small number of public REITs still retain externally managed structures, legacy leadership teams, staggered boards, or other features that, while offering certain defensive benefits, activists argue can entrench management or reduce strategic flexibility. Further, REIT-specific structural requirements, such as mandatory dividend distributions, naturally limit retained earnings and capital flexibility. Activists frequently use this regulatory constraint to push for more disciplined capital allocation, balance sheet optimization, or opportunistic repurchases at times of discounted valuation. Fragmentation across many REIT subsectors further encourages activists to advocate for consolidation as a pathway to scale and improved competitiveness.

Cyclical pressures, ranging from interest rate volatility to sector-specific slowdowns or leasing challenges, can also expose operational or strategic issues. When such pressures surface, activists often become more assertive, urging leadership changes, strategic reviews, asset monetizations, or, in some cases, the exploration of a full sale.

Within this framework, activists scrutinize REITs across structural, financial, operational, and governance dimensions to identify pressure points for a potential campaign. Strategically, they assess whether a REIT could be an acquisition target in a consolidating sector or whether management should adopt a more aggressive consolidation strategy itself. Calls for reviews of strategic alternatives are common when a REIT trades at a persistent discount to NAV.

Financial analysis follows a systematic pattern. Activists review total shareholder return (TSR) across one-, three-, and five-year periods; valuation metrics such as Price/NAV, Price/FFO, and implied cap rates; and operational efficiency indicators including same-store NOI, AFFO/Revenue, FFO/Revenue, trends in NAV, ROIC on redevelopment projects, and overall balance sheet strength. CEO credibility and execution track record frequently become focal points in this context.

Operational assessments include scrutiny of portfolio composition, diversification across tenants and geographies, cash flow durability, lease-rollover exposure, and margin pressure that may signal underperforming assets or elevated expense structures. As in other sectors, capital allocation is a central battleground. Activists focus closely on dividend sustainability, the effectiveness of capital deployment, the rationale for repositioning losses, leverage levels, and management's stance along the defensive-to-growth spectrum. Share repurchases are a common activist proposal when shares trade materially below estimated intrinsic value.

Themes in REIT Activist Campaigns

A number of high-profile campaigns in 2025 and recent years illustrate recurring themes in REIT activism and show how activists tailor tactics to market conditions that they believe create openings for intervention.

Elliott Investment Management's campaign at Rexford Industrial Realty exemplified operational- and management-focused activism. After private engagement, Rexford announced a leadership transition, appointing its COO as the next CEO and committing to add an independent director before the end of 2025. The company also agreed to pursue several initiatives Elliott reportedly encouraged, emphasizing high-return projects, pruning underperforming assets, sharpening cost discipline, and evaluating capital expenditures in the context of potential share repurchases.

At Whitestone REIT, Erez Asset Management deployed a strategy centered on strategic-sale pressure. Erez launched a proxy fight seeking two board seats while urging the board to consider a sale. Subsequently, MCB Acquisition delivered a cash offer of $15 per share, reinforcing the activist's argument that Whitestone was undervalued relative to its real estate assets.

Blackwells Capital's campaign at Ashford Hospitality Trust demonstrated the use of governance-focused "withhold the vote" campaigns. Training investor focus on capital strategy and governance practices, Blackwells urged shareholders to oppose the re-election of incumbent directors. Seven of nine directors were ultimately re-elected and two tendered their resignations after failing to obtain a majority of shareholder support.

Blackwells also led a high-profile campaign at Global Net Lease, highlighting activist frustration with external management structures. The firm cited underperformance, a substantial discount to NAV, and concerns regarding the company's long-term external management agreement. Blackwells called for board changes, governance reforms, and a strategic review, including a potential sale, and threatened litigation. The dispute ultimately concluded in a settlement that provided Blackwells with consulting and advisory roles.

Campaigns at Equity Commonwealth, led by Land & Buildings and followed by Irenic and Indaba, illustrated the "liquidation thesis" and the dynamics of activist swarming. The activists pressed for significant asset sales and argued that a full liquidation would unlock value, pointing to perceived timing issues in capital deployment and an underutilized balance sheet. The campaign culminated in shareholder approval of the company's plan of sale and dissolution.

Land & Buildings' campaigns at National Health Investors offers an example of sustained activist persistence. Over two proxy seasons, the activist pursued multiple tactics, including a withhold campaign in 2024 and a dissident slate in 2025. Although its nominees were ultimately defeated despite supportive recommendations from the proxy advisory firms, the campaign remained influential and coincided with an appreciation in the company's stock price during the two-year period.

Across these and other campaigns in the REIT sector, several themes recurred. Activists frequently focus on persistent NAV discounts. Governance critiques often target board composition, refreshment, and management accountability. Capital allocation remains a central battleground, particularly around asset sales and reinvestment. The push for a review of strategic alternatives, with an eye to full-company sales or liquidation, remains prominent among activist demands. Because structural defenses common to many REITs make hostile takeovers impractical, activists can use their campaigns to create momentum for M&A. By rallying shareholder support, activists seek to pressure boards to undertake strategic reviews or voluntary sale processes that would unlock value through negotiated transactions.

Focus on REIT Short Attacks

While distinct from traditional shareholder activism discussed above, short-seller campaigns — often referred to as "short attacks" or "bear raids" — are a related feature of the modern shareholder-engagement landscape. In a typical short campaign, a fund establishes a relatively small short position and then publishes research alleging accounting irregularities, valuation distortions, governance failures, or other forms of misconduct or misrepresentation, seeking to profit if the stock price declines following public dissemination of those claims. Over the past five years, there have been approximately 20 notable and publicly visible short campaigns involving REITs. Several of these efforts were led by repeat players well known to market participants.

Across short-seller campaigns targeting REITs, the core allegations tend to cluster around a common set of structural and accounting critiques. Short sellers frequently argue that REITs overstate asset values by relying on aggressive capitalization rates, stale appraisals, or optimistic assumptions about rent growth and occupancy, thereby inflating reported NAV. Relatedly, they often challenge the quality of earnings, asserting that metrics such as FFO and AFFO mask weak underlying cash generation through add-backs for recurring capital expenditures, straight-line rent adjustments, or tenant improvement costs that are portrayed as non-recurring. Governance and incentive issues are another recurring theme, with allegations that external management structures, related-party transactions, or fee arrangements encourage asset growth and leverage rather than per-share value creation. Short campaigns also commonly focus on balance sheet risk, contending that leverage is understated, debt maturities are poorly laddered, or liquidity is more fragile than disclosed, particularly in rising-rate environments. Some campaigns have accused REITs of selectively disclosing tenant concentration risks, lease rollover exposure, or asset-level performance issues, arguing that the market price fails to reflect operational deterioration until it is forced into view by adverse events.

Structural Defenses for REITs

The REIT market has long favored stability and relationship-driven transactions. Reflecting this culture, the vast majority of public REIT acquisitions are negotiated and friendly. Approximately a fifth of proposed deals develop from unsolicited bids. Only a handful of proposed transactions incorporate fully hostile measures such as director nominations, and these few efforts generally have not led to completed deals. This imbalance is reinforced by structural features that make hostile takeovers more challenging for REITs than for other corporations. Most REIT charters contain strict ownership limitation provisions, typically capping any single investor at 9.8% or lower unless the board grants a waiver. Although rooted in the federal tax "5/50" rule for REIT qualification, pursuant to which five or fewer individuals may not own more than 50% of the value of the REIT, these limits function as powerful antitakeover mechanisms because any shares acquired above the cap are void and transferred to a trust with no voting or economic rights. A hostile bidder cannot compel a waiver, giving boards effective control over any accumulation of a meaningful stake. See our alert "Waivers of Ownership Limitation Provisions in REIT Charters" for a more fulsome discussion of REIT ownership limitation provisions.

The umbrella partnership REIT (UPREIT) structure adds further complexity. Operating partnership (OP) unitholders — often founders, senior executives, or long-time asset contributors — frequently have the benefit of long-term tax protection agreements or otherwise possess tax or economic incentives that may lead them to resist transactions that could trigger taxable events. So even when public shareholders support asset sales, portfolio simplification, or a take-private offer, certain OP unitholders may not. Combined with the constraints of maintaining REIT status, these dynamics create hurdles that hostile bidders do not face when targeting conventional corporations. See our alert "Unlocking the UPREIT Structure: OP Unit Transactions for REITs" for a detailed discussion of tax protection agreements under the UPREIT structure.

Moreover, roughly 80% of REITs are incorporated in Maryland, a jurisdiction that affords corporate boards a range of defensive tools. Maryland law makes it easier than Delaware to adopt strong protections such as classified boards, fair-price provisions, and removal-for-cause standards. Specifically, the Maryland Unsolicited Takeover Act (MUTA), among other things, permits boards of public REITs incorporated in Maryland, notwithstanding any contrary provision in their charter or bylaws, to classify their board without shareholder approval.2

Yet when it comes to activism defense, the vast majority of REITs do not fully rely on these statutory advantages. Approximately 12% of publicly-traded equity REITs today have classified boards — far below the approximately 43% rate in the Russell 2000 — despite staggered boards being one of the most effective deterrents to activist-driven board turnover. This reflects a broader pattern: While Maryland law offers companies the ability to adopt potent defenses, REITs generally stop short of fully adopting or deploying them, commonly balancing investor expectations for strong governance against the desire for structural protections. See our alert "2026 Update: Corporate Governance Trends in the Public REIT Sector" for further discussion of corporate governance dynamics among publicly traded REITs.

Proactive REIT Preparedness for Shareholder Activism and Short Attacks

The REITs that fare best in activist situations are those that have assessed their vulnerabilities in advance, built strong relationships with shareholders, and established response frameworks before a campaign emerges. Preparedness reduces disruption and strengthens board credibility and strategic optionality when pressure arrives.

Effective readiness begins with building the right response infrastructure. Boards should identify a coordinated team that includes outside legal counsel to lead or co-lead the defense, advise on fiduciary obligations, oversee compliance with federal securities law and state corporate law, and, if needed, prepare soliciting materials. A financial adviser may also steer the defense and help develop the company's analytical and strategic platform, including developing arguments to rebut the activist's thesis where and as appropriate. A public relations or investor relations adviser may manage messaging, prepare press releases and fight communications, support media engagement, and assist with a compelling investor-facing presentations. A proxy solicitor can be called on to build vote models, advise on engagements with investors and proxy advisors, and manage the solicitation process.

An internally-conducted vulnerability analysis, performed before an activist arrives, can also be critical. Activists systematically evaluate strategic, financial, operational, capital allocation, and governance factors to identify potential pressure points. Companies can mirror this process by reviewing their governing documents and defenses, analyzing board composition, and conducting tabletop exercises to simulate how an unsolicited approach or activist campaign might unfold.

Beyond internal readiness, companies should prioritize proactive shareholder engagement. Ongoing dialogue with institutional investors, proxy advisory firms, and retail shareholder groups (beyond traditional proxy season engagement) builds trust and surfaces concerns early. REITs can move beyond earnings calls and quarterly updates to articulate their value proposition, governance philosophy, and long-term vision with consistency and clarity.

Boards must also be prepared to articulate a thoughtful capital allocation strategy. Activists frequently challenge capital deployment decisions, and the ability to explain trade-offs, such as leveraging near-term net operating income to fund long-term repositioning, can preempt criticism. Transparency in capital allocation helps investors understand how management is evaluating opportunities and constraints, especially in an environment shaped by interest-rate volatility, refinancing needs, and asset-level performance divergence.

Governance remains a focal point of investor scrutiny. Shareholders often favor board refreshment practices that balance continuity with fresh perspectives, independent leadership structures, and compensation frameworks aligned with performance. Executive pay, in particular, remains a consistent pressure point for activists when incentive programs are opaque, overly generous, or insufficiently tied to measurable outcomes. At the same time, corporate governance for REITs is not a one-size-fits-all proposition. Boards should not adopt defensive or shareholder-friendly mechanisms reflexively but rather evaluate their governance profile in light of the REIT's strategic priorities, capital needs, investor base, and long-term value-creation goals.

Boards should also be prepared to respond nimbly and credibly if an activist campaign emerges. This includes scenario planning, engagement protocols, and alignment with legal, financial, and communications advisers. A fractured or overly defensive reaction can embolden activists and underline board and management legitimacy. Conversely, a calm, fact-driven, and respectful response can preserve credibility, stabilize investor sentiment, and keep the company in control of the narrative.

Preparing for potential short attacks is a related but distinct discipline, reflecting both the speed with which such campaigns can unfold and the risk that allegations of short research may be exaggerated or misleading. Boards that are best positioned to withstand a short attack tend to treat preparedness as an extension of good governance rather than as a contingency plan. This preparedness includes regularly stress-testing the company's disclosures, valuation methodologies, governance structures, and liquidity profile to ensure that accounting judgments and asset-level assumptions are well-documented and defensible and to confirm that disclosure controls and crisis-response protocols are current. Advance alignment with independent advisers — legal, financial, and communications — can materially shorten response times and enhance credibility if a campaign emerges. By investing in transparency, documentation, and governance discipline before a short attack materializes, companies reduce the likelihood that a campaign gains traction and preserve flexibility to respond calmly and credibly if one does.

Conclusion: A New Normal for REITs

Shareholder activism is no longer a sporadic or peripheral phenomenon in the REIT sector. It is a defining feature of the landscape. The transparency, valuation sensitivity, and structural particularities that make REITs attractive to investors and resistant to hostile takeovers also make them susceptible to activist pressure. The combination of a diversified field of activist investors and elevated market scrutiny ensures that no REIT is necessarily immune, regardless of size, strategy, or history. By anticipating activist concerns, communicating transparently, and taking preparatory measures, boards can reduce the likelihood of confrontation and emerge stronger if challenged.

Footnotes

1 Activism and merger trend data is derived from

DealPoint Data and FactSet data as January 1, 2026. Activism data

includes proxy contests, public engagements without nominations or

proposals, and activism in connection with hostile or unsolicited

acquisition bids, and generally excludes short attacks and exempt

solicitations.

2 In addition, MUTA permits boards of public REITs incorporated in Maryland, notwithstanding any contrary provision in their charter or bylaws, to take action without shareholder approval to (i) require a two-thirds supermajority vote requirement for removing a director, (ii) require that the number of directors be fixed only by vote of the directors, (iii) require that a vacancy on the board be filled only by a majority vote of the remaining directors, and (iv) require that special meetings may only be called by shareholders entitled to cast at least a majority of all the votes entitled to be cast at the meeting. Most REITs organized in Maryland have opted out of the Business Combination Act and the Control Share Acquisition Act, the state's other two primary anti-takeover statutes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.