Securitization is a structured financing method that consists mainly of the monetization of certain credit rights owned by an entity, based on the assignment of (present) assets or future cash flows, for the purpose of issuing securities represented as certificates. This allows companies to obtain financing and liquidity by converting illiquid or long-maturity assets into liquid ones.

Asset securitization as a financing method and source of liquidity emerged in the United States in the 1970s and was introduced to the Mexican market in 1998; however, securitizations backed by Mexican assets had already been carried out in the US market.

Currently, the Mexican securitization market is the largest in Latin America and represents an attractive investment opportunity, both for qualified or institutional investors and for the general public (i.e., retail investors).

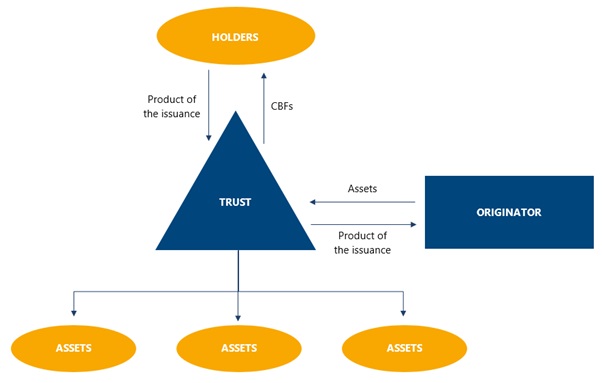

In general terms, a standard securitization transaction consists of:

- The incorporation of a trust or corporation ("SPV") by the originator of the credit rights, created specifically to carry out the transaction;

- The contribution to the SPV of certain assets pertaining to the originator;

- The issuance of asset-backed certificates by the SPV; and

- The placement of the certificates (whether privately or via public offering) and the consequent raising of funds from investors, who will be entitled to the payment of principal and interest.

One of the great advantages of a securitization structure is the legal protection it provides to investors against a potential insolvency or bankruptcy event of the originator. This is due to the fact that the assets backing the certificates stop belonging to the originator the moment they are contributed to the SPV through a true sale, excluding the assets from the originator's estate.1

The Certificados Bursátiles Fiduciarios ("CBFs") are a financial instrument that allows the securitization of assets in the Mexican market. One of the many advantages offered by CBFs is their versatility with respect to the type of assets that can be the subject of these types of transactions. For example, CBFs can be used as a source of financing through the securitization of commodities such as gold, oil, natural gas, corn or cotton; futures or derivatives; collection rights on mortgage loans; collection rights on infrastructure projects; credit portfolios; foreign currencies; accounts receivable; or various financial instruments. Similarly, CBFs' regulation allows the issuing trust to contain different asset classes, thus making it possible to diversify investments in order to mitigate the idiosyncratic risk inherent to any particular asset class.

Another of the great advantages of CBFs is the diversity of options they offer with respect to the rights they grant in favor of their holders (i.e., investors), so they can easily be adapted to any business plan.

Securitization through the issuance of CBFs | Typical structure

Footnote

1 However, there have been certain isolated criteria (not jurisprudential and, consequently, not of general application) that have jeopardized the legal certainty of the true sale when dealing with future rights securitizations (in contrast to the contribution of existing assets at the time of contribution to the SPV).

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.