- within Law Practice Management topic(s)

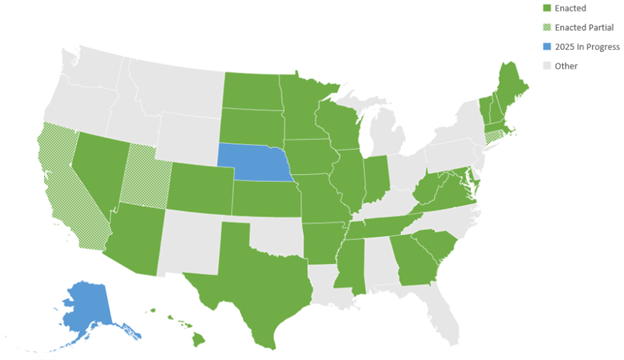

Within the past two months, three states have adopted the Money Transmission Modernization Act (MTMA). The governors of Virginia, Mississippi, and most recently Colorado, signed bills that implement the MTMA, and two other states are currently considering similar bills (Alaska and Nebraska).

Mobile wallets, peer-to-peer payments, and digital assets are modern methods of moving money, but have been historically regulated by laws that in some states have been around for over one hundred years. These laws were originally designed for older forms of non-bank payments, such as money orders, Western Union style remittance services, and travelers checks. The recent boom in financial technology has enabled fintechs to provide nationwide and instant payments, which heightens the need for more uniform laws governing non-bank money transmission. To keep up with the pace of financial technology, the Conference of State Bank Supervisors created the MTMA to bring state money transmission laws into the 21st century. To date, more than half of the states have enacted at least part of the model law. As the rest of the country continues to converge on the MTMA's model

provisions, money transmission licensing for non-banks will grow more streamlined, enabling more efficient compliance, and thus more efficient payments.

Source: Conference of State Bank Supervisors, CSBS Money Transmission Modernization Act (MTMA) (updated Apr. 30, 2025 ), https://www.csbs.org/csbs-money-transmission-modernization-act-mtma.

The three recent states' bills enacting the MTMA will go into effect over the next year: Mississippi HB1428 (effective 7/1/2025); Colorado HB1201 (expected to be effective around 8/6/2025); and Virginia HB1942 (effective 7/1/2026). Interestingly, all of these new laws omitted one provision from the model act. Each bill excluded the optional "virtual currency" provisions of the MTMA, which would have explicitly treated certain virtual currency activity as money transmission. Moreover, Virginia also excluded "virtual currency" from the definition of money, indicating a legislative intent to exempt virtual currency from the law. These differences demonstrate that, despite the MTMA efforts to bring general uniformity in state laws, nuances among the states still exist.

Our group maintains a survey of state-by-state money transmissions laws and other key laws impacting fintech business models. Please reach out to a member of our group to learn more.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.