- with readers working within the Banking & Credit industries

Rules 424(b) and Rule 433 under the Securities Act of 1933 ("Securities Act") are the two primary filing mechanisms for preliminary offering disclosures in the structured note market. Both rules are essential—but practices, technology, and regulatory interpretations have evolved.

PRELIMINARY OFFERING DOCUMENTS FOR REGISTERED OFFERINGS OF STRUCTURED PRODUCTS

Preliminary offering documents for most offerings of structured products registered with the Securities and Exchange Commission (the "SEC") under the Securities Act, are usually prepared and filed in one of two ways:

- Preliminary pricing supplements ("PPSs"), which are filed with the SEC under Rule 424(b) under the Securities Act, often referred to as a "Red Herring";1 or

- Free writing prospectuses ("FWPs"), which are filed with the SEC under Rule 433.2

This article explains the difference between these two, and describes some of the reasons why market practice varies as to their use.

RULE 424(B): THE WORKHORSE OF THE STRUCTURED NOTE MARKET

Rule 424(b) is the backbone for filing PPSs and final pricing supplements. It requires issuers to file these documents publicly with the SEC to ensure that they are accessible to investors via EDGAR.

Under Rule 424(b), PPSs must be filed within two business days of their first use. However, market practice in 2025, shaped by the SEC's push for real-time disclosures, now sees most issuers filing on the same day to facilitate immediate access through electronic delivery platforms.

In the case of a final pricing supplement, it must be filed within two business days of pricing. A pricing supplement filed with the SEC must indicate the sub-paragraph of Rule 424(b) pursuant to which the filing is made, and the filing must be electronically tagged with that information.

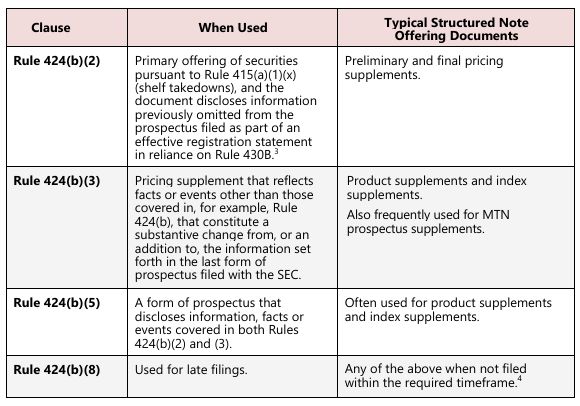

The following chart attempts to provide a summary of which prong of Rule 424(b) applies to which types of structured product offering documents, it being understood that market practice varies.

RULE 433: FREE WRITING PROSPECTUSES AS AN ALTERNATIVE

With the SEC's introduction of Rule 433, the filing of a Free Writing Prospectus ("FWP") was permitted. Typically, a statutory prospectus is long and detailed, and the rule only permits a limited amount of pricing dependent information to be omitted, e.g., principal amount, final interest rate, etc.

FWPs on the other hand are flexible written communications that supplement statutory prospectuses. In the structured note market, FWPs often function as slimmed-down red herrings, enhanced by hyperlinks to base prospectuses and MTN supplements.

Under Rule 433(d)(1) and SEC Compliance and Disclosure Interpretation 232.02 (Rule 433), FWPs must be filed no later than 10:00 p.m. Eastern time on the date of first use. This same-day filing requirement contrasts with the two-day window under Rule 424(b).

KEY DIFFERENCES BETWEEN A PPS VS. FWP

In practice, an FWP and a PPS need not be very different.5 However, there are a few differences worth noting.

SEC Filing Timing Requirements. FWPs must be filed on the same day, whereas PPSs are required to be filed within two business days of first use (but are often filed the same day in practice).

Rule 433 Legend. FWPs require a Rule 433 legend linking to the issuer's base prospectus that has been filed with the SEC and provides a toll-free number that an investor can call to obtain the filed document.6

WHY WOULD AN ISSUER CHOOSE ONE OVER THE OTHER?

Factors affecting issuer choice of a PPS or an FWP include the following:

Issuer Eligibility. Some structured note issuers are not allowed to use an FWP in place of a PPS. For example, "ineligible issuers" (per Rule 405) and their distributors may not use FWPs for their offerings, except for the limited purpose of providing preliminary terms of a security.7 Ineligible issuers must rely on PPSs.

Liability Considerations. Both PPSs and FWPs expose issuers to liability under Section 12(a)(2) of the Securities Act (15 U.S.C. § 77l(a)(2)). An FWP that contains material misstatements or omissions should be viewed in a similar manner as a PPS (or final pricing supplement). Unlike a PPS, an FWP is not part of the registration statement for purposes of Section 11 liability.8

Flexibility. FWPs allow greater design freedom, while PPSs must adhere to Regulation S-K (17 C.F.R. Part 229). Under Regulation S-K, a variety of detailed form and content requirements apply, some of which are "non negotiable." If a product manufacturer wishes to use a different format to market a red herring, for example, by using a cover page that does not conform to the specific requirements of Regulation S-K, then an FWP may be a more suitable approach.

Disclosure Philosophy. Which is better? A short document, which might be more inviting for an investor to read? Or a longer document, which the reader might immediately discard? On the one hand, many market participants believe that an FWP that links to the longer base documents can include sufficient disclosure for most or all retail investors. On the other hand, other market participants believe that placing the full PPS in front of the reader helps to remove any concerns about the adequacy of the disclosure package. Accordingly, practice varies.

TAKEAWAYS FOR ISSUERS IN 2025

Both Rule 424(b) and Rule 433 remain cornerstones of disclosure. For both, best practices include same-day filings for both PPSs and FWPs to support electronic dissemination, careful eligibility assessment before opting for an FWP and hyperlinking to base documents and exhibits.

In 2025's mobile-first, digital distribution landscape, FWPs offer efficiency and investor-friendly formatting, but PPSs remain essential for ineligible issuers or complex offerings.

Originally published in REVERSEinquiries: Volume 7, Issue

1.

Click here to read the articles in this latest

edition.

Footnotes

1. In the case of a final pricing supplement, it must be filed within two business days of pricing. A pricing

2. Rule 433 was promulgated in December 2005 as part of Securities Offering Reform.

3. Rule 430B permits a registration statement to exclude, for example, information that is unknown or not reasonably available to the issuer, the plan of distribution, and a description of the specific terms of the securities.

4. A late Securities Exchange Act of 1934 ("Exchange Act") report filing can have negative consequences for the issuer, including the loss of Form S-3/F 3 eligibility. A late Rule 424(b) filing does not have the same consequences under the SEC rules. However, market participants work hard to ensure timely filing of these documents, particularly since the adoption of Rule 424(b)(8) made it easier for the SEC to identify late filings.

5. A PPS is subject to the detailed disclosure requirements of Regulation S-K, while an FWP may follow a different form. However, because a [red herring] will ultimately be superseded by a final pricing supplement, which is also subject to Regulation S-K disclosure requirements, the form and content of an FWP used as a red herring will largely resemble that of a PPS.

6. We would mention that our clients advise us that these toll-free numbers are rarely used by investors as a means to obtain a prospectus. You may also find these toll-free numbers in a PPS, even if not required; that is done (a) to help investors and (b) for consistency. Also, many PPS's include a legend very similar to that required in an FWP.

7. See Rule 164(e). An ineligible issuer may use a "preliminary term sheet" as an FWP, but not much more than that.

8. See Rules 433(a) and 164(a). In contrast, under Rule 430B, a PPS becomes part of the registration statement for purposes of Section 11 liability as of the earlier of the date it is first used or the date and time of the first contract of sale of securities in the offering to which the prospectus supplement relates.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2026. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.