- in United States

Since mid-2024, the reincorporation of certain high-profile companies, both public and private, has received a great deal of media attention. Companies, including, among others, Roblox, Dropbox, The Trade Desk, Simon Property Group, Coinbase, Tesla, and Trump Media & Technology Group have opted to move their jurisdictions of incorporation. The majority of these companies moved to Nevada or Texas, both of which are sometimes viewed as being more "company friendly" than Delaware. Indeed, in July 2025, Andreesen Horowitz (or "a16z"), a Silicon Valley-based venture capital firm, blogged about its decision to reincorporate in a post titled "We're Leaving Delaware, And We Think You Should Consider Leaving Too."1 In the post, the firm detailed many of the reasons for the reincorporation of its primary business, AH Capital Management, from Delaware to Nevada, including an increasing lack of judicial certainty in Delaware and strong corporate statutes in Nevada designed to protect companies, their officers and directors.

Coinbase followed suit in November 2025, filing both an Information Statement with the U.S. Securities and Exchange Commission and publishing an op-ed in The Wall Street Journal in connection with its reincorporation from Delaware to Texas.2 In his op-ed, Paul Grewal, Chief Legal Officer of Coinbase, argued that "Delaware's Chancery Court in recent years has been rife with unpredictable outcomes [...] companies need a more efficient and sustainable solution than relying on the legislature to fix judicial surprises after the facts." He further cited Texas' "efficiency and predictability, in part thanks to recent corporate-law reforms that enhance governance flexibility and legal predictability" as a rationale for the move, echoing the sentiments that AH Capital Management shared about Nevada.

"DExodus?"

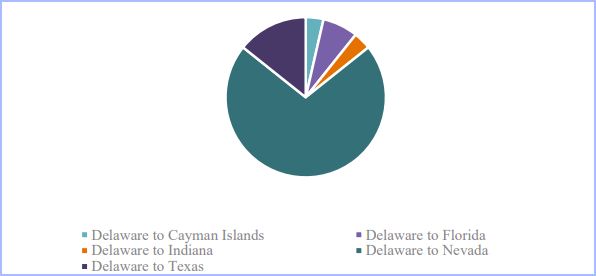

Based on our research, approximately 60 US public companies, most of which are US domestic reporting companies, have changed their jurisdiction of incorporation since January 1, 2024. Approximately 50% of these companies left Delaware, with the vast majority moving to Nevada.

On the opposite end of the spectrum, about 30% of these 60 companies changed their jurisdiction of incorporation to Delaware. Approximately 40% of these moved from an international jurisdiction, such as the British Virgin Islands or the Cayman Islands, to Delaware.3 The remainder reincorporated domestically, including five companies that moved from Nevada to Delaware.

The remaining approximately 20% of these companies consisted of those reincorporating, both internationally and domestically, from other jurisdictions besides Delaware, including two companies reincorporating to Nevada, one company reincorporating to Texas, and one company reincorporating to Florida. While these numbers are small, they demonstrate that companies from jurisdictions other than Delaware are opting to move to jurisdictions perceived as more "company-friendly."

Out of the approximately 30 companies that left Delaware, around 50% are large accelerated filers.4 Around 43% are smaller reporting companies, including both accelerated filers and non-accelerated filers.5 The "DExit" trend, then, is perhaps reflected more by the actions of larger companies than by the actions of smaller ones, although both groups are represented.

While these numbers are interesting, it is important to remember that there are thousands of reporting companies in the United States, and the majority of these remain incorporated in Delaware (for example, at the end of 2024, the Delaware Division of Corporations claimed that 66.7% of all Fortune 500 companies were incorporated in Delaware).6 In addition, while some of the companies that left Delaware are quite large by market cap, only two are large enough to be included in the S&P 500. That said, it remains to be seen whether additional, and potentially larger, more prominent, companies will opt to leave the state.

Considerations and Characteristics Driving the "DExodus"

Based on our research, key drivers of reincorporation likely include:

- Influence of significant or controlling shareholders;

- An increasingly litigious business environment;

- Unfavorable court decisions in Delaware state courts;

- Franchise taxes and fees in Delaware; and

- Director and officer liability.

Influence of Significant and Controlling Shareholders

Company-specific attributes appear to increase the likelihood of reincorporation. In its review of recent proxy statements, Glass Lewis reported that 55% of reincorporation proposals were submitted by companies with significant or controlling shareholders, suggesting that these moves may be more feasible where ownership is concentrated and decision-making is centralized.7 Influential holders seem to be weighing the benefits of a more favorable litigation environment, regulatory and governance flexibility and long-term cost savings against the litigation risks that may arise as a result of reincorporation and the benefits of remaining in the current state of incorporation. Significant or controlling shareholders being able to more easily align the company's board and management on making changes compared to companies with more diffuse shareholder control appears to be the most relevant internal attribute driving change.

Increasingly Litigious Business Environment

Some research shows that in recent years both the quantity of settlements and aggregate settlement amounts have increased significantly in cases before Delaware state courts. Considering only M&Arelated Delaware Court of Chancery settlements, between 2019 and 2024, the number of settlements increased from five to 21, and the average settlement increased from $110.1 million to $618.3 million, with plaintiff counsel's fees between 8.8% and 33.7% of the settlement amount.8 The increasing frequency of lawsuits coupled with the increasing incentives has gained widespread attention and has been cited by at least one company as the rationale for reincorporating.9

Unfavorable Court Decisions in Delaware State Courts

In addition to the increased risk of litigation, key state court decisions in Delaware may create the impression that conditions are increasingly favorable for investors to bring suits against companies incorporated in Delaware. In Maffei v. Palkon, the Delaware Court of Chancery applied the entire fairness standard when evaluating TripAdvisor's proposed reincorporation to Nevada. The decision was later overturned by the Delaware Supreme Court, which held that the transaction should be reviewed applying the business judgment rule—but, while the decision ultimately resulted in a ruling in favor of the company, it seems to highlight the potentially growing risk of litigation in Delaware.10

In Tornetta v. Musk, the Delaware Court of Chancery again applied the entire fairness standard to an executive compensation package, finding that the board failed to prove that the process for awarding the package was fair and that the package itself was fair, and thus, ordered the company to rescind the package. However, on December 19, 2025, the Delaware Supreme Court reinstated the compensation package, holding that rescission of the package "was an improper remedy," but did not otherwise address whether or not the compensation package was entirely fair to the company. The Court awarded the plaintiff "$1 in nominal damages" and attorneys' fees and expenses based on quantum meruit and a fourtimes multiplier.11

Lower Franchise Taxes and Tees

Financial factors may play a role in a company's decision to leave Delaware too, although these are more of a balancing act based on the unique facts and circumstances of individual companies. Delaware has no state sales tax and no taxes on intangible assets, such as patents and trademarks, but Nevada does not have franchise taxes. Texas structures franchise taxes as a percentage of annual revenue, which will vary greatly depending upon a company's annual revenue. Neither Texas nor Nevada has state corporate income taxes. Overall, a company will have to do its own analysis to determine the "best" incorporation option from a financial perspective.

Officer and Director Liability

Officer and director indemnification has been cited both as a reason to reincorporate in Delaware and as a reason to avoid Delaware in favor of other states. Companies have cited the extensive decisions by the Delaware state courts that define officer and director liability clearly as a reason to reincorporate in Delaware.12 However, companies have cited Nevada's mandatory indemnification statutes as a consideration in reincorporating in Nevada, such that this factor also does not result in a clear-cut outcome as to the "best" jurisdiction of incorporation for any given company.13

Changes and Competition Among the States

Nevada and Texas

Nevada and Texas have both made concerted efforts to attract more companies.14 For example, in Nevada, directors' and officers' fiduciary duties are codified in statute, unlike in Texas and Delaware, where fiduciary duties are derived from case law.15 This can provide certainty to companies, and minimize the risks resulting from judicial interpretation. Nevada also has a controlling shareholder anti-takeover statute that specifically permits the use of "poison pills" by companies incorporated in Nevada, whereas the same is permitted only as a result of case law in Delaware.16 In addition, in May 2025, Nevada's legislature adopted Assembly Bill No. 239, which clarifies the fiduciary duties of controlling stockholders, allows companies to waive jury trials in their articles of incorporation and permits holding company reorganizations without a shareholder vote, subject to certain requirements.17

In May 2025, Texas adopted Senate Bill No. 29 ("SB 29") and Senate Bill No. 1057 ("SB 1057"), which seek to make Texas the preferred state for incorporation. SB 29 amends the Texas Business Organizations Code to codify the business judgment rule, with the intent of creating more certainty for officers and directors that their decisions will be upheld in court by creating a rebuttable presumption that they acted "(1) in good faith, (2) on an informed basis, (3) in furtherance of the interests of the corporation, and (4) in obedience to the law and the corporation's governing documents." A party alleging "fraud, intentional misconduct, an ultra vires act, or knowing violation of law" must state with particularity the circumstances constituting fraud, a heightened standard that creates a further challenge for claimants. SB 29 also (i) allows companies to impose minimum ownership requirements for derivative actions, and waive jury trials in their governing documents and (ii) restricts books and records requests by excluding electronic data and increasing the circumstances under which public companies can deny these requests. SB 1057 allows companies to impose share ownership requirements for shareholder proposals to be included in the company's proxy statement.

Delaware—Legislative Changes and Responses

Delaware has long been seen as a preferred state of incorporation for companies, in large part because of its stable, well-developed corporate code, specialized corporate judiciary, and predictable judicial precedents. In March 2025, Delaware enacted Senate Bill 21 ("SB 21"). SB 21 amended Delaware General Corporate Law ("DGCL") Section 144, which governs transactions involving interested directors, officers and controlling shareholders, to, among other things, provide a "safe harbor" for transactions involving conflicted directors and officers if such transactions are approved by an informed majority of either the company's (i) disinterested directors acting in good faith or (ii) disinterested shareholders. If a transaction is approved by either process, Delaware courts will evaluate the transaction under the business judgment rule, rather than the entire fairness standard. Suits involving equitable challenges, including fiduciary duty claims, will also benefit from the Section 144 safe harbor if the material facts of the director's interest are disclosed and proper procedure is followed. In addition, SB 21 creates a presumption of independence for public company directors that can only be refuted with "substantial and particularized facts" that a director has a material interest in a transaction.18

SB 21 also amended Section 220 of the DGCL, which gives shareholders the right to inspect corporate books and records if the shareholder has a "proper purpose." The amendment imposes a higher standard of particularity with regard to both the stated purpose and records requested, and limits, absent a showing of extraordinary circumstances, the scope of such requests to formal corporate documents and board materials. It also excludes director, officer and manager communications and allows companies to impose reasonable restrictions on the use and distribution of corporate records.19

Shortly after SB 21 was enacted, it was subject to a number of lawsuits. The Delaware Supreme Court heard oral arguments on this in November.20 There has been no decision to date, but the result will undoubtedly be key to Delaware incorporation (or reincorporation) decisions going forward.

However, and perhaps tipping the reincorporation scales in the other direction, in addition to the above mentioned decisions in Delaware state courts, in August 2025, Section 115(c) of the DGCL became effective, which may prohibit Delaware companies from including a mandatory arbitration provision in their charters or bylaws.21 Specifically, Section 115(c) permits forum selection provisions in a company's governing documents for shareholder claims, as long as such provisions are consistent with applicable jurisdictional requirements and allow the shareholder to bring the claim in at least one Delaware court (such as the United States District Court for the District of Delaware).

This change took effect immediately prior to the U.S. Securities and Exchange Commission reversal of its longstanding position to consider the "presence of a provision requiring arbitration of investor claims arising under the federal securities laws" when determining whether to grant a request to accelerate the effectiveness of a registration statement.22 In other words, the Commission's position on binding arbitration provisions had acted as a bar, practically speaking, to their inclusion in public company governing documents. Now that the bar is lifted, it remains to be seen if companies move to Texas or Nevada, or stay in Delaware, where state law may still prohibit such provisions. Texas and Nevada do not have such state law provisions, which may be viewed as a more company-friendly approach, but since large investors may still object to such reincorporation, the state of play may remain relatively static.

Conclusion

While the trend away from incorporation in Delaware is currently small, even a small trend away from a century-long practice, coupled with the recent high-profile reincorporations, is notable and underscores that there is now an unsettled landscape in corporate law. There may no longer be a one-size-fits all option for incorporation as company boards consider litigation risks, evolving judicial doctrine and statutory reforms. Nevertheless, while these moves have captured headlines, Delaware continues to be the jurisdiction of choice for incorporation due to its well-developed corporate code, responsive state legislature, dedicated corporate judiciary, and expansive judicial precedent, which provide boards more certainty in decision making.

Footnotes

1. See We're Leaving Delaware, And We Think You Should Consider Leaving Too.

2. See Coinbase Global, Inc. Preliminary Information Statement and Why Coinbase Is Leaving Delaware for Texas.

3. Just under 30% of the companies that moved from an international jurisdiction to Delaware were special purpose acquisition companies ("SPACs") that reincorporated in Delaware simultaneously with a deSPAC transaction. These reincorporations may have been motivated by the SPAC seeking to avoid the possibility of unfavorable judicial treatment of SPACs in the Delaware courts by incorporating elsewhere prior to the deSPAC transaction, while still ultimately benefiting from incorporation in Delaware following the deSPAC transaction once the company was no longer a SPAC.

4. Pursuant to Rule 12b-2 under the Securities Exchange Act of 1934 (the "Exchange Act"), large accelerated filers have an aggregate worldwide market value of voting and non-voting common equity held by non-affiliates of $700 million or more, among other criteria.

5. Exchange Act Rule 12b-2 defines a smaller reporting company, in relevant part, as having (i) a public float of less than $250 million; or (ii) annual revenues of less than $100 million and either (1) no public float; or (2) a public float of less than $700 million.

6. See Delaware Division of Corporations' Annual Report Statistics.

7. See The State of US Reincorporation in 2025: The Growing Threat and Reality of "DEXIT".

8. See M&A Litigation Settlements in the Delaware Court of Chancery.

9. See Mall Giant Plans to Ditch Delaware, Citing 'Increasingly Litigious Environment'.

10. See Maffei v. Palkon. In addition, see our alert for more information, Exiting Delaware: The TripAdvisor Decision.

11. See Tornetta v. Musk.

12. See Daktronics Inc. 2025 Proxy Statement.

13. See Nevada Revised Statutes Section 78.751; see also Forward Industries, Inc., although Forward Industries' reincorporation proposal did not receive the affirmative vote of the majority of shares of outstanding common stock, due at least in part to significant broker non-votes.

14. See Texas Takes Aim at Delaware's State of Incorporation Crown; Texas Set to Lead: Governor Abbott's "Bigger, Better Texas" Economic Development Strategic Plan; Nevada lawmakers aim to lure business incorporations amid Delaware's 'Dexit' concern.

15. See Nevada Revised Statutes Section 78.138.

16. See Nevada Revised Statutes Section 78.195.

17. See Nevada Amends Corporate Law to Attract Incorporations.

18. SB 21 also created safe harbors for controlling stockholders in going private transactions and non-going private transactions. For more information on SB 21, see our alert, Delaware Law Alert: A Step-by-Step Approach for Boards Evaluating Conflicted Director, Officer, and Controlling Stockholder Transactions.

19. For more information on the amendments to Section 220 of the DGCL, see our alert, Delaware Law Alert: Books and Records Inspection Under the Amended §220.

20. See Rutledge v. Clearway Energy Group LLC.

21. See Section 115(c) of the DGCL..

[View Source]