- within Energy and Natural Resources topic(s)

- in European Union

- with readers working within the Banking & Credit industries

- within Energy and Natural Resources topic(s)

- in European Union

- in European Union

- in European Union

- with readers working within the Banking & Credit industries

- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law and Law Practice Management topic(s)

Is Europe on the cusp of an infrastructure investment super-cycle?

This paper follows the recent publication of the latest Q2 2025 Infrastructure Pulse Survey1 by GIIA and Alvarez & Marsal and examines in more detail the reasons behind signs of a resurgence in the attractiveness of Europe to infrastructure investors.

Investor sentiment builds towards Europe2,3

After two years of stalled transaction volumes and infrastructure investment, investors had anticipated a global rebound driven by the U.S. election and expected interest rate cuts. However, this stalled in early 2025 due to U.S. tariffs and global trade tensions. While initial optimism about Donald Trump's pro-business policies spurred a U.S. market rally,4 investors are proceeding with caution due to market volatility, policy uncertainty, and overexposure to U.S. bonds. In the first half of 2025, European equity funds have attracted over $100 billion in inflows — triple the amount recorded last year — while U.S. equity fund outflows have nearly doubled to $87 billion.5 This search for portfolio diversification has led to green shoots of investment into Europe, with recent data indicating that deal values in the European infrastructure sector have increased by more than 25% over the past six months.6

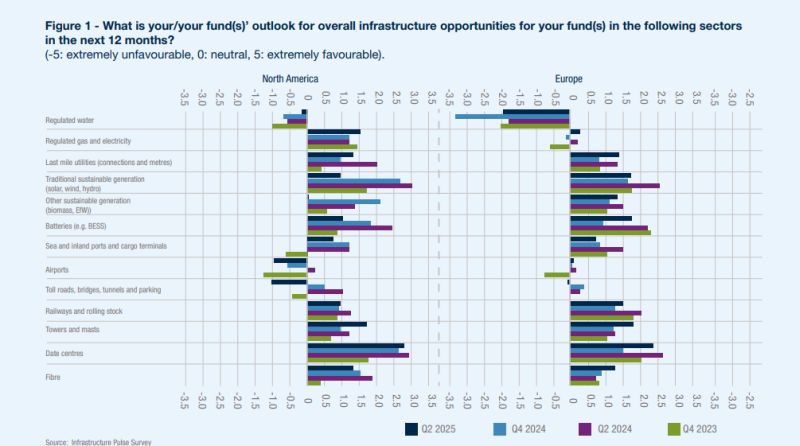

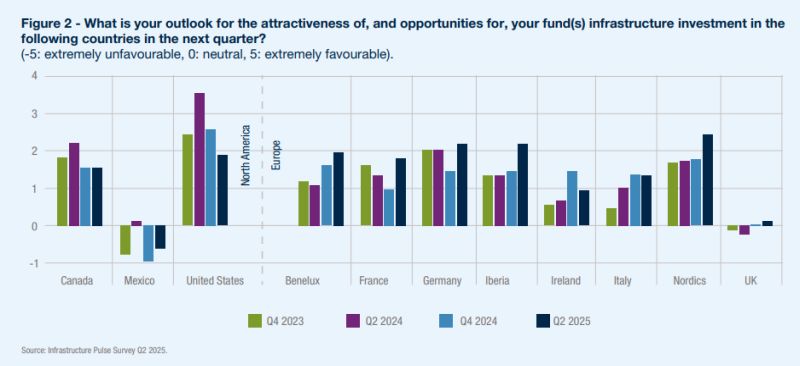

GIIA's Infrastructure Pulse survey, produced by Alvarez & Marsal, offers a unique insight into market sentiment among the world's leading infrastructure investors.7 The recent Q2 2025 edition shows that Europe has become more attractive and that investors are keen to spend in Europe (See Figure 1 and Figure 2).

- In the Q2 2025 survey, investor outlook toward overall infrastructure opportunities in Europe was generally positive, with sectors like traditional sustainable generation and other sustainable generation remaining stable at +1.75 and +1.5 respectively, and batteries climbing from below +1.0 to +1.75 compared to the previous quarter. Data centres dominated investor sentiment over the period, surging from +1.5 to +2.5.

- In contrast, North America displayed mixed trends, with regulated gas and electricity hovering at around +1.5, while airport infrastructure sentiment declined from +2.5 to +1.5 over the last six months,8,8 due to a lack of opportunities rather than the attractiveness of the sector.

Looking ahead, the macroeconomic outlook for Europe is moderately positive. The European Central Bank has cut rates from 4% to 2% over the past year, and governments are prioritising economic security with renewed infrastructure investment. Growth in peripheral regions — Northern Europe (+3.4%), Southern Europe (+2.2%), and Eastern Europe (+1.6%) — is outperforming and offsetting slower growth in core Europe (+0.6%).9

Germany's push for public infrastructure investment could spark a virtuous growth cycle. Investors will assess whether this momentum stems from real structural change or merely increased interest. Key focus areas include investment quality, productivity, job creation, M&A activity, European market expansion, infrastructure deal flow, public-private partnerships, and cross-border capital deployment.

Overall, there is a broader push for portfolio balance and long-term risk management. Growing investor unease over the persistent U.S. current account deficit, a weak U.S. dollar,12 rising fiscal deficits (projected to rise above 7% of GDP), debt levels exceeding 120%, real interest rates over 2%,13 and uncertainty over tariff policy (with a delayed deadline of 1 August 2025) are together prompting a reassessment of U.S. market dominance. Washington's recent announcement of a 30% import tariff on goods from the EU14 could intensify existing investor concerns over retaliatory trade measures and deepening global trade fragmentation, shifting their capital allocation to more stable or undervalued markets.

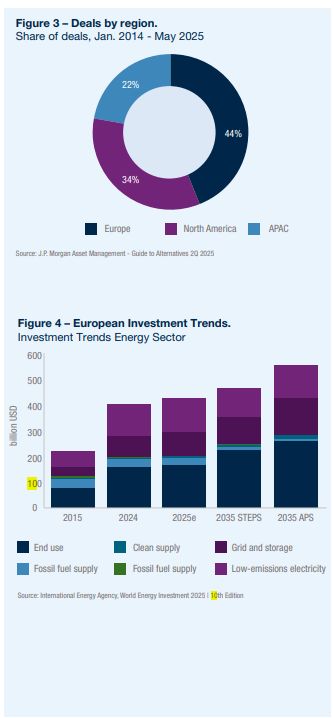

In response, European nations are actively promoting investment across the bloc, primarily in infrastructure and defence. In fact, Europe remains a thriving hub for infrastructure investment, leading global private infrastructure investment since 2014, with 44% of deals and surpassing North America's 34% (Figure 3).15 This dominance is driven by strong political support for large-scale infrastructure projects, particularly in renewables and data centres.

Investors see Europe as an emerging leader in sustainabilityfocused infrastructure like green and digital sectors, with government spending aimed at crowding in even greater levels of private capital. By 2034, the International Energy Agency forecasts significantly higher investment in European energy investments toward clean energy, low-emissions electricity, and grid infrastructure; aligned with several ambitious climate scenarios (Figure 4).16

The investment optimism for Europe, particularly in relation to its green transition agenda, comes about after the Trump administration rolled back funding by about $14 billion in battery, EV, and solar sectors17 and is likely to be propelled further with the codification of the "One Big Beautiful Bill" that transitioned tax credits from renewable energy to a technology-neutral system.18 However, this trend may be partially reversed with latent investment into the U.S. ESG sector once the 2026 Sustainability-Focused Stock Exchange is launched.

Europe's stable legal and financial frameworks, combined with a strong emphasis on public-private partnerships (PPPs), offers an attractive risk-reward profile for investors. This is particularly evident in the Nordics, a region widely regarded for its stability that has seen a resurgence of potential deal opportunities across sectors, from aquaculture to district heating.19

Several EU initiatives are contributing to this momentum:

- The EU Green Deal and Clean Industrial Deal, which aims to decarbonise legacy industries and promote innovation in clean technologies

- The Circular Economy Act (expected in 2026), aimed at targeting waste reduction and improve recycling processes

- Simplified sustainability reporting requirements by the European Commission (EC) that are making it easier for businesses to align with ESG goals

- Major investments are underway in data centres, 5G networks, and broadband infrastructure to support increasing digitalisation and the AI revolution.

Key EU market update: Germany's reformed "debt brake" and enhanced defence spending20

The renewed interest in Europe has also been further fuelled by Germany's recent macroeconomic reform. In March, the German government's rules requiring balanced budgets (the "debt brake") was amended for the second time in history, easing limits to public borrowing and long-term debt sustainability requirements. This change aims to enable greater investment in defence, infrastructure, and climate protection, with potential to boost economic growth across the EU.

In addition, a €500 billion special infrastructure fund was launched, with €100 billion earmarked for energy infrastructure (including renewable energy systems, storage technologies, smart grids, and electricity network expansion) to reduce the country's dependence on Russian energy imports.21

Enabled by relaxed fiscal rules, Germany's 2025 budget and medium-term fiscal plan reflected significantly higher spending than expected, particularly on defence and infrastructure. As a result, the country is set to run larger deficits — 3.3% of GDP in 2025 and 3.6% to 3.8% in the following year. The infrastructure fund includes major transfers to states and €19 billion in federal investment, over half of which is allocated to railways.22

Germany's updated Investment Ordinance Act allows regulated investors to allocate up to 5% of capital to infrastructure, boosting equity and debt deals in the DACH region, especially in solar, wind, and energy transition. While welcomed, investors indicated a preference for funds as subsidies or PPP seed capital and stressed the need for high-quality projects, citing three-year delays in German planning and procurement processes that slow the realisation of investment returns.23

Enhancing EU productivity: streamlining regulations and integrating markets24

Despite growing investor interest, the EU faces structural challenges hindering private infrastructure investment. Its $12 trillion capital markets (60% of GDP) are far smaller than the U.S.'s $60 trillion (200% of GDP). Fragmented markets, lower R&D spending, fewer high-growth firms, and a dominance of small, low-growth companies leave EU productivity 20% behind the U.S. Additional barriers, including limited labour mobility, an aging population, and bank-dominated finance, further constrain growth.

The positive sign here is that the EC is investigating ways to overcome this productivity gap, by deepening the single market to drive growth. Recent independent reports to the Commission by former Italian prime ministers Mario Draghi and Enrico Letta argue for a swathe of reforms such as lowering internal trade barriers, encouraging R&D and high-risk investments, and harmonising regulations.25,26 Additionally, calls for a single Savings and Investment Union to mobilise EU savings into equity financing, supporting young high-growth firms and lower financing costs through venture capital and market integration, could generate even further investor interest in the region.27

Conclusion

Investor sentiment in Europe remains positive, boosted by rebalancing away from the U.S. and opportunities in energy and infrastructure. Germany's €500 billion infrastructure fund and "debt brake" reform could spark a continental investment boom. Despite challenges like market complexity, regulatory barriers, and low productivity, optimism signals strong potential for infrastructure growth and economic development.

Footnotes

1. "Infrastructure Pulse Survey Report: Q2 2025," Alvarez & Marsal and GIIA, June 18, 2025, https://giia.net/sites/default/files/2025-06/AMTAG_InfrastructurePulse_Q2_2025_11_0.pdf

2.Harvey H. McVey et al., "Thoughts From the Road | Europe and the Middle East," KKR, March 2025, https://www.kkr.com/content/dam/kkr/insights/pdf/thoughts-from-the-road europe-and-the-middle-east-march-2025.pdf

3. "Infrastructure in 2025: Megatrends and Mid-Market Opportunities," Goldman Sachs Asset Management, n.d., accessed July 16, 2025, https://am.gs.com/en-us/advisors/insights/ article/2025/infrastructure-2025-megatrends-mid-market-opportunities

4. Ian Smith et al., "US stock market comeback tests investor faith in rotation to Europe," Financial Times, June 30, 2025, https://www.ft.com/content/5ff8625e-7255-4a8d-8686- 377a33ace8b5?accessToken=zwAGOMd9Gpdwkc9f-GJeclVKjdOGhjd6M6zotQ. MEYCIQDQOJKjG4YgdhUzlCLVL4l-MnOd2_slTPqPNIAy-WrFcQIhALDtE9mL3GX33dnUZr nYPlIAcW0Bviy6PdAp9kRq9_6x&sharetype=gift&token=c7ede908-8f5c-4f67-bf32- e5cd6a10e16a

5. Christopher Steitz, "Investors flock to Europe as bloc's stability contrasts with concerns over US," Reuters, June 30, 2025, (Data quoted from LSEG Lipper Funds), https://www. reuters.com/business/finance/investors-flock-europe-blocs-stability-contrasts-with concerns-over-us-2025-06-30

6. A&M market analysis

7 "Infrastructure Pulse Survey Report: Q2 2025," Alvarez & Marsal and GIIA, June 18, 2025, https://giia.net/sites/default/files/2025-06/AMTAG_InfrastructurePulse_Q2_2025_11_0.pdf

8. Ibid.

8. Q2 2025 Infrastructure Pulse scoring based on a scale of: -5: extremely unfavourable, 0: neutral, 5: extremely favourable.

9. Core Europe defined as: France, Germany, and Benelux countries.

10. Samuel Zief and Yuxuan Tang, "Dollar Diversification: Why Now?" J.P. Morgan Private Bank, July 14, 2025, https://privatebank.jpmorgan.com/eur/en/insights/markets-and-investing/tmt/dollar-diversification-why-now

11. "US fiscal policy is going off the rails — and nobody seems to want to fix it," Financial Times, June 6, 2025, https://www.ft.com/content/812a06b0-2819-4a75-abaf-455722cf63e8

12. Samuel Zief and Yuxuan Tang, "Dollar Diversification: Why Now?" J.P. Morgan Private Bank, July 14, 2025

13. US fiscal policy is going off the rails — and nobody seems to want to fix it," Financial Times, June 6, 2025

14. "Donald Trump announces 30% tariff on imports from EU," Sky News, July 14, 2025, https://news.sky.com/story/donald-trump-announces-30-tariff-on-imports-from-eu-13395817

15. "Guide to Alternatives 2Q 2025," J.P. Morgan Asset Management, as of May 31, 2025, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/ guide-to-alternatives/

16. World Energy Investment 2025 |10th Edition, International Energy Agency, n.d., accessed July 16, 2025, https://iea.blob.core.windows.net/assets/1c136349-1c31-4201-9ed7- 1a7d532e4306/WorldEnergyInvestment2025.pdf

17. "E2: $14 Billion in Clean Energy Projects, 10,000 Jobs Cancelled So Far in 2025; $4.5 Billion Cancelled in April," E2, May 29, 2025, https://e2.org/releases/april-2025-clean-economy-works/

18. Keith Martin et al., "Effects of "One Big Beautiful Bill" on Projects," Norton Rose Fulbright, July 7, 2025, https://www.projectfinance.law/publications/2025/july/effects-of-one-big-beautiful-bill-on-projects

19. "Q2 2025 Pulse Survey reveals latest trends in the attractiveness of core markets to investors," GIIA, June 10, 2025, https://www.giia.net/insights/q2-2025-pulse-survey-reveals-latest-trends-attractiveness-core-markets-invest

20. Alfred Kammer, "Europe's Integration Imperative," International Monetary Fund, Finance and Development Magazine, June 2025, https://www.imf.org/en/Publications/fandd/ issues/2025/06/europes-integration-imperative-alfred-kammer

21 "Germany's Historic €500bn Defence and Infrastructure Fund – Implications for the German Economy," Eversheds-Sutherland, April 25, 2025, https://www.eversheds-sutherland.com/en/germany/insights/germanys-historic-500bn-defence-and-infrastructure-fund-implications-for-the-german-economy

22. "Germany's Budget May Boost Its Economy More Than Expected," Goldman Sachs, July 10, 2025, https://www.goldmansachs.com/insights/articles/germanys-budget-may-boost-its-economy-more-than-expected

23. Anne-Louise Stranne Petersen, "Why private infra may - eventually - benefit from new German initiatives," Infrastructure Investor, April 16, 2025, https://www. infrastructureinvestor.com/why-private-infra-may-eventually-benefit-from-new-german-initiatives/

24. Alfred Kammer, "Europe's Integration Imperative," International Monetary Fund, Finance and Development Magazine, June 2025

25. Enrico Letta, "Much more than a market, Consilium, April 2024, https://www.consilium. europa.eu/media/ny3j24sm/much-more-than-a-market-report-by-enrico-letta.pdf

26. "The future of European competitiveness," European Union Publications Office, September 2024, https://commission.europa.eu/document/download/97e481fd-2dc3- 412d-be4c-f152a8232961_en?filename=The%20future%20of%20European%20 competitiveness%20_%20A%20competitiveness%20strategy%20for%20Europe.pdf

27. Ravi Balakrishnan and Mahmood Pradhan, "Europe's Elusive Savings and Investment Union," International Monetary Fund, Finance and Development Magazine, June 2025, https://www.imf.org/en/Publications/fandd/issues/2025/06/europes-elusive-savings-and investment-union-ravi-balakrishnan

Originally Published 28 July 20225

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.