- within Energy and Natural Resources topic(s)

- with readers working within the Advertising & Public Relations and Banking & Credit industries

- with readers working within the Advertising & Public Relations and Banking & Credit industries

- within Law Department Performance and Insolvency/Bankruptcy/Re-Structuring topic(s)

Until the recent explosion in demand for data centers, driven by requirements for artificial intelligence platforms, siting data centers required a holistic assessment of such factors as connectivity (i.e., to minimize latency and capital costs), land availability, climate, tax incentives, natural disaster resilience, and inexpensive and reliable power.

State energy policy is no longer just background noise—it's become the frontline filter for where hyperscale infrastructure can and can't be built

Electricity demand is rising at rates not seen in decades—driven by the explosive growth of AI and data centers, increased onshoring of energy-intensive manufacturing, and the broad electrification of transportation and buildings. Load growth of 3–5 percent annually through 2030, more than double historical norms, is no longer a future scenario—it is already showing up in interconnection queues and utility forecasts. The U.S. grid is lacking generation capacity necessary to support this load growth, driven by a combination of unexpected load growth, retirement of generation capacity (primarily older coal-fired power plants), and delays in getting new generation on-line because of holdups in the interconnection queue. As a result, many hyperscale developers are seeking alternatives to grid power, i.e., recent announcements by Google and others about co-locating data centers at purpose-built power plants. The ability to obtain adequate, reliable power (grid connected or not) quickly has become one of the prime movers in siting data centers.

As our previous white papers—Power to Compete,1 A New Deal for Clean Firm Power,2 and When the Bill Comes Due3 —have shown, the energy transition under AI-era demand will require more than new infrastructure. It demands new frameworks for how risk is shared, how investment is governed, and how public benefit is secured.

This paper complements those system-level strategies by zooming in on the state level: how different regulatory and policy approaches are shaping the ground game for data center siting, energy reliability, and clean power alignment. The picture that emerges is one of divergence—and increasing strategic risk for both developers and state policymakers.

Against this backdrop, the competition for new projects is both real and fierce. In an era where power reliability and cost are nonnegotiable for industries like big tech, state energy policies around data centers will play a significant role in which states' new data centers are sited. This paper maps how divergent state energy policies—ranging from cost pass-through bans to clean energy mandates—are starting to reshape the decision-making around hyperscale infrastructure siting.

State Data Center Energy Policies

Currently, most states do not have regulations or policy directly addressing data centers and their energy considerations. However, several states have specific laws/regulations on data center and energy. These states have adopted varying approaches to the issues around data centers and energy, which we examine below.

- West Virginia – West Virginia's

approach is aimed at attracting new data centers with HB2014, which

was signed into law this spring. This law is designed to attract

data centers to the state by offering incentives and reducing

regulatory obstacles. Key provisions are:

- Certified Microgrid Program – Streamlines development, provides regulatory exemptions within designated microgrid districts for generation capacity. However, new data centers can connect to the grid if they desire. The bill includes language to shield current electric ratepayers from bearing microgrid connection costs.

- HB 2014 does not mandate data centers to use renewable energy and encourages use of West Virginia energy resources—coal and natural gas.

- Limits Local Oversight – HB 2014 prohibits counties and municipalities from adopting or enforcing ordinances that limit certified microgrid districts or data center projects. This strips local governments of authority over zoning, noise, and environmental protection.

- Outside of energy issues, HB 2014 offers streamlined development processes, regulatory exemptions, and a special tax valuation framework, making West Virginia an appealing destination for data center operators.

- Texas – Texas Senate Bill 6 (SB6),

enacted in 2025 and effective immediately with some provisions

starting September 1, 2025, and others applying to new

interconnections after December 31, 2025, introduces significant

regulatory changes for data centers in Texas. Major provisions are:

- Load Shedding – For large loads (> 75 MW) interconnected after December 31, 2025, utilities must develop protocols for firm load shed events, requiring equipment for remote disconnection. In addition, during emergencies, ERCOT may order deployment of on-site backup generation or load curtailment.

- Demand Response – ERCOT will procure demand reductions from large load customers with at least 24-hour notice, prohibiting participation by those responding to wholesale prices.

- Transmission Cost Allocation and Behind-the-Meter Connections – Prior to SB6, many data centers leveraged co-location to avoid transmission costs, but SB6 shifts this dynamic. It requires retail customers in ERCOT served behind-the-meter to pay retail transmission charges based on a percentage of their noncoincident peak demand.

- Flat study fee of at least $100,000 to be paid to the interconnecting electric utility or municipally-owned utility for initial transmission screening studies for large loads. This targets the issue of announced data centers that never get built. While the exact amount of overstatement is difficult to confirm definitively, some experts believe speculative interconnection requests were five to 10 times more than the number of actual data centers.4

- Oregon – House Bill 3546 was signed into

law in June of 2025. While not as extensive as Texas SB6 law, it:

- Requires new data centers to purchase electricity from utilities for a minimum of 10 years

- Grants the PUC more power to ensure large energy users pay for the infrastructure costs they create

- Establishes a new customer classification for large energy users within Oregon's for-profit electric utilities

- Indiana – In March 2025, the Indiana

Utility Regulatory Commission (IURC) approved a settlement

agreement that sets clear rules for connecting data centers and

other large-load users to the grid. While the agreement is between

the American Electric Power (AEP) subsidiary, Indiana Michigan

Power (I&M), and several large data center companies, including

Amazon, Google, and Microsoft, it establishes new rules for

connecting data centers to the grid for all state regulated

utilities. Key elements of the regulations are:

- Long-term financial commitments – Data centers are required to make financial commitments to cover the costs associated with their connection to the grid.

- Cost allocation – The agreement aims to ensure that the costs of serving data centers are reasonably recovered from them and not shifted to existing customers.

- Grid modernization – Investments made by data centers will also support ongoing grid modernization efforts, benefiting all customers with enhanced reliability.

- Transparency and oversight – The agreement includes provisions for transparency and oversight, such as requiring I&M (and other utilities) to submit any planned reductions in a large load customer's contracted peak capacity to the IURC for review and approval.

- Washington – House Bill 1416, enacted in 2023, sets requirements for data centers and other large nonresidential power consumers served by public power entities (i.e., municipal utilities, public utility districts). HB 1416 addresses a gap in Washington's Clean Energy Transformation Act (CETA) by ensuring that large energy consumers served by consumer-owned utilities, such as rural utility districts, are subject to the same clean energy standards as those served by investor-owned utilities, which are achieving greenhouse gas neutrality by 2030, and transitioning to 100 percent clean, renewable, and non-emitting electricity by 2045.

- Ohio – The Public Utilities Commission of Ohio (PUCO) ruled in July that allows AEP Ohio to establish enhanced financial obligations for data centers to support the development of any new electric infrastructure electric required to serve them. The financial requirements are designed to protect other customers from paying for the costs of grid improvements required to meet data centers' energy demands. The rule requires new, large data center customers to pay for a minimum of 85% of they energy they are subscribed to use even if they use less to cover costs of new infrastructure required to bring electricity to the data center.

Tax Incentives Linked to Energy Requirements

Although 36 states offer some form of tax incentives for data centers, currently only Michigan, Illinois, Iowa, and Minnesota link receiving those credits to meeting clean energy or energy efficiency targets. Michigan and Illinois have explicit clean energy percentage requirements: 90 percent for Michigan and overall carbon neutral for Illinois. Iowa requires compliance with sustainable design/construction standards, and Minnesota mandates renewable energy usage through requiring solar energy standards and clean energy options. Other states, such as Washington and Virginia, have discussed environmental impacts but have not yet implemented similar requirements, with legislative efforts often failing due to economic priorities.

While 36 states provide tax incentives for data centers, only Michigan, Illinois, Iowa, and Minnesota require meeting clean energy or energy efficiency targets to receive these credits.

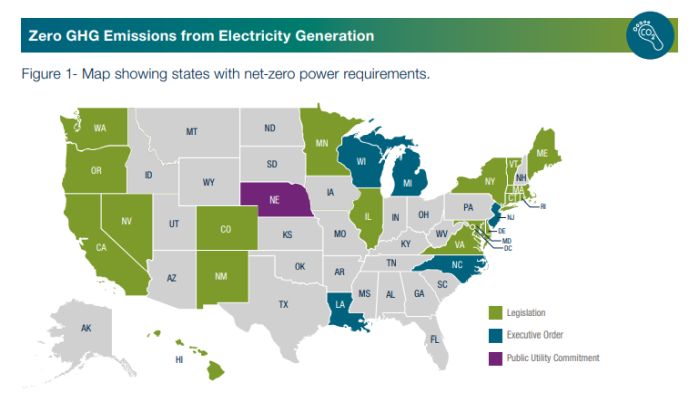

While not addressing data centers specifically, 24 states, plus the District of Columbia and Puerto Rico, have goals to have net-zero greenhouse gas emissions from electric power by some future date. These entities are targeting 2050 or earlier to achieve net-zero. While most states are aiming for net-zero and are technology neutral, Maine, Vermont, Rhode Island, Hawaii, Puerto Rico, and the District of Columbia require 100 percent renewables to meet their goals. Most of these commitments are codified by law, but a handful of commitments were created by executive order from the respective governor's office. Nebraska is unique as it is served exclusively by public utilities, and the three public utilities that serve almost all the customers in the state have adopted 100 percent clean energy goals. Figure 1 shows the states having net-zero goals.

For these states, it is clear that the current set of renewable options (solar/wind + storage) and the emerging clean energy generation technologies (advanced nuclear/SMR, advanced geothermal, RNG) will not be developed in the timeframe and the scale needed to meet the power demand for new data centers. This leaves natural gas combined-cycle plants as the logical option, which puts states with these net-zero commitments in the unenviable position of forgoing the economic growth engendered by new data centers or rendering new natural gas generation capacity- making decarbonization goals unreachable and potentially locking in increased emissions for a generation or more. This is borne out by data on the data centers announced since 2023.5 Only 35 percent of the total MW are in states with net-zero requirements, and if one removes Virginia (which is attractive for data centers for a host of nonenergy-related issues) from the net-zero list, the percentage in net-zero states decreases to 15 percent.

The Risks of Policy Fragmentation

As this paper illustrates, state energy policy is fast becoming a decisive factor in the siting of AI infrastructure. Yet the current policy landscape is marked by divergence—some states embrace rapid deregulation or clean energy mandates; others protect incumbent fuels or impose limited siting oversight. This patchwork may reflect local priorities, but it also introduces new national-scale risks.

Without more coordination or a shared framework, the U.S. risks building a critical sector on fractured foundations. The implications extend well beyond individual projects:

- Uneven investment competitiveness: States without clear or adaptive energy strategies may lose data center investments to jurisdictions that can offer faster approvals or more predictable long-term energy access—even if those states have weaker alignment with national decarbonization goals.

- Regulatory arbitrage: Inconsistent cost allocation models allow hyperscalers to site facilities where grid upgrade costs are most easily externalized, rather than where the systemlevel value is highest. This could strain ratepayer fairness and erode long-term grid resilience.

- Clean energy detours: Even net-zero-aligned states are being forced to approve new natural gas capacity to meet short-term reliability goals. Without a scalable path for clean firm power, today's fragmented responses may result in long-term carbon lock-in

As explored in When the Bill Comes Due and A New Deal for Clean Firm Power, aligning market forces with infrastructure investment—and building a shared governance model—may be essential if states and hyperscalers are to avoid missteps with generational consequences.

Summary

States are increasingly adopting laws and regulations around data centers and their energy use.

While it is early yet, the states that are adopting specific laws and regulations around data centers and energy are mostly focused on making sure data centers pay their fair share of infrastructure costs and that other ratepayers, particularly residential customers, are not negatively impacted by the infrastructure costs. In addition, some states are linking incentives, such as tax credits, to use clean energy or recognized energy efficiency/sustainability standards. In general, the cumulative effect of most states' approaches trend toward making it more expensive to site data centers in those states. Currently, the one notable exception is West Virgina. West Virginia's approach is very data center friendly. It will be interesting to track if West Virginia's approach proves successful in attracting data centers, and whether states that have yet to adopt data center energy regulations follow the broader trend or the West Virginia model.

Footnotes

1. Gary Leatherman et al, "Power to Compete: A Framework for Clean Economic Development," Alvarez & Marsal, March 4, 2025, https://www.alvarezandmarsal.com/ insights/power-compete-framework-clean-economic-development

2. Gary Leatherman et al., "A New Deal for Clean Firm Power: A PPA Framework for AI-Era Energy Infrastructure," Alvarez & Marsal, June 25, 2025, https://www.alvarezandmarsal.com/ thought-leadership/a-new-deal-for-clean-firm-power-a-ppa-framework-for-ai-era-energy-infrastructure

3. Gary Leatherman and Gary Rahl, "When the Bill Comes Due: Why Powering AI Needs a New Public–Private Model," Alvarez & Marsal, July 8, 2025, https://www.alvarezandmarsal. com/thought-leadership/when-the-bill-comes-due-why-powering-ai-needs-a-new-public-private-model

4. Utility Dive May 15, 2025; www.utilitydive.com/news/a-fraction-of-proposed-data-centers-will-get-built-utilities-are-wising-up/748214/

5. Derived from Chris Seiple and Ben Hertz-Shargel, "US power struggle | How data centre demand is challenging the electricity market model," Wood Mackenzie, June 2025, https:// www.woodmac.com/horizons/us-data-centre-power-demand-challenges-electricity-market-model/

Originally Published 24 July 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]